Femtech Market Outlook:

Femtech Market size was valued at USD 51.65 billion in 2025 and is likely to cross USD 246.16 billion by 2035, expanding at more than 16.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of femtech is estimated at USD 59.51 billion.

The femtech market has experienced the rise of intensive technological products and services, primarily adopted to improve women's health and wellness. Moreover, growing awareness of issues surrounding women's health and a rapidly developing need for personalized healthcare solutions is also driving the market. For instance, in November 2023, the MyBreastAI suite was introduced by GE HealthCare. It's a full suite of AI tools created to improve breast cancer detection and optimize radiologists' workflows.

Societies pay more attention to gender-specific health requirements, and the demand for innovation in areas of reproductive health and fertility, management of menopause, and menstrual health increases. For instance, in April 2022, WHO stated that a single-dose Human Papillomavirus (HPV) vaccine offers strong protection against HPV, the virus that causes cervical cancer, especially for girls. These aspects can be increasingly achieved with the help of artificial intelligence, wearables, and mobile health applications integrated into products. Thus, accessibility, convenience, and efficiency are all factors stimulating the growth of the femtech market.

Furthermore, growing incidences of poor health and hygiene amongst women are leading to a declining potential for the well-being of society and a healthy population. For instance, in January 2024, a report published by McKinsey & Company stated that every year, 75 million years of life are lost as women spend a larger percentage of their lives in poor health than men do. In addition, by 2040, closing this gap could result in a USD 1 trillion global economic boost, with working-age women having the majority of the potential. A confluence of supportive regulatory frameworks, investor interest, and the shift toward holistic health models also goes a long way toward determining the future rapid evolution of the sector.

Key Femtech Market Insights Summary:

Regional Highlights:

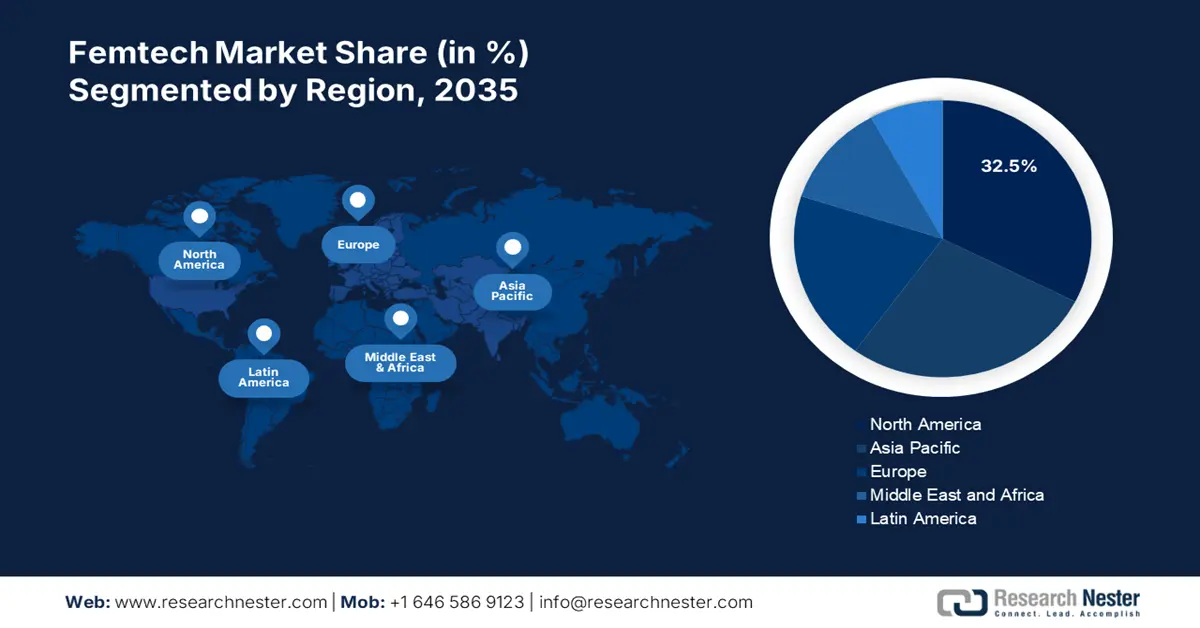

- North America holds a 32.5% share in the Femtech Market, driven by strong digital health infrastructure and supportive VC and regulatory environment, ensuring robust growth by 2035.

- The Asia Pacific region is poised for rapid growth in the Femtech Market from 2026 to 2035, driven by rising awareness, tech advancements, and a surge in female entrepreneurship.

Segment Insights:

- The Software segment is anticipated to secure a 50.70% share by 2035, fueled by increasing demand for personalized and accessible digital health solutions for women.

- The Reproductive Health segment is expected to dominate the market from 2026-2035, driven by rising interest in fertility tracking and home diagnostic solutions.

Key Growth Trends:

- Investments and funding towards female well-being

- Access to healthcare facilities and digital health

Major Challenges:

- Gender bias in medical research and design

- Fragmentation of market

- Key Players: Preglife, Univfy Inc., Natural Cycles, LunaJoy, HeraMED Limited, Flo Health Inc..

Global Femtech Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 51.65 billion

- 2026 Market Size: USD 59.51 billion

- Projected Market Size: USD 246.16 billion by 2035

- Growth Forecasts: 16.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Femtech Market Growth Drivers and Challenges:

Growth Drivers

-

Investments and funding towards female well-being: Female health is emerging as one of the gigantic growth drivers for the femtech market. More venture capital firms begin to realize untapped potential in addressing unique healthcare needs in women and pay more attention to gender-specific health issues. Thus, investments are made through a startup focused on innovative solutions in reproductive health. For instance, in October 2024, it was published that venture capital investments in women's health startups nearly tripled since 2018, reaching about USD 15.1 billion in 2023 from USD 4.2 billion in 2022.

Furthermore, the capital increase not only accelerates innovation of new technologies but also very competitive femtech markets that will catalyze innovation and growth of products and services to meet diverse needs for women's health care. For instance, in April 2022, a femtech startup, Conceive raised USD 3.7 million to fund its results-driven fertility solution. In addition, investor interest is likely to accelerate continued growth and transformation in the femtech industry. -

Access to healthcare facilities and digital health: The growth in the femtech market has been hugely influenced by access to healthcare facilities and the increasing popularity of digital health solutions. For instance, in October 2024, Flo Health collaborated with FemTech India and launched its Pass It on Project during a special Diwali campaign. FemTech India's platform connects founders, professionals, and investors to innovate and collaborate in the femtech space. Flo Premium subscriptions will be made available for women in 22 countries where access to safe and credible health information is limited.

Digital health platforms, telemedicine, and mobile health applications are currently breaking down many geographical and logistical barriers for women to access healthcare services. This will result in convenient, affordable, and personalized care that enables women to take more agency over their health. As the healthcare system becomes increasingly digital, femtech solutions are placed well in meeting an emerging need for healthcare that is accessible, flexible, and inclusive as the boundaries of the femtech market are further pushed.

Challenges

-

Gender bias in medical research and design: Traditionally, women's health was not sufficiently tested in clinical trials and medical studies, therefore leading to a non-personalized solution for specific health needs among women. Furthermore, most developmental roles in femtech products are held by mostly male-led teams, hence not fully understanding the uniqueness of women's experiences and requirements. This bias hampers the development of effective, evidence-based solutions and perpetuates gaps in healthcare, limiting the sector's ability to fully address women's health challenges.

-

Fragmentation of market: Femtech presents one of the most significant challenges where the femtech market consists of many startups and products focusing on niche areas of women's health such as fertility, menstrual care, and menopause management. This does provide tailored solutions, but it also creates the problem of the lack of standardization and integration across technologies, meaning it is difficult for consumers to navigate their choices and for companies to scale. The femtech market's fragmented nature also complicates the creation of coherent, all-around healthcare solutions, potentially hindering the overall capability of femtech to merge organically with current healthcare systems.

Femtech Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.9% |

|

Base Year Market Size (2025) |

USD 51.65 billion |

|

Forecast Year Market Size (2035) |

USD 246.16 billion |

|

Regional Scope |

|

Femtech Market Segmentation:

Type (Software, Products, Services)

Increased requirements for digital health solutions will be dominating the software segment in the femtech market with 50.7% by 2035. Such solutions are capable of bringing personalized, accessible, and data-driven healthcare to women. For instance, in June 2024, TytoCare announced a major software update for its Home Smart Clinic. The update includes several new features such as it enables clinicians to conduct remote physical exams, regardless of location or condition such as acute or chronic. This is aimed at making high-quality healthcare more accessible on a large scale for payers, providers, and patients. Due to the inherent preference for convenient, on-demand access to healthcare services, women can monitor their health privately and at their own pace, thereby accounting for significant growth in the sector.

Application (Reproductive Health, Pregnancy Care, Maternal/Postpartum and Nursing Care, Integrative Physical and Mental Health & Overall Well-being, Other Applications)

The reproductive health segment is dominating the femtech market due to rising interest in fertility tracking, family planning, and prenatal care. An impressive array of telemedicine platforms that offer user-specific advice and counseling is increasing as women are growing more vocal about advocacy for their reproductive health. For instance, in December 2023, Arva Health launched at-home fertility tests for women with PCOS and thyroid issues. The test will enable women to monitor and track their hormones, allowing them to make informed decisions about their reproductive health. Subsequently, increased consciousness coupled with the desire for easier invasive care options places reproductive health at the forefront of top-grossing applications.

Our in-depth analysis of the femtech market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Femtech Market Regional Analysis:

North America Market Statistics

North America industry is estimated to dominate majority revenue share of 32.5% by 2035. North America has a well-developed digital health infrastructure with widely available smartphones, wearables, and telemedicine services, making it easier to bring such products into the consumer market. The strong presence of venture capital and supportive regulatory framework facilitate innovation and investment in the space of femtech start-ups, thereby driving North America into hosting innovation regarding the development of digital platforms and tracking fertility tools, all of which are shaping the region into a leader in the femtech space.

The U.S. is the leader in the femtech market through the core focus on individualized care and digital health technologies to meet women's special and unique health needs. For instance, in June 2024, Emagine Solutions Technology announced a new partnership with Fitbit to address maternal health. The collaboration will enable users of Emagine's The Journey Pregnancy app to track and monitor their maternal health using Fitbit devices. It will assist patients in tracking their vital signs during pregnancy and transmitting this information to providers in real time.

The major characteristic of Canada is that the country is up-to-date in its stance on women's health matters and has invested more heavily in tech-enabled healthcare solutions, rendering it promising for a progression of femtech products and services. For instance, in February 2024, it was published that the Shoppers Foundation for Women's Health will invest USD 50 million by 2026 to improve healthcare equity for women in Canada.

Asia Pacific Market Analysis

Asia Pacific is the most rapidly growing region in the femtech market, driven by increased awareness, technological advancements, and a growing number of female entrepreneurs. As societal attitudes change and the conversation about women's health becomes more normalized, the opportunity for innovation and investment in this sector grows significantly. The formation of networks such as the FemTech Association of Asia bolsters this growth by encouraging community and collaboration among stakeholders in the FemTech ecosystem.

The femtech market growth in China is being driven by a proliferation of government initiatives focused on women's health. For instance, in August 2024, it was published that China has made significant strides in improving healthcare access. A hierarchical maternal and child health system has been established nationwide, with 26,000 maternal health facilities. Over 90% of China households can get to the nearest health facility in 15 minutes, and most pregnant women can get affordable maternity care, with approximately 95% covered by social health insurance.

The femtech market in India is marking a new transformation through the Women’s Health and Livelihood Allowance (WOHLA), which aims to empower women in underserved communities across India. The initiative addresses the interconnected aspects of women's health and economic well-being, with a focus on young women aged 19 to 29 from low- and middle-income families living in urban and periurban areas.

Key Femtech Market Players:

- AVA Women

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amzon.com, Inc.

- Clue

- Flo Health Inc.

- HeraMED Limited

- LunaJoy

- Nanit

- Univfy Inc.

- Soula -AI

- Preglife

- Natural Cycles

- Google Nest

- Peppy Health Limited

The femtech market is stimulated strongly by the demand for innovative products catering to women’s needs. The companies play a crucial role in customizing wellness plans focusing on issues related to female health. In addition, the collaborations between startups and well-established companies are making femtech a promising sector. For instance, in December 2022, Hindustan Unilever entered the health and wellness space. The FMCG conglomerate will acquire a 100% stake in OZiva, a leading plant-based consumer wellness brand that focuses on need areas such as lifestyle protein, hair and beauty supplements, and women's healthcare.

Here’s the list of some key players:

Recent Developments

- In June 2024, the soft launch of HeraCARE within the Telstra Health Smart Connected Care ecosystem was announced by HeraMED Limited. In line with their Smart Partner Marketing Plan, the two companies will collaborate on marketing and education projects. The initiative's goal is to increase the company's presence in additional areas.

- In August 2021, L'Oréal collaborates with Clue, a period tracking app and femtech industry leader, to advance scientific understanding of the relationship between skin health and the menstrual cycle.

- Report ID: 6716

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Femtech Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.