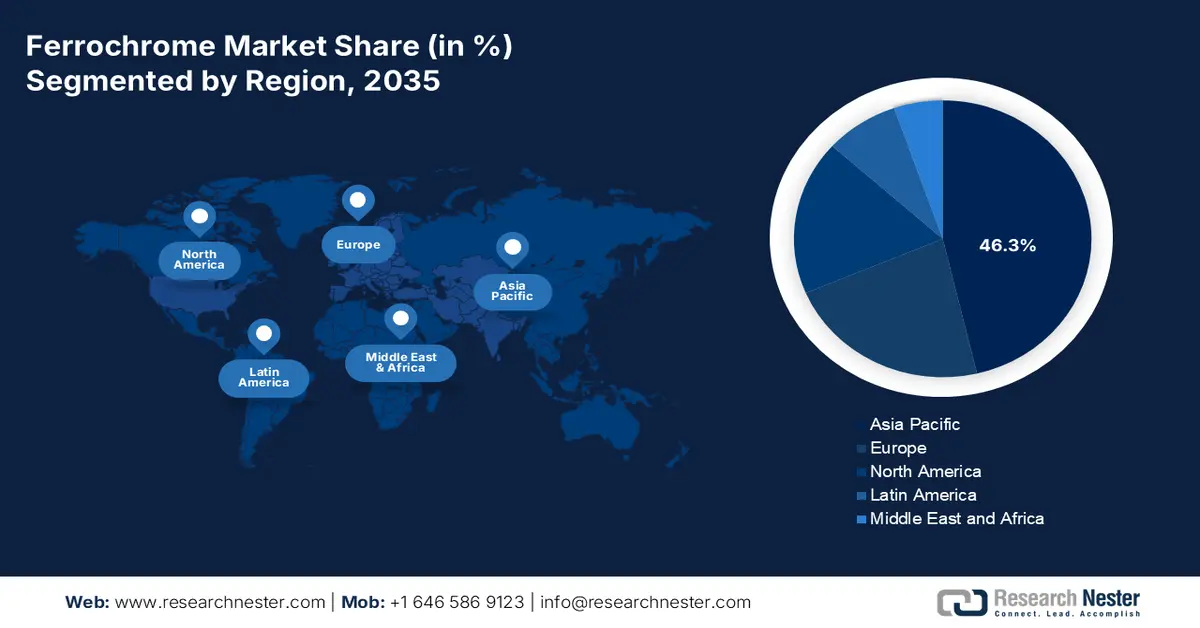

Ferrochrome Market - Regional Analysis

APAC Market Insights

The Asia Pacific market is anticipated to garner the highest share of 46.3% by the end of 2035. The market’s upliftment in the region is boosted by an increase in the stainless-steel capacity in South Korea, Japan, India, and China, along with a surge in the high-carbon ferrochrome utilization across integrated merchant and mills supply chains. According to an article published by the ILO Organization in September 2025, the supply chain aspect in the region accounts for 41% of the international merchandise trade valuation and supports almost 75 million workers, particularly in Southeast Asia, built in large-scale corporations, along with micro and small and medium-sized enterprises. These small economic units make up nearly 97% of overall enterprises and readily employ 70% of the region’s labor force, thereby making it suitable for bolstering the market’s growth.

China’s ferrochrome market is growing significantly, owing to a surge in the stainless steel production, dominance of high-carbon ferrochrome, as well as the sustained industrial investment. As per an article published by the AISU Steel Organization in January 2024, the stainless steel production in the country readily increased by 12.6% as of 2023 in comparison to 2022, reaching 36 million tons. Besides, the stainless steel export in the country has been estimated to account for 4.1 million tons as of 2023, in comparison to 4.5 million tons in 2022. Meanwhile, imports reached 2.0 million tons from 3.2 million tons within the same timeline. Moreover, the yearly production capacity has reached 50 million tons, along with the capacity utilization rate catering to 70%. Additionally, in 2024, it was about 13 million tons of energy that has been put into operation, thus boosting the market’s growth.

India’s market is also growing due to industrial modernization, infrastructure, and growth in the chemical industry. Besides, the government ensures standard documents to provide evidence for the continuous policy support and funding for petrochemicals and chemicals. As stated in an article published by Invest India in March 2025, the domestic chemical sector has been estimated to be worth USD 220 billion as of 2024, and is expected to reach USD 300 billion by the end of 2028. Additionally, the upcoming chemical manufacturing center has predicted that the country’s chemical sector is poised to witness growth by 11% to 12%, along with 7% to 10% by the end of 2040, denoting an increase by three times. Besides, 70% of the domestic chemical production is consumed regionally, and the country is expected to account for 205 of incremental international consumption of chemicals for more than the upcoming two decades, thus suitable for uplifting the market.

North America Market Insights

North America in the ferrochrome market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly driven by an increase in stainless-steel demand in the automotive, chemical processing, and machinery sectors. In addition, the region has strict safety and environmental frameworks that shape choices throughout the chemical value chain. Besides, according to an article published by the U.S. Department of Energy (DOE) in March 2024, the chemical sector in the U.S. supports over 25% of the gross domestic product (GDP). It is also heavily dependent on fossil resources both as energy and feedstock, and is responsible for 513 million metric tons of energy-based carbon dioxide emissions. Moreover, the industry presently converts raw materials into more than 70,000 different products, thus proliferating the market’s upliftment.

The U.S. in the ferrochrome market is gaining increased traction, owing to the demand linkage, federal budget context, the presence of governmental programs, along with advanced materials and manufacturing. Besides, as per the March 2022 EPA Government data report, the 2023 President’s Budget amounted to USD 11.8 billion with 16,204.1 FTE for making advancements to protect human and environmental health. Besides, the EPM, as well as the S&T, has demonstrated USD 11.9 million as of 2022, along with USD 23.7 million in 2023, thereby suitable for supporting programs to ensure chemical sustainability and safety. This also signals sustained public funding for environmental oversight of chemicals within the country. Moreover, the annual EPA budget provision frequently favors stainless steel for durability and compliance for sustaining the ferrochrome demand, particularly in regulated chemical operations.

Yearly EPA’s Budget Analysis in the U.S. (2014-2023)

|

Year |

Budget Amount (USD Billion) |

|

2014 |

8.2 |

|

2015 |

8.1 |

|

2016 |

8.1 |

|

2017 |

8.3 |

|

2018 |

8.8 |

|

2019 |

8.8 |

|

2020 |

9.0 |

|

2021 |

9.2 |

|

2022 |

9.2 |

|

2023 |

11.9 |

Source: EPA Government

Canada in the ferrochrome market is also developing due to industrial demand, government support for chemicals, regulation and sustainability, along with market and trade competitiveness. As stated in an article published by CIAC in November 2025, USD 2 billion has been allocated as a critical minerals fund for more than 5 years to successfully establish a Critical Minerals Sovereign Fund for supporting tactical investments across the country’s clean economy value chain. Besides, as stated in a data report published by the Clean Energy Canada in March 2023, the country’s chemical and fertilizer industry effectively employs more than 88,800 workers and produces 21 million tons of greenhouse gas emissions, thereby making it the highest emitter of the robust industries. Additionally, the sector has generated USD 4.7 trillion in international yearly revenues, thus denoting an optimistic outlook for the market’s growth.

Europe Market Insights

Europe in the ferrochrome market is projected to experience considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly uplifted due to chemical processing equipment, along with the stainless-steel demand in construction, automotive, and machinery. In addition, tightened regional regulatory frameworks on industrial and chemical emissions steer buyers towards traceable, lower-emission, and quality smelting routes are also fueling the market’s exposure. According to an article published by the Europe Environment Agency in March 2023, the chemical sales in the region amounted to EUR 499 billion, with the production hitting 271 million tons, and meanwhile, the consumption aspect stood at 289 million tons. Moreover, in the case of chemical diversity, there have been more than 26,600 chemical registrations in the region under the domestic REACH legislation.

The ferrochrome market in Germany is gaining increased exposure, owing to the presence of the massive industrial base in chemicals, engineered, automotive, and machinery equipment that depends on corrosion-based stainless steel. As per an article published by the British Stainless Steel Association in 2025, the steel consumption in the overall region grew to 148.1 million tons. In addition, the steel consumption in the country rose by 3.2% as of 2024, accounting for 28.9 million tons, as well as denoting a rise by 10% in 2025 with 31.8 million tons. Besides, Thyssenkrupp, the domestic steelmaker, has declared plans to lower the production capacity at its very own Duisburg location from 11 million tons to between 9 to 9.5 million tons, ensuring a suitable balance in the production process, therefore denoting an optimistic outlook for the market’s growth.

The ferrochrome market in Poland is also growing due to the existence of regional sustainability and safety standards, industrial expansion, structural funding opportunities, and modernization of manufacturing and chemical bases. As per the January 2024 ITA article, the country is an emerging innovator by grabbing 62.8% of the regional average, based on which the overall performance is increasing at an increasing rate on a whole. Besides, the country spends 1.3% of its GDP on research and development. Meanwhile, 66% of domestic organizations have successfully implemented at least one innovative digitalized technology for the overall manufacturing process. Besides, as of June 2023, Intel Corporation has initiated the largest foreign direct investment, amounting to a USD 5 billion Semiconductor Integration and Testing Plant in Miękinia, thereby proliferating the market’s growth.