Ferrochrome Market Outlook:

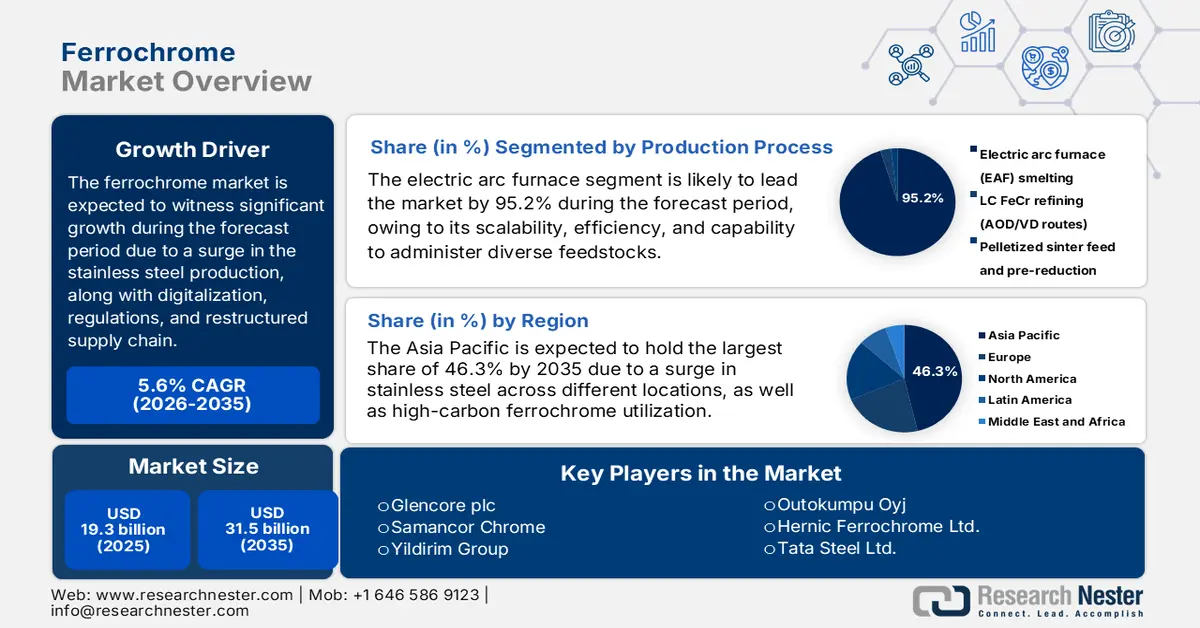

Ferrochrome Market size was over USD 19.3 billion in 2025 and is estimated to reach USD 31.5 billion by the end of 2035, expanding at a CAGR of 5.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of ferrochrome is estimated at USD 20.3 billion.

The international market is significantly entering a transformative phase, with a continuous surge in demand across different nations. Stainless steel is considered the dominant application, but with the emergence of latest forces, including supply chain restructuring, digitalization, and environmental regulations, the market is gradually reshaping. According to a data report published by the OECD Organization in 2025, almost 2 billion tons of steel are produced globally every year, and an estimated 75% of 3,500 steel grades have been developed over the past 20 years. Besides, as stated in an article published by the World Steel Organization in April 2025, there has been an increase in the stainless steel melt shop production by 7% as of 2024, accounting for an overall 62.6 million metric tons, thereby denoting an optimistic outlook for the market.

Regional Stainless Steel Melt Shop Production (2023-2024)

|

Regions |

2023 (metric tons) |

2024 (metric tons) |

% Change |

|

Europe |

5,997 |

6,088 |

1.5 |

|

U.S. |

1,824 |

1,950 |

6.9 |

|

China |

36,676 |

39,441 |

7.5 |

|

Asia, excluding South Korea and China |

6,880 |

7,322 |

6.4 |

|

Others |

7,163 |

7,820 |

9.2% |

|

Total |

58,539 |

62,621 |

7.0% |

Source: World Stainless Steel Organization

Furthermore, the aspects of ESG compliance and sustainability, digital transformation, trade realignment, vertical integration, and product diversification are other factors that are driving the market globally. As stated in a data report published by the OECD in May 2025, there has been a substantial increase in the steelmaking capacity by almost 6.7%, which is 165 million metric tons. In addition, Asia-based economies are projected to cater to 58% of the newest capacity, which is driven by an upsurge in India and China. Besides, the aspect of cross-border investment is readily involved, which is nearly 16% of the overall tonnage. Moreover, by the end of 2030, the international stainless steel demand is expected to grow by 0.7% every year. Besides, in terms of trade facilities, the ongoing wire of stainless steel is also responsible for uplifting the market internationally.

2023 Wires of Stainless Steel Export and Import

|

Countries/Components |

Export (USD) |

Import (USD) |

|

India |

416 million |

- |

|

China |

321 million |

164 million |

|

South Korea |

246 million |

- |

|

Germany |

- |

283 million |

|

U.S. |

- |

244 million |

|

Global Trade Valuation |

2.5 billion |

|

|

Global Trade Share |

0.011% |

|

|

Product Complexity |

1.3 |

|

Source: OEC