Farming as a Service Market Outlook:

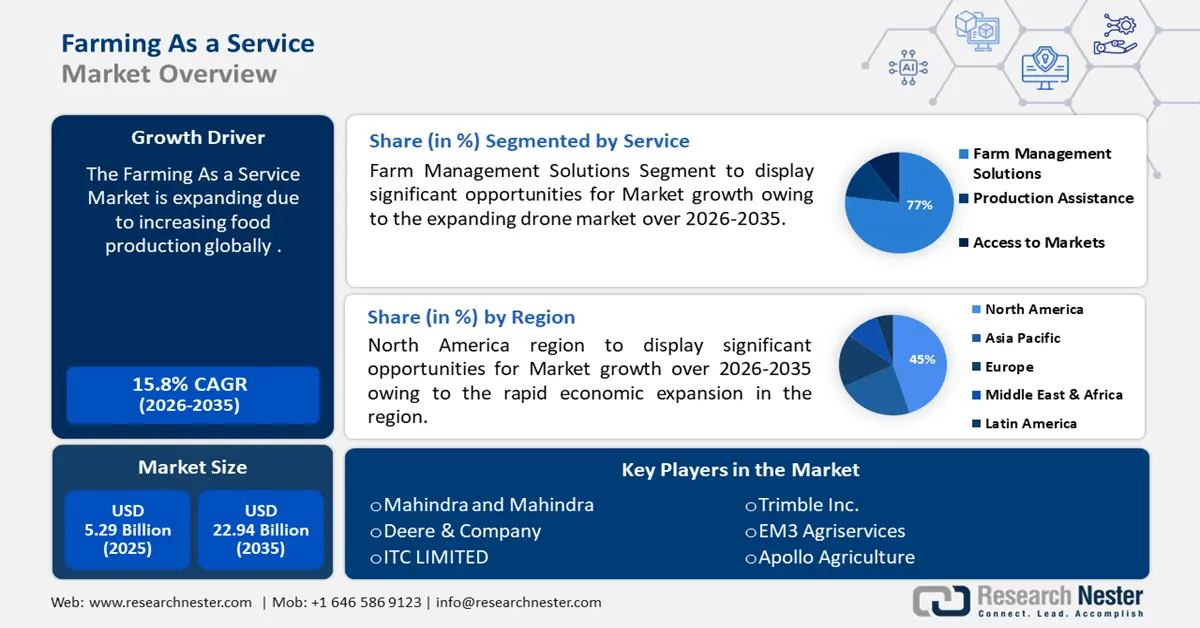

Farming as a Service Market size was over USD 5.29 billion in 2025 and is projected to reach USD 22.94 billion by 2035, growing at around 15.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of farming as a service is evaluated at USD 6.04 billion.

Increasing food production globally is a driving factor behind this market expansion. Farming as a service (FaaS) has the potential to change farmers' lives and reshape the food system by advancing much-needed process and product innovations in agriculture. As per the Food and Agriculture Organization, to feed the 9.1 billion people that will inhabit the planet by 2050, total food production would need to increase by about 70%.

Key Farming as a Service Market Insights Summary:

Regional Highlights:

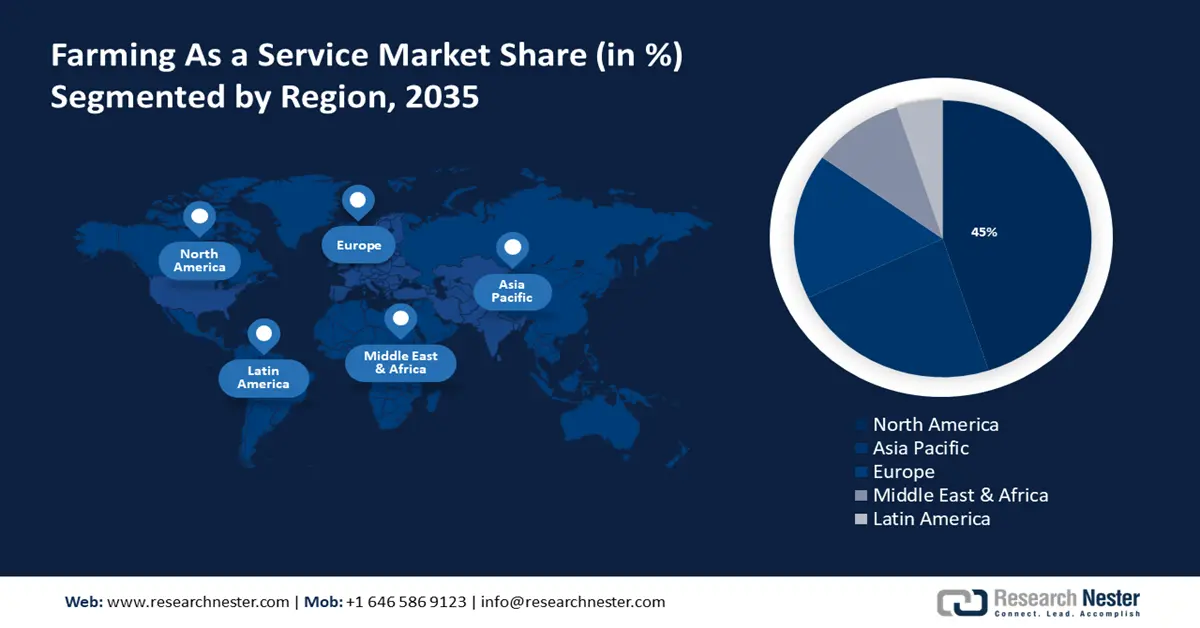

- North America farming as a service market will hold more than 45% share by 2035, driven by strong agricultural industry presence and high economic output in the region.

Segment Insights:

- The farm management solutions segment in the farming as a service market is projected to achieve a 77% share by 2035, attributed to the adoption of drones and high-tech tools enhancing farming decisions.

- The subscription segment in the farming as a service market is anticipated to achieve the highest CAGR through 2035, attributed to rising preference for convenient, cost-effective subscription-based farming services.

Key Growth Trends:

- Adoption of advanced technologies

- Rising focus on sustainability

Major Challenges:

- High initial setup costs

- Data privacy and security concerns

Key Players: Ninja Kart, Mahindra and Mahindra, Deere & Company, ITC LIMITED, Trimble Inc., EM3 Agriservices, Apollo Agriculture, Accenture plc, Taranis, Precision Hawk, IBM, BigHaat Agro Pvt Ltd, Føn Energy Services.

Global Farming as a Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.29 billion

- 2026 Market Size: USD 6.04 billion

- Projected Market Size: USD 22.94 billion by 2035

- Growth Forecasts: 15.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Farming as a Service Market Growth Drivers and Challenges:

Growth Drivers

-

Adoption of advanced technologies - Advanced technology such as IoT in agriculture provides farmers with useful tools to maximize every farming operation and also aids in reducing the difficulties caused by things like bad weather, managing farms, using pesticides, and crop quality. As a result, the role of farming as a service in modernizing agriculture is likely to increase.

For instance, the implementation of novel IoT technologies has led to the following outcomes: around 34% decrease in energy expenses, over 5% decrease in irrigation water consumption, and about 1% rise in yield. - Rising focus on sustainability - FaaS solutions are being adopted by an increasing number of farmers worldwide since they improve farming methods, give farmers more authority, and forge a sustainable future for the sector.

Globally, the number of people searching for sustainable products online has increased by over 70% in the last five years.

Challenges

- High initial setup costs - For small-scale farmers in particular, the switch to technology-driven farming can be expensive and they may not be able to afford the high setup and maintenance expenses associated with agri-tech equipment.

- Data privacy and security concerns - Concerns about data security and privacy are yet another major barrier to the FaaS business that could seriously affect farmers, therefore maintaining data confidentiality is crucial for farms and other precision agriculture-related enterprises.

Farming as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.8% |

|

Base Year Market Size (2025) |

USD 5.29 billion |

|

Forecast Year Market Size (2035) |

USD 22.94 billion |

|

Regional Scope |

|

Farming as a Service Market Segmentation:

Service Segment Analysis

Farm management solutions segment is expected to dominate farming as a service market share of over 77% by 2035. The segment growth can be attributed to the expanding landscape of drones. It is predicted that the global drone industry will expand by more than 2% between 2024 and 2028. Farm management software helps farmers make accurate agronomic and financial decisions to enhance production and profitability by using high-tech equipment including drones, and satellites which help in gathering exact information about farms and their situations.

Farming as a service (faaS) models are gaining traction, giving farmers access to drone technology that can raise national agricultural standards by helping farmers with various tasks and facilitating improved data management.

Delivery Model Segment Analysis

The subscription segment in farming as a service market is estimated to gather the highest CAGR from 2024 to 2035. The major factor for the expansion of the segment is the rise of the subscription economy. Convenience ranked as the primary motivation for subscription service usage globally in 2023, with over 45% of consumers either presently enrolled or expected to do so.

Farming as a service provides cutting-edge, expert-level solutions for agriculture and related services through a subscription model where farmers can rent out equipment for a certain amount of time, which proves to be more economical as compared to the pay-per-use model.

Our in-depth analysis of the farming as a service market includes the following segments:

|

Delivery Model |

|

|

End-User |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Farming as a Service Market Regional Analysis:

North American Market Insights

North America industry is predicted to dominate majority revenue share of 45% by 2035. The market growth in the region is due to the rapid economic expansion. Despite making up less than 4% of the global population, Americans produce and earn more than 15% of global GDP.

The region's economy benefits greatly from the agricultural industry, which may augment the adoption of farming as a service market.

The United States is home to significant international producers of agricultural machinery, who have maintained their dominant positions in the sector, leading to a higher adoption of farming as a service market.

In Canada, agriculture is a major industry and is a worldwide hub for companies looking to expand into the food, agri-tech, and agriculture industries.

APAC Market Insights

The Asia Pacific region will also encounter huge growth for the farming as a service market during the forecast period and will hold the second position owing to the increasing popularity of precision farming in the region.

The most common farming technique in the area is expected to be digital farming, which is an innovative technique driving improvements in the APAC food supply chain led by government programs in emerging nations that promote the adoption of contemporary precision farming technologies intending to maximize productivity.

Japan is a leader in the field of smart farming, with technology that uses AI and satellite imaging to make data-driven agriculture accessible to even smallholder farmers at reasonable prices.

China has emerged as one of the agriculturally technologically advanced nations, which may fuel the farming as a service market revenue.

A lot of agritech businesses that use the farming-as-a-service (FaaS) model are currently working to develop cutting-edge farming-related technology processes in India to assist farming in becoming a sustainable business and providing farmers a wide range of services at reasonable costs.

Farming as a Service Market Players:

- Ninja Kart

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mahindra and Mahindra

- Deere & Company

- ITC LIMITED

- Trimble Inc.

- EM3 Agriservices

- Apollo Agriculture

- Accenture plc

- Taranis

- Precision Hawk

- IBM

- BigHaat Agro Pvt Ltd

- Føn Energy Services

It is projected that the top five companies will dominate the farming as a service market by initiating strategic initiatives, and through consistent expansion, partnerships, agreements, and teamwork.

Recent Developments

- BigHaat Agro Pvt Ltd announced an investment of over USD 1 million to digitize the agricultural inputs ecosystem and also empower farmers by making hydroponics-based farming accessible to small and commercial institutions.

- IBM along with Yara International announced the creation of an open data-sharing platform to help people work together on farm and field data to increase the productivity, sustainability, and openness of the world's food production.

- Report ID: 6199

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Farming as a Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.