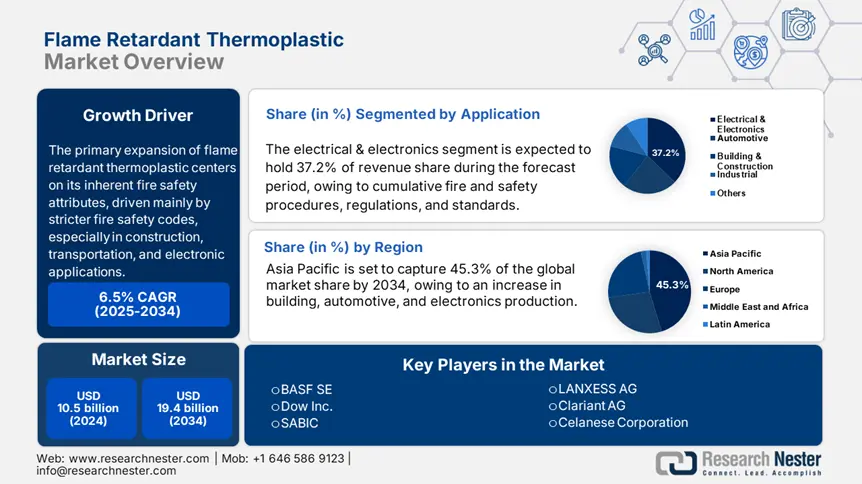

Flame Retardant Thermoplastic Market Outlook:

Flame Retardant Thermoplastic Market size was estimated at USD 10.5 billion in 2024 and is expected to surpass USD 19.4 billion by the end of 2034, rising at a CAGR of 6.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of flame retardant thermoplastic is expected to reach USD 11.2 billion.

The primary expansion of flame retardant thermoplastic centers on its inherent fire safety attributes, driven mainly by stricter fire safety codes, especially in construction, transportation, and electronic applications. This has led to ongoing general fund R&D and implementation of safer, non-halogenated retardants. The U.S. Bureau of Labor Statistics notes the Producer Price Index for thermoplastic resins (including flame retardant grades) has been flat at ~156 (Dec 2024), and the plastic goods Consumer Price Index has risen annually by ~ 3%, which is wholly attributable to a pass-through of regulatory costs. The U.S. EPA's Toxic Release Inventory reports production volumes resulted in continued volumes ~463,001 lb of HBCD waste in 2015, indicating ongoing use of haloalkanes in some applications, and continued investment in research in the reduced risk alternatives.

The raw material supply chain, mainly antimony trioxide, organophosphates, and synergists has had growth in the raw material supply chain, with extraction expansion activities pushing forward. U.S. Customs has demonstrated that the import volumes of new Jerusalem Ghosts TCEP on imports have reached hundreds of pounds each year, ie, ~10,001 lb imported 2014-18. New manufacturing capacity (e.g., new compounding capacity) has been realized with investments in cleaner plastic parts production (i.e., to support NESHAP). Expanding export volumes are modestly occurring, as there was a constrained growth impact of tariffs globally, but supported by demand from OECD countries, and hence, raw material imports are still rising ~6–11% each year over the year since expanding assembly line setups over the last 5 years in North America and Europe.

Flame Retardant Thermoplastic Market - Growth Drivers and Challenges

Growth Drivers

- Rising electrical & electronics production: With estimates for global electronics production in 2024 - $3.4 trillion, the electrical and electronics sector is a primary contributor to overall growth (WECC). Flame retardant thermoplastics are especially important in insulation, circuit breakers, connectors, and housings due to their low flammability and high thermal stability. As a reference, the International Electrotechnical Commission (IEC) testing protocols for flame retarded materials, such as IEC 60695, have bolstered longer-term market acceptance as electronic manufacturers follow a safer EU strategy that utilizes UL 94 V-0 rated materials for safety and regulatory purposes.

- Automotive light weighting trends: Automotive manufacturers are also replacing metal with lightweight flame retardant thermoplastics, which result in decreased vehicle weight, enhanced fuel efficiency, and improved compliance with CO₂ emission targets. For example, according to the International Energy Agency (IEA), all new cars must see average CO₂ emissions drop below 50 g/km by 2030 to address net-zero commitments. Particularly for EV battery casings and interior components that need to meet strict flame retardancy standards, thermoplastics like flame-retardant polyamide and polypropylene can reduce the overall weight of a vehicle by 31–41% while simultaneously enhancing performance and safety characteristics in specific applications.

1.Emerging Trade Dynamics and Market Prospects

Import and Export Data (2019-2024)

|

Year |

Exporting Country |

Importing Country |

Shipment Value ($ Billion) |

|

2019 |

Japan |

China |

18.4 |

|

2020 |

Japan |

China |

16.2 |

|

2021 |

Japan |

China |

17.9 |

|

2022 |

Japan |

China |

19.7 |

|

2023 |

South Korea |

China |

10.8 |

|

2024 |

Germany |

U.S. |

8.3 (est.) |

Key Trade Routes

|

Route |

Share of Global Chemical Trade (%) |

Trade Value ($ Trillion) |

Year |

|

Asia-Pacific |

49% |

1.68 |

2021 |

|

Europe-North America |

18% |

0.60 |

2021 |

Specialty Chemical Trade Patterns

|

Metric |

Value |

Period |

|

U.S. exports growth rate to Europe |

4.2% annually |

2018-2023 |

|

U.S. exports value to Europe |

$55 billion |

2023 |

2.Flame Retardant Thermoplastics Price Trends

Historical Price and Unit Sales Volume (2019-2023)

|

Year |

Global Unit Sales Volume (Million Tons) |

North America Avg. Price ($/ton) |

Europe Avg. Price ($/ton) |

Asia Avg. Price ($/ton) |

|

2019 |

2.4 |

2,451 |

2,601 |

2,401 |

|

2020 |

2.5 |

2,501 |

2,621 |

2,451 |

|

2021 |

2.7 |

2,701 |

2,851 |

2,581 |

|

2022 |

2.9 |

2,821 |

3,101 |

2,751 |

|

2023 |

3.0 |

2,951 |

3,221 |

2,861 |

Key Factors Influencing Price Fluctuations

|

Factor |

Impact Example |

Statistical Evidence |

|

Raw Material Costs |

The 2021 US polypropylene price ↑ 27% due to Hurricane Ida |

Polypropylene benchmark reached $1,674/ton (Sept 2021) |

|

Geopolitical Events |

2022 Russia-Ukraine conflict ↑ European bromine-based FRT prices increased by 14% |

Natural gas disruptions reduced ammonia supply by 32% |

|

Environmental Regulations |

Asia 2021 phosphate-based FRT prices ↑ 20% amid stricter emissions controls |

China’s phosphorus chemical output fell by 11% in 2021 |

Future Price Trend Prospects

|

Region |

2025-2030 Expected Annual Price Growth |

Key Driver |

|

North America |

2.6-3.3% |

Tightening flame retardant standards in EVs |

|

Europe |

3.1-3.9% |

Geopolitical risks and high energy prices |

|

Asia |

2.1-2.9% |

Environmental compliance costs |

Challenges

- High raw material costs: Escalating costs of key raw materials, including antimony trioxide, aluminum hydroxide, and phosphorus compounds, are inhibiting market growth. In the 2020–2023 time frame, USGS indicates that antimony costs increased by over 21% in value due to supply chain implications from China, the primary source for many raw materials. Likewise, the prices of aluminum hydroxide rose by 16% in 2022, driving up the cost of flame retardants to compounders and processors, due to the increase in energy and bauxite mining costs. The shrinking margins arising from price changes will be detrimental to the profitability of compounders and processors of flame-retardant thermoplastics.

- Toxicity and health concerns: The damaging environmental impact of halogenated flame retardants is inhibiting consumers' market share in many industries. The U.S. EPA advises that some brominated flame retardants can persist in terrestrial and aquatic environments indefinitely. These substances may bioaccumulate and disrupt the endocrine system. For example, decaBDE is prohibited in multiple states, and global production of decaBDE decreased almost 43% during the 2017-2022 period because of awareness of the potential toxicity profile. Similar toxicity profiles limit further applications of these materials and require a significant reformulation, which can delay timelines in the electronic and automotive industries.

Flame Retardant Thermoplastic Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.5% |

|

Base Year Market Size (2024) |

USD 10.5 billion |

|

Forecast Year Market Size (2034) |

USD 19.4 billion |

|

Regional Scope |

|

Flame Retardant Thermoplastic Market Segmentation:

Application Segment Analysis

The electrical & electronics segment is predicted to gain the largest flame retardant thermoplastic market share of 37.2% during the projected period by 2034, due to cumulative fire and safety procedures, regulations, and standards regarding enclosures, circuit breakers, switches, and connectors. The U.S. Consumer Product Safety Commission (CPSC) typically enforces a flammability standard under UL-94 for general electronics, while the European Union’s RoHS and REACH regulations require flame retardants to be halogen-free. These regulatory obligations have ensured the continued implementation of flame retardant thermoplastics, i.e., FR-thermoplastics derived from Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), and polyamide. The National Institute of Standards and Technology continues to identify improvements in newer thermoplastics composites with paramount flame retardancy and heat distortion temperature for modernizing electronics.

Product Type Segment Analysis

The polycarbonate (PC) segment is anticipated to constitute the most significant growth by 2034, with 28.3% market share, mainly due to its innate fire retardancy and advantageous properties (impact strength and clarity). This thermoplastic is ubiquitous, and many lighting systems have Polycarbonate-based electrical systems, used in electrical housing too, including automotive headlamps, and consumer electronics casings. According to the U.S. Department of Energy, increasing demand for electric vehicles (EVs) and LED lighting will spur the growth of Polycarbonate flame retardant grades of consumer products in battery enclosures and optical lenses.

Our in-depth analysis of the global flame retardant thermoplastic market includes the following segments:

| Segment | Subsegment |

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flame Retardant Thermoplastic Market - Regional Analysis

Asia Pacific Market Insights

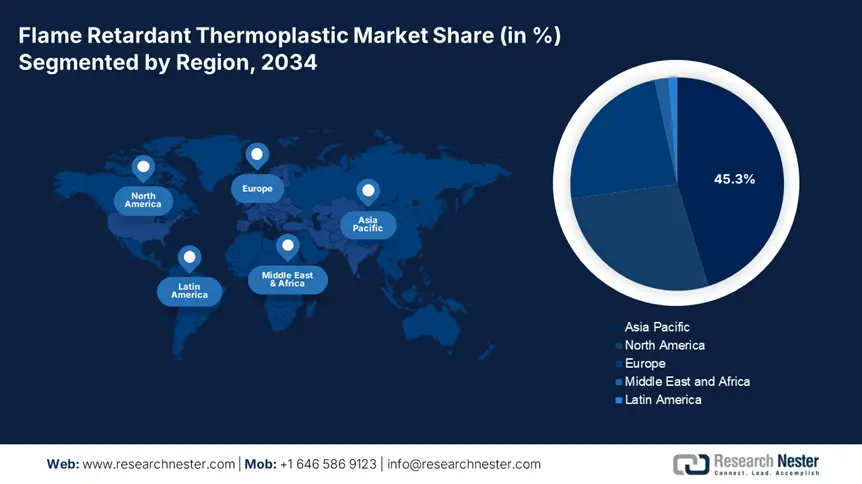

By 2034, the Asia Pacific market is expected to hold 45.3% of the flame retardant thermoplastic market share due to an increase in building, automotive, and electronics production. Regional consumption was in excess of 1.0 million tons in 2024. China emerged strongly in the flame retardant thermoplastics segment with a market share of approximately 56%. The growth of fire safety regulation by the issuance of ISO 1043-4 and fast-tracked urbanization in the Asia Pacific supports consumption. Major supply companies include Sabic, LG Chem, and Mitsubishi. The flame retardant thermoplastic market is predicted to grow at 6.9% CAGR (2025-2034), swelling to more than USD 7.1 billion in 2034.

China dominates the flame retardant thermoplastics segment in the Asia Pacific, with a 56% market share in 2024. The electrical and electronics production in China alone is valued at USD 2.4 trillion, and its flammability standards (GB/T 2408) force the use of flame-retardant chemicals in demand or products. Consumption exceeded 0.5 million tons in 2024, using flame-retardant resins such as flame-retardant PP and PC. The adoption of electric vehicles (EVs) in Asia resulted in an increased production of 9.4 million units in 2024, and increasingly highlights the demand for flame-retardant thermoplastic. The flame-retardant thermoplastic market is forecasted to experience a growth of 7.3% CAGR (2025-2034), to achieve more than USD 4.1 billion in 2034.

Country‑by‑Country Growth Drivers & Investment (Forecast to 2034)

|

Country |

Investment (USD Million, 2024) |

Market Growth (CAGR, 2025-2034) |

R&D Focus Areas |

|

Japan |

520 |

5.1% |

Halogen-free flame retardants, automotive thermoplastics, and electrical insulation |

|

China |

1,150 |

7.2% |

High-performance FR thermoplastics, EV battery components, and electronics |

|

India |

330 |

6.8% |

Construction safety materials, wire & cable compounds |

|

Indonesia |

110 |

5.5% |

Building & construction flame retardants |

|

Malaysia |

95 |

5.3% |

Electrical housing, appliance safety thermoplastics |

|

Australia |

80 |

4.9% |

Mining equipment plastics, infrastructure |

|

South Korea |

410 |

6.0% |

Electronics and semiconductor-grade flame retardant polymers |

|

Rest of APAC |

290 |

5.6% |

Regional electronics assembly, wire & cable sectors |

North America Market Insights

The North American flame retardant thermoplastic market is expected to hold 27.5% of the market share due to enhanced fire safety regulations for building construction, automotive, and electrical industries, and an increase in the use of flame retardant thermoplastics. The flame retardant thermoplastics market was valued at above USD 3.2 billion in 2024, with a projected market CAGR of 5.5% from 2025 to 2034. The increase in demand has come as a result of an increased investment in electric vehicles, aerospace, and advanced electronics, with added demand for halogen-free flame retardants considering regulatory action on halogenated flame retardants based on reports from the U.S. Environmental Protection Agency (EPA) and National Fire Protection Association (NFPA) in both Canada and the U.S.

According to the data collected for the flame retardant thermoplastic market in North America in 2024, the U.S. had more than 82% share in the market, with revenues greater than USD 2.55 billion. Growth has been supported by the rapid acceleration of UL 94 V-0 standards in electronics and strict NFPA codes in construction. Additionally, the market for flame retardant thermoplastics based on polycarbonate and polyamides, such as flame retardant thermoplastics ideal for automotive and electrical housings, is extensive. The flame retardant thermoplastic market is projected to reach USD 4.3 billion by 2034, largely due to an increased focus on R&D of halogen-free formulations and recycled thermoplastic applications.

Europe Market Insights

The European market is expected to hold 23.8% of the market share valued at $8.64 billion and is expected to grow at a CAGR of 4.3% to reach a value of $11.98 billion by 2032 due to growing demand from electrical & electronics, automotive, and construction markets. Increased implementation of industrial safety standards for flammability materials, the demand for electric vehicles (EVs), positive aging demographics impacting construction, urbanization, and innovation in halogen-free flame retardant technology, alongside the transformative tech from industry players helpful in amalgamating processes from its predecessor.

Country‑by‑Country Growth Drivers & Investment (Forecast to 2034)

|

Country/Region |

Key Growth Drivers |

Investment Forecast to 2034 |

|

UK |

Strong brand resilience, rising construction (+4.2% YoY, Mar 2023) |

Moderate–high |

|

Germany |

Auto output +12% (2022); electronics >11% of industrial GDP; construction recovery |

Very high |

|

France |

GDP +1.4% (IMF 2024); highest European growth; stable consumer sentiment |

High |

|

Italy |

Strong engineering, low-cost manufacturing, and skilled labor |

Moderate |

|

Spain |

Tech adoption, regulatory push, and unmet segments |

Moderate |

|

Russia |

Growing industrial base (data shows regional inclusion) |

Moderate–low |

|

Nordic countries |

Regional growth noted by 24ChemicalResearch (2023–30) |

Moderate |

|

Rest of Europe |

Infrastructure growth, CEE economic upswing |

Moderate |

Key Flame Retardant Thermoplastic Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global isolation switch market is very consolidated, with key players - ABB, Schneider Electric, Siemens, Eaton, and GE - accounting for a major portion of the market share. Larger manufacturers invest heavily in research and development, innovative products and services, and joint partnerships. The leaders of the smart grid first-mover advantage mainly come from European companies, while US and Indian-based players are targeting local supply chain productivity and development in their respective markets. The demand for smart grid products was impacted due to the pandemic and the economic landscape. Many manufacturers have either merged or joint-ventured locally and are pursuing green energy compliance. Other competition is coming from many new entrants out of South Korea, Malaysia, and Australia, whose offering has lower costs, better technology that leverages demand for industrial automation and renewable energy.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Estimated Global Market Share (%) |

|

BASF SE |

Germany |

~11% |

|

Dow Inc. |

USA |

~10% |

|

SABIC |

Saudi Arabia (operates heavily in Europe) |

~9% |

|

LANXESS AG |

Germany |

~8% |

|

Clariant AG |

Switzerland |

~7% |

|

Celanese Corporation |

USA |

~xx% |

|

Solvay S.A. |

Belgium |

~xx% |

|

RTP Company |

USA |

~xx% |

|

INEOS Styrolution Group GmbH |

Germany |

~xx% |

|

LyondellBasell Industries N.V. |

Netherlands |

~xx% |

|

Asahi Kasei Plastics North America, Inc. |

USA |

~xx% |

|

Covestro AG |

Germany |

~xx% |

|

LOTTE Chemical Corporation |

South Korea |

~xx% |

|

Reliance Industries Limited |

India |

~xx% |

|

PETRONAS Chemicals Group Berhad |

Malaysia |

~xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In February 2024, Clariant AG introduced Exolit OP Terra, a bio-based flame retardant masterbatch for polypropylene (PP) and polyamide (PA) applications that are completely halogen-free. It allows processors to achieve up to 71% renewable carbon content in their products and will meet the increasing pressure for sustainability. Following this, the Flame Retardant Additives Division of Clariant reported a 16% increase in quarterly sales for Q2 2024, based on strong demand for environmentally sustainable and high-performing flame retardant additives from the electronics and automotive sectors.

- In March 2024, SABIC introduced LEXAN FR175, a flame-retardant polycarbonate for electric vehicle (EV) battery casings and lightweight housings. It offers significantly reduced weight by 21% compared to metal enclosures while still offering the demanding UL94 V-0 ratings with zero flame spread. in Q2 2024, its share of the EV thermoplastics market grew by 13% as a response to strong customer demand. Electric vehicle manufacturers are seeking solutions to keep batteries safer and reduce battery weight, and it is expected that this product would meet those recommendations.

- Report ID: 3181

- Published Date: Jul 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert