Floor-Standing Platelet Incubator Market Outlook:

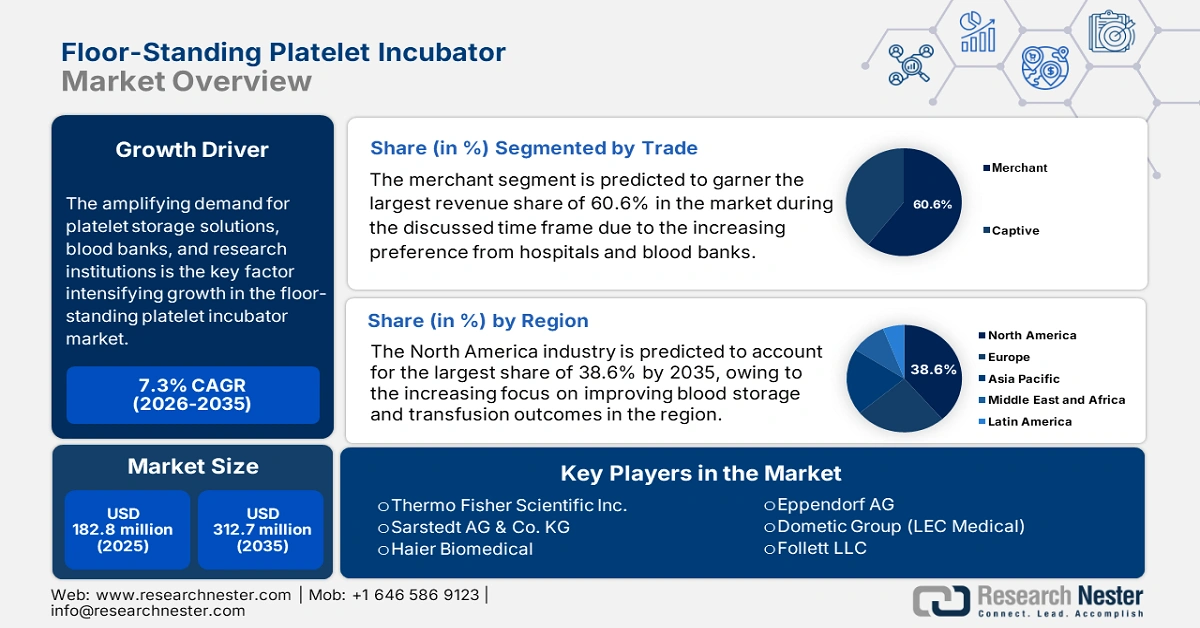

Floor-Standing Platelet Incubator Market size was valued at USD 182.8 million in 2025 and is projected to reach USD 312.7 million by the end of 2035, rising at a CAGR of 7.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of floor-standing platelet incubator is evaluated at USD 192.9 million.

The amplifying demand for platelet storage solutions, blood banks, and research institutions is the key factor intensifying growth in the floor-standing platelet incubator market. Also, the escalating patient pool affected by blood-related disorders increases the need for platelet transfusions. The NIH article published in April 2023 stated that Hemophilia A is the most common congenital coagulopathy, which affects around 1 in 5,000 males, whereas Hemophilia B, also known as Christmas disease, impacts about 1 in 30,000 male births, thereby positively influencing market expansion.

Furthermore, the merchandise receives strong support from healthcare organizations and governments, which are expanding healthcare infrastructure in developing regions. In September 2022, the Government of Tamil Nadu notified that it had sanctioned a total of ₹1.20 crore (~$144,578) for the establishment of Blood Storage Units in 8 government health facilities. Besides, the cost of each unit will be ₹15.0 lakhs ($18,070), wherein ₹11.0 lakhs ($13,250) is for the procurement of essential medical equipment, hence positively influencing market growth.

Key Floor-Standing Platelet Incubator Market Insights Summary:

Regional Insights:

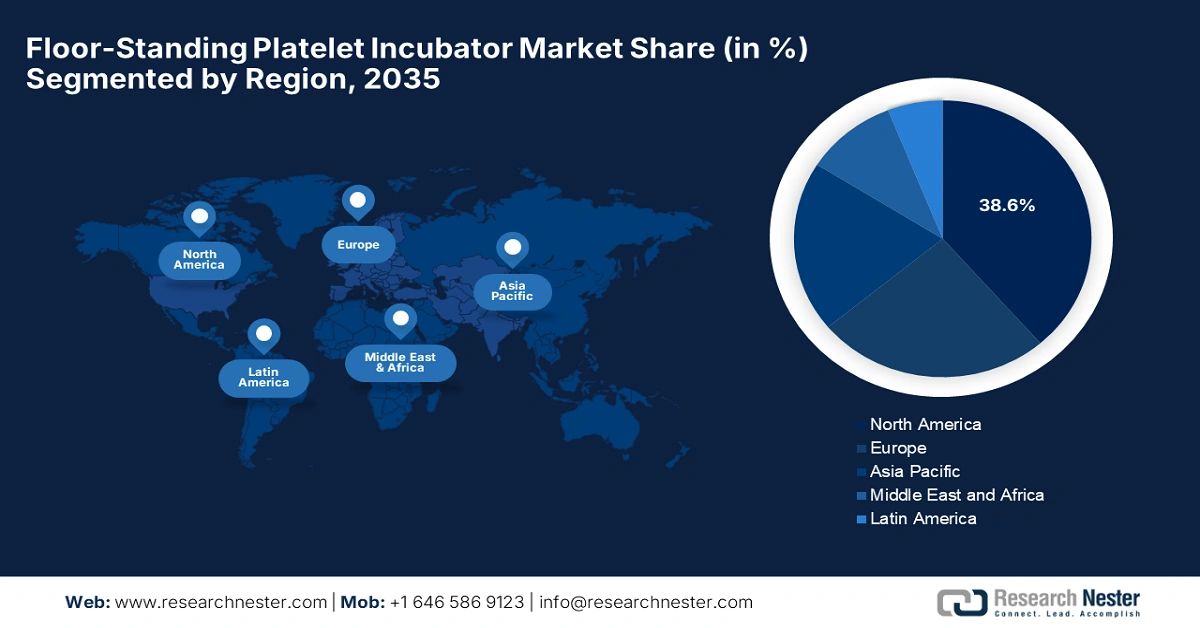

- North America is projected to command a 38.6% share of the Floor-Standing Platelet Incubator Market by 2035, supported by advanced healthcare infrastructure and a strong focus on enhancing blood storage and transfusion efficiency.

- Asia Pacific is anticipated to emerge as the fastest-expanding region by 2035, propelled by rising healthcare investments and growing awareness of blood transfusion safety.

Segment Insights:

- The trade merchant segment is forecast to account for the largest revenue share of 60.6% by 2035 in the Floor-Standing Platelet Incubator Market, driven by hospitals and blood banks preferring vendor-based procurement for technological access and reduced capital expenditure.

- The hospital segment is estimated to capture a 50.4% share by 2035, fueled by rising platelet transfusion volumes and growing blood management requirements.

Key Growth Trends:

- Escalating demand for platelet transfusions

- Advancements in storage systems

Major Challenges:

- High capital costs

- Lack of skilled professionals

Key Players: Thermo Fisher Scientific Inc. (Helmer Scientific), Sarstedt AG & Co. KG, Haier Biomedical, Eppendorf AG, Dometic Group (LEC Medical), Follett LLC, Boeckel + Co GmbH, Binder GmbH, Daihan Scientific Co., Ltd., BioBase Group, Remi Group, Angelantoni Life Science (ALS), Zhongke Meiling Cryogenics Co., Ltd., Labcold Ltd., Gram Equipment A/S, Globalsafe Inc.

Global Floor-Standing Platelet Incubator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 182.8 million

- 2026 Market Size: USD 192.9 million

- Projected Market Size: USD 312.7 million by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

• Largest Region: North America (38.6% Share by 2035)

• Fastest Growing Region: Asia Pacific

• Dominating Countries: United States, Germany, Japan, United Kingdom, China

• Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 16 September, 2025

Floor-Standing Platelet Incubator Market - Growth Drivers and Challenges

Growth Drivers

-

Escalating demand for platelet transfusions: The increasing volume of surgical procedures, trauma, cancer, and hematologic disorders is fueling the greater need for platelet transfusions. In this regard, the study published by PLOS in April 2024 revealed that it analyzed 61,377 platelet transfusions across 47,496 patients in four hospitals and observed a high annual wastage rate, which is approximately 9% at hospitals (USD 400,000/year) and 15% at Canadian Blood Services. Additionally, around 14% of platelet orders were urgent same-day requests, highlighting urgent demand for platelet incubators.

-

Advancements in storage systems: There has been a continued progress in the modern incubators, such as precise temperature control, digital monitoring, which is fostering a favorable business environment for the market. For instance, in November 2022, TruMed Systems announced that it is integrating with Helmer Scientific to enhance access-controlled cold storage for temperature-sensitive vaccines and medications, which enables TruMed’s AccuShelf software to interface with Helmer’s iA series of medical-grade refrigerators and freezers, providing biometric access, auto-locking doors, and real-time inventory tracking through barcode verification, hence a positive market outlook.

- Government support: Both the established and emerging economies are receiving huge support from the governments to expand their healthcare infrastructure, which is positively impacting the progression of the floor-standing platelet incubator market. DGHS reported that the Raktdaan Amrit Mahotsav in 2022 organized over 11,868 blood donation camps with 419,642 donors registering. Also, the drive successfully collected 271,574 units of blood, including a record single-day collection of more than 168,000, thereby increasing adoption of advanced platelet storage equipment.

Historic Trends in the Global Blood Donation Volumes and Rates by Income Group (2008-2018)

|

Income Group |

Donation Rate (per 1000 people) |

Median Annual Donations per Blood Centre |

|

High-Income Countries |

31.5 |

25,700 |

|

Upper-Middle-Income |

16.4 |

9,300 |

|

Lower-Middle-Income |

6.6 |

4,400 |

|

Low-Income Countries |

5.0 |

1,300 |

Source: WHO

Comparison of Platelet Use and Minimum Apheresis Dose Across Countries 2025

|

Country |

Platelet Use Per 1000 Population (×10^11 units) |

Apheresis Minimum Required Dose (×10^11 units) |

|

U.S. |

7.1 |

3.0 |

|

Canada |

2.9 |

2.4 |

|

U.K. |

5.0 |

2.4 |

|

France |

4.8 |

2.0 |

|

Germany |

6.0 |

2.0 |

|

Australia |

4.9 |

2.0 |

Source: NIH

Challenges

-

High capital costs: The aspect of budget constraint is the principal challenge hindering the expansion of the floor-standing platelet incubator market. This advanced equipment is often expensive, wherein a significant portion of blood collection activities are handled by administrative bodies in developing nations due to the tight budget constraints. On the other hand, the private healthcare facilities are delaying the investments since the return on investment is not immediately tangible.

-

Lack of skilled professionals: Another considerable challenge in the floor-standing platelet incubator market is the absence of adequate infrastructure and skilled professionals. This equipment necessitates a proper power supply, environmental controls to ensure that platelets are stored at a stable temperature. Also, most of the developing nations are facing the scarcity of trained biomedical engineers and lab technicians, which is further causing a hindrance to expansion in this field.

Floor-Standing Platelet Incubator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 182.8 million |

|

Forecast Year Market Size (2035) |

USD 312.7 million |

|

Regional Scope |

|

Floor-Standing Platelet Incubator Market Segmentation:

Trade Segment Analysis

Based on the trade merchant segment is predicted to garner the largest revenue share of 60.6% in the floor-standing platelet incubator market during the discussed time frame. The increasing preference from hospitals and blood banks to purchase these incubators from vendors to access the latest technology is the key factor propelling the dominance of this segment. Besides, the outsourcing procurement reduces the capital expenditure and provides access to expert maintenance services, thereby denoting a wider segment scope.

Application Segment Analysis

In terms of application hospital segment is expected to capture a significant share of 50.4% in the floor-standing platelet incubator market by the end of 2035. The growth in the subtype is readily facilitated by the high volume of platelet transfusions and blood management requirements. In December 2022, Bharat Electronics Limited reported that it donated a high-end Apheresis machine to the blood bank of MMG District Hospital, under its CSR initiatives. Besides, the machine separates blood into components such as platelets, plasma, and red and white blood cells, allowing targeted treatment for conditions such as anemia, dengue, and COVID-19.

Type Segment Analysis

Based on the type, the floor-standing incubator segment is anticipated to grow at a considerable rate, with a share of 45.7% in the market over the analyzed tenure. The high storage capacity and suitability for large-scale platelet storage in major hospitals and blood banks are the central factors behind the leadership. In April 2025, Haier Biomedical reported that its Platelet Incubator with Agitator was installed at Ittefaq Hospital, which achieved positive feedback from users. Besides the incubator features energy-saving PID technology and precise semiconductor temperature control to maintain optimal platelet storage conditions, hence denoting a wider segment scope.

Our in-depth analysis of the floor-standing platelet incubator market includes the following segments:

|

Segment |

Subsegments |

|

Trade |

|

|

Application |

|

|

Type |

|

|

Capacity |

|

|

Agitation Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Floor-Standing Platelet Incubator Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest share of 38.6% in the floor-standing platelet incubator market during the forecast timeline. The advanced healthcare infrastructure and increasing focus on improving blood storage and transfusion outcomes are indications for the region being the epicenter of success in this field. In February 2023, Terumo Blood and Cell Technologies reported that it received the U.S. FDA clearance for its IMUGARD WB Platelet Pooling Set, which is the first in the U.S. approved for extending whole blood-derived platelet storage from five to seven days.

The U.S. plays a prominent role in the floor-standing platelet incubator market owing to the rising number of blood banks and transfusion centers. Besides, the increasing prevalence of surgeries and trauma cases requiring platelet transfusions creates a steady demand. In May 2025, AABB stated that, in collaboration with the International Collaboration for Transfusion Medicine Guidelines, it published new evidence-based platelet transfusion guidelines that recommend transfusing platelets only when necessary to reduce adverse reactions, thereby increasing the need for efficient platelet storage in the country.

Canada also has a strong potential in the floor-standing platelet incubator market, backed by the government’s initiatives to improve blood transfusion services and blood product safety. In January 2022, Cerus Corporation reported that it had received Health Canada approval to extend the storage duration of platelets treated with its INTERCEPT Blood System from five to seven days. Therefore, this move enhances the availability and reduces the waste of platelet supplies for blood centers and hospitals in the country.

Key Numerical Metrics for U.S. Platelet Utilization and Storage as of NIH 2025 Data

|

Metric |

Statistic |

|

Standard Apheresis Dose |

≥3.0 × 10¹¹ platelets/unit |

|

Annual Transfusion Volume |

~2,000,000 transfusions/year |

|

Apheresis Platelet Market Share |

90-95% |

|

Storage Temperature |

20-24 °C (Room Temperature) |

|

Storage Duration |

5-7 days |

|

Historical Bacterial Contamination Rate |

Up to 1 in 3,000 units |

|

Historical Clinical Sepsis Rate |

~1 in 20,000 transfusions |

|

Historical Septic Fatality Rate |

~1 in 60,000 transfusions |

|

FDA-Approved PR Technology |

Intercept Blood System |

|

FDA-Approved PAS Formulations |

PAS-C, PAS-F |

|

Cold Storage Allowance (2023 Guidance) |

1-6 °C for up to 14 days (for active bleeding) |

Source: NIH

APAC Market Insights

Asia Pacific is identified as the fastest-growing region in the floor-standing platelet incubator market by the end of 2035. The growing healthcare investments and awareness about blood transfusion safety are propelling the region’s pace of progress in this field. In July 2023, Haier Biomedical declared that it received the Best Asia Pacific Layout Case award in 2023 for its successful expansion and localized operations across the Asia-Pacific region. The company has a strong regional network and tailored solutions such as ultra-low temperature storage to meet domestic healthcare needs.

China has a huge scope in the floor-standing platelet incubator market, strongly supported by government initiatives to modernize blood banks and the implementation of advanced blood storage technologies. In November 2024, Terumo Blood and Cell Technologies announced the launch of its domestic manufacturing in the country, strengthening its presence in the Asia-Pacific market. Also, the move aims to provide high-quality, locally made blood and cell therapy products to better serve patients in the country, thereby aligning with the Healthy China 2030 initiative, boosting access to advanced medical technologies.

India is becoming an epitome of investment opportunities in the floor-standing platelet incubator market owing to the expansion of public and private healthcare sectors, alongside government campaigns promoting safe transfusion practices. In July 2022 WHO reported that India held a National Workshop on Blood Safety to develop a roadmap for improving blood transfusion services, supported by the WHO and the National Institute of Biologicals, which reviewed state-level performance, released updated national standards.

Blood Centers and Collection Trends in India

|

Year |

Total Registered Blood Centers |

Total Blood Collection (Units) |

Blood Collected via Camps (Units) |

|

2021 |

3,337 |

4,588,541 |

1,691,098 |

|

2022 |

3,811 |

8,028,781 |

3,637,394 |

|

2023 |

4,029 |

12,659,363 |

5,005,770 |

|

2024 |

4,263 |

11,710,951 (January-October) |

4,235,269 (January-October) |

Source: DGHS

Europe Market Insights

Europe is expected to represent a steadily growing landscape for the floor-standing platelet incubator market, which is bolstered by strong regulatory frameworks and increasing public health investments. In November 2021, Hemanext Inc. reported that it had received CE Mark certification for its Hemanext ONE Red Blood Cell Processing and Storage System, which is designed to reduce oxygen and carbon dioxide exposure during storage, potentially lowering transfusion frequency and complications in patients with chronic blood disorders.

Germany is the key contributor to upliftment in Europe’s floor-standing platelet incubator market, which is backed by its robust healthcare infrastructure and significant investments in medical technology. Besides, the country’s progress in this field is also facilitated by the well-developed blood donation programs, and a strong focus on innovation and quality in blood management systems has made hospitals and blood banks early adopters of advanced storage solutions. Therefore, all of these factors responsibly create a profitable ecosystem for floor-standing platelet incubators in Germany.

The U.K. is one of the largest and influential landscapes in the floor-standing platelet incubator market, which has extremely benefited from rigorous clinical guidelines and continued investment in blood banking infrastructure. In June 2025, the NHS announced that it had launched a campaign calling on 1 million people to become blood donors to address the shortfall in the national supply due to cyber-attacks and holiday disruption. Also, only 2% of the population is donating, further boosting demand for platelet incubators, especially floor-standing models with higher capacity.

Key Floor-Standing Platelet Incubator Market Players:

- Thermo Fisher Scientific Inc. (Helmer Scientific)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sarstedt AG & Co. KG

- Haier Biomedical

- Eppendorf AG

- Dometic Group (LEC Medical)

- Follett LLC

- Boeckel + Co GmbH

- Binder GmbH

- Daihan Scientific Co., Ltd.

- BioBase Group

- Remi Group

- Angelantoni Life Science (ALS)

- Zhongke Meiling Cryogenics Co., Ltd.

- Labcold Ltd.

- Gram Equipment A/S

- Globalsafe Inc.

The global floor-standing platelet incubator market is semi-consolidated, wherein the top five players captured a significant market share. Competition between the global pioneers is intensifying, effectively attributable to technological innovation, regulatory compliance, and geographic expansion. Besides, organizations are also making significant investments in R&D to integrate IoT, cloud connectivity, and advanced data logging features, thereby differentiating their products as premium, smart solutions.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In March 2025, Haier Biomedical stated that its incubator agitator for platelets was recently installed at Union Hospital, which comprises advanced safety systems, real-time data traceability, and energy-efficient technology that reduces power consumption by a remarkable 13%.

- In August 2023, Helmer Scientific announced that it has launched Pro Line Floor Model Platelet Storage Systems, which possess OptiCool RT Cooling and Heating Technology for reliable platelet storage at 20-24°C with ±1°C uniformity and use 75% less energy when compared to previous models.

- Report ID: 8110

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.