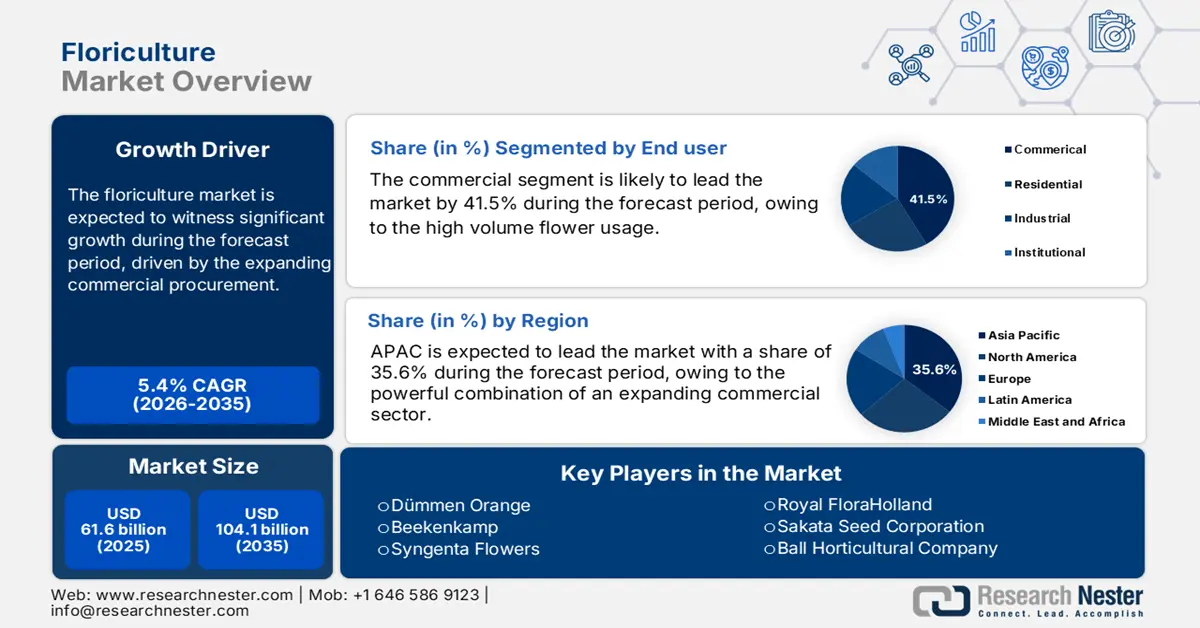

Floriculture Market Outlook:

Floriculture Market size was valued at USD 61.6 billion in 2025 and is projected to reach USD 104.1 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of floriculture is estimated at USD 64.9 billion.

The global floriculture market continues to scale due to expanding commercial procurement, stable import flows, and greater integration of controlled-environment production systems. Based on the data from the U.S. Department of Agriculture, the commercial floriculture sector in the U.S. represents a multi-million dollar industry with stable production. The data from the NASS 2023 depicts that the total number of floriculture producers in 2023 totaled 10,216, compared to 8,949 in 2022. Further, the area of production used to yield the floriculture crops was 851 million square feet in 2023, compared to 833 million square feet in 2022. This growth in both the producer count and production area shows a strong and expanding domestic industry. Furthermore, these measures indicate a solid supply base capable of meeting both local demand and foreign trade objectives.

The market’s structure is defined by its supply chain that moves product from growers to consumers via key channels, including mass merchandisers and garden centers that are the primary outlets. The operational focus for producers involves managing highly perishable inventory via complex logistics, including temperature-controlled transportation. International trade is a vital component of the market, supplementing domestic production to ensure year-round supply. The USDA’s Animal and Plant Health Inspection Service plays a vital role in facilitating this trade by enforcing phytosanitary regulations to reduce the pest and disease risks related to live imports. While domestic production meets a significant portion of demand, imports fulfill specific product and seasonal needs, creating an integrated North American market. The industry’s performance is closely tied to factors such as input cost management for energy and labor, and adherence to biosecurity protocols to maintain crop health and meet the standards for both international and domestic sales.