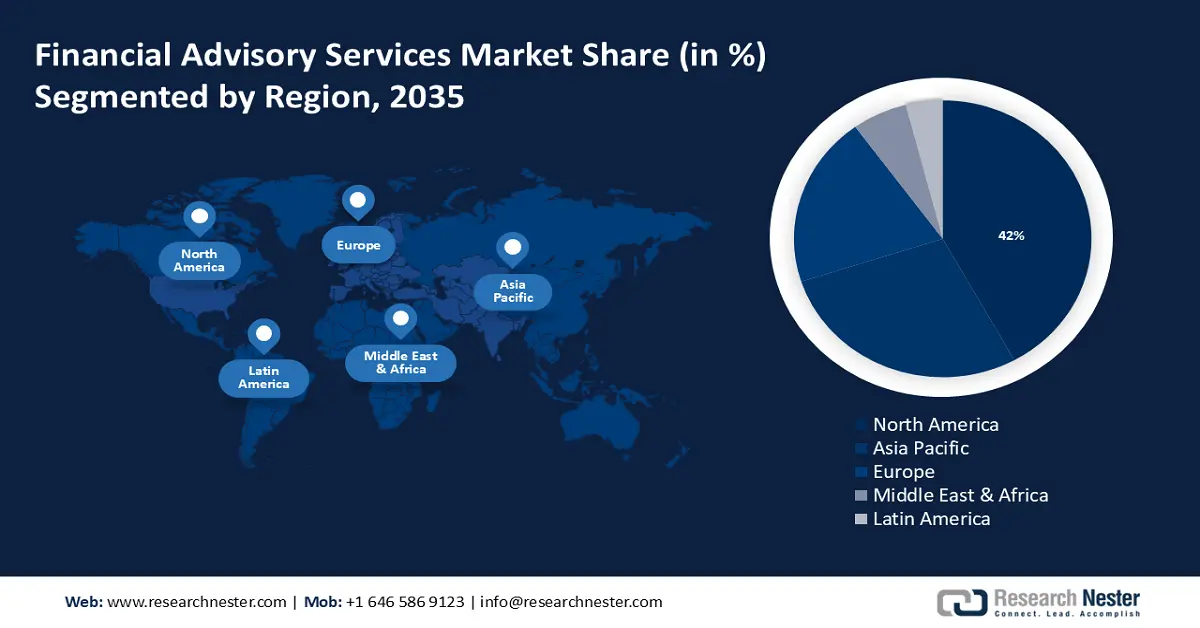

Financial Advisory Services Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 42% by 2035. Because there are a lot of wealthy people and businesses in the area with complex financial needs, there is a need for sophisticated financial advice and investment methods. The 400 richest Americans in 2020 had a collective net worth of USD 3.2 trillion, which was an increase from USD 2.7 trillion in 2017. In the United States, there were 735 billionaires as of March 2023.

The United States financial advisory services market is seeing tremendous growth as a result of shifting customer demographics, swift technological developments, and altered competitive dynamics. A wide range of goods and services tailored to the unique financial climate of United States are included in financial advising services. For instance, to assist clients in navigating economic instability, Kroll introduced a property insurance value platform in April 2023. The platform provides clients with rapid, thorough, and expert-driven insights for property insurance assessment, assisting them in navigating economic uncertainty.

APAC Market Insights

The APAC region will also encounter huge growth for the financial advisory services market during the forecast period. Because of the ongoing growth of regional wealth management goods, distribution networks, laws, technological usage, growing middle class, and social skills, the Asia Pacific area is predicted to expand at the quickest rate. Asia-Pacific's middle-class population is projected to grow from 1.38 billion in 2015 to 3.49 billion by 2030.

The Chinese financial advisory services market is influenced by factors such as urbanization, and expanding wealth. China's urbanization rate was 66.2% by the end of 2023 and is predicted to rise to 75–80% by 2035.

Technology advancement, cultural differences, and legal restrictions all have a big influence on how the business is portrayed in Korea. In 2021, South Korea had the fifth position in the Global Innovation Index. The sixth-largest private investment in artificial intelligence as of 2022 is made in South Korea.

In Japan financial consulting services are crucial for firms in the retail and e-commerce sectors to handle their finances well, negotiate the complexities of the market, and make strategic decisions. A rough estimate of the amount individuals spent on fashion goods online in 2023 was USD 31.9 billion.