Floor POP Display Market Outlook:

Floor POP Display Market size was valued at USD 5.79 billion in 2025 and is likely to cross USD 10.87 billion by 2035, expanding at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of floor POP display is assessed at USD 6.13 billion.

The growth of the market can be attributed to the high expenditure on advertising and sales strategies. It was estimated that media owners’ ad revenue worldwide was over USD 750 billion in 2021. Furthermore, multinational retail chains are collaborating with local players to create a strong presence in emerging economies. The fast-growing retail sector in such economies is expected to provide significant opportunities for the growth of the market.

Rapid changes in customer behavior have led to transformations in advertising and merchandising strategies. POP displays have become an integral part of product merchandising strategy. Floor POP displays are emerging as an effective retailing solution in hypermarkets, supermarkets, and modern retail stores. The sales of POP-displayed products were observed to rise by over 130% internationally as per the observations in 2022. Existing separate from the standard aisle shelf, these allow brands to make the most out of the limited-timed engagement of the customers with the products. Floor POP displays are easy to recycle and hence, have high demand than other merchandising solutions. The demand for multi-tiered POP or corrugated floor displays is expected to provide lucrative growth opportunities for the floor POP display market.

Key Floor POP Display Market Insights Summary:

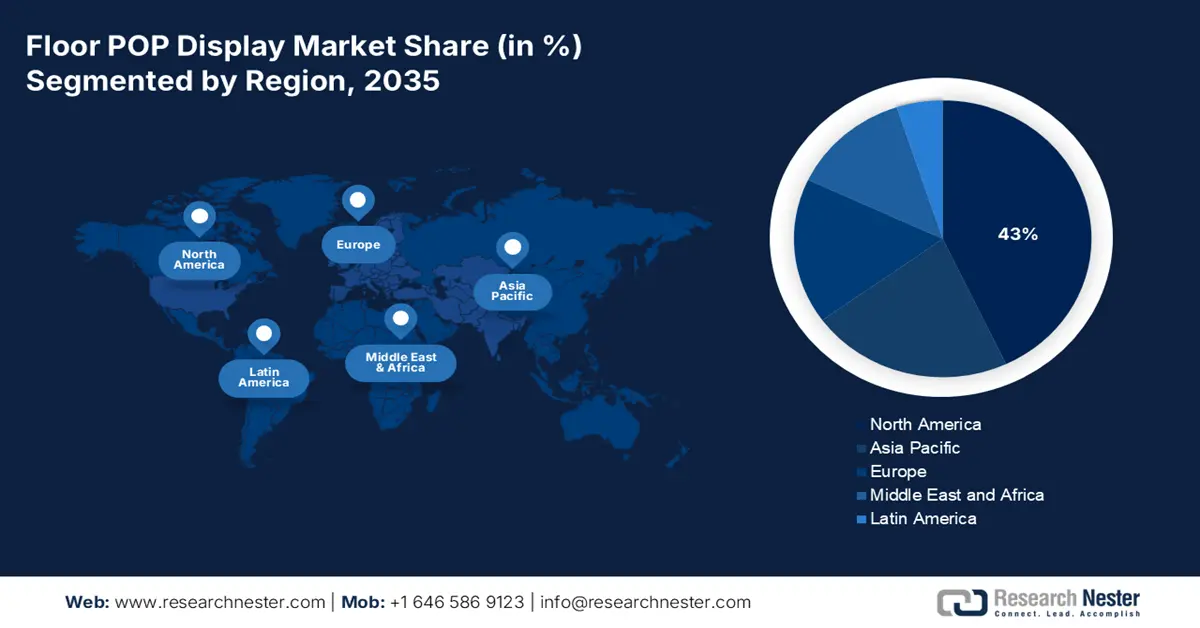

Regional Highlights:

- North America floor POP display market will hold around 43% share by 2035, attributed to high use of POP displays and strong advertising and retail presence.

- Asia Pacific market will achieve the fastest growth from 2026 to 2035, fueled by rising urbanization and growing adoption of POP strategies in developing nations.

Segment Insights:

- The supermarkets segment in the floor pop display market will experience significant share by 2035, influenced by the increasing number of supermarkets and consumer preference for convenience and accessibility.

- The corrugated board segment in the floor pop display market is anticipated to hold the largest share by 2035, driven by rising demand for eco-friendly packaging.

Key Growth Trends:

- High Expenditure on Advertisement and Sales Strategies

- Rapid Changes in Customer Behavior Leading to Transformations in Advertising and Merchandising Strategies

Major Challenges:

- Lack of Required Customization in the Floor POP display

- The Expensiveness of Customized POP Displays and Their Restricted Reach

Key Players: Pratt Visual Solutions (The Vomela Companies), Creative Displays Now, Marketing Alliance Group, Georgia-Pacific LLC, Siffron, Inc., TPH Global Solutions, WestRock Company, Sonoco Products Company, Smurfit Kappa, DS Smith.

Global Floor POP Display Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.79 billion

- 2026 Market Size: USD 6.13 billion

- Projected Market Size: USD 10.87 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 9 September, 2025

Floor POP Display Market Growth Drivers and Challenges:

Growth Drivers

-

High Expenditure on Advertisement and Sales Strategies – The brands spend most of the money on advertisement and publicity as they believe the higher the ratio of advertising expenditure greater the sales ratio. Advertisements help people to know about a certain product when it is newly launched. To improve the sales of the new products heavy advertising is necessary to get a consumer approach. It helps people to know that there is a product of a certain brand released into the market. Floor POP is one such advertisement strategy to enhance sales. According to the records. The total expenditure of ads in media was estimated to be over USD 1200 million in the year 2022 in India.

-

Rapid Changes in Customer Behavior Leading to Transformations in Advertising and Merchandising Strategies – It is observed that over 75% of consumers adjusted their shopping habits, and 70% of the residents started purchasing the household booth online due to COVID-19 concerns across the world.

-

Increasing Disposable Income of People Across the World – The total per capita disposable income of people in the United States in the year 2023 is over USD 44,800 billion as per the estimations.

-

Growing Benefits of Brands with Floor POP displays as it Increases Sales – As per the estimations, the sales of brands in 2022 increased by about 20% with the use of POP trends around the world.

Challenges

-

Lack of Required Customization in the Floor POP display - Floor POP displays need to be customized according to requirements which generate high cost. This factor is likely to restrain the growth of the market. Moreover, factors such as limited reach, and significantly reduced in-store shopper footprints on the back of growth in e-commerce platforms are also expected to challenge the market growth.

- The Expensiveness of Customized POP Displays and Their Restricted Reach

- Significant Reduction of In-Store Shopper Footprints

Floor POP Display Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 5.79 billion |

|

Forecast Year Market Size (2035) |

USD 10.87 billion |

|

Regional Scope |

|

Floor POP Display Market Segmentation:

Material Type Segment Analysis

The global floor POP display market is segmented and analyzed for demand and supply by material type into corrugated board, foam board, plastic sheet, glass, and metal, out of which, the corrugated board segment is anticipated to hold the largest market share over the forecast period owing to their superior functionality and high convenience which makes them highly preferred among brands. The growth of corrugated boards is attributed to the rising demand for eco-friendly products, and the increasing adoption of sustainable products among people. Further, the growing use of corrugated boards by many end-users in place of plastic as plastic causes environmental damage is estimated to boost the market growth. The rising economy of e-commerce sales and the packaging industry that utilizes the correlated boxes for transport or anticipated to boost the market growth. Also, increasing usage in the marine sector to transport goods as it is very lightweight compared to wooden boxes. It is reported that over 410 billion square feet of corrugated boxes were shipped to the United States in the year 2021.

Sales Channel Segment Analysis

The global floor POP display market is also segmented and analyzed for demand and supply by sales channel into hypermarkets, supermarkets, departmental stores, specialty stores, convenience stores, and others. Amongst these segments, the supermarkets segment is expected to garner a significant share. The increasing number of supermarkets across the world winged the rising sales with high access to consumers is anticipated to drive the market growth. Also, the growing preference of people to visit supermarkets is high as they can walk, choose, and buy products of their own choice, unlike the grocery store. Supermarkets allow customers to check the quality of the product before purchasing. Also, the increasing discounts and coupons provided by supermarkets raise the market growth in the coming years. Additionally, supermarkets are basically a single place where one can buy groceries, vegetables, daily necessities, dairy products, beverages, and other communities without running to different stores which come consumes a lot of time and energy. The number of supermarkets across the U.S. in 2019 was over 30,000 and in India, it is over 430,000 supermarkets as per the reports.

Our in-depth analysis of the global market includes the following segments:

|

By Material Type |

|

|

By Sales Channel |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Floor POP Display Market Regional Analysis:

North American Market Insights

North America industry is predicted to hold largest revenue share of 43% by 2035. POP displays are highly popular and are extensively used in hypermarkets, supermarkets, and retail stores in the region. With the U.S. being the largest advertising market in the world, North America is projected to exhibit market growth at a rate of nearly 5%. It is estimated that, in 2021, over USD 285 billion was spent on advertising in the United States. The growing transport across the region with rising imports and exports of various goods and increasing use of eco-friendly packaging is estimated to rise the market growth. Moreover, the growing e-commerce sales with increasing internet penetration are driving the market growth. Additionally, digitalization and rapid urbanization are other major factors for the increasing demand for the floor POP market.

APAC Market Market Insights

The market in the Asia-Pacific region is projected to witness the fastest growth over the forecast period owing to increasing urbanization and adoption of POP merchandising strategies, especially in developing countries such as India, China, and Indonesia. This region is expected to provide significant business opportunities for market players.

Floor POP Display Market Players:

- Pratt Visual Solutions (The Vomela Companies)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Creative Displays Now

- Marketing Alliance Group

- Georgia-Pacific LLC

- Siffron, Inc.

- TPH Global Solutions

- WestRock Company

- Sonoco Products Company

- Smurfit Kappa

- DS Smith

Recent Developments

-

WestRock Company, a leader in the paper and packaging industry, had been recognized with high honors at the Outstanding Merchandising Achievement awards 2021 and won a total of 21 awards including the OMAs: Display of the Year, which is considered the most prestigious award in the industry.

-

Company, declared a 100% recycled paperboard, EcoTect packaging board that can be used in folding cartoon applications, and can be converted into a customized gift box with a natural look.

- Report ID: 4134

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Floor POP Display Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.