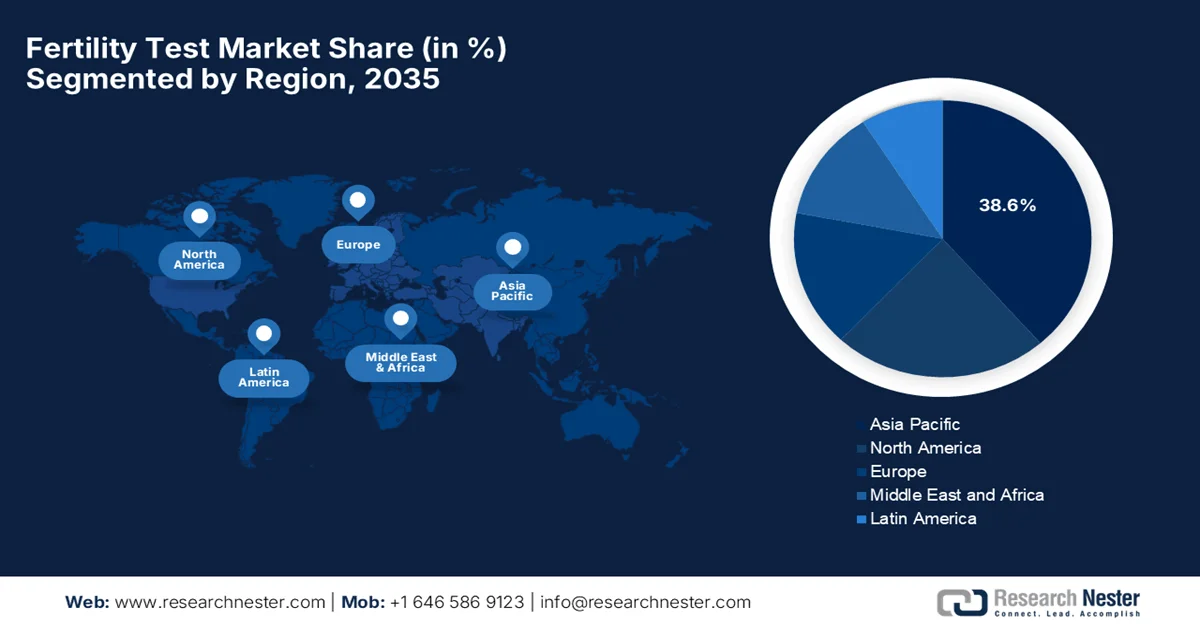

Fertility Test Market - Regional Analysis

APAC Market Insights

The Asia Pacific fertility test market is expected to be the largest regional landscape owing to the presence of rapid healthcare investment, rising infertility awareness, and expanding access. In addition, the aspects of delayed marriage and lifestyle changes, i.e., smoking and poor diet, are efficiently fueling demand for fertility testing devices. As per the article published by NIH in June 2025, Japan has faced a persistent decline in fertility, with its total fertility rate (TFR) dropping from 1.54 two decades ago to 1.26 in 2022, contributing to an aging population and shrinking workforce. Also under the child future strategy 2023, the country has plans to provide ¥15,000/month (USD 110) for the first two children under age 2, ¥10,000/month (USD 73) for children age 3 to high school, and subsequent children, along with parental leaves. Therefore, these scaling benefits could raise the probability of reversing the fertility decline from 29% (current policy) to over 65% to 79% by the conclusion of 2035, highlighting the critical role of timely policy implementation.

The aspects of delayed childbearing and rising demand for privacy, ovulation, and home-based tests are propelling the growth of China fertility test market. Also, the strong government backing and rise of e-commerce platforms facilitate easy access, enhancing the popularity of these devices. In July 2025, the country’s State Council Information Office (SCIO) reported that China is addressing its demographic decline by improving childbirth support policies, including child care subsidies, parental leave, and education support, to ease financial burdens on families and promote moderate fertility. It also mentioned that the central government will fund around 90% of a 90-billion-yuan (approximately USD 12.7 billion) Child Care Subsidy Fund, providing proportional transfers to local governments. In addition, the government will be providing tax exemptions on subsidies, expanded parental leave, and a full lifecycle support system covering medical care, housing, and education to encourage high-quality population development.

The rising awareness of reproductive health and a focus on personalized medical solutions are facilitating the continued growth of the India fertility test market. At-home fertility test kits and clinical diagnostic services are gaining traction, supported by the increasing availability of proper testing technologies and digital health platforms. Birla Fertility & IVF in August 2024, notified that it has acquired BabyScience IVF clinics, thereby making it 50 clinics in total across the country’s vast geography. Besides, the acquisition is identified as a major milestone in terms of its expansion strategy, with a total investment of more than Rs 500 crores (approximately USD 60.24 million). Thus, with the presence of such strategic activities and strong government backing, the country is emerging as a targeted landscape for investors across the globe.

North America Market Insights

The high awareness, advanced diagnostics adoption, and strong digital fertility test uptake benefit the North America fertility test market. In addition, the suitable insurance policies coupled with the emergence of telehealth are also propelling continued growth in the region’s market. In this context, the White House published an executive order in February, 2025, with a prime focus on expanding in vitro fertilization. It states that one out of every seven couples face infertility, whereas the high costs, ranging from USD 12,000 to USD 25,000 per cycle creates both financial and emotional burdens. Therefore, this order directs the administration to recommend policies within 90 days to lower IVF costs and remove barriers to treatment. Furthermore, these implementations will comply with existing laws and budget provisions, without creating any enforceable legal rights.

The heightened demand for pregnancy detection and rising infertility rates are prompting a favorable business ecosystem for the U.S. fertility test market. Partnerships among device manufacturers and telehealth platforms that are allowing remote consultations are yet another asset for this landscape. According to the official data published by the Centers for Disease Control and Prevention in April 2024, in 2023, the fertility rate in the country declined for the second consecutive year, reaching a historic low, as observed by the CDC’s National Center for Health Statistics (NCHS). It also mentioned that the general fertility rate fell 3% from 2022, wherein 3,591,328 births were recorded. Therefore, these findings reflect the delays in terms of childbearing and shifts in reproductive behavior across the U.S. population, highlighting a significant growth potential for fertility tests.

U.S. Fertility and Birth Statistics, 2023

|

Statistic |

Value (2023) |

Change from 2022 |

|

Total births |

3,591,328 |

↓ 2% |

|

Birth rate, ages 15-19 |

13.2 per 1,000 women |

↓ 3% |

|

Birth rate, ages 20-24 |

55.4 per 1,000 women |

Record low |

|

Cesarean delivery rate |

32.4% |

↑ 4th year in a row |

|

Preterm birth rate |

10.41% |

Essentially unchanged |

Source: Centers for Disease Control and Prevention

Canada fertility test market has gained enhanced traction, propelled by the heightened demand for technologically advanced solutions. Therefore, AI-enabled diagnostic tools and home-based testing options are being integrated into fertility assessments, thereby enhancing both accessibility and convenience. Also, the aspect of provincial health programs and supportive healthcare policies contributes to market development by efficiently improving access to reproductive services. As of September 2024, data from the government of Canada, the country provides a combination of federal and provincial support for fertility treatments, such as IVF and surrogacy, with coverage being varied across different regions. In addition, it also notes that the federal Medical Expense Tax Credit (METC) helps offset eligible fertility-related expenses, though treatments abroad or reimbursed elsewhere.

Public Health Insurance Covering Fertility Treatment by Province and Territory in Canada

|

Province / Territory |

Public Health Insurance Program |

|

British Columbia |

MSP |

|

Manitoba |

MSHIP |

|

New Brunswick |

New Brunswick Medicare |

|

Ontario |

OHIP |

|

Prince Edward Island |

PEI Health |

|

Quebec |

QHIP |

Source: Government of Canada

Europe Market Insights

Europe fertility test market is projected to witness significant growth during the discussed timeframe. The region’s prominence in this field is majorly supported by well-established healthcare systems and the expanding adoption of both clinical diagnostics and home-based fertility test solutions. Regulatory harmonization also enhances product availability and consumer confidence in the region. For instance, Fertility Europe and the Coalition for Fertility, in October 2025, launched an inclusive fertility care for all, which calls for fertility services in the region regardless of factors such as background, identity, or any circumstance. Also, this paper highlights the persistent legal, social, and financial barriers that are faced by marginalized groups, such as LGBTI people, migrants, racialized communities, and individuals with disabilities. Furthermore, it also requests governments and healthcare providers to avoid any type of discrimination, ensure inclusive policies, and provide accessible fertility care.

The advanced healthcare infrastructure, extensive insurance support for diagnostic services, and strong consumer interest in medically certified reproductive health tools are the main factors responsible for boosting the fertility test market in Germany. The country’s public health insurance systems provides its mounting support for clinically indicated hormone diagnostics, reinforcing trust in laboratory-based fertility testing procedures. Besides, the country has witnessed digital health platforms and app-connected tools efficiently enable individuals to track fertility indicators and share results with healthcare providers. Therefore, the presence of all of these factors reflects a well-integrated, patient-centric fertility testing ecosystem in Germany, attracting both national and international players to establish their footprint in the country.

The presence of suitable healthcare coverage and supportive reproductive health policies contributes to increasing uptake of the fertility test market in France. The market has witnessed innovation in terms of testing approaches and rising awareness of fertility issues, prompting a profitable business environment for market players. As per the officially reported data in April 2025, medically assisted procreation in France, which is overseen by the Agence de la biomédecine, deliberately enables individuals and couples facing infertility to pursue parenthood through techniques such as IVF, artificial insemination, and fertility preservation. It also mentioned that all women, regardless of marital status, can access these services, with gamete donation playing a vital role. Furthermore, the agency regulates these practices, authorizes centers, and ensures safety through monitoring, inspections, and vigilance systems, hence making it suitable for standard market growth.