Fiberglass Roving Market Outlook:

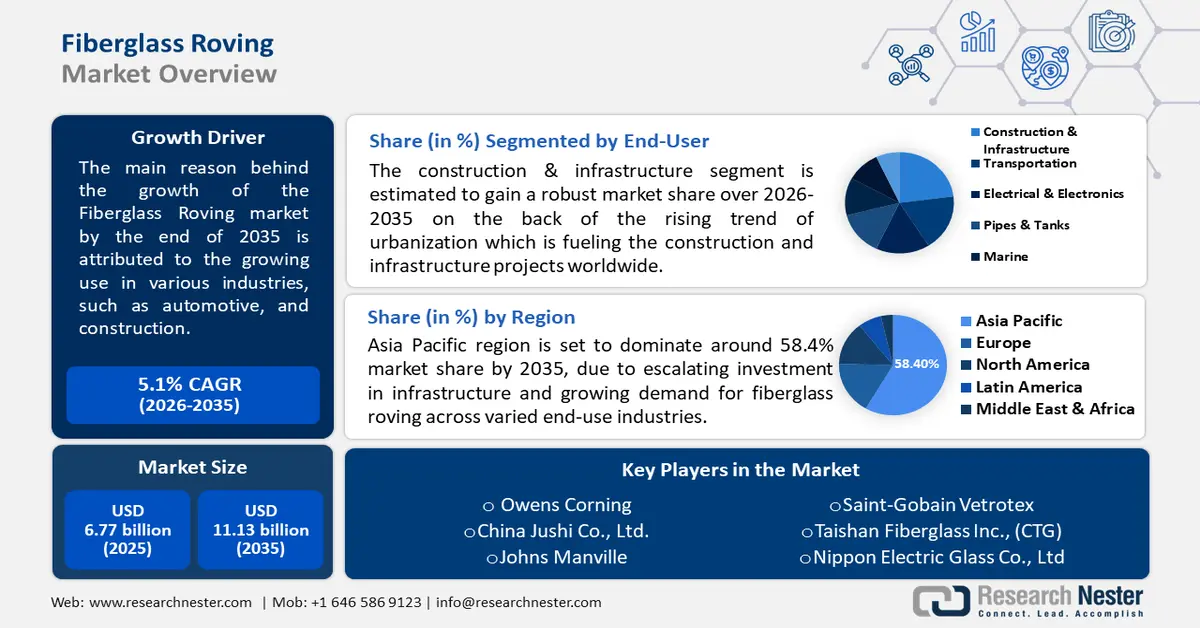

Fiberglass Roving Market size was over USD 6.77 billion in 2025 and is projected to reach USD 11.13 billion by 2035, witnessing around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fiberglass roving is evaluated at USD 7.08 billion.

The growth of the market is primarily attributed to the growing use of fiberglass roving in various industries, such as automotive, construction, and so on. Fiberglass roving is used largely for wind generation, especially to make rotor blades and nacelles. According to the data provided by the International Renewable Energy Agency (IRENA), the total onsite installed wind power energy worldwide reached 698043 MW in 2020, which is higher compared to 177795 MW in 2010.

Fiberglass roving is made up of microscopic glass filaments. These are frequently sold commercial scale as woven roving. Fiberglass roving comes in a variety of weights, weaves, finishes, and widths. When compared to other composites, these are lightweight materials with high durability. Additionally, they help give the product more heft and solidity. Demand for fiberglass roving is increasing across a variety of sectors as a result of growing industrialization. For instance, India's industrial production increased 2.6% year on year in July 2022, following an 11.9% year-on-year rise in the prior month.

Key Fiberglass Roving Market Insights Summary:

Regional Highlights:

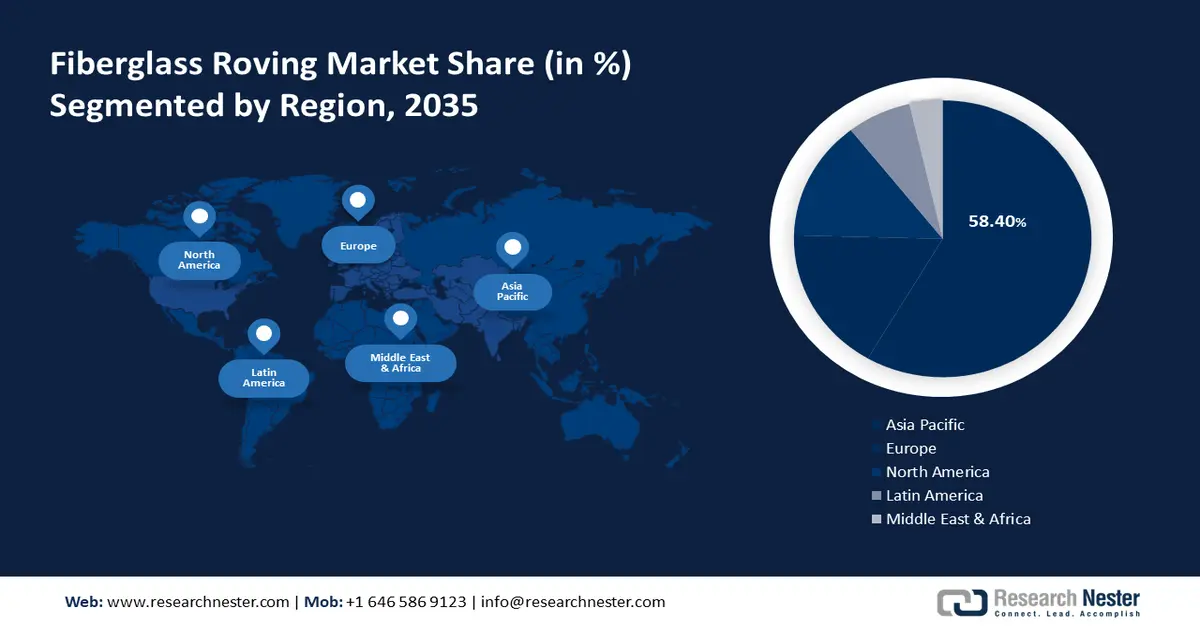

- Asia Pacific’s fiberglass roving market dominates with a 58.4% share by 2035, driven by escalating investment in infrastructure and growing demand for fiberglass roving across varied end-use industries.

Segment Insights:

- The construction & infrastructure segment in the fiberglass roving market projects significant growth during 2026-2035, driven by increasing urbanization and the surge in global construction projects.

Key Growth Trends:

- Surge in Electronics Industry

- Increase in Aerospace and Defense Manufacturing

Major Challenges:

- Difficulties in Recycling Glass Wool

- Health Risks Coupled with Fiberglass

Key Players: Owens Corning, China Jushi Co., Ltd., Johns Manville, Saint-Gobain Vetrotex, Taishan Fiberglass Inc., (CTG), Nippon Electric Glass Co., Ltd, AGY Holding Corp., Taiwan Glass Industry Corporation, China Beihai Fiberglass Co., Ltd, Binani Industries Ltd.

Global Fiberglass Roving Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.77 billion

- 2026 Market Size: USD 7.08 billion

- Projected Market Size: USD 11.13 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (58.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

Fiberglass Roving Market Growth Drivers and Challenges:

Growth Drivers

- Dynamic Properties that Make Fiberglass Roving to be Used in Various Verticals - Fiberglass is thought to be the backbone of the composites industry. It has been used in a variety of composite applications for decades, and its physical properties are very well comprehended in the industry. It is lightweight, has moderate tensile strength, and is easier to handle. For instance, the main component of all fiberglass is silica (SiO2), but the addition of other oxides such as Al2O3, B2O3, CaO, and so on allows for modification of the glass fiber properties and performance.

- Surge in Electronics Industry – For instance, since mid-2020, the global electronics industry indicated strong growth. South Korean ICT exports have increased by 19 percent year on year to USD 122 billion during the first six months of 2022, contributing 37% of total South Korean exports. South Korean semiconductor exports increased by nearly 22% year on year, reaching around USD 71 billion. Whereas, in the first six months of 2022, semiconductor exports in Japan increased by nearly 17% year on year.

- Significant Escalation in Transportation Industry - By 2027, the global transportation industry is expected to be worth around USD 7.5 trillion.

- Upsurge in Insulating Applications - In July 2022, China's insulated wire or cable export increased to USD 2351215, up from USD 2375490 in June 2022.

- Increase in Aerospace and Defense Manufacturing – For instance, in 2021, the aerospace and defense manufacturing industry have expanded by around 7.7%, and it’s estimated to see an expansion of around 25% in the year 2022.

Challenges

- Difficulties in Recycling Glass Wool - Recycling is essential to lessen the bad effects on the environment, as well as to cut back on disposal expenses and the production of raw materials. According to Glass Fiber Europe, the production of glass fibers and the resin used in the matrix requires between 13 and 45 MJ/kg and 76 and 137 MJ/kg of energy each, with additional fossil fuel usage and significant environmental effects.

- Health Risks Coupled with Fiberglass

- Stringent Policies of Government

Fiberglass Roving Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 6.77 billion |

|

Forecast Year Market Size (2035) |

USD 11.13 billion |

|

Regional Scope |

|

Fiberglass Roving Market Segmentation:

End-user Segment Analysis

The global fiberglass roving market is segmented and analyzed for demand and supply by end-user into transportation, construction & infrastructure, electrical & electronics, pipes & tanks, marine, aerospace & defense, wind energy, and others. Out of these, the construction & infrastructure segment is estimated to significantly grow over the forecast period on the back of the significantly rising trend of urbanization which is fueling the massive surge in construction and infrastructure projects across the globe. For instance, the global construction industry garnered approximately USD 2.3 trillion in revenue in 2019.

Our in-depth analysis of the global fiberglass roving market includes the following segments:

|

By Product Type |

|

|

By Glass Type |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fiberglass Roving Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is set to dominate around 58.4% market share by 2035, backed by the escalating investment for infrastructure, especially in countries, such as China, Bhutan, Vietnam, and India among others, and for the increasing demand for fiberglass roving across varied end-use industries. As per the Asian Development Bank statistics, the public sector infrastructure investment rate (% of GDP) in the People's Republic of China, Bhutan, Vietnam, Fiji, Sri Lanka, and India was 6.76%, 6.56%, 5.12%, 3.53%, and 3.31%, respectively.

Fiberglass Roving Market Players:

- Owens Corning

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- China Jushi Co., Ltd.

- Johns Manville

- Saint-Gobain Vetrotex

- Taishan Fiberglass Inc., (CTG)

- Nippon Electric Glass Co., Ltd

- AGY Holding Corp.

- Taiwan Glass Industry Corporation

- China Beihai Fiberglass Co., Ltd

- Binani Industries Ltd.

Recent Developments

-

Owens Corning announced the launch of PINK Next Gen Fiberglas insulation, which enables its users to install at up to 23% faster speeds than the other existing products of the organization. The product had no added formaldehyde or hazardous chemicals mixed on-site.

-

Johns Manville announced that it has launched a thermal recycling unit for waste glass fibers in Trnava, Slovakia, where it has its Engineered Products plant. The new recycling unit would help the company to achieve its overall target for sustainable management of the natural resources of the planet, as well as meet the zero-waste program of the European Commission.

- Report ID: 3543

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fiberglass Roving Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.