Flooring Market Outlook:

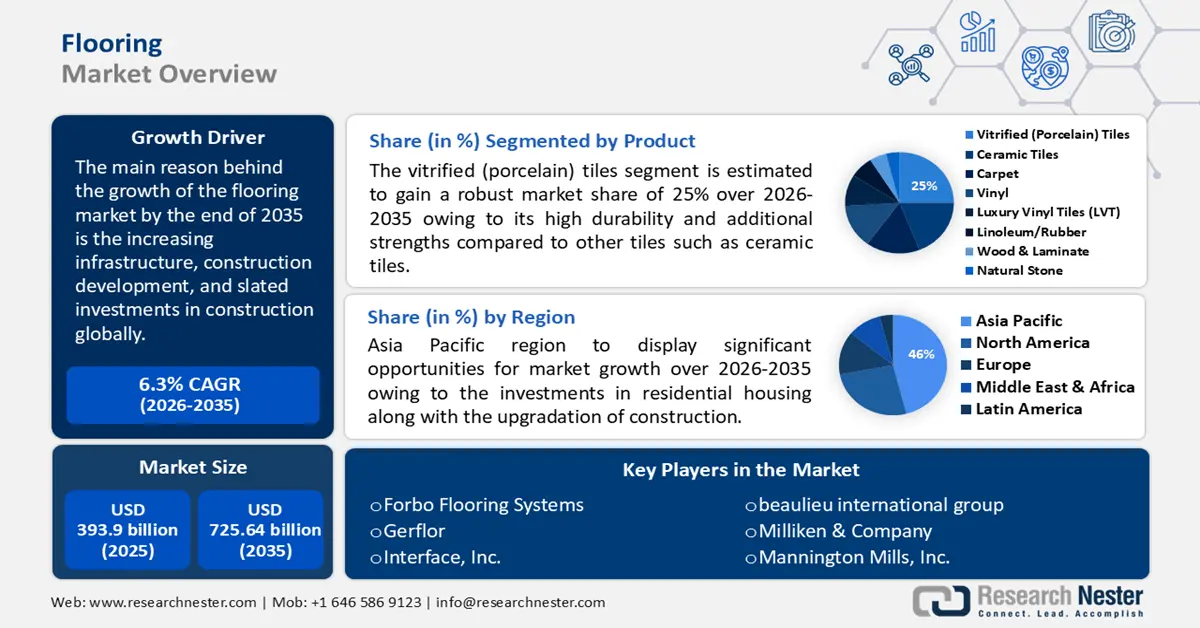

Flooring Market size was valued at USD 393.9 billion in 2025 and is likely to cross USD 725.64 billion by 2035, registering more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flooring is assessed at USD 416.23 billion.

The reason behind this boost is impelled by the increasing infrastructure and construction development along with the slated investments in construction globally due to the increase in commercial, renovated, constructed, industrial, and residential activities. According to a report by the Global Infrastructure Hub 2023, about 42% of the G20 government invested in several sectors such as infrastructure, transportation, and many more in 2022.

Key Flooring Market Insights Summary:

Regional Highlights:

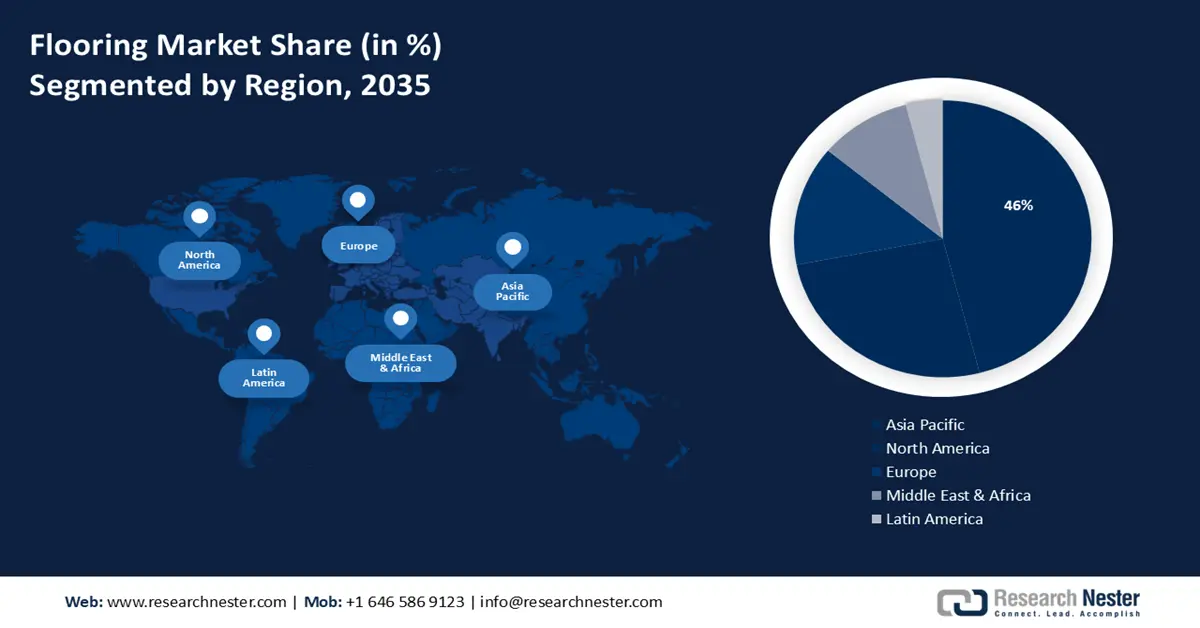

- Asia Pacific flooring market is expected to capture 46% share by 2035, driven by surge in investments in residential housing and construction equipment upgrades.

- North America market will hold the second largest share by 2035, driven by increasing population and boosted public infrastructure spending in the region.

Segment Insights:

- The vitrified (porcelain) tiles segment in the flooring market is projected to capture a 25% share by 2035, driven by its high durability and resistance to bacteria and mold.

- The residential segment in the flooring market is poised for robust growth, driven by increasing demand for small houses, complexes, and residential buildings by the forecast year 2035.

Key Growth Trends:

- Growing urbanization

- Increase in disposable income

Major Challenges:

- Disposal of waste

- Volatility in raw material prices

Key Players: Mohawkind Industries, Inc., Tarkett, Shaw Industries Group, Inc., Armstrong Flooring, Inc., Forbo Flooring Systems, Gerflor, Interface, Inc., Beaulieu International Group, Milliken & Company, Mannington Mills, Inc.

Global Flooring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 393.9 billion

- 2026 Market Size: USD 416.23 billion

- Projected Market Size: USD 725.64 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Flooring Market Growth Drivers and Challenges:

Growth Drivers

- Growing urbanization - Urbanization has been considered one of the major driving forces for the flooring industry owing to the increasing construction and residential activities such as renovation or new housing developments and the boost in the demand for flooring products in various projects such as public spaces, railway stations, airports, bridges, roads, and many more. According to a report in 2024, about 44% of the world's population lives in cities, about 43% lives in suburbs and towns, and around 13% lives in rural areas in 2020. Additionally, urbanization has also led to an increasing focus on aesthetics and design, which has created a surge in the flooring market demand for flooring solutions that are not only functional but also visually appealing.

- Increase in disposable income - There has been a growth in disposable income, which is attributed to the growing need for comfort in residential buildings. According to a report, by the Office for National Statistics in 2023, when compared to the gross disposable household income (GDHI) of 2020, it increased by 3.6% in 2021 in the UK. Moreover, there has been growth in residential housing, which fuels the demand for this sector.

- Surge in population - There is a surge in the population that demands both non-residential and residential construction. According to a report in 2023, the global population was predicted to be 8 billion and is estimated to increase by 1 billion by 2040.

Challenges

- Disposal of waste - The flooring sector produces a large amount of garbage when it comes to renovation, demolition, and installation. Old flooring materials, scraps, packaging, adhesives & sealants, and other associated materials are all included in this garbage. Such massive waste quantities can be expensive and time-consuming to dispose of the hazardous compounds that may be present in some flooring products, including specific adhesives, coatings, and underlays. Adherence to particular legislation and guidelines is necessary for the proper handling, containment, and disposal of hazardous materials to prevent threats to the environment and human health.

- Volatility in raw material prices - Changes in raw material prices have the potential to restrict market expansion by impacting the profitability of manufacturers. The main raw materials used in surface-covering goods are vinyl fibers, fiber composites, and resins, and therefore the cost of production rises on account of increased raw material prices. The final product's price also rises, boosting the cost for both raw materials and completed goods, which eventually has an impact on flooring demand.

Flooring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 393.9 billion |

|

Forecast Year Market Size (2035) |

USD 725.64 billion |

|

Regional Scope |

|

Flooring Market Segmentation:

Product Segment Analysis

Vitrified (porcelain) tiles segment is predicted to dominate flooring market share of around 25% by the end of 2035, driven by its high durability and additional strengths compared to other tiles, such as ceramic tiles. Vitrified tiles don’t have any effect due to temperature as they are made from denser and ultrafine clays.

In addition, vitrified tiles are resistant to bacteria and mold, which makes them more durable and increases the long-term value of these tiles as well as of the floors. Furthermore, ceramic tiles are also scratch-resistant and are highly used in areas such as pathways, parking, landscapes, shop floors, and many more due to the high pressure or stress of their application. In total, the landed value of ceramic floor and wall tile imports is estimated to have risen by 17.9% in 2022 to USD 2.9 billion, while the domestic production value rose 7% to USD 1.46 billion.

Application Segment Analysis

The residential segment in flooring market is estimated to gain a robust revenue owing to the increasing demand for small houses, complexes, apartments, residential buildings, and many more. According to a report by the International Energy Agency in 2023, by 2030 it is expected that the global floor is projected to increase by 15%, which is similar to building an entire floor area in North America.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flooring Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to hold largest revenue share of 46% by 2035. The landscape's substantial growth in the region is expected to be credited to the surge in investments in residential housing along with the upgradation of construction equipment used in several infrastructures. According to a report in 2023, investments in residential construction would grow by 2.5 times, which is about 12 to 15% of APAC investments in total.

The Chinese government also contributes by appointing manufacturers to various projects worldwide. According to a report by the National Bureau of Statistics of China, more than 54 million rural migrant workers are assigned to work in the construction industry. The DIY option is also gaining popularity in this region, and therefore the market value is growing rapidly.

North America Market Insights

The North American region will also encounter a huge influence on the flooring market share during the forecast period, and will account for the second position attributed to the increasing population of this region.

According to a report in 2021, the United States is expected to boost its public infrastructure with a spending of about USD 2.1 trillion by 2024.

There has been an increase in the construction sector in Canada in residential and commercial real estate. According to a report in 2024, the industrial space in Canada increased by 4.3% in 2023, which is about 16 million sq. ft of new space.

Flooring Market Players:

- Mohawkind Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tarkett

- Shaw Industries Group, Inc.

- Armstrong Flooring, Inc.

- Forbo Flooring Systems

- Gerflor

- Interface, Inc.

- beaulieu international group

- Milliken & Company

- Mannington Mills, Inc.

Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- Mohawkind Industries, Inc.- recently acquired Vitromex, a leading Mexican ceramic tile business with four other manufacturing companies all around Mexico, to build a strong solid company position in the ceramic tile market.

- Tarkett- launched its green building cards in EMEA, which signified sustainability attributes and their promotion with our circular selections, which help customers achieve a green building certification.

- Report ID: 6134

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flooring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.