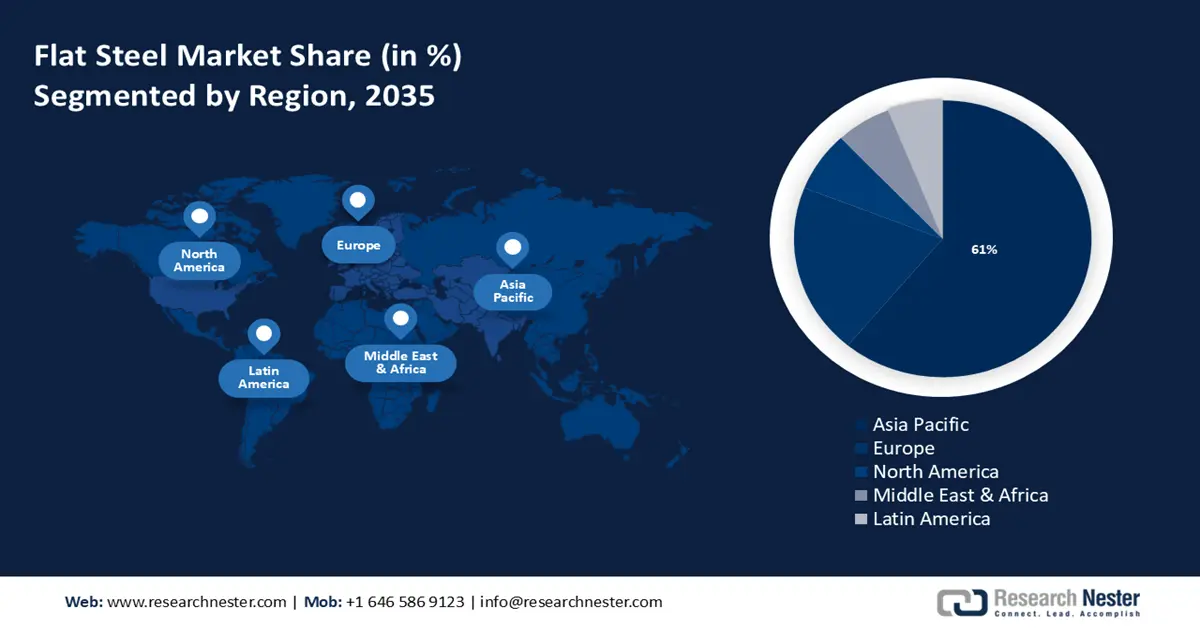

Flat Steel Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 61% by 2035. The market growth in the region is propelled by the growing food and beverage industry. Strict health and safety requirements and regulations must be adhered to by the food processing business in the region which necessitates the usage of flat steel since it upholds the highest standards of food safety and hygiene, and is utilized in processing machinery, storage tanks, and other pieces of equipment.

The largest high-speed rail network in the world is found in China, which is also considered special since it is the only nation in the world expanding its rapid rail network. This may drive the demand for flat steel in the country as it gives railway tracks stability and reinforcement by acting as ties or track sleepers.

Half of South Korea's stainless steel imports are flat goods, and the majority of the flat steel plates imported into the region come from Germany, Belgium, and Vietnam.

In 2023, Korea imported over 9 million tons of flat steel, around a 21% increase.

Similarly, Japan became the 36th highest importer of flat-rolled steel in the world in 2022 after importing over USD 175 million worth of the material.

European Market Insights

Europe region is set to witness significant growth till 2035 and will hold the second position owing to the increasing demand for flat steel products in this region. It is anticipated that in 2024 the demand for flat steel goods in Europe will rise by around 3%.

In addition, with an estimated 31 million metric tons produced in 2022, Germany was the EU's top producer of hot-rolled steel. Particularly, more than 9 million tons of steel goods were sold in Germany in total in 2023. About 59% of sales were made up of flat items, over 25% of long products, and 9% of other steel products.

Furthermore, Acciaierie d'Italia (ADI), an Italian integrated flat steel producer, has announced that it will increase crude steel production to around 3 million metric tons in 2023 and over 4 million metric tons in 2024, and has also stated that it intends to reopen Blast Furnace 2 this year and begin relining Blast Furnace 5 in the second half of 2023.