Fertility Test Market Outlook:

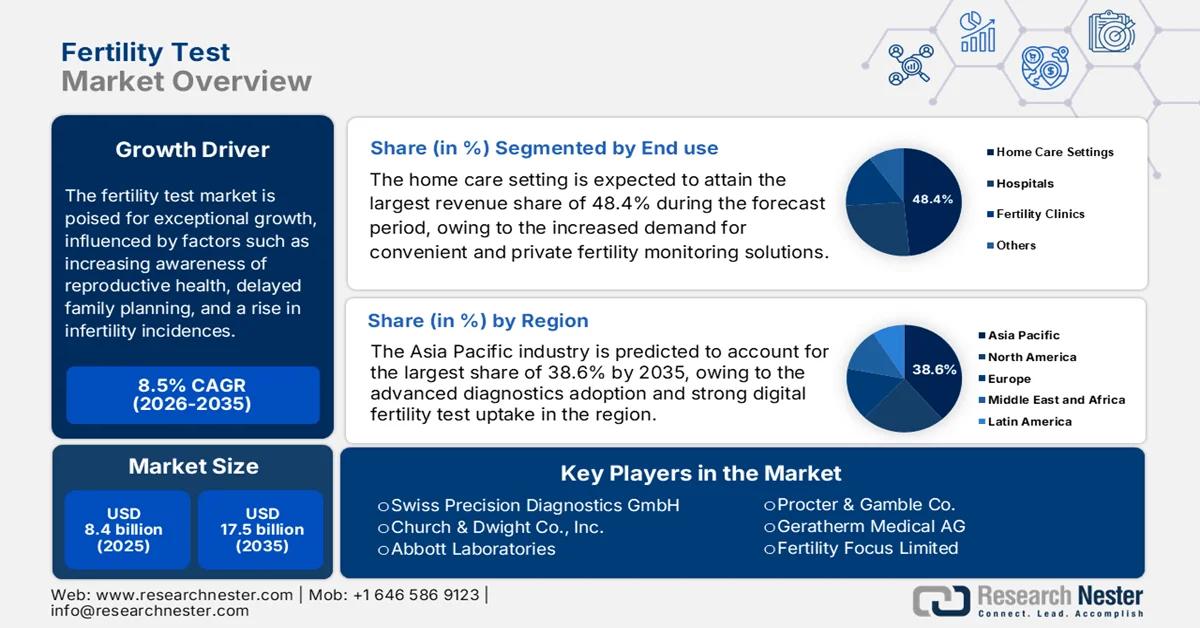

Fertility Test Market size was valued at USD 8.4 billion in 2025 and is projected to reach USD 17.5 billion by the end of 2035, rising at a CAGR of 8.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of fertility test is estimated at USD 9.1 billion.

The market is poised for exceptional growth, influenced by factors such as increasing awareness of reproductive health, delayed family planning, and a rise in infertility incidences, which efficiently drive demand for both at-home and clinical diagnostic solutions. According to the official statistics reported by the World Health Organization in November 2025, infertility affects around one in six people of reproductive age across the globe, wherein the causes range from hormonal and structural disorders in both men and women to lifestyle and environmental factors. It also mentioned that access to fertility care, such as diagnosis and assisted reproductive technologies, is limited, particularly in low- and middle-income countries. In this context, WHO emphasizes integrating fertility care into national health policies, promoting prevention, early diagnosis, and hence increasing the growth potential of the fertility test sector.

Furthermore, as per the reports published by the Washington State Health Care Authority (WSHCA), historical Medicaid enrollment data from 2020 to 2022 revealed highly detailed demographic insights, which are highly essential for assessing fertility benefit impacts. For example, female enrollees aged 18 to 24 increased from approximately 1.24-million-member months in 2020 to 1.48 million in 2022, whereas males in the same age group rose from around 940,000 to over 1.21-million-member months; it also mentioned the projections for 2024 and 2027. Hence, the study provides forecasting of fertility test demand and cost impact by identifying key demographic trends within Medicaid populations, underscoring the importance of proper fertility diagnostics and services in the evolving market landscape.

Washington State Medicaid Enrollment for Fertility Benefits: Historical and Projected Member Months by Gender and Age Band (2021-2027) - Official Government Data

|

Gender |

Age Band |

2021 |

2022 |

2024 (Projected) |

2027 (Projected) |

|

F |

Under Age 18 |

4,850,790 |

4,949,992 |

4,266,973 |

4,394,256 |

|

F |

Ages 18 to 24 |

1,385,450 |

1,475,827 |

1,272,013 |

1,309,974 |

|

F |

Ages 25 to 29 |

1,049,296 |

1,122,341 |

966,881 |

995,783 |

|

F |

Ages 30 to 34 |

986,408 |

1,088,165 |

937,656 |

965,662 |

|

F |

Ages 35 to 39 |

809,068 |

883,799 |

761,607 |

784,350 |

|

F |

Ages 40 to 44 |

634,544 |

712,669 |

614,333 |

632,658 |

|

F |

Ages 45 to 49 |

494,497 |

536,465 |

462,528 |

476,316 |

|

F |

Ages 50 to 54 |

497,137 |

533,431 |

459,969 |

473,675 |

|

F |

Ages 55 and over |

1,702,696 |

1,819,254 |

1,568,326 |

1,615,098 |

|

M |

Under Age 18 |

5,095,944 |

5,197,074 |

4,479,691 |

4,613,346 |

|

M |

Ages 18 to 24 |

1,099,155 |

1,214,741 |

1,047,461 |

1,078,672 |

|

M |

Ages 25 to 29 |

757,977 |

815,873 |

703,418 |

724,389 |

|

M |

Ages 30 to 34 |

754,147 |

844,421 |

728,079 |

749,780 |

|

M |

Ages 35 to 39 |

648,968 |

716,024 |

617,509 |

635,900 |

|

M |

Ages 40 to 44 |

543,443 |

612,970 |

528,753 |

544,489 |

|

M |

Ages 45 to 49 |

435,029 |

476,056 |

410,630 |

422,853 |

|

M |

Ages 50 to 54 |

472,713 |

500,836 |

431,963 |

444,824 |

|

M |

Ages 55 and over |

1,321,609 |

1,429,904 |

1,232,934 |

1,269,679 |

|

Total |

|

23,538,871 |

24,929,842 |

21,490,722 |

22,131,704 |

Source: Washington State Health Care Authority (WSHCA)

Key Fertility Test Market Insights Summary:

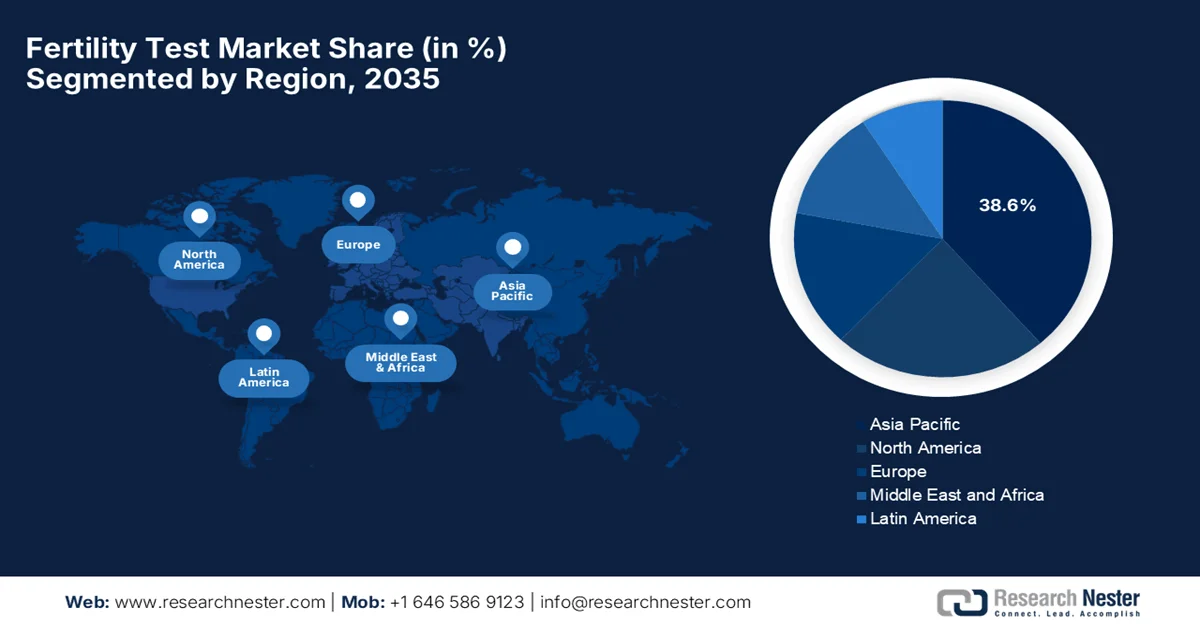

Regional Highlights:

- Asia Pacific in the fertility test market is expected to command the largest regional share by 2035, supported by rising healthcare investments, growing infertility awareness, lifestyle-related fertility challenges, and government-backed population support initiatives.

- North America is projected to hold a significant share by 2035, strengthened by high diagnostic awareness, rapid uptake of digital fertility testing, favorable insurance coverage, and expanding telehealth integration.

Segment Insights:

- Home care settings in the fertility test market are forecast to account for 48.4% revenue share by 2035, attributed to escalating demand for convenient, non-invasive, and private fertility monitoring solutions.

- Blood-based tests are anticipated to secure a leading share by 2035, reinforced by their superior accuracy, reliability, and comprehensive hormonal assessment capabilities.

Key Growth Trends:

- Shifting demographics and social trends

- Technological advancement and digital integration

Major Challenges:

- Accuracy and reliability concerns

- Limited awareness and adoption in emerging markets

Key Players: Swiss Precision Diagnostics GmbH, Church & Dwight Co., Inc., Abbott Laboratories, Procter & Gamble Co., Geratherm Medical AG, Fertility Focus Limited.

Global Fertility Test Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.4 billion

- 2026 Market Size: USD 9.1 billion

- Projected Market Size: USD 17.5 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (Largest share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 5 February, 2026

Fertility Test Market - Growth Drivers and Challenges

Growth Drivers

- Shifting demographics and social trends: The emergence of trends such as delayed parenthood, priority towards career, and rising awareness of reproductive health efficiently drives demand in the market for the proactive planning tools. On the other hand, the aspect of single parenthood and same‑sex couples who are looking for fertility solutions readily expands the consumer base in this field. Based on the government data in December 2024 Ministry of Health & Family Welfare in India reported that the country has achieved a total fertility rate (TFR) of 2.0 as per the National Family Health Survey-5 by aligning with the National Population Policy 2000 and National Health Policy 2017 targets. In this context, the country’s government is proactively promoting family planning through expanded contraceptive options, programs such as Mission Parivar Vikas, post-pregnancy contraception, awareness campaigns, and schemes for home delivery of contraceptives, hence positively impacting market growth in the upcoming years.

- Technological advancement and digital integration: The continued innovations in terms of fertility test improvements, such as advanced hormone detection, smartphone connectivity, AI‑enhanced prediction models. are readily enhancing both accuracy and convenience. Besides, the digital health solutions, such as apps, wearables, and telehealth platforms, are expanding access and engagement with testing tools, prompting a profitable business environment for the fertility test market. In January 2026, OTO Fertility announced that it had launched the world’s first-ever AI-based fertility platform and clinical-grade wearable at CES, thereby providing personalized, real-time reproductive insights. The system monitors more than 50 biometric markers, such as heart rate variability and stress response, to identify optimal fertility windows, offering a more precise measure of pregnancy readiness when compared to traditional indicators. With such continued developments, the market is forecasted to witness unprecedented growth over the years.

- Increasing adoption of assisted reproductive technologies: This aspect creates encouraging opportunities for pioneers in the market. Most of the couples across almost all nations are opting for ART such as IVF and IUI, which necessitates fertility assessments before and during treatment. Also, this trend associates diagnostic testing closer to treatment decisions, thereby boosting demand for a wide range of fertility tests. As of the March 2025 data reported by the NSW government, the NSW Affordable IVF Initiative deliberately provides financial support to reduce the cost of fertility testing and assisted reproductive technology treatments such as IVF, for eligible residents. In addition, the program offers rebates for pre-IVF fertility tests, a USD 2,000 fertility treatment rebate, access to publicly funded lower-cost IVF clinics, and subsidized fertility preservation services for patients who have serious medical conditions, hence providing access to fertility care across the state.

Challenges

- Accuracy and reliability concerns: Consumers and clinicians are looking for highly accurate and reliable fertility results since false results can lead to incorrect treatment decisions and reduced trust in products. Therefore, any variability in terms of hormone levels or improper test usage can negatively affect result accuracy, especially in the case of at-home tests. Besides, the aspect of laboratory-based assays is mostly precise, but they are considered to be expensive and less accessible, impacting the market growth. Companies face the major burden of maintaining consistent sensitivity and specificity across diverse populations, hormonal profiles, and user handling. Furthermore, these misinterpretations can cause negative brand reputation and impact adoption rates, necessitating continuous R&D investment in improving test accuracy.

- Limited awareness and adoption in emerging markets: The lack of proper consumer awareness and understanding of fertility testing in most of the developing regions is a major challenge in the market. The existence of cultural stigmas around infertility, social taboos, and a lack of reproductive health education also suppresses demand in the fertility test market. Therefore, many potential users are unaware of the available testing options or prefer traditional medical consultations over at-home diagnostic kits. This, in turn, limits market penetration and slows growth in high-population regions. In this context, companies need to make investments in terms of educational campaigns, community outreach, and awareness programs to encourage adoption and expand market access, which adds operational and marketing challenges.

Fertility Test Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 8.4 billion |

|

Forecast Year Market Size (2035) |

USD 17.5 billion |

|

Regional Scope |

|

Fertility Test Market Segmentation:

End use Segment Analysis

By 2035, the home care settings segment is expected to attain the largest revenue share of 48.4% owing to the increased demand for convenient, non-invasive, and private fertility monitoring solutions. There has been an increased interest in tracking ovulation and sperm quality at home, which in turn boosts the adoption of these at-home testing devices. In addition, the e-commerce availability has also made these devices more accessible, solidifying home-based fertility care as a preferred choice for many users. In January 2026, Pulsenmore Ltd. announced that it entered into a commercial agreement with Clalit Health Services to provide its Pulsenmore FC at-home ultrasound solution for remote follicular monitoring in women undergoing IVF and fertility preservation. The deal was valued at USD 4.5 million over five years, following an 18-month pilot, and will operate through Beilinson NEXT, which is the virtual hospital at Beilinson Medical Center, offering patients real-time guidance and specialist oversight from home, hence denoting a wider segment scope in the market.

Sample Type Segment Analysis

By the conclusion of the forecast duration, the blood-based subtype is expected to lead this segment with a considerable share in the fertility test market. The higher accuracy, reliability, and ability to deliver proper hormonal insights when compared to other tests are the key factors behind this leadership. Also, these blood-based tests measure key fertility-related hormones such as FSH, LH, AMH, estradiol, and progesterone, which are highly essential for evaluating ovarian reserve, ovulation cycles, and overall reproductive health. In this context, Sysmex Corporation in March 2024 announced that it had launched six new immunoassay kits in Japan, which include LH, FSH, estradiol, progesterone, prolactin, and testosterone, for gynecological and gonadal hormone testing. It also notes that these blood-based assays are compatible with the HISCL-series automated systems, enabling accurate hormone measurement, supporting the diagnosis and treatment of infertility and other gynecological disorders.

Application Segment Analysis

In terms of application, the female fertility testing is anticipated to garner a significant share over the forecasted years. The growing burden of conditions such as polycystic ovary syndrome (PCOS) and increased focus on female reproductive health are the key factors driving this leadership. Therefore, most of the national and national health surveys highlight that female reproductive health screening is common in pre-conception care. In this context, the statistically validated analysis by the World Health Organization in January 2026 reported that PCOS is a common hormonal disorder affecting 10% to 13% of reproductive-aged women, wherein up to 70% are undiagnosed worldwide. It causes irregular menstrual cycles, abnormal ovulation, infertility, excess hair growth, acne, and ovarian cysts, indicating a sustained demand in the market for women.

Our in-depth analysis of the fertility test market includes the following segments:

|

Segment |

Subsegments |

|

End use |

|

|

Sample Type |

|

|

Application |

|

|

Test Type |

|

|

Technology |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fertility Test Market - Regional Analysis

APAC Market Insights

The Asia Pacific fertility test market is expected to be the largest regional landscape owing to the presence of rapid healthcare investment, rising infertility awareness, and expanding access. In addition, the aspects of delayed marriage and lifestyle changes, i.e., smoking and poor diet, are efficiently fueling demand for fertility testing devices. As per the article published by NIH in June 2025, Japan has faced a persistent decline in fertility, with its total fertility rate (TFR) dropping from 1.54 two decades ago to 1.26 in 2022, contributing to an aging population and shrinking workforce. Also under the child future strategy 2023, the country has plans to provide ¥15,000/month (USD 110) for the first two children under age 2, ¥10,000/month (USD 73) for children age 3 to high school, and subsequent children, along with parental leaves. Therefore, these scaling benefits could raise the probability of reversing the fertility decline from 29% (current policy) to over 65% to 79% by the conclusion of 2035, highlighting the critical role of timely policy implementation.

The aspects of delayed childbearing and rising demand for privacy, ovulation, and home-based tests are propelling the growth of China fertility test market. Also, the strong government backing and rise of e-commerce platforms facilitate easy access, enhancing the popularity of these devices. In July 2025, the country’s State Council Information Office (SCIO) reported that China is addressing its demographic decline by improving childbirth support policies, including child care subsidies, parental leave, and education support, to ease financial burdens on families and promote moderate fertility. It also mentioned that the central government will fund around 90% of a 90-billion-yuan (approximately USD 12.7 billion) Child Care Subsidy Fund, providing proportional transfers to local governments. In addition, the government will be providing tax exemptions on subsidies, expanded parental leave, and a full lifecycle support system covering medical care, housing, and education to encourage high-quality population development.

The rising awareness of reproductive health and a focus on personalized medical solutions are facilitating the continued growth of the India fertility test market. At-home fertility test kits and clinical diagnostic services are gaining traction, supported by the increasing availability of proper testing technologies and digital health platforms. Birla Fertility & IVF in August 2024, notified that it has acquired BabyScience IVF clinics, thereby making it 50 clinics in total across the country’s vast geography. Besides, the acquisition is identified as a major milestone in terms of its expansion strategy, with a total investment of more than Rs 500 crores (approximately USD 60.24 million). Thus, with the presence of such strategic activities and strong government backing, the country is emerging as a targeted landscape for investors across the globe.

North America Market Insights

The high awareness, advanced diagnostics adoption, and strong digital fertility test uptake benefit the North America fertility test market. In addition, the suitable insurance policies coupled with the emergence of telehealth are also propelling continued growth in the region’s market. In this context, the White House published an executive order in February, 2025, with a prime focus on expanding in vitro fertilization. It states that one out of every seven couples face infertility, whereas the high costs, ranging from USD 12,000 to USD 25,000 per cycle creates both financial and emotional burdens. Therefore, this order directs the administration to recommend policies within 90 days to lower IVF costs and remove barriers to treatment. Furthermore, these implementations will comply with existing laws and budget provisions, without creating any enforceable legal rights.

The heightened demand for pregnancy detection and rising infertility rates are prompting a favorable business ecosystem for the U.S. fertility test market. Partnerships among device manufacturers and telehealth platforms that are allowing remote consultations are yet another asset for this landscape. According to the official data published by the Centers for Disease Control and Prevention in April 2024, in 2023, the fertility rate in the country declined for the second consecutive year, reaching a historic low, as observed by the CDC’s National Center for Health Statistics (NCHS). It also mentioned that the general fertility rate fell 3% from 2022, wherein 3,591,328 births were recorded. Therefore, these findings reflect the delays in terms of childbearing and shifts in reproductive behavior across the U.S. population, highlighting a significant growth potential for fertility tests.

U.S. Fertility and Birth Statistics, 2023

|

Statistic |

Value (2023) |

Change from 2022 |

|

Total births |

3,591,328 |

↓ 2% |

|

Birth rate, ages 15-19 |

13.2 per 1,000 women |

↓ 3% |

|

Birth rate, ages 20-24 |

55.4 per 1,000 women |

Record low |

|

Cesarean delivery rate |

32.4% |

↑ 4th year in a row |

|

Preterm birth rate |

10.41% |

Essentially unchanged |

Source: Centers for Disease Control and Prevention

Canada fertility test market has gained enhanced traction, propelled by the heightened demand for technologically advanced solutions. Therefore, AI-enabled diagnostic tools and home-based testing options are being integrated into fertility assessments, thereby enhancing both accessibility and convenience. Also, the aspect of provincial health programs and supportive healthcare policies contributes to market development by efficiently improving access to reproductive services. As of September 2024, data from the government of Canada, the country provides a combination of federal and provincial support for fertility treatments, such as IVF and surrogacy, with coverage being varied across different regions. In addition, it also notes that the federal Medical Expense Tax Credit (METC) helps offset eligible fertility-related expenses, though treatments abroad or reimbursed elsewhere.

Public Health Insurance Covering Fertility Treatment by Province and Territory in Canada

|

Province / Territory |

Public Health Insurance Program |

|

British Columbia |

MSP |

|

Manitoba |

MSHIP |

|

New Brunswick |

New Brunswick Medicare |

|

Ontario |

OHIP |

|

Prince Edward Island |

PEI Health |

|

Quebec |

QHIP |

Source: Government of Canada

Europe Market Insights

Europe fertility test market is projected to witness significant growth during the discussed timeframe. The region’s prominence in this field is majorly supported by well-established healthcare systems and the expanding adoption of both clinical diagnostics and home-based fertility test solutions. Regulatory harmonization also enhances product availability and consumer confidence in the region. For instance, Fertility Europe and the Coalition for Fertility, in October 2025, launched an inclusive fertility care for all, which calls for fertility services in the region regardless of factors such as background, identity, or any circumstance. Also, this paper highlights the persistent legal, social, and financial barriers that are faced by marginalized groups, such as LGBTI people, migrants, racialized communities, and individuals with disabilities. Furthermore, it also requests governments and healthcare providers to avoid any type of discrimination, ensure inclusive policies, and provide accessible fertility care.

The advanced healthcare infrastructure, extensive insurance support for diagnostic services, and strong consumer interest in medically certified reproductive health tools are the main factors responsible for boosting the fertility test market in Germany. The country’s public health insurance systems provides its mounting support for clinically indicated hormone diagnostics, reinforcing trust in laboratory-based fertility testing procedures. Besides, the country has witnessed digital health platforms and app-connected tools efficiently enable individuals to track fertility indicators and share results with healthcare providers. Therefore, the presence of all of these factors reflects a well-integrated, patient-centric fertility testing ecosystem in Germany, attracting both national and international players to establish their footprint in the country.

The presence of suitable healthcare coverage and supportive reproductive health policies contributes to increasing uptake of the fertility test market in France. The market has witnessed innovation in terms of testing approaches and rising awareness of fertility issues, prompting a profitable business environment for market players. As per the officially reported data in April 2025, medically assisted procreation in France, which is overseen by the Agence de la biomédecine, deliberately enables individuals and couples facing infertility to pursue parenthood through techniques such as IVF, artificial insemination, and fertility preservation. It also mentioned that all women, regardless of marital status, can access these services, with gamete donation playing a vital role. Furthermore, the agency regulates these practices, authorizes centers, and ensures safety through monitoring, inspections, and vigilance systems, hence making it suitable for standard market growth.

Key Fertility Test Market Players:

- Swiss Precision Diagnostics GmbH (Switzerland)

- Church & Dwight Co., Inc. (U.S.)

- Abbott Laboratories (U.S.)

- Procter & Gamble Co. (U.S.)

- Geratherm Medical AG (Germany)

- Fertility Focus Limited (UK)

- Fairhaven Health LLC (U.S.)

- Advacare Pharma (U.S.)

- Babystart Ltd (UK)

- HiLin Life Products Inc. (U.S.)

- Sensiia (UK)

- Uebe Medical GmbH (Germany)

- AVA Science (Switzerland)

- ExSeed Health (Denmark)

- Roche Diagnostics (Switzerland)

- Quest Diagnostics (U.S.)

- Thermo Fisher Scientific (U.S.)

- Mira (Quanovate Tech Inc.) (U.S.)

- Tulip Diagnostics Pvt. Ltd. (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Swiss Precision Diagnostics GmbH is a leading manufacturer of fertility and pregnancy test kits, which is best known for its Clearblue brand. The company holds a significant share of the international market, facilitated by its extensive portfolio of ovulation and pregnancy tests and digital innovations such as smartphone-connected test devices that enhance both accuracy and usability.

- Church & Dwight Co., Inc. is yet another dominant force in this field that competes strongly in the fertility testing space through its First Response brand, which offers accessible at-home pregnancy and ovulation test kits. The firm also leverages broad distribution across pharmacies and retail outlets, and is mainly focused on product reliability and consumer trust while expanding its test portfolio.

- Abbott Laboratories has registered itself as a global healthcare and diagnostics giant, which supports fertility testing mainly through its investment in joint ventures. The company's strategy is focused on strong R&D, product quality, digital integration, and ensuring that its fertility test products are available across both developed and developing markets.

- Fairhaven Health LLC is a specialty player in this field that is concentrated on reproductive health by offering fertility monitors, supplements, and test kits targeting both female and male fertility. Besides, the company has a differentiated focus on holistic reproductive health and specialized products, which allows it to compete in niche segments of the market.

- Fertility Focus Limited is a notable firm in this field, which is well known for its advanced fertility tracking and monitoring solutions, which include wearable and app-enhanced devices that provide continuous hormonal and cycle data. In addition, Fertility Focus’s strategy combines technology innovation with mobile integration to deliver high-accuracy fertility insights, attracting a widespread audience group.

Below is the list of some prominent players operating in the global market:

The fertility test market is hosting both well-established diagnostics and consumer health companies that are leveraging brand strength and strong distribution networks to maintain their leadership. Leading pioneers such as Swiss Precision Diagnostics, Church & Dwight, and Abbott Laboratories dominate the sector with their broad portfolios, which span ovulation predictors, pregnancy kits, and hormone assays. On the other hand, mergers & acquisitions, digital health integrations, and expansion into emerging markets are a few growth strategies opted by these players to strengthen their market position. For instance, in December 2022, CCRM Fertility, a global leader in reproductive medicine, announced that it had acquired RADfertility, with a key goal of expanding services to Delaware with offices in Newark, Wilmington, and Dover. This move strengthens CCRM’s presence in the Mid-Atlantic by combining advanced IVF technology, genetic testing, and fertility preservation with RADfertility’s experienced team, hence positively impacting market growth.

Corporate Landscape of the Fertility Test Market:

Recent Developments

- In November 2025, Femasys Inc. announced the launch of its femsperm insemination prep kit, which supports the company’s gynecology-focused commercialization strategy by enabling wider first-step fertility treatment access ahead of IVF.

- In June 2024, CooperSurgical announced the acquisition of ZyMōt Fertility, thereby adding ZyMōt’s patented sperm separation technology to its assisted reproductive technology portfolio. The move effectively strengthens CooperSurgical’s leadership in terms of fertility by expanding access to devices that improve sperm selection and pregnancy outcomes.

- In September 2023, Merck notified that it had launched a fertility benefit program to financially support employees and their partners with fertility treatments, i.e., fertility tests, IVF, and hormonal therapies across eight markets in Europe, Asia, and Latin America.

- Report ID: 3231

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fertility Test Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.