Fixed Mounting Power Distribution Component Market Outlook:

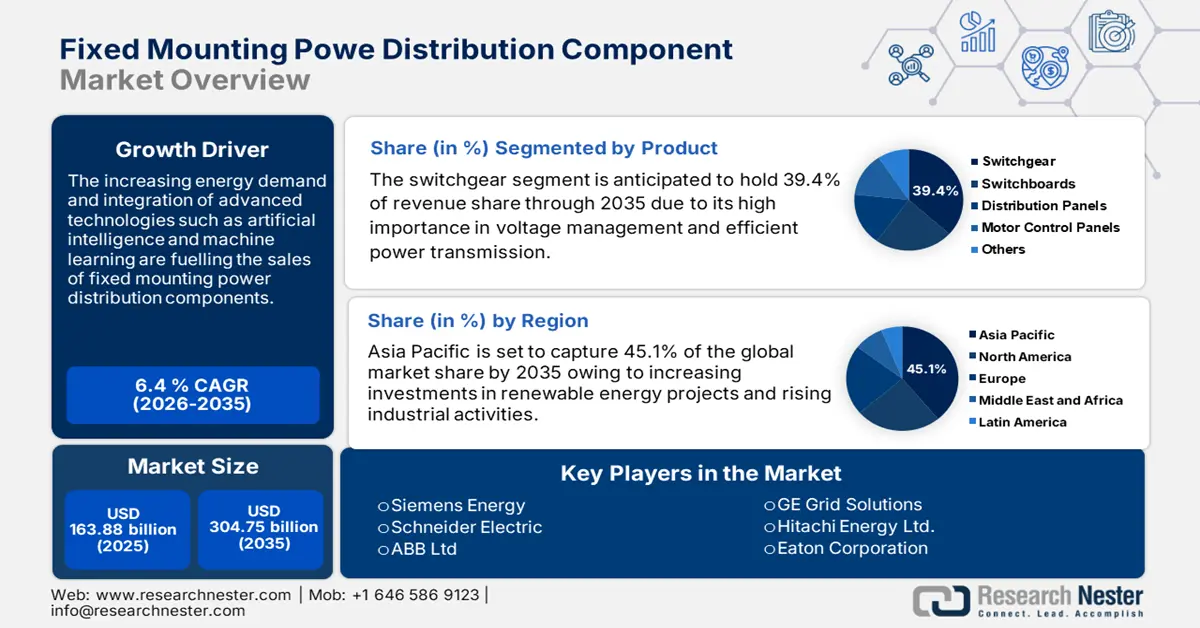

Fixed Mounting Power Distribution Component Market size was valued at USD 163.88 billion in 2025 and is expected to reach USD 304.75 billion by 2035, expanding at around 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fixed mounting power distribution component is evaluated at USD 173.32 billion.

The rising adoption of sustainable manufacturing practices, strict environmental regulations, and growing demand for cleaner energy sources are augmenting the sales of fixed mounting power distribution components. The International Energy Agency (IEA) estimates that in 2024, the global investment in clean energy technologies and infrastructure was valued at USD 2.0 trillion. These statistics aid in understanding the increasing importance of cleaner energy and the need for advanced electrical systems, including, fixed-mounting power distribution components.

The world is seeing significant investments in renewable energies, smart grids, and advanced power storage than coal, gas, and oil. Many governments around the globe are also launching initiatives supporting the adoption of solar energy sources, which are set to push for the adoption of fixed-mounting power distribution components in the coming years.

Key Fixed Mounting Power Distribution Component Market Insights Summary:

Regional Highlights:

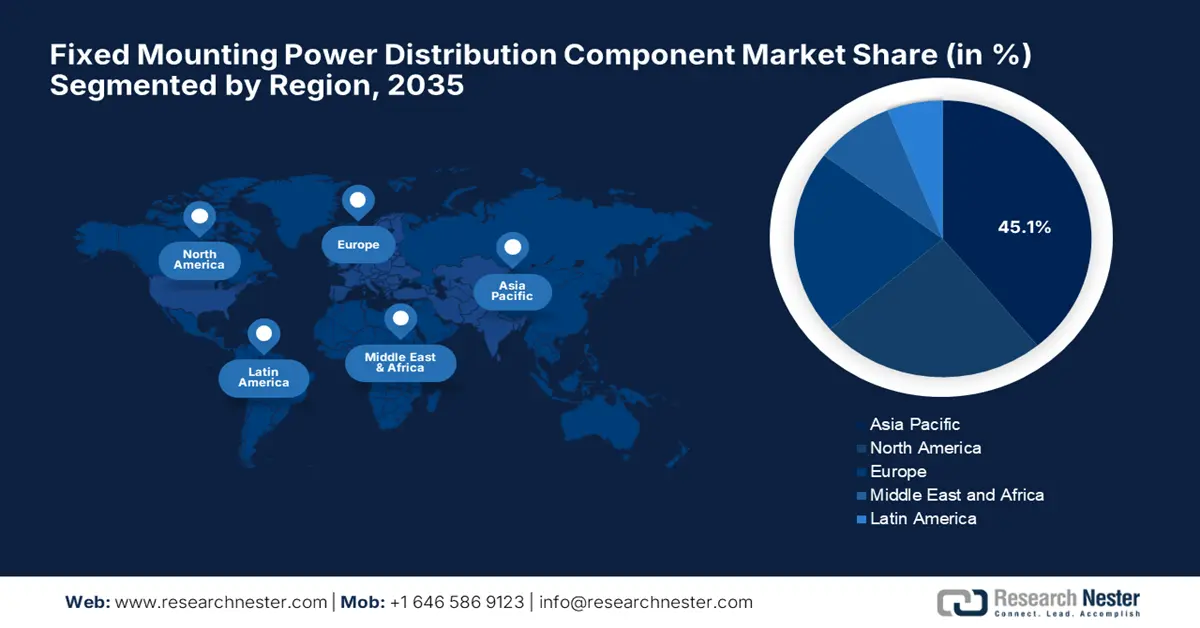

- Asia Pacific dominates the Fixed Mounting Power Distribution Component Market with a 45.10% share, driven by high investments in energy infrastructure projects and rising urban and industrial activities across the region, ensuring strong growth through 2035.

- North America's Fixed Mounting Power Distribution Component Market is anticipated to achieve the fastest growth by 2035, fueled by rapid digitalization, aging infrastructure, and the adoption of energy-efficient solutions and smart grid technologies.

Segment Insights:

- The Switchgear Segment is expected to hold a substantial share by 2035, driven by demand for advanced switchgear technologies enhancing safety, reliability, and efficiency in power distribution.

- The Commercial Segment is projected to hold a 38.5% share by 2035, driven by the rise in commercial infrastructure development projects requiring efficient power distribution components.

Key Growth Trends:

- Emergence of digital technologies

- Hike in infrastructure developments

Major Challenges:

- High initial investments

- Supply chain disruptions

- Key Players: ABB Ltd, Schneider Electric, Siemens, Alstom SA, CG Power & Industrial Solutions Ltd., and Eaton Corporation.

Global Fixed Mounting Power Distribution Component Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 163.88 billion

- 2026 Market Size: USD 173.32 billion

- Projected Market Size: USD 304.75 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Fixed Mounting Power Distribution Component Market Growth Drivers and Challenges:

Growth Drivers

- Emergence of digital technologies: The integration of digital technologies such as artificial intelligence, machine learning, and deep learning is leading to the development of smart fixed mounting power distribution components. These advanced technologies make sure that the energy flows from plants to end users most efficiently and safely. These smart technologies also enhance the features of power distribution components such as demand forecasting, predictive maintenance, real-time analysis, improved grid stability, move towards smart connectivity, and more. IEA estimates that AI has more than 50 different applications in energy systems, and the demand for this technology in the energy sector is expected to be over USD 13 billion in the coming years.

- Hike in infrastructure developments: The rise in infrastructure development projects worldwide is expected to fuel the fixed mounting power distribution component market growth during the forecast period. Governments are investing heavily in upgrading aging infrastructure or developing new infrastructure, which is creating high-earning opportunities for fixed-mounting power distribution component manufacturers. The high-speed rail line California, the Skagerrak Railway line, and the Trans-Asean Railway line are some of the major infrastructure development projects initiated, globally, and to meet the effective and safe power distribution and transmission the adoption of advanced fixed mounting power distribution components in these projects is set to gain high traction.

Challenges:

- High initial investments: The high costs of advanced power distribution components can significantly hamper sales in poor economies. Many small-scale organizations or companies running on limited budgets may find it difficult to invest in advanced technologies and prefer conventional alternatives. Thus, even though technological advancements are enhancing operational efficiency, their high prices are expected to create hurdles for such organizations.

- Supply chain disruptions: The ongoing geopolitical tensions among countries such as Israel-Palestine, Russia-Ukraine, and the Sudanese civil war, scarcity of raw materials, and increased logistic prices are leading to supply chain disruptions of raw materials, increasing final product costs. The supply chain disruptions also lead to delays in final product production because of which many fixed mountings power distribution component market players are deterred from profitable opportunities.

Fixed Mounting Power Distribution Component Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 163.88 billion |

|

Forecast Year Market Size (2035) |

USD 304.75 billion |

|

Regional Scope |

|

Fixed Mounting Power Distribution Component Market Segmentation:

Product (Switchgear, Switchboards, Distribution Panels, Motor Control Panels, Others)

Switchgear segment is projected to account for more than 39.4% fixed mounting power distribution component market share by the end of 2035 owing to its major role in power distribution. These advanced switchgear technologies manage the voltage flow and act effectively in sudden power cuts, resulting in safer and more reliable power transmission. The demand for fixed mounting power distribution switchgear systems is anticipated to reach a valuation of USD 172.7 billion by 2035. For instance, in February 2024, Schneider Electric announced the launch of its new SureSet MedimVoltage switchgear in Canada. The compact design, greater uptime, and durability are some of its latest features that are expected to boost its sales growth.

Application (Residential, Commercial, Industrial, Utility)

By the end of 2035, commercial segment is estimated to hold over 38.5% fixed mounting power distribution component market share. The rise in commercial infrastructure development projects such as skyscrapers, advanced healthcare facilities, shopping malls, hotels, office buildings, and sports facilities is fuelling high demand for advanced fixed mounting power distribution components for efficient glow of energy.

Our in-depth analysis of the fixed mounting power distribution component market includes the following segments:

|

Product

|

|

|

Voltage Rating |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fixed Mounting Power Distribution Component Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific in fixed mounting power distribution component market is set to hold over 45.1% revenue share by the end of 2035. The high investments in energy infrastructure projects and rising urban and industrial activities are pushing the demand for power distribution products. For instance, according to the IEA analysis, Southeast Asia invested around USD 15 billion in renewable power in 2024. South Korea, Japan, China, Australia, and India are some of the lucrative marketplaces for fixed mounting power distribution component manufacturers.

China is the top manufacturing hub of electrical systems including power distribution components, globally. The strong presence of electrical component manufacturers and increasing energy demand in the country augment the sales of power distribution components. According to the IEA analysis, China exceeded 6.4% of energy demand in 2023.

North America Market Statistics

The North America fixed mounting power distribution component market is expected to expand at a fast CAGR during the forecast period owing to rapid digitalization and aging infrastructure. The need to upgrade the older infrastructure fixed mounting power distribution components is exhibiting high demand. The rapid adoption of smart grid technologies and energy-efficient solutions is also contributing to the overall fixed mounting power distribution component market growth.

The adoption of sustainable manufacturing practices in the U.S. and strict environmental regulations have resulted in high demand for energy-efficient power distribution components. For instance, according to a report by the IEA, the U.S. invested around USD 315 billion in cleaner energy projects in 2024 to meet the COP28 goals.

Canada is at the top of renewable energy adoption across the world, which is pushing a consistent demand for advanced power distribution components in the country. The high investments in hydroelectric power projects are further influencing the sales of modern fixed mounting power distribution component projects in the country.

Key Fixed Mounting Power Distribution Component Market Players:

- ABB Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- Siemens

- Alstom SA

- CG Power & Industrial Solutions Ltd.

- Eaton Corporation

- Lucy Group Ltd.

- L&T Electrical & Automation

- GE Grid Solutions

- G&W Electric

- Hitachi Energy Ltd

- Meiden Europe GmbH

- Ormazabal

- Powell Industries

The global fixed mounting power distribution component market is extremely competitive and consists of several players that operate on global and regional levels. These players in the fixed mounting power distribution component market are adopting various organic and inorganic strategies such as new product introductions, technological advancements, mergers and acquisitions, collaborations, partnerships, and regional expansion to earn high profits. Industry giants are partnering with other players and collaborating with technology firms to introduce technologically advanced fixed mounting power distribution solutions. They are also tapping into high-potential economies to cater to a wider consumer base and earn high fixed mounting power distribution component market shares. Some of the key players include:

Recent Developments

- In September 2023, ABB Ltd. announced the launch of its new air-insulated (AIS) medium-voltage (MV) switchgear, UniGear ZS1, 500mm panel version at ADIPEC 2023. This technology is gaining popularity among space constraint, end use organizations.

- In October 2022, Schneider Electric revealed its advanced energy management solutions at the Innovation Summit World Tour. The products include GM AirSeT, a new gas-insulated switchgear, EcoStruxure Energy Hub, and Electric EcoCare.

- Report ID: 6583

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fixed Mounting Power Distribution Component Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.