Flip Chip Market Outlook:

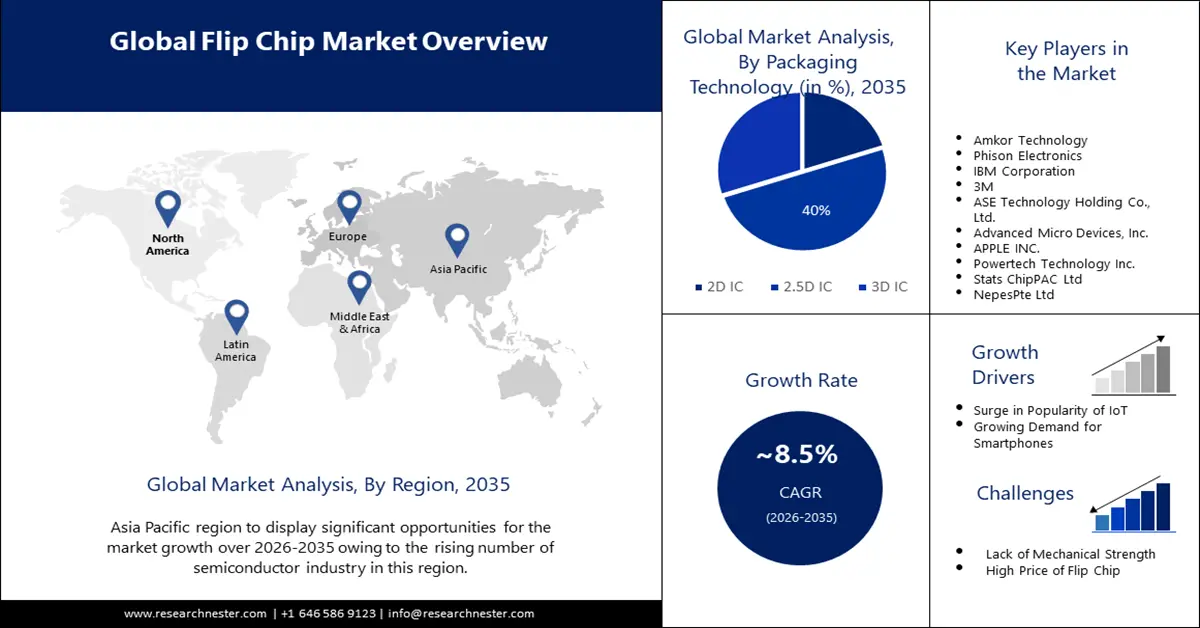

Flip Chip Market size was valued at USD 37.38 billion in 2025 and is likely to cross USD 84.52 billion by 2035, registering more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flip chip is assessed at USD 40.24 billion.

The major element to influences the market expansion is the growing demand for electric vehicles. In 2022, there were over 9 million electric cars sold globally; this year, sales are predicted to increase by another 34% to close to 13 million.

Furthermore, there has been a rising need to reduce the power consumption which is expected to be achieved through flip chips. For instance, excellent heat-dissipation and energy-saving features are additional features of flip-chip COB. The flip-chip's power consumption may be lowered by over 44% within the same brightness circumstances, and its screen surface temperature is about 9% lower than that of other screens, enabling it better to ensure the consistent operation of LED display panels.

Its increased service life is attributed to its ultra-high protection, shock resistance, impact resistance, waterproof, dustproof, smoke prevention, and anti-static properties. Hence, further with the growing demand for LED lights, the market is expected to grow significantly.

Key Flip Chip Market Insights Summary:

Regional Highlights:

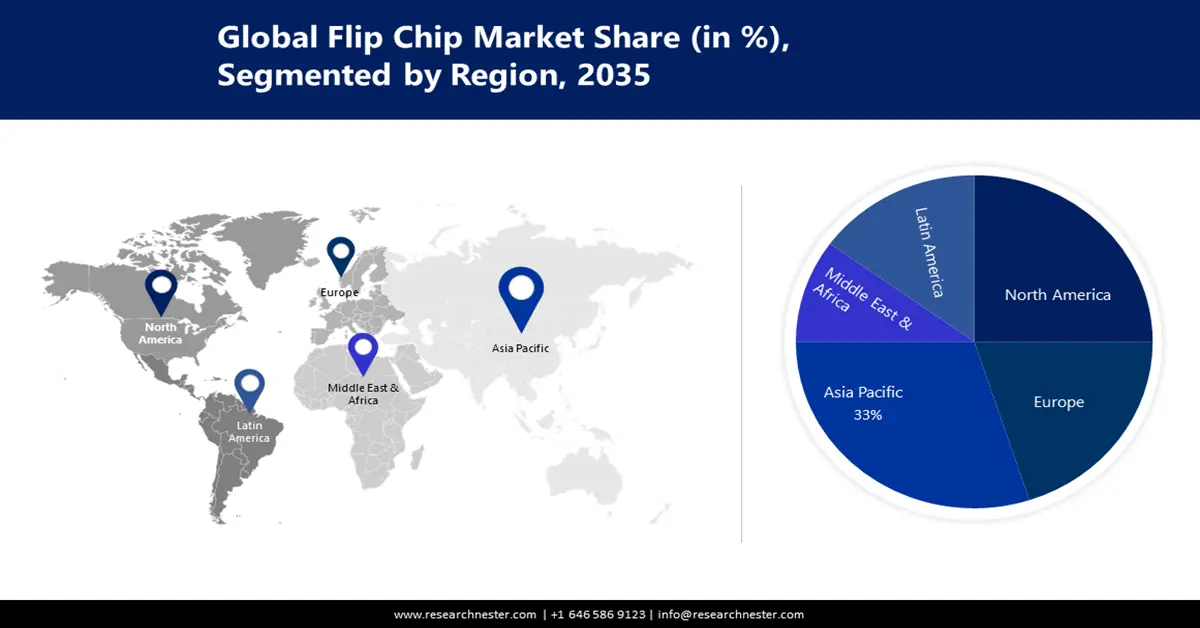

- Asia Pacific flip chip market will hold more than 33% share by 2035, driven by a key factor driving this segment is the rising number of semiconductor industries and surging production of electric and self-driving vehicles.

- North America market will account for 27% share by 2035, driven by rising demand for wearables and growing investment in advancing healthcare technology.

Segment Insights:

- The 2.5d ic segment in the flip chip market is projected to capture a 50% share by 2035, driven by demand for compact, high-efficiency packaging with better chip connectivity.

- The copper pillar segment in the flip chip market is expected to achieve significant growth through 2035, driven by its low cost, better circuit performance, and high durability.

Key Growth Trends:

- Surge in trend for IoT integration

- Growing demand for smartphones

Major Challenges:

- Lack of mechanical strength

- The high price of flip chips is anticipated to hamper the market revenue in the upcoming years.

Key Players: Amkor Technology, Phison Electronics, IBM Corporation, 3M, ASE Technology Holding Co., Ltd., Advanced Micro Devices, Inc., APPLE INC., Powertech Technology Inc., Stats ChipPAC Ltd, NepesPte Ltd.

Global Flip Chip Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.38 billion

- 2026 Market Size: USD 40.24 billion

- Projected Market Size: USD 84.52 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, South Korea, Japan, Taiwan

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 16 September, 2025

Flip Chip Market Growth Drivers and Challenges:

Growth Drivers

- Surge in trend for IoT integration - The demand for Internet of Things devices has surged as a result of the introduction of concepts including smart factories, smart manufacturing, and smart grids. There will be a greater need for IoT devices as industrialized nations integrate smart grids with their current networks.

The need for sensors has grown as the market for IoT devices has expanded. IoT sensors must operate at high-performance levels in difficult circumstances due to their small size. Flip chip technology, which can miniaturize equipment and offer higher performance than traditional technologies, is being used in the Internet of Things. Therefore, flip-chip architecture is used in microelectromechanical systems sensors, which propels the expansion of the flip chip market worldwide. - Growing demand for smartphones - There are expected to be over 5 billion smartphone users globally in 2024, a rise of 2.2% each year. Furthermore, close to 3 billion, or about 83%, more people use smartphones currently than there were in 2013, which was more than ten years ago. Flip-chip technologies have been extensively used for the CPUs of smartphones

- Rising technological advancement in wire bounding - The improvements in flip chip connectivity technology over wire bonding technology are what is driving demand for it. ICs have to be packed into more space using wire bonding technology, and the wires use more energy. In addition, these chips are less reliable given that cables are being used to establish connections, which raises the possibility of malfunction because of lost connections.

Compared to traditional wire-bond packaging, flip chips have several benefits, including increased 1/O capability, improved thermal and electrical performance, substrate flexibility for a range of performance needs, familiarity with well-established production equipment, and smaller form factors.

Challenges

- Lack of mechanical strength - With flip chips, a semiconductor die is connected to a substrate by being nudged and then flipped onto it. Directly on the die input-output pads, bumps are usually arranged in an array over the whole die surface. Since the chip and circuit board are directly connected, there is less resistance and faster signal transmission due to the shorter connection.

Nevertheless, due to their lack of mechanical strength and susceptibility to thermal expansion mismatch, these short-distance bumps may rupture at higher temperatures. Since the amplifier and other components are suspended above a substrate on metal bumps that serve as thermal stand-offs, another problem that arises is the effective removal and dissipation of heat. Using a low-loss substrate in conjunction with a flip-chip device and on-module EMI shielding is a popular design strategy. - The high price of flip chips is anticipated to hamper the market revenue in the upcoming years.

- Lack of enough customization options is another substantial factor hindering the market growth during the forecast time

Flip Chip Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 37.38 billion |

|

Forecast Year Market Size (2035) |

USD 84.52 billion |

|

Regional Scope |

|

Flip Chip Market Segmentation:

Wafer Bumping Process Segment Analysis

In flip chip market, copper pillar segment is likely to hold more than 40% share by 2035. The primary factors driving the demand for copper pillar bumping technology are its superior longevity, convenient availability, good circuit performance, and cheaper cost as compared to alternative bumping technologies.

Additionally, it is believed that the benefits of this technology-such as less bump pitch and the ability to maintain standoff with less pitch will present prospects for market expansion shortly. Furthermore, the growing demand for tablets is also estimated to boost the segment growth. In 2023, almost 127 million tablets were supplied globally, in the last quarter of the year, shipments topped over 35 million devices.

Packaging Technology Segment Analysis

In flip chip market, 2.5D IC segment is predicted to account for more than 50% revenue share by the end of 2035. In the 2.5D IC packaging technique, a silicon interposer substrate (passive or active) is inserted between the SiP substrate and the dice, enabling considerably finer die-to-die connections that boost efficiency and lower power expenses.

International adoption of 2.5D IC flip chips is primarily driven by its reduced size in comparison to other packaging technologies, improved performance, increased capacity to pack more chips, and higher efficiency.

Our in-depth analysis of the global market includes the following segments:

|

Wafer Bumping Process |

|

|

Packaging Technology |

|

|

Product |

|

|

Packaging Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flip Chip Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 33% by 2035. This growth is set to be influenced by the rising number of semiconductor industries in this region. Additionally, this region also consists of key manufacturers in the field of flip chips.

Moreover, the production of automobiles such as self-driving cars and electric vehicles. is surging in this region. Hence, the adoption of flip chips in autonomous cars is surging further boosting market growth. Furthermore, various initiatives have been launched by the government to encourage the sale of electric vehicles which is also projected to encourage market growth.

North American Market Insights

By the end of 2035, North America region in flip chip market is set to dominate around 27% revenue share. This growth could be owing to rising demand for wearables. In the US, over 39% of survey people between the ages of 35 and 54 in 2021 reported using wearable technology, such as activity trackers and smartwatches.

Also, the use of flip chips is growing in healthcare applications owing to the growing investment in advancing healthcare technology in this region.

Flip Chip Market Players:

- Amkor Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Phison Electronics

- IBM Corporation

- 3M

- ASE Technology Holding Co., Ltd.

- Advanced Micro Devices, Inc.

- APPLE INC.

- Powertech Technology Inc.

- Stats ChipPAC Ltd

- NepesPte Ltd

Recent Developments

- IBM Corporation has announced a new version of the LinuxONE server, based on highly scalable Linux and Kubernetes technology1, designed to handle thousands of workloads in one system footprint1. The IBM LinuxONE Emperor 4 is equipped with features that may aid clients to save energy.

- Phison Electronics Corp., the world's first PCIe 5.0 Redriver, IC PS7101 certified by the PCI-SIG Association to help resolve issues with high-speed signal transmission between CPU and peripheral devices.

- Report ID: 5690

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flip Chip Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.