Fiber Management Systems Market Outlook:

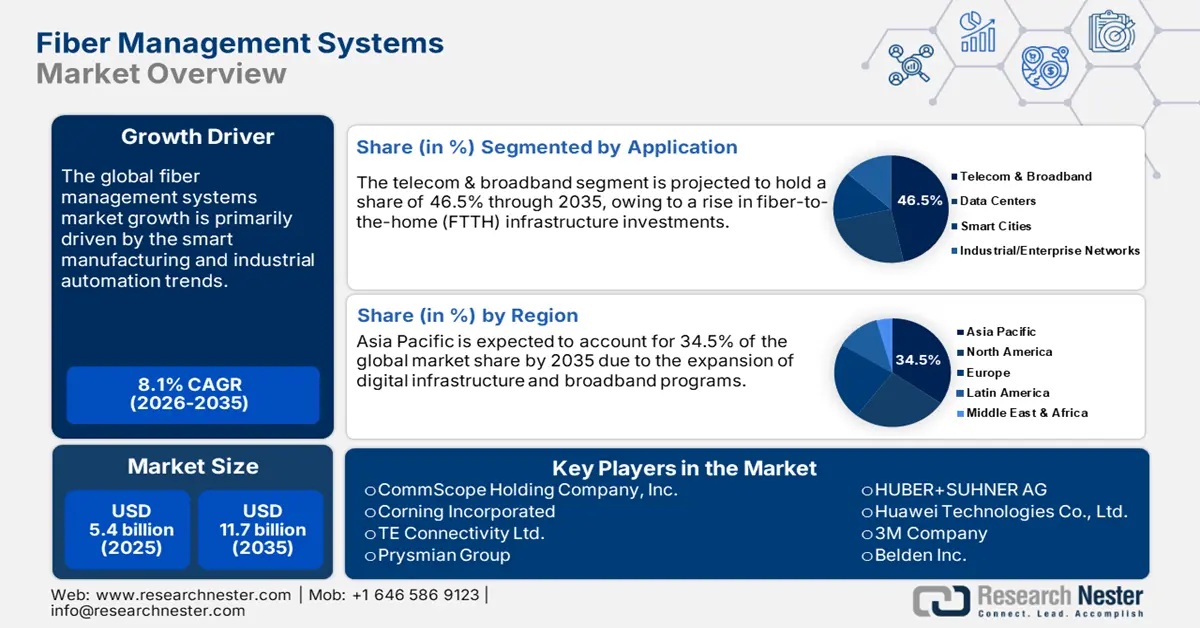

Fiber Management Systems Market size was USD 5.4 billion in 2025 and is estimated to reach USD 11.7 billion by the end of 2035, expanding at a CAGR of 8.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of fiber management systems is estimated at USD 5.8 billion.

The changing costs of optical fiber cables, the availability of plastic housing parts, and the logistics of moving goods between manufacturing hubs drive the global trade of fiber management systems. The U.S. Bureau of Labor Statistics reported that the producer price index for communications equipment manufacturing, including fiber systems, increased from 105.257 in June 2024 to 108.973 in June 2025. This rise was mainly due to higher prices for specialized plastics and semiconductor parts used in these systems.

Furthermore, the consumer price index for cable, satellite, and live streaming television service stood at a relative importance of 0.653 in December 2024. The expanding smart city projects and infrastructure development activities are contributing to the sales of fiber management systems. Demand for fiber optic gear, including rack- and wall-mounted units, is growing steadily owing to the ongoing investments in broadband and fiber-to-the-home projects. Overall, the digital shift is set to fuel the global trade of fiber management during the foreseeable period.

Key Fiber Management Systems Market Insights Summary:

Regional Highlights:

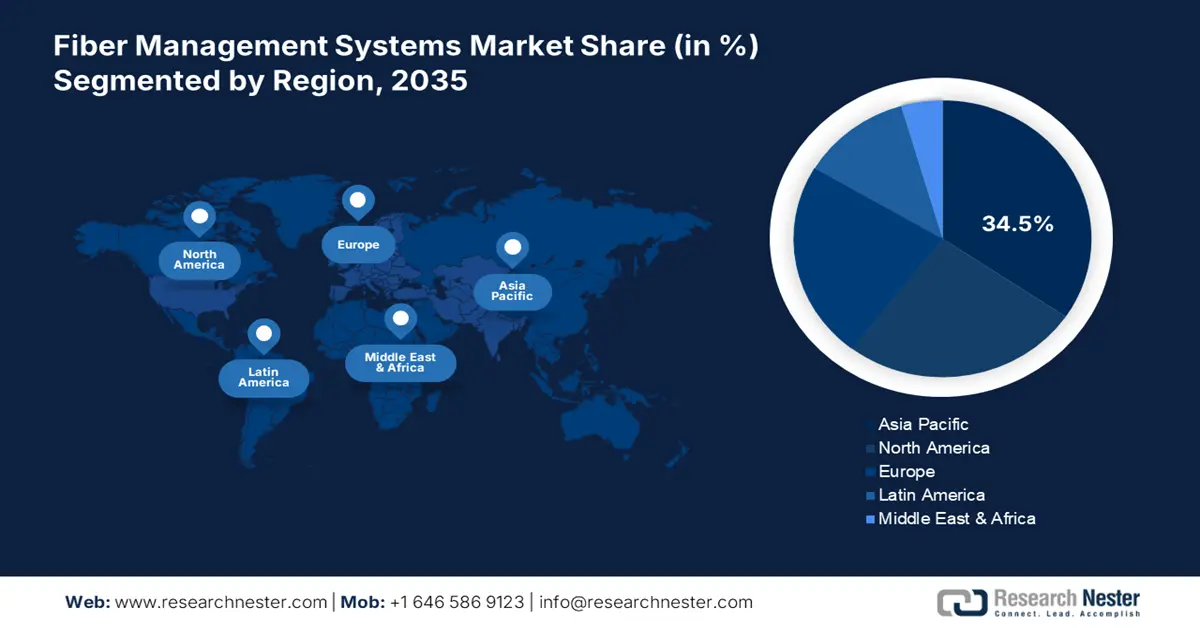

- Asia Pacific is expected to secure 34.5% of the global market share by 2035, driven by government-backed digital infrastructure programs, rapid 5G backhaul expansion, smart city deployments, and rising adoption of AI-integrated and cloud-connected fiber management solutions.

- North America is projected to grow at a 9.8% CAGR (2026–2035), supported by expanding 5G networks, rural broadband initiatives, and large-scale government-funded fiber rollout programs. Increasing investments in scalable fiber management platforms from U.S. and Canadian vendors further strengthen regional growth.

Segment Insights:

- The telecom & broadband segment is projected to secure a 46.5% share by 2035 in the fiber management systems market, driven by accelerating FTTH deployments, rural broadband expansion, and rising capex in global telecom infrastructure.

- The outdoor segment is expected to command a 63.6% share during the forecast period, supported by rapid 5G tower growth, smart city initiatives, and surging demand for weather-resilient, secure fiber management solutions.

Key Growth Trends:

- Expansion of global FTTH (Fiber to the Home) initiatives

- Manufacturing automation and Industry 4.0

Major Challenges:

- Lack of infrastructure readiness in emerging economies

- High import tariffs

Key Players: CommScope Holding Company, Inc., Corning Incorporated, TE Connectivity Ltd., Prysmian Group, HUBER+SUHNER AG, Huawei Technologies Co., Ltd., 3M Company, Belden Inc., Hexatronic Group AB, YOFC (Yangtze Optical Fibre and Cable), Rosenberger Group, AFL (a subsidiary of Fujikura Ltd.), Molex LLC (Koch Industries), Amphenol Corporation, Molex Premise Networks (Australia Pty Ltd)

Global Fiber Management Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.4 billion

- 2026 Market Size: USD 5.8 billion

- Projected Market Size: USD 11.7 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 18 August, 2025

Fiber Management Systems Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of global FTTH (Fiber to the Home) initiatives: Fiber management system (FMS) sales are expected to grow as more homes worldwide get connected with fiber-to-the-home networks. In March 2024, the FTTH Council Europe reported that by September 2023, 244 million homes in the EU39 had access to Fibre to the Home (FTTH) or Fibre to the Building (FTTB), up from 221 million homes in September 2022. This expansion is directly translated into high demand for structured, scalable fiber management systems that accommodate last-mile deployments. The developed markets are offering high-earning opportunities for fiber management system producers. India’s BharatNet program and China’s Broadband China initiative have scaled fiber networks to rural zones, which is driving demand for modular enclosures, termination boxes, and patch panels. The emerging markets are also estimated to attract international players to earn a high return on investment.

- Manufacturing automation and Industry 4.0: The smart manufacturing and industrial automation trends are set to double the revenues of fiber management system manufacturers in the years ahead. Automation in fiber management system production is expected to lead to cost reduction and quality improvements. In January 2024, the World Economic Forum (WEF) estimated that the global AI in manufacturing market is poised to cross USD 20.5 billion by 2028. Significant investments, both public and private, are likely to unleash the power of artificial intelligence in the manufacturing sector. Firms investing in predictive analytics and robotics to streamline production and meet just-in-time (JIT) delivery expectations are estimated to fuel the sales of fiber management technologies in the years ahead.

- Technological innovations and sustainability trends: The 5G expansion and Industry 4.0 practices are expected to fuel the sales of advanced fiber management systems. The digital shift is estimated to emerge as a boon to fiber management system manufacturers. The continuous investments in technological innovations are accelerating the demand for advanced fiber management solutions. The decarbonization mandates and regulatory compliance are also contributing to the increasing sales of the fiber management system. The renewable energy sourcing, strict environmental regulations, and circular economy models are further pushing the trade of fiber management technologies.

Challenges

- Lack of infrastructure readiness in emerging economies: The unavailability of advanced infrastructure is likely to act as a restraint on the fiber management systems industry growth. Many countries in Sub-Saharan Africa, Southeast Asia, and parts of Latin America lack basic fiber networks required to support modern telecom systems. The International Telecommunication Union (ITU) study reveals that around 23.3% of rural African areas have access to the internet, which directly hinders the adoption of advanced fiber management systems. Companies entering emerging markets often need to package their products with a basic network setup or team up with public-private groups to roll out infrastructure step by step. Without these foundational networks, demand for fiber management systems is poised to stay low.

- High import tariffs: The raw materials, such as specialized plastic, copper, and composites, often face heavy import taxes in some countries. These high tariffs can create pricing pressure for manufacturers and limit their revenue growth. Also, the hiking project expenses for local telecom providers hamper the sales of fiber management systems. To overcome this issue, companies are expected to shift production to markets where they can cut costs and navigate customs more easily.

Fiber Management Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 5.4 billion |

|

Forecast Year Market Size (2035) |

USD 11.7 billion |

|

Regional Scope |

|

Fiber Management Systems Market Segmentation:

Application Segment Analysis

The telecom & broadband segment is poised to capture 46.5% of the fiber management systems market share by 2035. The rise in fiber-to-the-home (FTTH) infrastructure investments is likely to accelerate the application of fiber management systems. The Federal Communications Commission (FCC) states that more than 8.2 million U.S. households remain underserved by high-speed broadband, prompting a need for federal funding for the expansion the fiber connections. Fiber management systems such as high-density ODFs and splitters are gaining dominance owing to the ability to streamline patching and maintenance in rural and urban deployments. The scaling FTTx coverage via state-sponsored BharatNet and MyTV projects, spurring demand for durable, modular outdoor fiber cabinets in India and Vietnam. Overall, high capex in telecom infrastructure is projected to drive the sales of fiber management systems in the coming years.

Deployment Environment Segment Analysis

The outdoor segment is projected to account for 63.6% of the global fiber management systems market throughout the study period. The growth of 5G towers and the smart city shift are creating a profitable environment for key players. The increasing weather-resilient infrastructure requirements are also expected to contribute to the high sales of fiber management technologies. The U.S. Department of Transportation’s Smart Cities Challenge and Japan’s Society 5.0 are emerging as the key drivers for the deployment of hardened FMS products. The weatherproofing, security, and remote monitoring features promote the adoption of fiber management systems in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Deployment Environment |

|

|

Application |

|

|

Component |

|

|

Enterprise Size |

|

|

Cable Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fiber Management Systems Market - Regional Analysis

APAC Market Insights

The Asia Pacific fiber management systems industry is anticipated to hold 34.5% of the global market share through 2035. The government-led digital infrastructure programs and broadband policies are accelerating the sales of fiber management solutions. The digital shift is significantly driving innovations in the AI-integrated FMS, smart diagnostics, and scalable cloud-connected fiber solutions. The 5G backhaul expansion, IoT connectivity in the smart city projects are further promoting the demand for fiber management systems.

The demand for fiber management systems in China is poised to increase at a high pace, owing to the smart city and infrastructure development projects. The Ministry of Industry and Information Technology (MIIT) and China Academy of Information and Communications Technology (CAICT) support massive investments in fiber-optic infrastructure, which are likely to double the revenues of key players in the years ahead. Furthermore, the Broadband China strategy and 5G base station deployment are expected to increase the trade of fiber management systems in the country.

The India fiber management systems market is estimated to increase at a CAGR of 13.9% from 2026 to 2035. The supportive government policies and funding schemes are creating high-earning opportunities in the country. The Ministry of Communications revealed that between March 2014 and June 2024, the number of internet connections in India grew from 25.15 crore to 96.96 crore, a growth of 285.53%. Broadband connections also jumped from 6.1 crore in March 2014 to 94.92 crore in August 2024, increasing by 1452%. This reflects a high need for fiber management technologies in the country. The smart manufacturing trend and industrial automation are also fueling the revenues of key players. The increasing adoption of digital technologies in the logistics and agri-tech sectors is pushing the deployment of fiber management systems.

North America Market Insights

The North America fiber management systems market is estimated to increase at a CAGR of 9.8% from 2026 to 2035. The expanding 5G infrastructure and rising rural broadband connectivity goals are likely to fuel the deployment of fiber management technologies. The advancing large-scale fiber deployments through government programs are also contributing to the market growth. The key players in the region are investing in scalable fiber management platforms to meet growing demand from smart cities, cloud-based services, and IoT connectivity. Both the U.S. and Canada are opportunistic marketplaces for fiber management systems.

In the U.S., the fiber management system sales are set to increase at a rapid pace owing to the escalating federal investments in broadband infrastructure. The 5G rollout and increasing expansion of data centers are also propelling the trade of fiber management solutions. For example, in July 2024, the U.S. Department of Energy’s Advanced Materials and Manufacturing Technologies Office (AMMTO) announced USD 33 million in funding to support the development of smart manufacturing technologies. This effort aims to speed up the shift to a clean energy economy. Such developments in smart manufacturing technology expansion are likely to accelerate the deployment of fiber management solutions. The growth in public-private partnerships is further promoting the production and commercialization of fiber management systems.

The strategic government initiatives focused on rural connectivity, innovation, and digital transformation are propelling the sales of fiber management systems in Canada. The Innovation, Science and Economic Development (ISED) agency leads broadband programs such as the Universal Broadband Fund (UBF), which committed CAD 3.225 billion to expand high-speed internet across the country are attracting several international players. Further, the growing demand for fiber-backed cloud and ICT infrastructure is increasing the adoption of advanced fiber management solutions. The government-backed smart city projects are also emerging as key drivers for the sales of fiber management systems.

Europe Market Insights

The Europe fiber management systems market is projected to account for 22.9% of the global revenue share by 2035. The digital infrastructure modernization and gigabit broadband rollouts are fueling the sales of fiber management solutions. Germany, the UK, and France are leading with large-scale public-private partnerships for full-fiber deployments. The rising public spending on 5G/FTTH backhaul projects is estimated to amplify the adoption of fiber management systems. The urban densification and data center interconnect demands are some of the key factors augmenting the sales of fiber management systems.

Germany is projected to lead the sales of fiber management systems in the coming years, owing to the expanding robust communication network projects. The Federal Ministry for Digital and Transport’s strategic push through its Gigabitstrategie 2026 for nationwide gigabit networks is also propelling the demand for advanced fiber management solutions. The country is also focused on integrating FMS solutions into Industry 4.0 corridors to boost the digital twins and predictive maintenance for industrial fiber networks. Overall, investing in the country is poised to offer double-digit profit margins for key players.

The demand for fiber management systems in the U.K. is likely to increase at a healthy pace during the study period. The increasing digitalization and 5G expansion are fueling the deployment of fiber management solutions. For example, in December 2024, Ofcom reported that around 20.7 million homes have access to full-fibre broadband. The government's Project Gigabit, which targets nationwide gigabit broadband coverage by the end of the decade, is also contributing to the growing sales of fiber management systems. The government-backed initiatives are playing a vital role in the expansion of the fiber management systems.

Key Fiber Management Systems Market Players:

- CommScope Holding Company, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Corning Incorporated

- TE Connectivity Ltd.

- Prysmian Group

- HUBER+SUHNER AG

- Huawei Technologies Co., Ltd.

- 3M Company

- Belden Inc.

- Hexatronic Group AB

- YOFC (Yangtze Optical Fibre and Cable)

- Rosenberger Group

- AFL (a subsidiary of Fujikura Ltd.)

- Molex LLC (Koch Industries)

- Amphenol Corporation

- Molex Premise Networks (Australia Pty Ltd)

The market is highly competitive owing to the strong presence of technology-driven companies. The industry giants are holding leading positions in the marketplace through global supply chains and strong R&D capabilities. They are focusing on the development of AI-integrated FMS platforms, edge connectivity, and modular rack systems to attract a tech-savvy consumer base. The automation and sustainability trends are expected to boost the revenue of key players in Europe. The government-backed telecom expansion programs are opening high-earning opportunities for fiber management systems manufacturers in the developing markets.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2025, Corning Incorporated introduced its latest fiber, cable, and connectivity solutions at Fiber Connect 2025. The following products were displayed by the company: Evolv Field-Installable Pushlok, Evolv Multifiber Pushlok, FlexNAP, and RPX Long-Span Ribbon Cables

- In March 2025, Corning Incorporated announced the launch of Corning GlassWorks AI solutions. These solutions help data center operators build strong fiber networks for advanced AI technology.

- In May 2025, In May 2025, a global research team, including Japan’s Photonic Network Laboratory of the National Institute of Information and Communications Technology and Sumitomo Electric Industries, Ltd., set a new record by introducing 1.02 petabits of data per second through optical fiber over 1,808 kilometers. This breakthrough helps pave the way for faster, long-distance internet systems.

- In March 2025, Furukawa Electric Co., Ltd. announced it had combined its optical fiber cable business into a new company called Lightera Holding G.K. From April 1, 2025, the business operates under the brand name Lightera.

- Report ID: 7919

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fiber Management Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.