Fire Tube Food Processing Boiler Market Outlook:

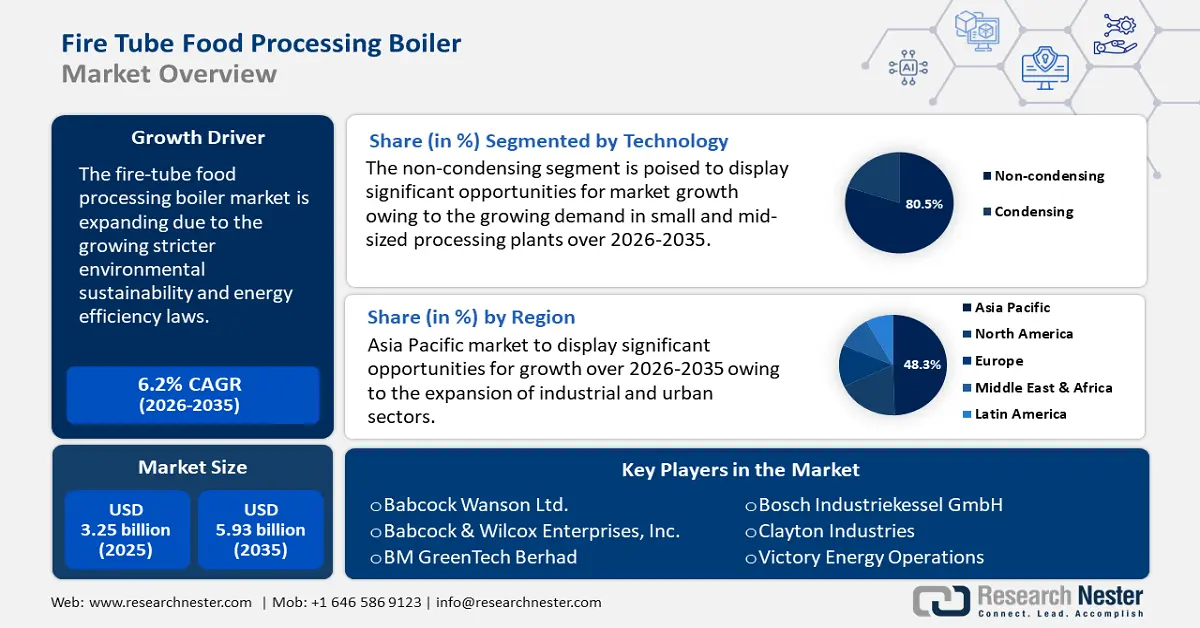

Fire Tube Food Processing Boiler Market size was valued at USD 3.25 billion in 2025 and is likely to cross USD 5.93 billion by 2035, expanding at more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fire tube food processing boiler is estimated at USD 3.43 billion.

The fire tube food processing boiler market is expanding due to the growing stricter environmental sustainability and energy efficiency laws and programs. The food processing industry is subject to strict regulations regarding hygiene and safety. Fire-tube boilers are effective in maintaining high sanitation standards, as steam generated from these boilers can be used for sterilization purposes.

Compliance with safety and environmental regulations is driving the adoption of advanced boiler systems. The U.S. Environmental Protection Agency (EPA) and the U.S. Department of Energy are in charge of managing Energy Star, which is a program that promotes energy efficiency. Thousands of businesses, including approximately 40% of the Fortune 500, collaborate with Energy Star. Together with the EPA, they provide cost-effective energy efficiency solutions that safeguard the environment, enhance air quality, and protect public health. In addition to supporting food processing companies' environmental objectives, this shift toward energy efficiency also complies with legal mandates that promote fewer carbon footprints. Businesses may guarantee adherence to several environmental standards and favorably impact sustainability initiatives by investing in contemporary and effective boiler technologies.

Key Fire Tube Food Processing Boiler Market Insights Summary:

Regional Highlights:

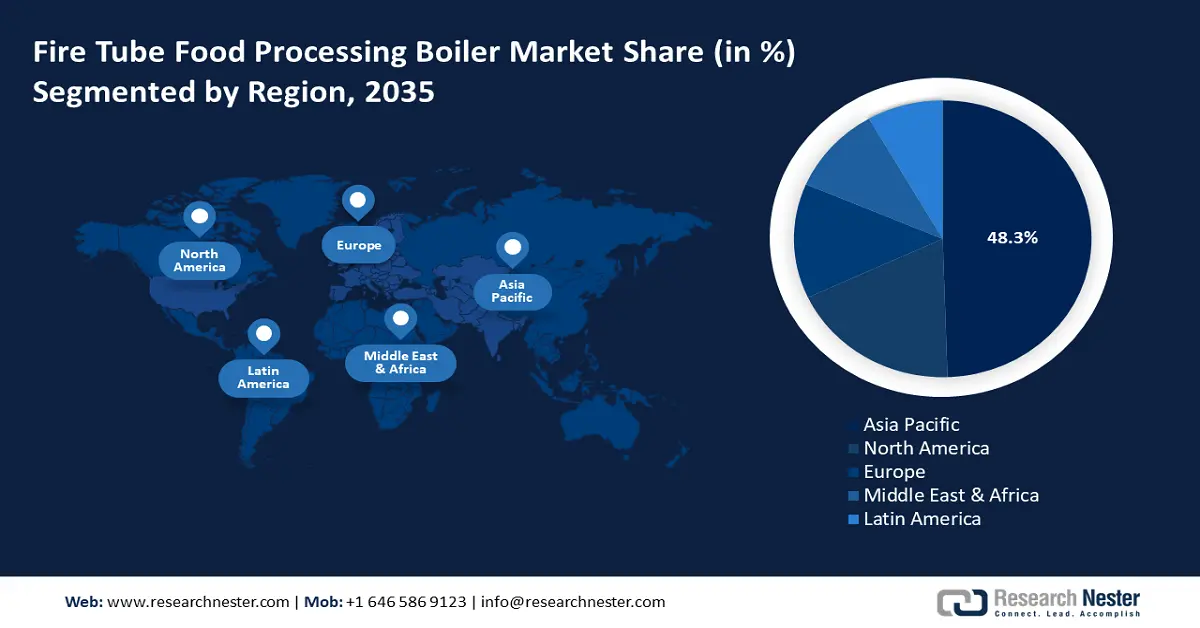

- Asia Pacific dominates the Fire Tube Food Processing Boiler market with a 48.3% share, propelled by the expansion of industrial and urban sectors in major countries, favorable trends towards energy efficiency, and emission reduction goals through 2026–2035.

Segment Insights:

- The Non-condensing segment is projected to dominate with over 80.5% market share from 2026 to 2035, driven by lower startup costs and rising demand in smaller processing facilities.

- The <10 MMBtu/hr segment is forecasted to secure around 26% market share by 2035, influenced by demand for compact and efficient boiler systems in the food processing sector.

Key Growth Trends:

- Rapid shift towards process automation in food processing operations

- Expansion of the food and beverage industry

Major Challenges:

- Exorbitant installation costs

- Energy-efficient alternatives

- Key Players: Babcock Wanson Ltd., Babcock & Wilcox Enterprises, Inc., BM GreenTech Berhad, Bosch Industriekessel GmbH, Clayton Industries, Victory Energy Operations, LLC, Cleaver-Brooks, Forbes Marshall, Hurst Boiler & Welding Co, Inc., Miura America Co., Ltd.

Global Fire Tube Food Processing Boiler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.25 billion

- 2026 Market Size: USD 3.43 billion

- Projected Market Size: USD 5.93 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, Germany, United States

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 14 August, 2025

Fire Tube Food Processing Boiler Market Growth Drivers and Challenges:

Growth Drivers

- Rapid shift towards process automation in food processing operations: Manufacturers in the food industry are increasingly relying on automated technologies like fire tube boilers to enhance the consistency and efficiency of their operations. For instance, in September 2023, Babcock Wanson Ltd., a specialist in industrial process heating equipment and solutions, finished a turnkey project to feed steam to cookers at IRC Cucina's new central kitchen in Trafford Park via its BWD30 fire tube boiler.

These boilers are crucial for various food processing tasks such as drying, sterilizing, and cooking, as they provide reliable and efficient heat generation. Automation reduces human interference in potentially dangerous situations, which increases safety in addition to production. - Expansion of the food and beverage industry: The demand for processed food increases as the population and disposable incomes rise. According to a 2024 UN Trade & Development Organization (UNCTAD) report, approximately 48% of the food imported by developed economies is processed food, whereas only roughly 35% is imported by emerging economies.

This trend demands increasing production capacity and using cutting-edge processing machinery, such as fire tube boilers, renowned for their dependability and effectiveness. The need for fire tube food processing boilers is anticipated to rise significantly as food manufacturers modernize their processing equipment and expand their production facilities to meet changing customer tastes. - Innovations in boiler systems: Boiler systems are now equipped with smart controls due to a shift towards digital transformation. The trend toward digitalization enhances energy management and improves operational efficiency across various food processing applications. Stakeholders are encouraged to adjust to these patterns to seize new possibilities and keep a competitive edge. Furthermore, companies are concentrating on incorporating cutting-edge technologies, such as smart sensors and the Internet of Things (IoT), which may enhance boiler performance, track energy usage, and adhere to environmental requirements.

Challenges

- Exorbitant installation costs: Potential consumers are discouraged by the initial installation cost, even though the steam generator is dependable and efficient for various industrial uses. This price covers the boiler and related labor and infrastructural expenses. As a result, companies might decide to delay boiler upgrades or choose other heating options, which would hinder market expansion.

- Energy-efficient alternatives: Modern boilers, such as water tube, and condensing boilers, are far more energy-efficient compared to fire-tube boilers. Condensing boilers recover heat from exhaust gases, achieving higher efficiencies and reducing operational costs. These alternatives are particularly appealing in industries like food processing, where energy efficiency is critical.

Fire Tube Food Processing Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 3.25 billion |

|

Forecast Year Market Size (2035) |

USD 5.93 billion |

|

Regional Scope |

|

Fire Tube Food Processing Boiler Market Segmentation:

Technology (Condensing, Non-condensing)

By 2035, non-condensing segment is estimated to hold more than 80.5% fire tube food processing boiler market share. The segment growth can be attributed to the lower startup costs and growing demand in small and mid-sized processing plants. Moreover, product deployment will increase due to the rapid development and retrofitting of current food processing facilities and the growing demand for dairy and baked goods. The Food and Agriculture Organization of the United Nations (FAO) stated that dairy products are consumed by about 6 billion people globally, most of whom reside in developing nations. Furthermore, strong urbanization expansion, dietary choice changes, and strict food safety standards are other major factors propelling the segment’s expansion.

Capacity (<10 MMBtu/hr, 10-25 MMBtu/hr, 25-50 MMBtu/hr, 50-75 MMBtu/hr, 75-100 MMBty/hr, 100-175 MMBtu/hr, 175-250 MMBtu, >250 MMBtu/hr)

In fire tube food processing boiler market, <10 MMBtu/hr segment is predicted to account for around 26% revenue share by 2035. The segment is expanding due to the food processing industry's ongoing need for compact, effective, and legally compliant fire-tube boilers. Favorable business prospects will arise from deploying smart control technologies that provide real-time monitoring, predictive maintenance, and enhanced operational efficiency. The market for these boiler systems will be further stimulated by ongoing governmental and private sector investment in their modernization and improvement, as well as by encouraging efficiency standards.

Fuel (Natural Gas, Oil, Coal, Others)

Natural gas segment is expected to hold fire tube food processing boiler market share of over 36.7% by the end of 2035. The segment is expanding due to the strong growth and expansion of conventional processing facilities and the rising demand for dairy and baked goods. Their excellent thermal efficiency, reduced initial cost, and improved energy utilization in industrial processes are expected to propel the industry. Modern heating systems embrace innovations such as better burner technologies and enhanced heat recovery systems, which increase their dependability and efficiency and boost the industry's potential.

Our in-depth analysis of the fire tube food processing boiler market includes the following segments:

|

Capacity |

|

|

Technology |

|

|

Fuel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fire Tube Food Processing Boiler Market Regional Analysis:

APAC Market Statistics

Asia Pacific in fire tube food processing boiler market is set to capture over 48.3% revenue share by 2035. The market is growing due to the expansion of industrial and urban sectors in major countries. The favorable trend toward raising energy efficiency and emission reduction goals and rising infrastructure investment in the food processing sector will fuel fire tube food processing boiler market expansion.

India has experienced a tremendous digital revolution, with greater connection and technological prowess resulting in greater digital accessibility and inclusivity for its people. For instance, the share of the digital economy in India's overall economy was 3.5% in 2014, is 10% currently, and is predicted to reach over 20% of the country's GDP by 2020-2026. This digital transformation has led manufacturers in the country to incorporate smart controls to optimize energy management and enhance the efficiency of these boilers across the food & beverage industry.

China's food processing business has advanced in the last several years. With the continuous improvement of its overall grain production capacity, China has generated a significant amount of grains. The yearly production has leveled off over 650 million tons, providing a solid platform for expanding China's food processing sector. Therefore, food processing businesses in the nation have increased the use of fire tube food processing boilers as they increase their production facilities and upgrade their processing equipment to keep up with evolving consumer preferences.

North America Market Analysis

North America will hold a significant share in the fire tube food processing boiler market by the end of 2035. The fire tube food processing boiler market is booming due to growing operational expenses, regulatory pressure, and supportive federal and state environmental laws that encourage the use of cleaner technology, the sector is placing a higher priority on energy efficiency. Furthermore, due to the growing adoption of energy-efficient technologies and the trend toward lowering greenhouse gas emissions, the industry is expected to increase.

In the U.S., the continuous growth of organic goods, frozen foods, and prepared meals along with the incorporation of low-NOx burners and other emission-reducing technology, will stimulate product demand. For instance, spending on frozen fruit increased dramatically in 2021, rising by over 20% over the previous year.

Key Fire Tube Food Processing Boiler Market Players:

- Babcock Wanson Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Babcock & Wilcox Enterprises, Inc.

- BM GreenTech Berhad

- Bosch Industriekessel GmbH

- Clayton Industries

- Victory Energy Operations, LLC

- Cleaver-Brooks

- Forbes Marshall

- Hurst Boiler & Welding Co, Inc.

- Miura America Co., Ltd.

The fire tube food processing boiler market is highly competitive, with a wide range of companies striving for market dominance through excellent product offerings and cutting-edge technologies. Businesses are spending more on R&D as the competition heats up to emerge from the competition, enhance customer satisfaction, and increase their fire tube food processing boiler market share.

Recent Developments

- In February 2023, Babcock Wanson’s BWD40 Fire Tube Boiler was erected at Meantime Brewing's Greenwich, for various brewery operations, including wort production and packaging line operations. The 4-tonne BWD40 replaces the original 2.5-tonne boiler, which had reached the end of its functional life.

- In September 2020, Victory Energy expanded its existing firetube product portfolio to include hot water and vertical boilers in response to rising market demand. Victory Energy's strategic action broadens and enhances its position in the firetube boiler product area.

- Report ID: 6587

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.