Fatty Amines Market Outlook:

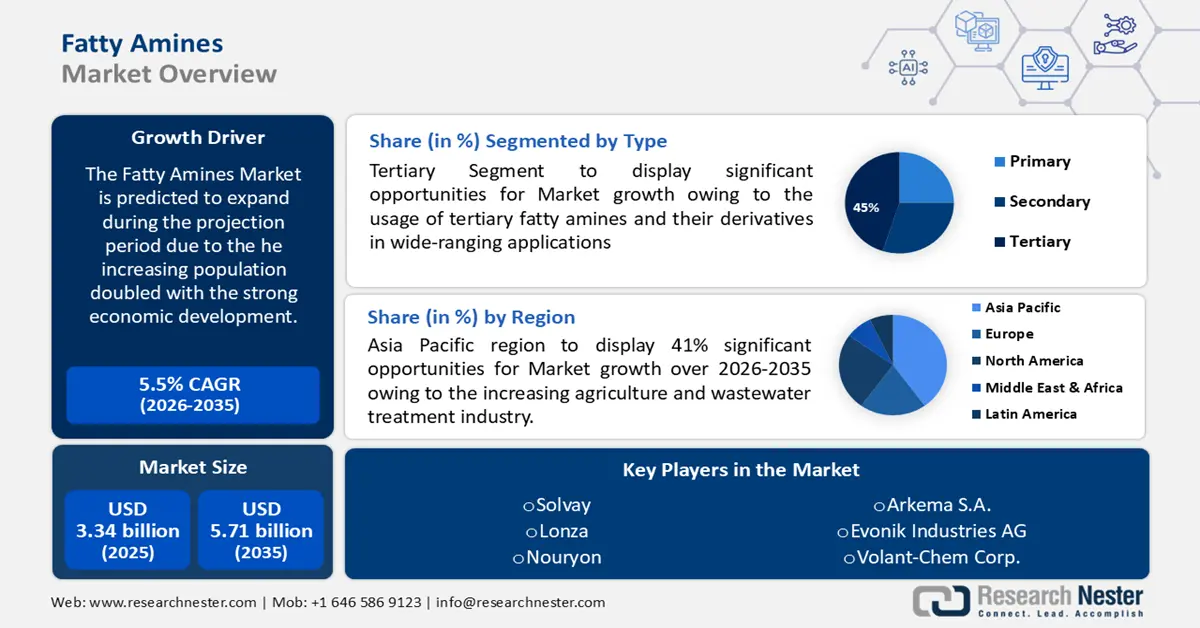

Fatty Amines Market size was over USD 3.34 billion in 2025 and is poised to exceed USD 5.71 billion by 2035, growing at over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fatty amines is evaluated at USD 3.51 billion.

Fatty amines are organic compounds that are derivatives of ammonia and contain one or more hydrogen atoms that are substituted by either an aryl or an alkyl group. These compounds are also known as oleochemicals. Fatty nitriles hydrogenation reaction, which is catalyzed, continuously separates fatty amines from oleochemicals. They can be used for a variety of purposes, including water treatment, agrochemicals, petroleum chemicals, additives for asphalt, anti-caking, and other uses in the mining, personal care, textile, painting, and blending industries.

Numerous consumer sectors use fatty amines, including those that deal with texture, sanitization, organology, corrosion inhibition, and other cosmetic additives. Additionally, they are increasingly being utilized in fabric softeners and liquid detergents. Rising demand for liquid detergent and fabric softeners the industrial investment from the developed countries is estimated to drive the growth of this market. As per data published by market research firm Kantar, liquid detergent had a penetration of 15.5% in India. In short low cost of raw material, with its easy availability doubled with low production cost and low toxicity level is expected to drive the growth of this market in the upcoming times.

Key Fatty Amines Market Insights Summary:

Regional Highlights:

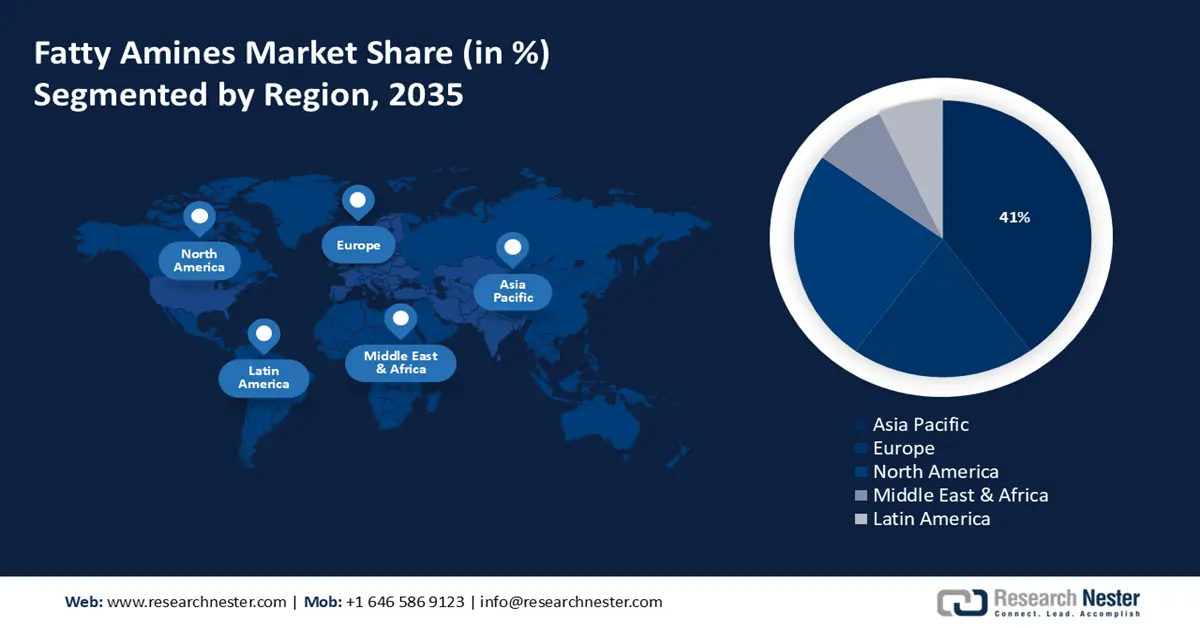

- Asia Pacific fatty amines market will hold around 41% share by 2035, driven by demand from agriculture and wastewater treatment.

- North America market projects lucrative growth during the forecast timeline, driven by key detergent and surfactant producers in the market.

Segment Insights:

- The agrochemical segment in the fatty amines market is anticipated to hold the largest share by 2035, driven by the use of fatty amines in fertilizers and pesticides for anti-caking properties.

- The tertiary fatty amines segment in the fatty amines market is expected to hold a majority share by 2035, driven by their wide-ranging applications including surfactants and disinfectants.

Key Growth Trends:

- Strong demand from diverse industries

- Growing Demand for Water Treatment Chemicals

Major Challenges:

- Availability of Alternatives

- Strict Government Regulations

Key Players: Kao Corporation, Nouryon, Arkema S.A., Lonza, Solvay, Evonik Industries AG, Huntsman International LLC, Volant-Chem Corp., Global Amines Company Pte. Ltd., India Glycols Limited.

Global Fatty Amines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.34 billion

- 2026 Market Size: USD 3.51 billion

- Projected Market Size: USD 5.71 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 8 September, 2025

Fatty Amines Market Growth Drivers and Challenges:

Growth Drivers

- Strong demand from diverse industries - The global market for fatty amines is anticipated to be primarily compelled by the burgeoning demand for agrochemicals and asphalt additives, worldwide. Also, the rapidly thriving water treatment chemicals industry is propelling the demand for fatty amines. The rising global population, followed by the growing demand for agricultural products, will contribute to the demand for agrochemicals based on fatty amines.

- Rising Technological Advancement - Further, technological advancements and growth in novel applications will be another imperative factor raising significant demand from the verticals, such as mining, fabric conditioning, paints & coatings, and detergents, over the foreseeable future. In 2022, the United States was regarded as the largest tech market in the world.

- Growing Demand for Water Treatment Chemicals – Water is found diversely in various parts of the world. Not all water is good for drinking use, therefore, wastewater treatment is a crucial part. Water treatment chemicals and fatty amines are widely used in wastewater treatment.

- Increasing Use of Personal Care and Cosmetic Products – As per the sources, the personal care and beauty industry generated a market revenue of USD 100 million in 2021.

Challenges

- Availability of Alternatives - The availability of economical alternatives that are relatively environment-friendly, uncertain raw material pricing and fluctuating availability of fatty amines, and the presence of stringent government regulations concerning the hazardous impact of these compounds restricting their usage, are the key factors that might hamper the growth of the overall fatty amines market in the forecast period.

- Strict Government Regulations

- Harmful Side Effects of Fatty Amines

Fatty Amines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 3.34 billion |

|

Forecast Year Market Size (2035) |

USD 5.71 billion |

|

Regional Scope |

|

Fatty Amines Market Segmentation:

End-user Segment Analysis

The agrochemical segment is anticipated to account for largest market share in the forecast period. Owing to fatty amine's anti-caking agent properties, fatty amines are highly used in the manufacturing of fertilizers and pesticides. Globally more than 2 million tonnes of pesticides and fertilizers are produced.

In addition, the need for higher productivity in the agricultural sector and growing sustainability concerns regarding the food supply are some of the main factors influencing the expansion of the agrochemicals segment. Since the past few decades, the demand for agrochemicals has increased in the agriculture and food industry owing to its reduced arable. Fatty amines are used as anti-caking agents and wetting agents, thus used as agrochemical additives .

Type Segment Analysis

The tertiary fatty amines segment is set to dominate majority market share by 2035. This growth is attributed to usage of tertiary fatty amines and their derivatives in wide-ranging applications such as fabric softeners, surfactants, drilling muds, asphalt emulsifiers, and disinfectants or bactericides. The primary fatty amines are likely to witness the fastest growth due to their quality of being used as a basic raw material to yield secondary and tertiary amines. Tertiary and secondary fatty amines are derived from primary fatty amines; thus, they are significant in different verticals.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By End Use |

|

|

By Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fatty Amines Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate 41% revenue share by 2035, owing to increasing agriculture and wastewater treatment industry in the region. As per Indian Brand Equity Foundation, the Indian agriculture sector will reach a revenue of USD 25 billion by the end of 2025. China, India, and Japan are the leading proponents of the escalating demand for fatty amines on a national and international level. Upsurging growth in water treatment operations throughout the region, especially from power generation and oil and gas operations, is what's driving the market need.

Additionally, demand for treated water is also caused by the fact that agriculture is a major industry in many Asia-Pacific countries. Positive petrochemical adjustments and regulations are predicted to further boost product demand. Furthermore, during the past several years, consumption of personal care and home goods has been gradually rising in Japan and developing nations like China and India.

North American Market Insights

North America market is anticipated to witness lucrative growth through 2035. The market expansion can be attributed to several detergent and surfactant producers are active in this industry, and their contributions to its expansion are important. The main players are more likely to include novel items to tap into unrealized potentials, which is poised to drive the market growth.

Europe Market Insights

The market in the Europe region is predicted to have a significant growth till 2035. This can be due to growing use of cosmetics and personal care products. Primary fatty amines are widely used in the production of personal care and makeup products as they are quite similar to esters and organic oils. Also, the increasing use of household products that consists of fatty amines within them is driving the market growth.

Fatty Amines Market Players:

- Kao Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nouryon

- Arkema S.A.

- Lonza

- Solvay

- Evonik Industries AG

- Huntsman International LLC

- Volant-Chem Corp.

- Global Amines Company Pte. Ltd.

- India Glycols Limited

Recent Developments

- Kao Corporation has decided to build a new tertiary amine production plant in Pasadena, Texas, United States, mainly to meet the growing demand for sterilizing/cleaning applications but also for a wide range of other industrial applications. Owing to Kao's unique catalyst technology, its tertiary amines are of superior quality. Kao has the world's largest production capacity with three production sites in Japan, the Philippines, and Germany.

- Evonik Industries AG made a technical collaboration with AG Tech, in order to enhance its regional agribusiness network.

- Report ID: 2734

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fatty Amines Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.