Financial Advisory Services Market Outlook:

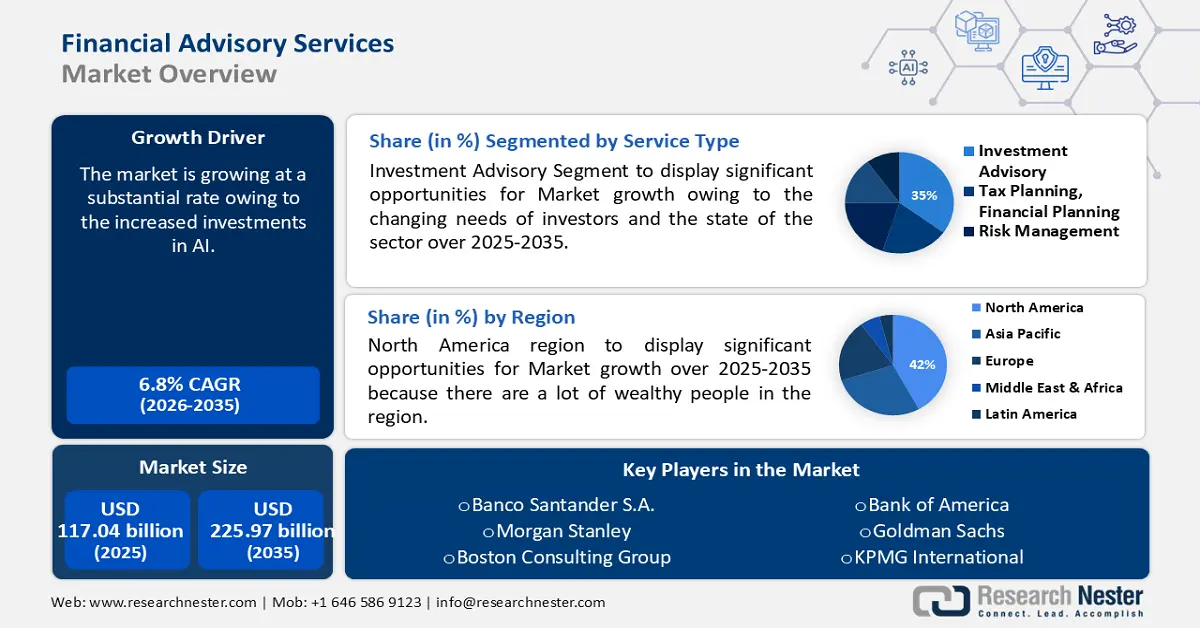

Financial Advisory Services Market size was valued at USD 117.04 billion in 2025 and is expected to reach USD 225.97 billion by 2035, expanding at around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of financial advisory services is evaluated at USD 124.2 billion.

The financial advisory services market is growing at a substantial rate owing to the increased investments in AI. Personalized financial insights, predictive analytics, and advanced data analysis are made possible by AI technologies. These developments optimize advisory procedures, enabling automated portfolio management, customized investment plans, and more precise risk evaluations. The International Trade Administration reported that global funding for AI more than doubled to USD 66.8 billion in 2021, while a record 65 AI businesses were valued at USD 1 billion or more, an increase of 442% over 2020.

Key Financial Advisory Services Market Insights Summary:

Regional Highlights:

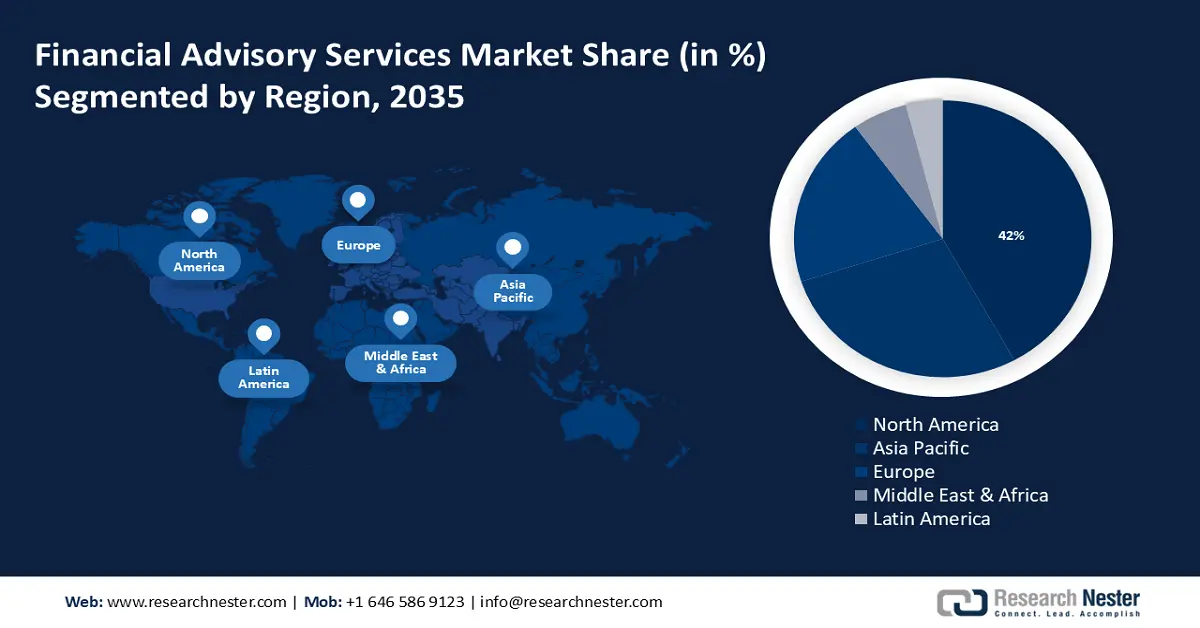

- North America financial advisory services market will hold more than 42% share by 2035, driven by the presence of wealthy individuals and complex financial needs.

- Asia Pacific market will experience the fastest CAGR during 2026-2035, driven by the rise in wealth management products and middle-class expansion.

Segment Insights:

- The investment advisory segment in the financial advisory services market is projected to achieve a healthy CAGR through 2026-2035, driven by the demand for personalized, specialized financial strategies.

- The large enterprises segment in the financial advisory services market is poised to hold the majority share by 2035, influenced by larger financial requirements and AI-driven advisory tools.

Key Growth Trends:

- SMEs are increasingly in need of financial advising services

- Global high-net-worth individuals' (HNWIs') constant climb

Major Challenges:

- Increasing compliance and regulation needs to restrain market expansion

- The COVID-19 pandemic's Effect on the market

Key Players: Morgan Stanley, Boston Consulting Group, Bank of America Corporation, Goldman Sachs Group Inc., JP Morgan Chase & Co., KPMG International Cooperative, Deutsche Bank AG, HSBC Holdings Plc, BNP Paribas S.A.

Global Financial Advisory Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 117.04 billion

- 2026 Market Size: USD 124.2 billion

- Projected Market Size: USD 225.97 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Singapore, Brazil, Mexico

Last updated on : 17 September, 2025

Financial Advisory Services Market Growth Drivers and Challenges:

Growth Drivers

- SMEs are increasingly in need of financial advising services - The best method to add value for SMEs is to offer financial advising services, which allow them to charge as much as they like while still providing their small business clients with value. Furthermore, 78% of small firms prefer an accountant who is a trusted counsel, per a recent Accounting Today survey. Actually, this need came in 10% higher than the perception of reasonably priced services.

Additionally, during the COVID-19 pandemic, SMEs suffered from inadequate financial management; as a result, a few big banks worked together to offer SMEs appropriate financial advising services. As an example, as part of their ongoing commitment to their clients in this market, Gulf Bank works with Balance Business consulting, a Kuwaiti SME, to offer financial consulting services to entrepreneurs and SMEs. The Bank's strategy to offer financial and advisory services to the SME sector is the foundation of this partnership. Therefore, the financial advisory services market is expanding due to the growing number of these benefits. - Global high-net-worth individuals' (HNWIs') constant climb - Due to improved money management and wise investment choices, the number of high net worth individuals (HNWIs) is rising globally. High-net-worth people also need extra services from wealth managers and financial advisors because of their significant holdings. HNWIs can access hedge funds and private equity firms, as well as receive assistance with trusts and estates, investment management, and tax guidance.

Moreover, over 13% of clients of financial advisors are high net worth individuals. Furthermore, because it takes more labor to protect and safeguard their assets the more money HNWIs have, the need for financial advising services is considerable. These people typically want individualized services for things like estate planning, tax preparation, financial management, and so on. - Increasing robo advisory usage - The financial advisory services market growing reliance on algorithm-driven advice services is reflected in the growing use of robo-advisors. Robo-advisors use algorithms to provide asset allocation, portfolio management, and automated, cost-effective investing advice. This trend offers low-cost options to tech-savvy investors. It streamlines the investing process and offers effective and easily accessible investment recommendations. It is also changing the way financial consulting services are delivered and appealing to a wider audience.

The necessity to manage people's assets for long-term financial goals with a low risk of loss is one of the factors that is expected to propel the worldwide robo advising industry’s growth. The World Bank reports that the share of insurance and financial services exported along with commercial services rose from 7.65% in 2005 to 8.56% in 2018.

Challenges

-

Increasing compliance and regulation needs to restrain market expansion - The market for financial advising services may be severely limited by the escalating regulatory and compliance requirements. Governments and financial authorities are enforcing stronger laws to protect consumers and provide transparency, which means that advisory businesses need to invest more time and resources in remaining compliant.

The operational costs of advising businesses may increase as a result of the training, administrative responsibilities, and technology advancements required to meet regulatory requirements. Advisors may also get more involved in compliance-related tasks, which could take time away from their main objective of providing customers with personalized financial advice. Strict restrictions may also discourage innovation in business models or service offerings due to concerns about permission from regulators and compliance. - The COVID-19 pandemic's Effect on the market - COVID-19 has a detrimental effect on the financial advisory services market because of the global financial crisis, market volatility, and economic depression. Investors and companies offering financial advice were affected by the outbreak, and investors observed changes in their existing investments right away. As a result, during the global health crisis, there has been a decline in the demand for financial counseling services.

Financial Advisory Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 117.04 billion |

|

Forecast Year Market Size (2035) |

USD 225.97 billion |

|

Regional Scope |

|

Financial Advisory Services Market Segmentation:

Service Type Segment Analysis

Investment advisory segment in the financial advisory services market is expected to grow at healthy CAGR through 2035. The segment growth can be attributed because of the changing needs of investors and the state of the sector. The need for specialized counsel is driven by the changing financial markets and the increasing complexity of investment possibilities. Investors look for specialized advice on risk management, retirement planning, and portfolio management. Segment growth is driven by the growing need for specialized and diverse investment strategies and the pursuit of higher returns in volatile markets.

Organization Size Segment Analysis

Large enterprises segment in the financial advisory services market is expected to hold majority share by the end of 2035. Larger businesses are more likely to look for specialized financial advice services in order to improve cash flow, risk management, and financial growth strategies, which will drive segment growth. This is because they have a stronger market presence and a wider range of financial requirements.

For instance, Morgan Stanley introduced an AI-powered assistant in September 2023 to help support teams and financial advisers. By using AI to improve decision-making, expedite procedures, and increase overall market operating efficiency, this technology will offer cognitive support.

Our in-depth analysis of the financial advisory services market includes the following segments:

|

Service Type |

|

|

Asset Class |

|

|

Organization Size |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Financial Advisory Services Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 42% by 2035. Because there are a lot of wealthy people and businesses in the area with complex financial needs, there is a need for sophisticated financial advice and investment methods. The 400 richest Americans in 2020 had a collective net worth of USD 3.2 trillion, which was an increase from USD 2.7 trillion in 2017. In the United States, there were 735 billionaires as of March 2023.

The United States financial advisory services market is seeing tremendous growth as a result of shifting customer demographics, swift technological developments, and altered competitive dynamics. A wide range of goods and services tailored to the unique financial climate of United States are included in financial advising services. For instance, to assist clients in navigating economic instability, Kroll introduced a property insurance value platform in April 2023. The platform provides clients with rapid, thorough, and expert-driven insights for property insurance assessment, assisting them in navigating economic uncertainty.

APAC Market Insights

The APAC region will also encounter huge growth for the financial advisory services market during the forecast period. Because of the ongoing growth of regional wealth management goods, distribution networks, laws, technological usage, growing middle class, and social skills, the Asia Pacific area is predicted to expand at the quickest rate. Asia-Pacific's middle-class population is projected to grow from 1.38 billion in 2015 to 3.49 billion by 2030.

The Chinese financial advisory services market is influenced by factors such as urbanization, and expanding wealth. China's urbanization rate was 66.2% by the end of 2023 and is predicted to rise to 75–80% by 2035.

Technology advancement, cultural differences, and legal restrictions all have a big influence on how the business is portrayed in Korea. In 2021, South Korea had the fifth position in the Global Innovation Index. The sixth-largest private investment in artificial intelligence as of 2022 is made in South Korea.

In Japan financial consulting services are crucial for firms in the retail and e-commerce sectors to handle their finances well, negotiate the complexities of the market, and make strategic decisions. A rough estimate of the amount individuals spent on fashion goods online in 2023 was USD 31.9 billion.

Financial Advisory Services Market Players:

- Banco Santander S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Morgan Stanley

- Boston Consulting Group

- Bank of America

- Goldman Sachs

- JP Morgan Chase & Co.

- KPMG International

- Deutsche Bank AG

- HSBC Group

- BNP Paribas

Financial advisory services market participants are increasingly being involved in strategies such as acquisitions, collaborations, mergers and others in order to grow their consumer base and commercial operations.

Recent Developments

- Morgan Stanley Investment Management has made an important strategic move for the company's wider presence in China by announcing that the China Securities Regulatory Commission (CSRC) has approved its request to acquire a full controlling position in Morgan Stanley Huaxin Funds.

- Boston Consulting Group, a global management consulting firm, has welcomed Axel Weber, the chairman of UBS and a former president of Germany's central bank, to its ranks. Chief Executive Officer of Boston Consulting Group Christoph Schweizer stated on his LinkedIn profile that Weber has been named a senior advisor and would provide the company with a "wealth of experience from his academic, regulatory, central banking and business career." In this capacity, Weber will counsel BCG's customers in the banking and financial services sectors, as well as provide guidance to the company's global financial services practice regarding important issues and services. Germany is the home base for Weber.

- Report ID: 6168

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Financial Advisory Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.