Flexible Tube Market Outlook:

Flexible Tube Market size was valued at USD 55.69 billion in 2025 and is projected to reach USD 80.02 billion by the end of 2035, rising at a CAGR of 3.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of flexible tubes is estimated at USD 57.75 billion.

The global flexible tube market is experiencing a significant rise, primarily driven by increasing demand in healthcare and consumer goods applications. The European Union mandates that recycling rates for plastic packaging be 50% by 2025 and 55% by 2030. It is expected that companies will be directing resources to advanced recycling technologies, bio‑based materials, and enhanced barriers in response to regulation and customer sustainability demands, as per the U.S. House Committee. Raw materials like thermoplastic and resin materials are monitored using the indices provided by the Bureau of Labour Statistics, on the supply side. The producer price index (PPI) of plastics material and resin manufacturing has indicated an index level of around 316.390 in July 2025, which indicates the continued inflation of material costs that directly increase as far as the inputs to the flexible tubes manufacturing.

The harmonized U.S. codes of export-import data show that flexible tubes, pipes, and hoses are growing exports out of North America, even as raw materials, laminated substrates of stainless steel, are being imported to enable greater production capacity. According to the World Steel Association, preliminary estimates, global crude steel output reached 1,884.6 million tonnes (MT) in 2024. In 2024, the United States (79.5 MT), Japan (84.0 MT), India (149.4 MT), and China (1,005.1 MT) were the world's top producers of crude steel. There has been significant investment by the companies in barrier coating research and development, new assembly lines, automated film extrusion, and ecologically piloted material deployment schemes. Although the noticeable trends in CPI levels of plastic packaging products are very similar to changes in producer input price indices, this demonstrates that the cost increases are passed across the supply chain to contract manufacturers.

Key Flexible Tube Market Insights Summary:

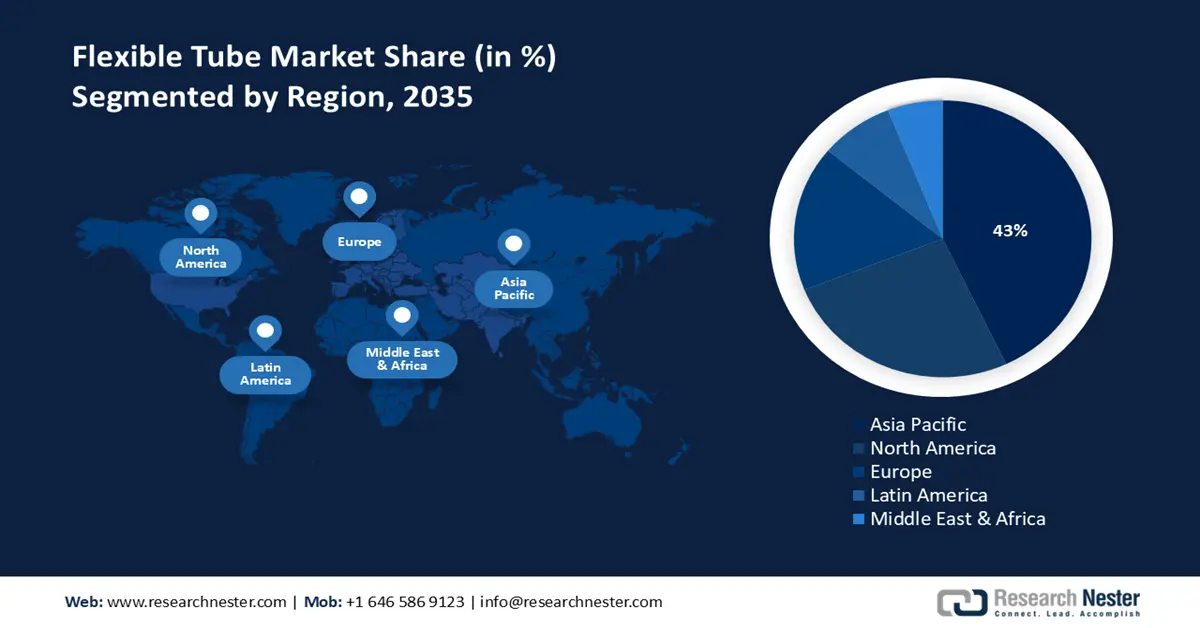

Regional Insights:

- By 2035, Asia Pacific is projected to lead the Flexible Tube Market with a 43% share, propelled by high demand across pharmaceuticals, electronics, and food packaging.

- North America is expected to hold 26% share by 2035, owing to increasing demand in pharmaceutical, personal care, and food industries.

Segment Insights:

- Polymer Segment is projected to account for 60.4% share by 2035, driven by its lightweight, affordability, and portability in sustainable packaging concepts in the Flexible Tube Market.

- 10mm to 25mm Diameter Segment is expected to hold 38.3% share by 2035, impelled by the rising demand for travel-size and single-dose products.

Key Growth Trends:

- CLP Labelling and Packaging Compliance Requirements

- The expanding packaging industry

Major Challenges:

- Trade Barriers & Technical Regulations

- Raw material price volatility

Key Players: Amcor, Berry Global, Hoffmann Neopac AG, Essel Propack (EPL Limited), Constantia Flexibles, Saint-Gobain, Parker Hannifin, Eaton Corporation, Trelleborg Sealing Solutions, FlexSteel Pipeline Technologies, Solvay S.A., TechnipFMC, Mitsubishi Chemical Group Corp., Daikin Industries, Ltd.

Global Flexible Tube Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 55.69 billion

- 2026 Market Size: USD 57.75 billion

- Projected Market Size: USD 80.02 billion by 2035

- Growth Forecasts: 3.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, USA, India, Japan, Germany

- Emerging Countries: South Korea, Brazil, Mexico, Indonesia, Turkey

Last updated on : 11 September, 2025

Flexible Tube Market - Growth Drivers and Challenges

Growth Drivers

- CLP Labelling and Packaging Compliance Requirements: The EU Classification, Labelling and Packaging (CLP) regulation requires a clear hazard communication dealing with mixtures of chemicals. By 2025, all hazardous substance packaging is required to carry a Unique Formula Identifier (UFI), which further complicates the tube labelling and design. This regulation stimulates the demand for such advanced printing technologies and high-barrier tube substrates, both of which meet the legal visibility and durability requirements. Manufacturers and companies are investing in compliant packaging infrastructure to sustain availability in European member states.

- The expanding packaging industry: Flexible tubes, favored by many sectors including cosmetics, pharmaceuticals, and food, are on the rise because they are lightweight, portable, squeezable, and offer convenience to consumers. As the world's population grows and demands for practical, high-quality, safe, and affordable packaging increase, manufacturers are shifting from rigid to flexible formats to meet this trend. The Indian packaging market was valued at USD 50.5 billion in 2019 and is projected to reach USD 204.81 billion by 2025, with a CAGR of 26.7% during 2020-2025. Packaging is among India's high-growth industries, expanding at 22-25% annually and becoming a preferred hub for the sector. This trend is further boosted by urbanization and the growth of e-commerce, which are transforming how we shop and consume products.

- Advances in the upswing of renewable and green chemicals: Green chemical deployments are gaining momentum at a rapid rate due to the global effort to reduce dependence on fossil-based chemicals. In 2021–2022, renewable energy sources, including solar, wind, and other sources (except nuclear or hydro), made up 11.51% of all commercial energy production. A growing proportion of clean, sustainable, and renewable energy sources coexist with a significant reliance on coal in India's commercial energy production mix. The green chemicals market is expected to experience an increase and creating a greater demand for flexible tubes that are compatible with bio-based contents that tend to demand different sealing properties, storage capabilities, and shelf life more than traditional petroleum-based formulations. Manufacturers are working on solutions to these new polymer requirements through the use of alternative polymers and barrier technologies.

1. Emerging Trade Dynamics in the Flexible Tube Market

Top Exporter of Flexible Tubes, Pipes, and Hoses

|

Exporter |

Export Value (USD) |

Quantity (Kg) |

|

China |

307,994.72 |

53,159,000 |

|

European Union |

226,404.82 |

11,654,600 |

|

Germany |

142,864.06 |

4,453,340 |

|

Poland |

133,925.16 |

3,120,020 |

|

United States |

132,409.28 |

5,762,370 |

|

United Kingdom |

119,240.54 |

2,831,730 |

|

Italy |

94,589.17 |

7,762,870 |

|

Malaysia |

78,753.64 |

8,663,240 |

|

France |

73,257.28 |

9,866,960 |

|

Korea, Republic |

61,207.53 |

14,589,900 |

Source: WITS

Challenges

- Trade Barriers & Technical Regulations: The manufacturers encounter trade barriers in different countries due to numerous technical regulations that are not uniform. WTO reports state that new technical barriers to trade (TBTs) were put in place in the world between 2020 and 2023. These comprise matters such as packaging, labelling, and chemical formulation that are often contrary to global criteria. Compliance costs to the small and mid-sized exporters can be increased, making them less competitive in the foreign market. Countries like Brazil and India have also added additional product testing requirements, which caused delays of months in entering the market.

- Raw material price volatility: The flexible tube market is highly reliant on polymers, plastics, and specialty resins. Fluctuating crude oil prices directly impact raw material costs, creating a degree of instability in manufacturing prices. This instability diminishes profit margins for manufacturers, complicates the negotiation of long-term contracts, and necessitates unpredictable adjustments to production costs. A lack of consistency in raw materials can marginalize raw material availability and disrupt supply chains that require timely delivery and order fulfillment. To stay competitive, companies in the industry need to consider other materials, seek cost-hedging alternatives, and enhance their supply chain relationships.

Flexible Tube Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 55.69 billion |

|

Forecast Year Market Size (2035) |

USD 80.02 billion |

|

Regional Scope |

|

Flexible Tube Market Segmentation:

Material Segment Analysis

The polymer segment is anticipated to grow at the fastest revenue share of 60.4% during the projected years by 2035, driven by its lightweight, affordability, as well as portability in sustainable packaging concepts. The most common polymers are high-density polyethylene (HDPE) and polypropylene (PP) because of their chemical resistance and recyclability. These materials fit the universal regulations on packaging materials globally, making them applicable in the pharmaceutical, personal care, and food industries. Rising polymer tube demand is expected to be observed from 2026 to 2035 due to the rise of mono-material packaging solutions. In the UK, the Plastic Packaging Tax was introduced in April 2022, incentivizing the use of recycled content by exempting packaging containing at least 30% recycled plastic from taxation. Furthermore, manufacturers are shifting to bio-based polymers to achieve zero-waste goals under the Circular Economy Action Plan by the EU.

Tube Diameter Segment Analysis

The 10mm to 25mm diameter segment is projected to increase to 38.3% by 2035. Single-use pharmaceutical, cosmetic, and nutraceutical products can be made with these diameters. The segment's unit sales are expected to increase between 2026 and 2035, especially in emerging countries where urban disposable income is increasing. The growing popularity of travel-size and single-dose products is also increasing demand in the personal care and clinical packaging industries because manufacturers prefer this size, as it fits into automatic fills and optimal shelves.

End-Use Industry Segment Analysis

The pharmaceuticals segment is predicted to grow steadily at a 34.8% share by 2035, owing to the increased demand for tamper-evident and sanitary packages of ointments, gels, and topicals. The regulatory compliance requirements, such as FDA and EU directives on pharmaceutical packaging integrity, are also driving the growth of the segment. The segment is expanding with flexible tubes taking a significant share since they can be easily transported, have superior blockades, and have a more accurate delivery mechanism. Asia-Pacific is expected to grow at the fastest rate, with China and India likely to lead the generics manufacturing sector.

Our in-depth analysis of the flexible tube market includes the following segments:

| Segment | Subsegment |

|

Material |

|

|

End‑Use Industry |

|

|

Tube Diameter |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flexible Tube Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific is expected to lead the global flexible tube market with the largest revenue share of 43% and an estimated CAGR of 5.1 % from 2026 to 2035. High demand for end-use sectors in China, India, Japan, and South Korea in pharmaceuticals, electronics, and food packaging stimulates the growth of the region. The rising usage of tubes as a result of increasing urbanization and industrialization among the ASEAN countries and the growth of healthcare infrastructure also contribute to the high demand for tubes. Additionally, notable governments' investments in green chemistry and sustainable production, such as stringent material compliance regulations introduced by South Korea and Japan, promote the use of recyclable and solvent-free materials by producers, thereby fueling the market expansion.

China’s flexible tube market is expected to grow at a rapid pace in the Asia Pacific region, owing to the high domestic demand in the pharmaceuticals, personal care, and consumer electronics industries. The demand for flexible tubes is buoyed by demand from cosmetics, toothpaste, and pharmaceuticals, and the rising online retail packaging is adding to the growth. Local manufacturers take advantage of their lower costs & volumes to cover the export market, while foreign companies invest locally to take advantage of the large consumer market. Technology in multilayer tubes and smart packaging should significantly strengthen China's market position.

India’s flexible tube market is expected to experience an upward trend over the forecast years, rising at the fastest CAGR of 6.6 to 7.2% between 2025 and 2034. India's chemical industry is expected to increase to USD 1.1 trillion by 2040, from USD 221 billion in 2023. In addition, the PCPIR strategy has drawn over USD 8 billion in foreign direct investment, and new destination states with energy-efficient pharmaceutical clusters have been established in Gujarat and Telangana to encourage the adoption of clean packaging. Additionally, government initiatives such as the Production Linked Incentives and the NITI Aayog chemistry roadmap support the flexible tube industry in the country. Nearly 1.9 million enterprises were using the green chemical process, and investment in flexible chemical technology increased by 41% between 2015 and 2023.

India’s Natural Polymers Trade in 2023

|

Importing |

Value (USD) |

Exporting |

Value (USD) |

|

United States |

$3.61M |

China |

$57.4M |

|

Algeria |

$3.51M |

United States |

$10.8M |

|

United Kingdom |

$1.33M |

Austria |

$7.2M |

|

Vietnam |

$1.19M |

Norway |

$5.79M |

|

South Korea |

$922K |

Sweden |

$4.4M |

Source: OEC

North America Market Insights

By 2035, the North American market is anticipated to grow at a 26% revenue share, owing to the increasing demand in the pharmaceutical, personal care, and food industries. By 2050, air pollution from the manufacture of primary chemicals will be decreased by almost 90% in the Clean Technology Scenario, while the base scenario's water demand will be decreased by nearly 30%. Regulatory support from agencies like the FDA and EPA enhances product safety standards. Rising e-commerce and pharmaceutical distribution further expand market opportunities, while innovations in eco-friendly polymers and barrier properties strengthen competitiveness across industries.

In 2024, the U.S. exported $264 million worth of flexible metal tubing, ranking it the 537th most exported product among 1,227. Imports reached $353 million, making it the 612th most imported product. The flexible metal tubing market plays a vital role in industries such as automotive, aerospace, construction, and energy, where durability and adaptability are critical. These tubes are widely used for fluid transport, gas distribution, and protective casing, reflecting steady trade activity and industrial demand.

U.S. Flexible Metal Tubing Trade in 2024

|

Exporting |

Value (USD) |

Importing |

Value (USD) |

|

Canada |

64.0 |

China |

82.0 |

|

Mexico |

45.5 |

South Korea |

37.5 |

|

China |

14.3 |

Mexico |

35.8 |

|

Saudi Arabia |

9.81 |

Israel |

33.1 |

|

Singapore |

9.67 |

India |

29.1 |

Source: OEC

The flexible tube market in Canada is estimated to grow at a significant rate by 2035. Increase in pharmaceutical exportation and clean packaging in Ontario, British Columbia, and Quebec supports its growth. Canada has focused more of its investment on bioplastics and circular material flows through investments in sustainable chemical production of 17.6 % in 2023. The federal government still encourages local manufacturing by offering tax incentives in terms of clean technology and recycling requirements. Environment and Climate Change Canada-managed programs are in an effort to encourage chemical manufacturers to adopt less-emission and material-solvent-free production. This decrease in imports of resin packaging was 11.8% between 2020 and 2023, based on the increasing domestic production capacity. Canada is also conforming to the U.S TSCA policies to harmonize cross-border compliance in the safety of chemical packaging.

Europe Market Insights

The European market held an 18% revenue share in 2035 and is expected to grow significantly over the coming years. Increasing use in pharmaceutical packaging, personal care, and sustainable food packaging fuels regional growth. The rising demand in the automotive, construction, and medical sectors for flexible tubes, enhanced with technology, has driven growth in the EU. Initiatives such as zero-waste from materials and circular economy practices have fostered innovation in tubing usage. Advances in lightweight, flexible tubes, durable chemistry, and resistant tubing that meet specific requirements support various industry applications, resulting in steady regional growth.

In 2024, approximately 60% of global greenhouse gas (GHG) emissions were produced by materials like iron and steel, cement, and plastic. Material efficiency strategies can reduce hard-to-abate process emissions in the EU's primary raw materials by more than 50% by 2050. Resource demand strategies in buildings, transport, food, and energy supply systems could yield savings of 40-70% by 2050 for global GHG emissions. Cities produce 50-70% of global waste. Without actions towards a circular economy, municipal waste generation is expected to grow by 5.3% from 220 Mt in 2018 to 231.5 Mt in 2035 in the EU. In this context, circular economy approaches could help reduce total municipal waste generation by 34% by 2030 when compared to 2020

Key Flexible Tube Market Players:

- Amcor

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Berry Global

- Hoffmann Neopac AG

- Essel Propack (EPL Limited)

- Constantia Flexibles

- Saint‑Gobain

- Parker Hannifin

- Eaton Corporation

- Trelleborg Sealing Solutions

- FlexSteel Pipeline Technologies

- Solvay S.A.

- TechnipFMC

- Mitsubishi Chemical Group Corp.

- Daikin Industries, Ltd.

Integrated packaging giants such as Amcor, Berry Global, Saint Gobain, and Constantia Flexibles dominate the global market with a market share of more than 49.9% using polymer and barrier tubes solutions. Parker Hannifin and Eaton work on engineering adaptable systems of chemical dispensing of pharmaceuticals and industrial fluids. High-volume FMCG and pharma tube packaging in Essel Propack and SRF Limited is dominant within the Indian market. Hoffmann Neopac performs spectacularly in sustainable mono-material tube innovations in Europe. Major strategic initiatives here are the growth of PCR-based production (e.g., the eco-tube rollouts of Amcor), the growth of capacity through acquisitions (Amcor), and the growth in regions of Asia and Latin America.

Top Global Flexible Tube Manufacturers

Recent Developments

- In May 2024, Neopac AG introduced Polyfoil Sensation, the first recycling-ready barrier tube. This invention was a great contribution to its product to the packaging of goods that were sustainable, with its products being targeted at the pharmaceutical and personal care segments. The new tube is a high-barrier, which is 100 % recyclable, and improves on the changing European and North American environmental expectations. To satisfy the increased demand, the company increased its production capacity by 70 million units per annum. Such an advancement deals with the fact that brand owners are increasingly interested in circular packaging. It also indicates the overall trend of eco-design and waste-reduction policies used in the whole market of flexible tubes in the world.

- In July 2025, UFlex Limited launched a new line of environmentally friendly flexible tubes with USFDA-approved recyclable polyethylene content. This launch happened during CMPL Expo 2025, which appropriately placed UFlex at the head of green packaging in India. Such tubes are aimed at the beauty and personal care industries, which conform to the regulations in the Extended Producer's Responsibility governance of India. The initiative helps to boost the use of post-consumer material in chemical packets. As the demand for eco-compliant products is emerging, the product is likely to enhance the sales of UFlex in the domestic and export markets. The acquisition also boosts the competitive power of the firm in the Asian competitive sustainable packaging industry.

- Report ID: 8087

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flexible Tube Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.