Faucet Market Outlook:

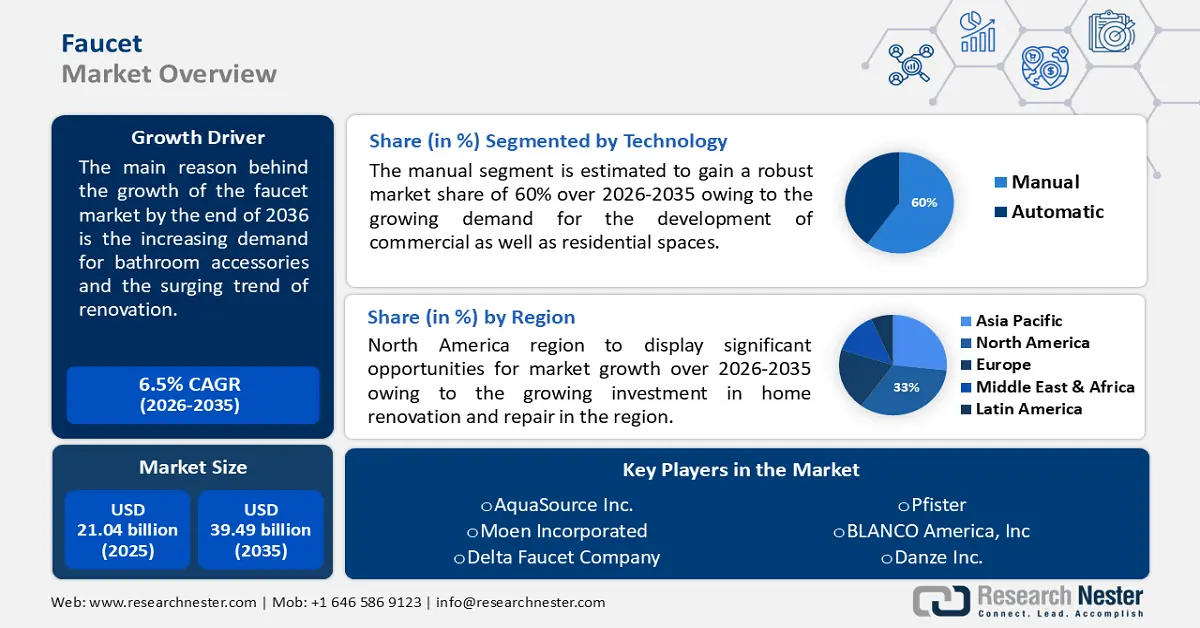

Faucet Market size was over USD 21.04 billion in 2025 and is poised to exceed USD 39.49 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of faucet is estimated at USD 22.27 billion.

The faucet market is expected to see a surge in demand due to the growing trend of renovating and the ensuing use of fashionable and intelligent bathroom accessories. The Joint Center for Housing Centers of Harvard University reports that expenditure on home repair projects climbed from USD 328 billion in 2019 to USD 472 billion in 2022, with an anticipated USD 485 billion in spending in 2024.

Key Faucet Market Insights Summary:

Regional Highlights:

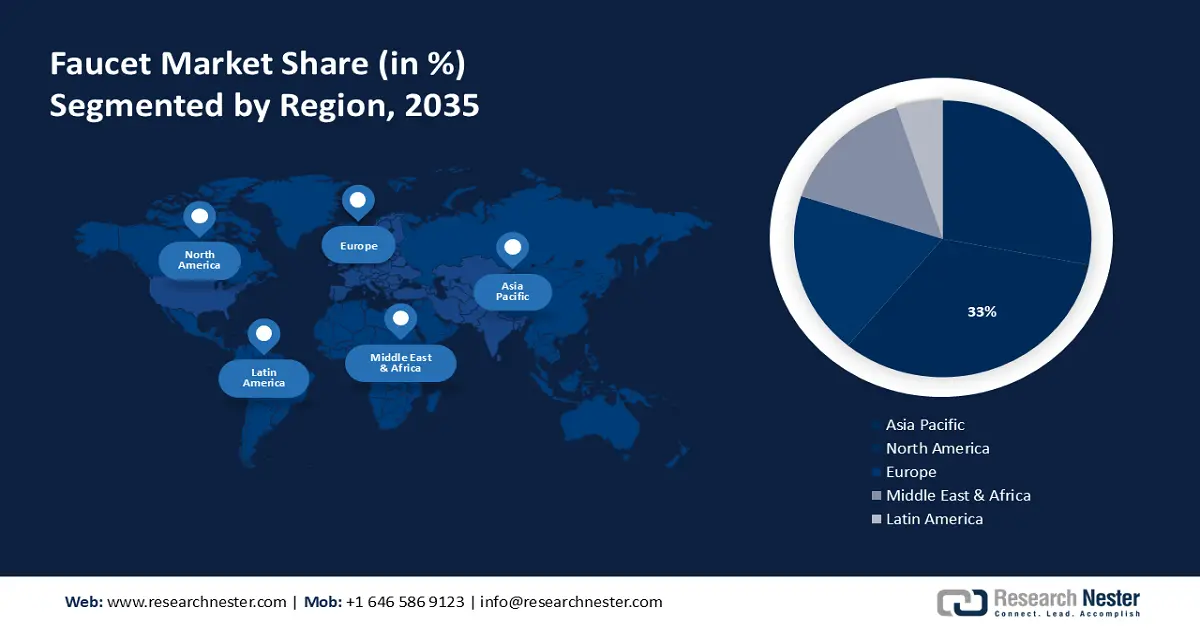

- North America faucet market will hold more than 33% share by 2035, driven by increased spending on residential renovation and repair.

Segment Insights:

- The manual (technology) segment in the faucet market is expected to experience robust growth till 2035, fueled by new residential units and commercial space development.

- The commercial segment in the faucet market is projected to hold a 59% share by 2035, driven by the expanding hospitality sector including hotels and hospitals.

Key Growth Trends:

- Escalating advancement

- Government aiding the population to build their home in a few regions

Major Challenges:

- Price sensitivity issues

- Shifting consumer preferences is a notable factor hindering market growth in the upcoming period.

Key Players: Kohler Co., Kraus, USA Plumbing LLC, American Standard Brands, Grohe America Inc., Pfister, Delta Faucet Company, Moen Incorporated, Aqua Source Inc., Danze Inc., BLANCO America, Inc., TOTO Ltd, Fortune Brand Home & Security Inc.

Global Faucet Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.04 billion

- 2026 Market Size: USD 22.27 billion

- Projected Market Size: USD 39.49 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Faucet Market Growth Drivers and Challenges:

Growth Drivers

-

Escalating advancement - Other reasons driving faucet industry growth include a variety of product advancements, such as the creation of digital, hybrid, and touch-free smart faucets with temperature gauges and efficiency sensors built in. An LED temperature display, for example, is included with the GROHE Plus smart faucet, as it reinterprets what variety means.

-

Government aiding the population to build their home in a few regions - Various schemes have been put in place by governments of different countries around the world to ensure that there are concrete homes for people with a middle class or lower income.

For example, to overcome the current shortage of about 6 million housing units, India's Government is planning to build around 11 billion houses and developments. Moreover, by 2022, the Government intends to provide housing for all India's citizens. In the range of 5 to 6 million units, the need for housing is almost equally distributed in urban and rural areas, with the majority of these dwellings being affordable.

In addition, the Smart Cities Mission announced by the Indian Government calls for a spending of USD 7.75 billion over the next five years to build 100 such smart cities in India. As a result, with the advent of new residential and commercial buildings, demand for faucets and other products is expected to increase substantially.

- Demand for modern bathroom accessories - The increasing popularity of modular bathrooms has led to increased customer demand for modern, ceramic sanitary ware, and high-quality built-in bathroom appliances.

The is therefore expected to grow over the forecast period, driven by an increase in faucet usage in modern bathrooms. Out of the 970,000 single-family houses finished in 2021, 27,000 had one and a half baths or less, and 320,000 had three or more bathrooms, according to the U.S. Census Bureau.

Challenges

- Price sensitivity issues - Especially in developing economies price is a major factor for many faucet buyers. This can put pressure on manufacturers to keep costs down which might impact quality or innovation.

- Shifting consumer preferences is a notable factor hindering market growth in the upcoming period.

- Competition from alternatives is another factor hampering the faucet market growth.

Faucet Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 21.04 billion |

|

Forecast Year Market Size (2035) |

USD 39.49 billion |

|

Regional Scope |

|

Faucet Market Segmentation:

End User Segment Analysis

Commercial segment is predicted to dominate over 59% faucet market share by 2035. Over the past decade, demand for faucets in these areas has increased as a result of an increasing hospitality sector that includes hotels, resorts, and hospitals.

The hospitality sector is one of the most important faucet market in Europe, with major US hotel chains increasing their presence significantly. For instance, in Q4 2022, there were 14,267 undertakings ready to go all through the world, adding up to 2,298,846 rooms, an ascent of 4% year over year recorded as per the Global Construction Pipeline Trend report.

Technology Segment Analysis

By the end of 2035, manual segment is likely to capture around 60% faucet market share. The market is expanding as a result of an increase in newly built residential units, commercial space development, home renovations, and faucet replacements.

According to research that examines the worldwide housing market, 62.0 million new homes will be built by 2028 across the globe, representing an annual growth rate of 2.1%.

Application Segment Analysis

In faucet market, application segment is poised to capture over 55% revenue share by 2035. The rising worldwide real estate commercial sector and the burgeoning hotel industry are the main drivers of the increased demand for faucets in bathroom applications.

Globally, the expanding tourism and hospitality sectors are the primary drivers of demand for bathroom accessories. According to the survey, 71% of respondents think homeowners will be more willing to spend on bathroom renovations in 2023 than they were in previous years.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Type |

|

|

Technology |

|

|

Application |

|

|

End User |

|

|

Material |

|

|

Finish Outlook |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Faucet Market Regional Analysis:

North American Market Insights

North America in faucet market is anticipated to dominate over 33% revenue share by 2035. The increase is mainly due to the increased spending by people in North America on residential renovation and repair.

In 2020, the US spent USD 363 billion on home improvement, renovations, and repair work while in the next year, it was USD 406 billion. The higher the number of rooms, the more bathrooms there are which leads to an increase in demand for taps that require the use of faucets.

Almost all the bedrooms have an attached bathroom, according to the housing patterns in the United States. In 2021, according to the U.S. Census Bureau, 160,000 of the 371,000 multifamily dwellings had only one bedroom, and 35,000 had three or more bedrooms.

The growth of the faucet industry in the Canadian region is driven by the increasing innovation in bathroom sanitary appliances and demand for the renovation of houses into advanced and modern designs.

APAC Market Insights

Asia Pacific faucet market size is projected to generate the highest market revenue by the end of 2035. Due to a large range of products on the regional and global market, e.g. motion faucets, smart faucets, or water-efficient ones, Asia Pacific is expected to grow significantly in the region. The construction sector in the region is growing rapidly, with almost half of all new buildings worldwide assessed to be built there by 2040 according to data from UNEP published in 2021.

Growth in India can be attributed to a range of factors, including the rise in household incomes, an increase in urbanization, changes in consumer preferences, and increased demand for luxury housing.

Rising urbanization in China is expected to drive the growth in the faucet market

The commitment of the industry to sustainability in Japan is why these faucets are used in construction projects.

Faucet Market Players:

- Kohler Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kraus, USA Plumbing LLC

- American Standard Brands

- Grohe America Inc.

- Pfister

- Delta Faucet Company

- Moen Incorporated

- Aqua Source Inc.

- Danze Inc.

- BLANCO America, Inc.

- TOTO Ltd

- Fortune Brand Home & Security Inc

The faucet market is evaluated to grow rapidly and the top 10 companies listed down are assessed to offer lucrative growth opportunities for the market in the future. Since some of them are among the leading textile manufacturers with a wide range of product portfolios for Faucet, market players have been facing strong competition from one another. To be able to reach both local and international consumers, these companies have a strong customer base due to the presence of an extensive distribution network.

Recent Developments

- Blanco launched new productive accessories and faucet finishes, the kitchen offline solutions brand supported by industrial excellence in Germany. Bold black and luxurious satin gold have also been added to the finish of their metal sinks.

- Moen's Smart Faucets have been put on display. Using gestures to control temperature and flow, the new feature has a completely hands-free operation.

- Report ID: 6049

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Faucet Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.