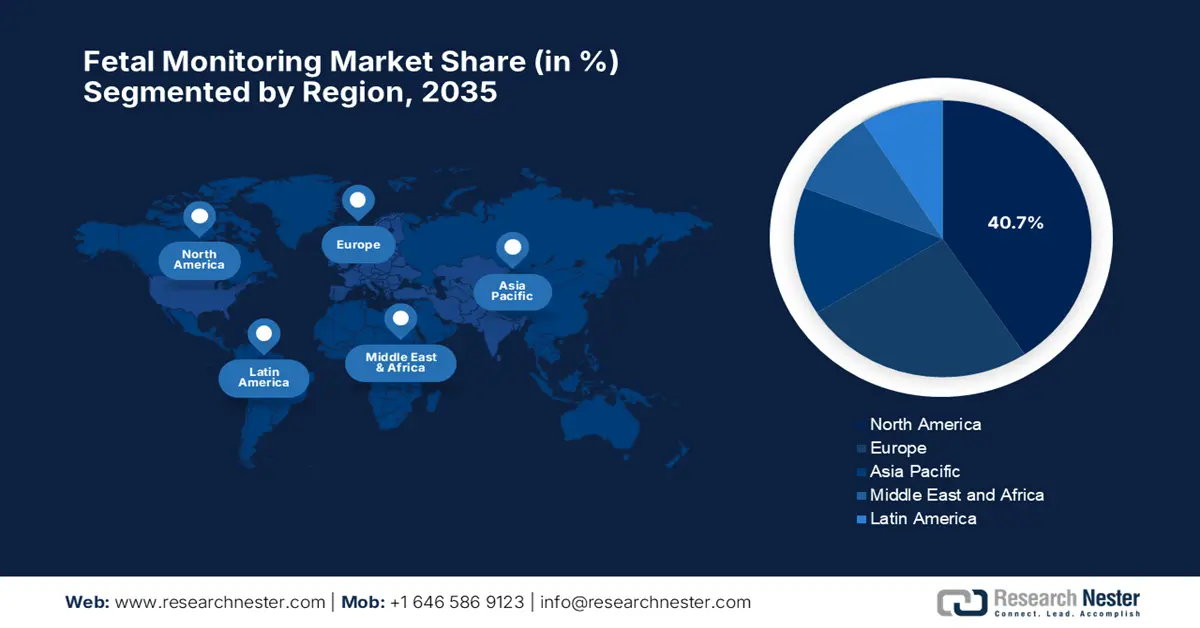

Fetal Monitoring Market - Regional Analysis

North America Market Insights

North America in the fetal monitoring market is expected to grow by capturing the largest revenue share of 40.7% by the end of 2035. This upliftment is readily propelled by the widespread adoption of medical technologies and a robust healthcare ecosystem. Therefore, NIH in September 2023 introduced a USD 2 million RADx Tech Fetal Monitoring Challenge to promote innovation in point-of-care and home-based fetal diagnostic technologies, which was sponsored by NIBIB, NICHD, and the Bill & Melinda Gates Foundation. The key emphasis is to improve fetal health outcomes, particularly in low-resource settings.

In the U.S., the fetal monitoring industry has become the key component in terms of both prenatal and perinatal care, which is extensively supported by a huge network of medical facilities. In this regard, UNICEF in May 2025 reported that it is supporting CareNX Innovations in expanding AI-driven fetal monitoring to ensure that no mother or baby is left behind due to a lack of access to quality care. The report also highlighted CareNX’s flagship product called Fetosense, which is a portable, AI-powered fetal monitoring system designed to enable early detection of fetal concerns, especially in underprivileged areas, hence benefiting the overall market.

Canada in the fetal monitoring market is displaying notable growth that benefits from the presence of a universal healthcare system, deliberately emphasizing preventive care and maternal health services. In June 2024, Clarius Mobile Health reported that it received FDA clearance for its Clarius OB AI, an AI-powered fetal biometric measurement tool integrated with its handheld Clarius C3 HD3 ultrasound scanner. The product is exclusively designed to automate critical obstetric calculations such as fetal age, weight, and growth, hence a positive market outlook.

Maternal and Infant Health Initiatives, Resources, and Key Data

|

Initiative / Resource |

Year(s) |

Key Focus / Data Points |

|

MIHI Webinar Series |

May-Aug 2024 |

Maternal mental health, substance use disorder (SUD), hypertension control, AIM bundles |

|

Affinity Groups |

Fall 2024 |

Maternal mental health & SUD; maternal hypertension & cardiovascular health |

|

Maternal Health Infographic |

2024 |

Medicaid covers ~42% of US births; 2/3 of adult women on Medicaid are of reproductive age (19 to 44) |

Source: Medicaid

APAC Market Insights

Asia Pacific in the fetal monitoring market is considered to be the fastest-growing region due to the growing awareness about maternal and fetal health. Also, there have been remarkable improvements in healthcare infrastructure, which in turn increases the adoption of advanced medical technologies, thereby making it suitable for standard market upliftment. Furthermore, the region also benefits from a rapidly growing consumer base and an increasing number of hospitals and maternity care centers focusing on prenatal care.

China is also witnessing robust advancements in its healthcare sector, which is positively impacting the market. The country’s enhanced government and private sector activities are providing an encouraging opportunity to capitalize on this sector. Shenzhen Luckcome Technology Inc., Ltd., in May 2023, announced that it will participate in CMEF 2023, and will showcase its newly launched Jaundice Detector, which is portable and easy to use, comprising a unique pressure calibration algorithm, and can store 20 sets of data.

India in the market has become the targeted hub due to the significant government initiatives that are readily propelling a profitable business environment. In October 2024, MOH&FW reported that the country’s government, under the National Health Mission, implements various programs to improve maternal and child health, especially for underserved communities. The report also underscored that tribal areas benefit from relaxed norms for setting up health facilities, deploying ASHAs, and operating Mobile Medical Units with a special focus on high-risk pregnancies, early child care, immunization, and healthcare access in remote and tribal regions.

Europe Market Insights

Europe in the fetal monitoring market is immensely supported by the well-established healthcare systems and widespread adoption of advanced prenatal technologies with a supportive regulatory framework. In September 2024, St. Vincent’s Private Hospital declared that it entered into a 10-year, €40 million Value Partnership with Siemens Healthineers, which marks the first-of-its-kind collaboration in Ireland’s private healthcare sector. Besides, this partnership enhances care by integrating with advanced AI technologies to enhance diagnostic and treatment capabilities.

The U.K. holds a strong position in the fetal monitoring sector that is proactively shaped by National Health Service protocols and guidelines that standardize care across the country. The pioneers in the country are also putting constant efforts to strengthen the ecosystem extremely supported emphasis on personalized maternity care. In September 2024, Comen introduced CF5/CF8 Fetal and Maternal Monitors, which are especially designed for advanced, stable, and streamlined monitoring. Also, they are equipped with intelligent algorithms that minimize false alarms due to fetal movement and feature a detailed CTG scoring system based on seven clinical criteria.

Germany is gaining traction in the market, which is both robust and technologically advanced, facilitated by widespread adoption. In July 2022, Siemens Healthineers stated that at the European Congress of Radiology, it unveiled its most comprehensive ultrasound portfolio, which features 12 new transducers across four ultrasound systems called Acuson Sequoia, Redwood, Juniper, and P500, along with major software enhancements and expanded AI-powered tools. Hence, such moves contribute to the steady demand for fetal monitoring equipment in the country.