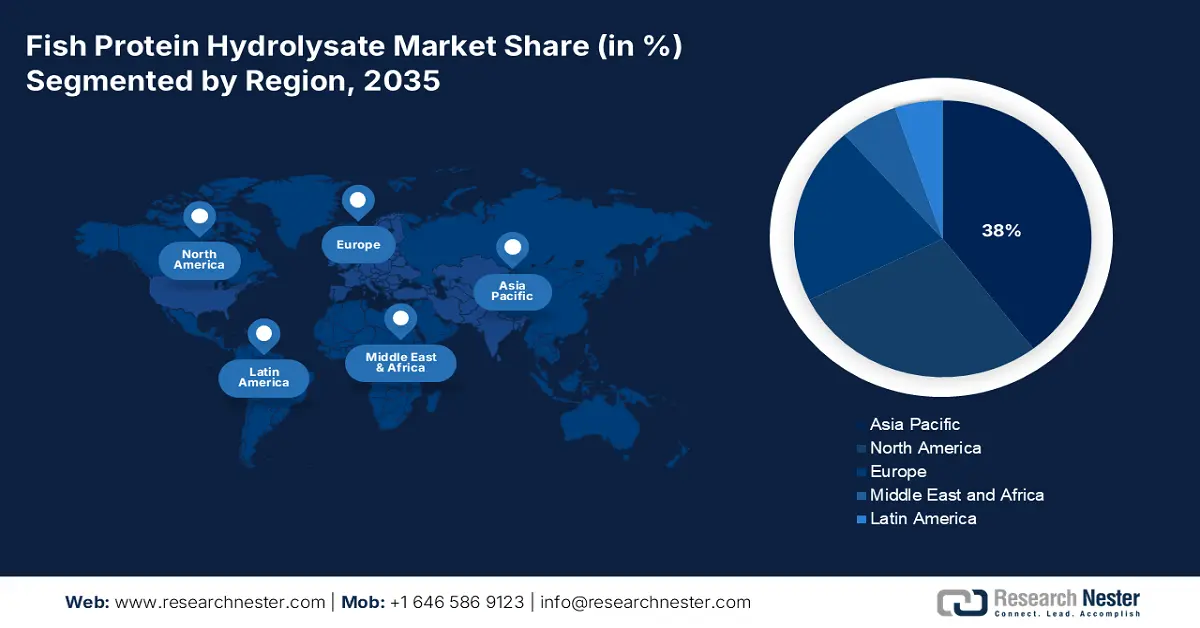

Fish Protein Hydrolysate Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific fish protein hydrolysate market is expected to hold 38% of the market share due to expanding use of seafood byproducts, increased aquaculture production, and the acceptance of sustainable chemistry. Countries like China, India, and Indonesia consume the most fish feed, which stimulates market growth and the development throughout the region, while South Korea, Malaysia, and Japan support bio-based innovations through national circular economy and R&D initiatives. The market in China is propelled by rising demand for aquaculture feed and pet nutrition. The country is the largest contributor to worldwide aquatic food availability, keeping the feed volume high. According to data published by the Food and Agriculture Organization, there are 20,276 different species living in the country’s marine environment.

India is witnessing prominent growth in the coming decade. The growth of the fish protein hydrolysate market can be attributed to government-led modernization initiatives and increasing demand for nutritious products. The country’s flagship program, Pradhan Mantri Matsya Sampada Yojana (PMMSY), is to modernize fisheries and upgrade productivity. According to the Government of India data in February 2025, the country remains the 2nd largest fish-producing country with 8% share in the global production of fish. Also, the country is grappling with widespread protein deficiency, and FPH renders a potent source capable of augmenting the market growth.

North America Market Insights

The North America fish protein hydrolysate market is anticipated to garner 23.6% of the share, driven by rising demand for sustainable protein supplements in aquaculture, food for pets, and nutraceuticals. In the U.S., the market growth is gaining maximum momentum, driven by burgeoning demand for high-quality protein alternatives in aquaculture feed. Also, there is increased demand for premium pet food products that are augmenting the usage of fish-derived protein. According to data published by the American Pet Products Association in 2025, more than 94 million households in the country own a pet.

Similarly, the fish protein hydrolysate market in Canada is powered by consumer inclination for sustainable food and supplements. The cod and herring cold-water fisheries in the country are providing an abundant source for procuring raw material for manufacturing high-quality hydrolysates, streamlining the supply chain stability. Additionally, the data published by the Canadian Institute of Food Safety in February 2025, 64.2% of the shoppers are inclined to opt for the brand for better ingredient transparency. The mushrooming interest in clean-label and natural supplements is supporting the market growth in the country.

Europe Market Insights

Europe market is set to register significant revenue owing to growing demand for sustainable protein sources across animal feed, nutraceuticals, and functional foods. A plethora of projects are promoting the usage of fish byproducts and regulatory support. Additionally, due to robust research and development strategies and government support, Germany is emerging as the largest growth-acquiring in the region. Germany's leadership is further cemented by its sophisticated biotech industry and stringent sustainability regulations. The data published by the Government in 2021 stated that more than 18,310 tonnes of fish were produced in the aquaculture business in the country.

The Netherlands is projected to garner significant traction owing to the strong commitment of the country to the circular economy and integrating ultra-modern aquaculture strategies. The country is home to a global powerhouse in fish feed, Nutreco, which derives innovation in the ingredients of the feed. Together, these structural benefits —a supportive innovation ecosystem, regulatory incentives, and sustainable feed demand—are propelling the growth pathway of the FPH market in the Netherlands. Also, under the Dutch National Protein Strategy, the country is endeavoring by 2030 to achieve an equivalent split for the consumption of animal and plant-based protein.