Ferroalloys Market Outlook:

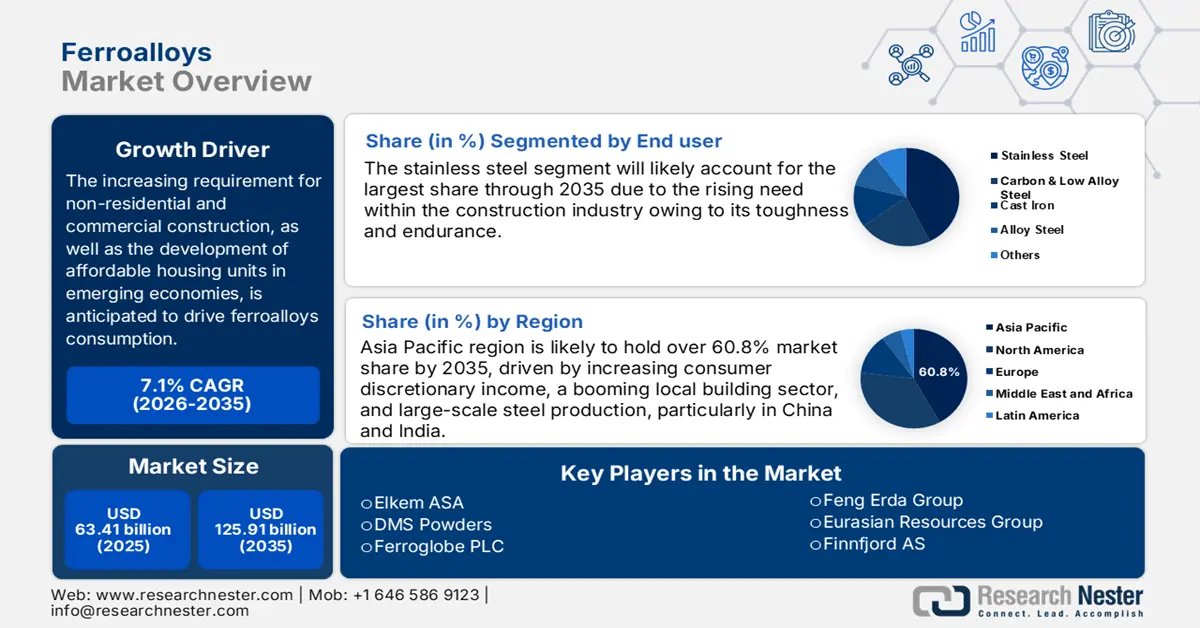

Ferroalloys Market size was valued at USD 63.41 billion in 2025 and is expected to reach USD 125.91 billion by 2035, expanding at around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ferroalloys is evaluated at USD 67.46 billion.

Ferroalloys are mainly used for the deoxidization and refining of steel, and therefore the primary growth driver for ferroalloys sales is the world steel market itself. As the steel industry expands, so does the demand for ferroalloys, which are important raw ingredients in the steelmaking process. Steel demand is influenced by a variety of variables, including economic expansion, population increase, urbanization, and infrastructure development. In fact, global steel production has increased slowly but steadily, from 1.88 billion tons in 2020 to 1.94 billion tons in 2021.

Ferroalloys are a primary material used in steel production. They entail several iron alloys that contain a significant amount of one or more other elements, such as silicon, manganese, or aluminum. They are employed in the synthesis of alloys and steels. The alloys are strongly linked to the iron and steel sector, the top consumer of ferroalloys, as they give steel and cast-iron specific properties or perform crucial tasks during manufacture. Steel is an essential raw material for most industries, so manufacturers have generated steady revenue over the last few years.

Key Ferroalloys Market Insights Summary:

Regional Highlights:

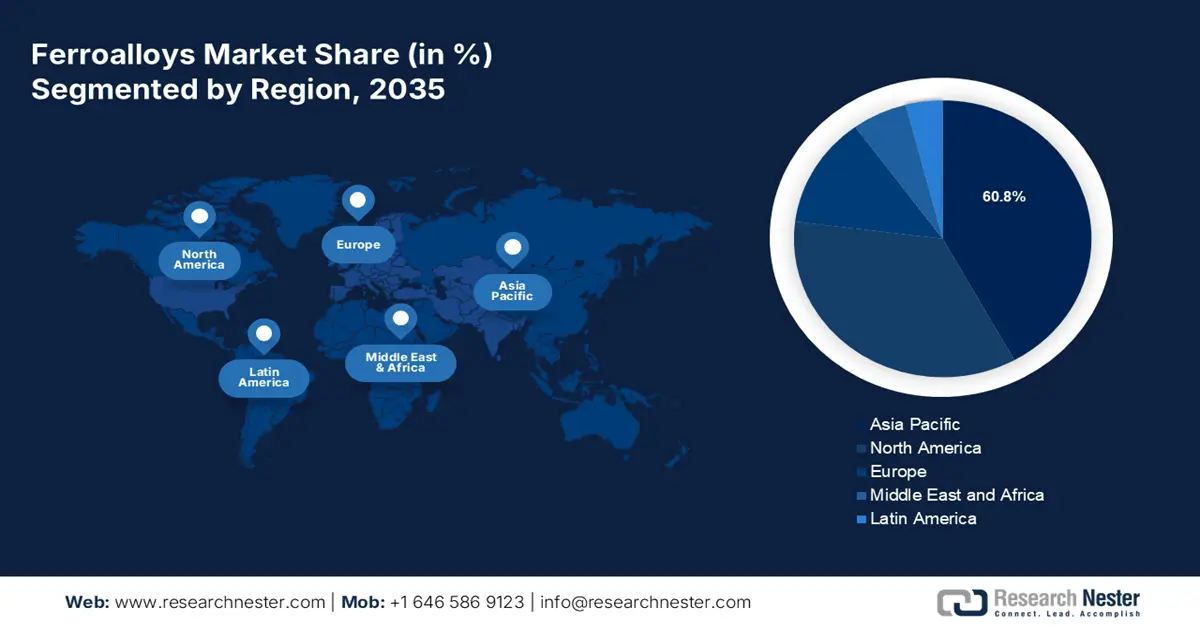

- Asia Pacific ferroalloys market will dominate more than 60.8% share by 2035, driven by increasing consumer discretionary income, a booming local building sector, and large-scale steel production, particularly in China and India.

Segment Insights:

- The bulk ferroalloys segment in the ferroalloys market is expected to maintain the largest market share by 2035, fueled by steady global demand for steel in various industries.

- The stainless steel (end-user) segment in the ferroalloys market is expected to achieve the highest market share by 2035, driven by the chromium addition via ferrochromium and growing steel consumption in key regions.

Key Growth Trends:

- Strong Demand for Steel in Construction

- Growing Use of Steel in the Automobile Sector

Major Challenges:

- Government Restrictions Regarding the Management of Hazardous Chemicals

- Rising Use and Development of Alternatives to Steel

Key Players: Elkem ASA, Feng Erda Group, DMS Powders, Eurasian Resources Group, Ferroglobe PLC, Finnfjord AS, Hindustan Alloys Private Limited, Russian Ferro-Alloys Inc.

Global Ferroalloys Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 63.41 billion

- 2026 Market Size: USD 67.46 billion

- Projected Market Size: USD 125.91 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (60.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 10 September, 2025

Ferroalloys Market Growth Drivers and Challenges:

Growth Drivers

-

Strong Demand for Steel in Construction: The demand for steel in the construction industry was predicted to increase by 6% in 2021 and 3% in 2022, according to a study. This is expected to positively impact the revenue generated in the ferroalloys market. In China and other developed countries, steel consumption is expected to be driven by government-sponsored infrastructure spending.

-

Use in the Deoxidation of Steel- Ferroalloys are used as strong deoxidizers in the production of steel. The U.S. Geological Survey reports that while net sales remained largely flat during the first half of 2022 compared to the same period in 2021, total output climbed by 5%.

-

Growing Use of Steel in the Automobile Sector – As steel is a key raw material in the automotive sector, both the use and production of ferroalloys will increase proportionally. Over 67 million vehicles were sold globally in 2021, up from 62 million in 2020. This is a result of the recovering vehicle industry, which had seen a significant decline in income as a result of the pandemic.

-

Increased Production of Cast and Pig Iron – Cast iron and pig iron, which are largely made of iron and carbon, are used in a variety of industrial processes, including those that create steel and other alloys, produce building materials, and create machinery and equipment. A larger demand for ferroalloys, which are utilized to improve the qualities of these items, would result from the increasing manufacturing of these products. When making cast iron, ferroalloys are injected into the process as an inoculant. The global production of pig iron climbed from 1,310 million metric tons in 2020 to 1,400 million metric tons in 2021, according to the U.S. Geological Survey.

-

Strong Demand for Noble Ferroalloys – Noble ferroalloys include ferroboron, ferromolybdenum, ferronickel, ferroniobium, ferrophosphorus, ferrotitanium, ferrotungsten, and ferrovanadium. Apart from deoxidizing and refinement of steel, noble ferroalloys such as ferrotungsten are used to create steel items for particular applications. Owing to their high melting point electrical properties, ferroalloys such as ferrotungsten are used in the aerospace industry, apart from applications in electron microscopes. The U.S. Geological Survey reports that the world production of noble ferroalloys increased to 1,40,00,000 metric tons from 1,15,00,000 metric tons.

Challenges

- Government Restrictions Regarding the Management of Hazardous Chemicals - The market for ferroalloys may also be impacted by governmental limitations and the control of hazardous substances. Many of the techniques used to produce ferroalloys contain dangerous substances that may be harmful to the environment and human health, such as heavy metals and toxins. Stricter rules are being implemented by governments all around the world to regulate the creation, consumption, and disposal of these substances.

- Rising Use and Development of Alternatives to Steel

Ferroalloys Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 63.41 billion |

|

Forecast Year Market Size (2035) |

USD 125.91 billion |

|

Regional Scope |

|

Ferroalloys Market Segmentation:

Abundance Segment Analysis

The global ferroalloys market is segmented and analyzed for demand and supply by abundance into bulk and noble ferroalloys. Out of these, the bulk ferroalloys segment is projected to hold most of the market share in 2035. This can be attributed to the rising and steady demand for steel across the world for various industries. For instance, the world production of bulk ferroalloys increased from 4,12,00,000 metric tons in 2018 to 4,47,00,000 metric tons in 2019.

End-user Segment Analysis

The global ferroalloys market is also segmented and analyzed for demand and supply by end-use into carbon & low alloy steel, stainless steel, alloy steel, cast iron, and others. Out of these segments, the stainless steel segment is expected to garner the highest share of the market, closely followed by carbon & low alloy steel. This can be owed to the fact that the chromium that provides stainless steel its ability to resist corrosion is added using ferrochromium. Numerous sectors, including constructions, automotive, and consumer products, frequently employ stainless steel. For instance, in the Asia Pacific Region, it is projected that steel consumption will increase by 1% in 2023.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Abundance |

|

|

By End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ferroalloys Market Regional Analysis:

APAC Market Insights

Asia Pacific region is likely to hold over 60.8% market share by 2035, driven by increasing consumer discretionary income, a booming local building sector, and large-scale steel production, particularly in China and India. According to the World Steel Association, China is recognized as the greatest steel manufacturer in June 2021 with an increase of 6.6 percent from 860 MT to 900 Mn Tonnes (MT) of steel. China is believed to be the core of the global steel supply with a production rate of 51.3% in 2018. Additionally, it is anticipated that the market demand for ferroalloys will increase owing to fast industrialization, significant expenditures by the Indian government and large corporations in growth, and the creation of a smart India.

Ferroalloys Market Players:

- Elkem ASA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Feng Erda Group

- DMS Powders

- Eurasian Resources Group

- Ferroglobe PLC

- Finnfjord AS

- Hindustan Alloys Private Limited

- Russian Ferro-Alloys Inc.

Recent Developments

-

Ferroglobe’s second silicon metal furnace situated in Selma, Alabama, United States has resumed operation. The restart of this furnace increases the annual capacity of silicon metal for the domestic market in the United States by 11,000 tons. The Selma facility's two furnaces can produce 22,000 pounds of silicon metal annually.

-

Elkem ASA unveiled a new Elkem bismuth inoculant at the virtual Elkem Silicon Products booth at the 2021 AFS Metalcasting Congress in the US. This new inoculant affordably enhances ductile-iron structures and qualities. If rare earths are present throughout the process of ductile-iron nodularising, new bismuth inoculant enhances graphite nodularity and lowers chill in ductile-iron castings.

- Report ID: 4612

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ferroalloys Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.