Flame Retardant Thermoplastic Market - Regional Analysis

Asia Pacific Market Insights

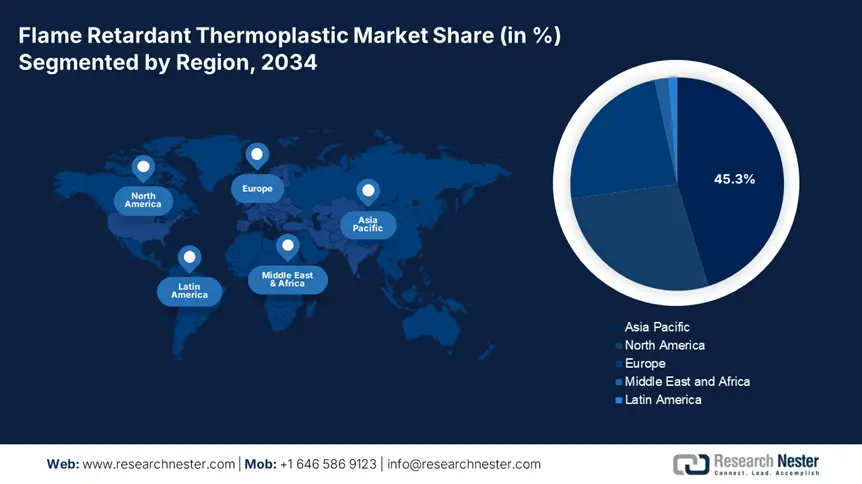

By 2034, the Asia Pacific market is expected to hold 45.3% of the flame retardant thermoplastic market share due to an increase in building, automotive, and electronics production. Regional consumption was in excess of 1.0 million tons in 2024. China emerged strongly in the flame retardant thermoplastics segment with a market share of approximately 56%. The growth of fire safety regulation by the issuance of ISO 1043-4 and fast-tracked urbanization in the Asia Pacific supports consumption. Major supply companies include Sabic, LG Chem, and Mitsubishi. The flame retardant thermoplastic market is predicted to grow at 6.9% CAGR (2025-2034), swelling to more than USD 7.1 billion in 2034.

China dominates the flame retardant thermoplastics segment in the Asia Pacific, with a 56% market share in 2024. The electrical and electronics production in China alone is valued at USD 2.4 trillion, and its flammability standards (GB/T 2408) force the use of flame-retardant chemicals in demand or products. Consumption exceeded 0.5 million tons in 2024, using flame-retardant resins such as flame-retardant PP and PC. The adoption of electric vehicles (EVs) in Asia resulted in an increased production of 9.4 million units in 2024, and increasingly highlights the demand for flame-retardant thermoplastic. The flame-retardant thermoplastic market is forecasted to experience a growth of 7.3% CAGR (2025-2034), to achieve more than USD 4.1 billion in 2034.

Country‑by‑Country Growth Drivers & Investment (Forecast to 2034)

|

Country |

Investment (USD Million, 2024) |

Market Growth (CAGR, 2025-2034) |

R&D Focus Areas |

|

Japan |

520 |

5.1% |

Halogen-free flame retardants, automotive thermoplastics, and electrical insulation |

|

China |

1,150 |

7.2% |

High-performance FR thermoplastics, EV battery components, and electronics |

|

India |

330 |

6.8% |

Construction safety materials, wire & cable compounds |

|

Indonesia |

110 |

5.5% |

Building & construction flame retardants |

|

Malaysia |

95 |

5.3% |

Electrical housing, appliance safety thermoplastics |

|

Australia |

80 |

4.9% |

Mining equipment plastics, infrastructure |

|

South Korea |

410 |

6.0% |

Electronics and semiconductor-grade flame retardant polymers |

|

Rest of APAC |

290 |

5.6% |

Regional electronics assembly, wire & cable sectors |

North America Market Insights

The North American flame retardant thermoplastic market is expected to hold 27.5% of the market share due to enhanced fire safety regulations for building construction, automotive, and electrical industries, and an increase in the use of flame retardant thermoplastics. The flame retardant thermoplastics market was valued at above USD 3.2 billion in 2024, with a projected market CAGR of 5.5% from 2025 to 2034. The increase in demand has come as a result of an increased investment in electric vehicles, aerospace, and advanced electronics, with added demand for halogen-free flame retardants considering regulatory action on halogenated flame retardants based on reports from the U.S. Environmental Protection Agency (EPA) and National Fire Protection Association (NFPA) in both Canada and the U.S.

According to the data collected for the flame retardant thermoplastic market in North America in 2024, the U.S. had more than 82% share in the market, with revenues greater than USD 2.55 billion. Growth has been supported by the rapid acceleration of UL 94 V-0 standards in electronics and strict NFPA codes in construction. Additionally, the market for flame retardant thermoplastics based on polycarbonate and polyamides, such as flame retardant thermoplastics ideal for automotive and electrical housings, is extensive. The flame retardant thermoplastic market is projected to reach USD 4.3 billion by 2034, largely due to an increased focus on R&D of halogen-free formulations and recycled thermoplastic applications.

Europe Market Insights

The European market is expected to hold 23.8% of the market share valued at $8.64 billion and is expected to grow at a CAGR of 4.3% to reach a value of $11.98 billion by 2032 due to growing demand from electrical & electronics, automotive, and construction markets. Increased implementation of industrial safety standards for flammability materials, the demand for electric vehicles (EVs), positive aging demographics impacting construction, urbanization, and innovation in halogen-free flame retardant technology, alongside the transformative tech from industry players helpful in amalgamating processes from its predecessor.

Country‑by‑Country Growth Drivers & Investment (Forecast to 2034)

|

Country/Region |

Key Growth Drivers |

Investment Forecast to 2034 |

|

UK |

Strong brand resilience, rising construction (+4.2% YoY, Mar 2023) |

Moderate–high |

|

Germany |

Auto output +12% (2022); electronics >11% of industrial GDP; construction recovery |

Very high |

|

France |

GDP +1.4% (IMF 2024); highest European growth; stable consumer sentiment |

High |

|

Italy |

Strong engineering, low-cost manufacturing, and skilled labor |

Moderate |

|

Spain |

Tech adoption, regulatory push, and unmet segments |

Moderate |

|

Russia |

Growing industrial base (data shows regional inclusion) |

Moderate–low |

|

Nordic countries |

Regional growth noted by 24ChemicalResearch (2023–30) |

Moderate |

|

Rest of Europe |

Infrastructure growth, CEE economic upswing |

Moderate |