Farm Management Software Market Outlook:

Farm Management Software Market size was over USD 3.93 billion in 2025 and is projected to reach USD 16.6 billion by 2035, witnessing around 15.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of farm management software is evaluated at USD 4.48 billion.

The growth of the market can be attributed to growing yield losses. With absent crop protection, many important food crops could have yield losses of up to about 69%. Weeds are the main cause of yield losses, accounting for approximately 29% of losses, followed by animal pests and diseases, which cause losses of about 22% and 16%, respectively. Pests cost the global economy a total of about USD 289 billion annually by causing approximately 19-40% of yield losses worldwide. Hence, farm management software market aids farmers and growers in making agronomic choices that reduce yield losses under challenging circumstances and enhance yield amounts and quality under ideal circumstances.

Farm management software is ideally suited to assisting farmers and growers in managing their agronomic practices as a result of data management's capacity to gather, record, and synthesize large amounts of information from numerous sources (such as weather stations, soil monitors, images from satellites and drones, local, regional, and federal agricultural databases, and more). Moreover, growing demand for food is also estimated to boost need to adopt farm management software. The globe would need to feed an additional of about 2 billion people by 2030, with approximately 89% of them residing in developing nations; and the world would need to increase food output by about 59-70% by 2050 to feed more than nine billion people.

Key Farm Management Software Market Insights Summary:

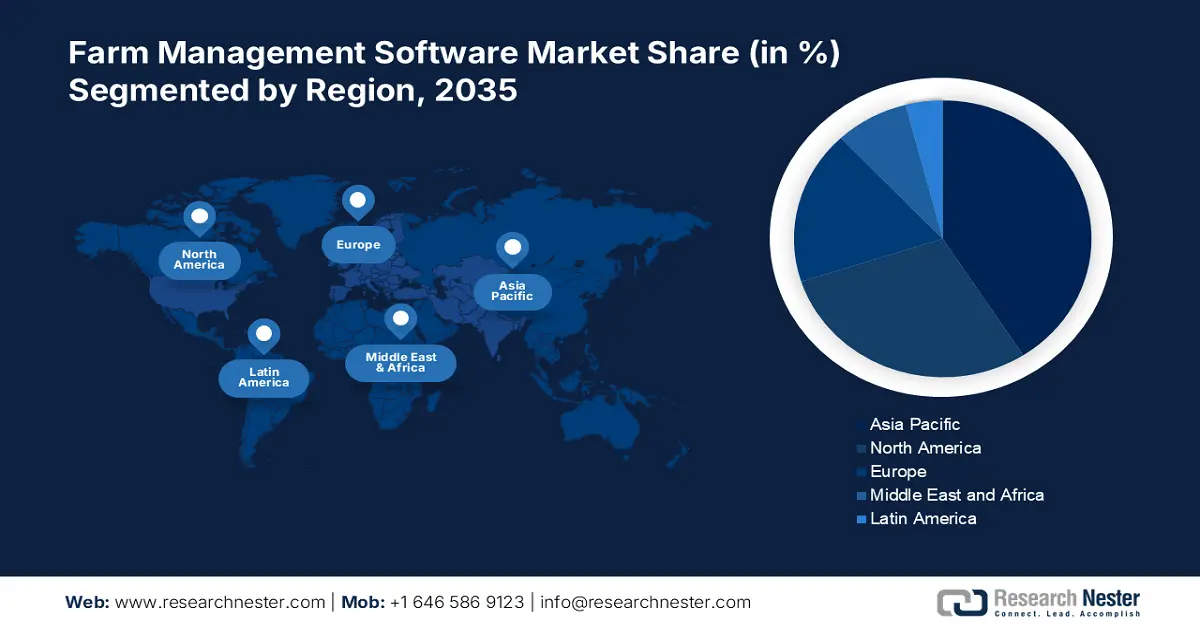

Regional Highlights:

- Asia Pacific farm management software market is expected to capture 38.50% share by 2035, growing population and demand for food, along with advances in farm management technologies.

- North America market will achieve the highest CAGR during 2026-2035, region's leading industrial automation industry and widespread use of artificial intelligence in farming.

Segment Insights:

- The cloud-based farm management segment in the farm management software market is forecasted to experience significant growth over 2026-2035, driven by cloud computing enabling better data access and direct market connections for farmers.

- The precision farming segment in the farm management software market is anticipated to exhibit the highest CAGR in 2026-2035, driven by growing adoption of precision farming supported by government encouragement and environmental benefits.

Key Growth Trends:

- Growing Population

- Rise in Adoption of Drones by Farmers

Major Challenges:

- Presence of Fragmented Farms

- Lack of Knowledge Among Farmers

Key Players: Trimble, Inc., Raven Industries, Inc., Topcon Positioning Systems, Inc., Corteva Agriscience, Agrivi, AgJunction, Farmers Edge, Inc., Agworld Pty Ltd, Deere & Company, IBM Corporation.

Global Farm Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.93 billion

- 2026 Market Size: USD 4.48 billion

- Projected Market Size: USD 16.6 billion by 2035

- Growth Forecasts: 15.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Brazil, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Farm Management Software Market Growth Drivers and Challenges:

Growth Drivers

- Growing Population - In mid-November 2022, there were 8.0 billion people on the planet, up from 2.5 billion in 1950, and 1 billion since 2010 and 2 billion since 1998. The population of the world is projected to rise by almost 2 billion people over the course of the next 30 years, from the present 8 billion to 9.7 billion in 2050, with a potential peak of roughly 10.4 billion in the middle of the 1980s. Hence, with the growing population the demand for food is also expected to increase. Therefore, in order to boost the production of agriculture also reducing the wastage of food the demand for farm management software is anticipated to increase.

- Rise in Adoption of Drones by Farmers - In Brazil, about 1,399 drones were registered legally for agricultural use as of August 2019. In the state of Sao Paulo, drone registrations made up more than one third. With each state having more than 149 drones, Minas Gerais and Paraná were among the states with the greatest number of registered agricultural drones. The Normalized Difference Vegetation Index (NDVI) is specialized imaging equipment that is mounted on the drones. The NDVI provides a thorough color breakdown of the plant's health. In order to address any issues swiftly enough to save the plant, this aids farmers in keeping tabs on crops as they develop. Hence, the adoption of drones is high.

- Surge in Government Initiatives to Adopt Modern Technologies - On August 22, 2022, it was announced that research and development projects would receive funding through the Farming Innovation Programme. These projects included artificial intelligence technology to optimise pig welfare, agri-robots to help speed up vegetable harvests, and automation to increase fruit crop yields. About USD 335 million Agricultural Innovation Project of the UK Government included about USD 19 million investment that was estimated to support innovation in horticulture and agriculture in 2022.

- Growth in Adoption of Agtech - Almost 60 percent of farmers in Europe and North America already use or intend to use one or more agtech products in the next two years, leading the world in agtech adoption.

- Upsurge in Agricultural Land Area- In 2020, there were about five billion hectares of agricultural land worldwide, or 38% of the earth's surface.

Challenges

- Require High Capital Investment - The majority of farmers believe that farm management systems are too expensive and that the price of the necessary hardware, software, and integration services is too high. The cost of GPS-enabled navigation and mapping devices is substantial, and the initial outlay for integrating guidance and sensing equipment with farm management software market is also significant. This limiting issue has a significant effect in developing economies such as China, Japan, and India where there are many marginal farmers and dispersed farmlands. Since these software solutions are complicated to use, farmers would pay extra for the integration of the software with the hardware equipment as well as for further advice. So, it is anticipated that the high cost of farm management equipment and software would impede the farm management software market expansion.

- Presence of Fragmented Farms

- Lack of Knowledge Among Farmers

Farm Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 3.93 billion |

|

Forecast Year Market Size (2035) |

USD 16.6 billion |

|

Regional Scope |

|

Farm Management Software Market Segmentation:

Application Segment Analysis

The global farm management software market is segmented and analyzed for demand and supply by application into precision farming, livestock monitoring, smart greenhouse, and aquaculture. Out of which, the precision farming segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing adoption of precision farming. Larger farms in the US are using precision agriculture more frequently and implementing strategies despite technological obstacles. In the US, about 14–40% of big farms in 2022 used guidance systems, variable-rate technology, or another type of precision technology. However, only a small percentage of America's small farms, which account for more than 85% of all American farms, have embraced precision agriculture. Hence, government are encouraging farmers to adopt precision farming which would further boost the farm management software market growth. The idea of precision agriculture makes it feasible to maximize crop growth and health, apply the appropriate amount of inputs where they are required, and increase yield and ROI. Moreover, this method lowers input usage and related costs. Reducing input utilization lowers pollution, agricultural waste, and carbon emissions. Hence, soil fertility is unaffected. Therefore, the preference for precision farming is growing.

Type Segment Analysis

The global farm management software market is also segmented and analyzed for demand and supply by type into local/web-based, and cloud-based. Amongst which, the cloud-based segment is anticipated to have the significant growth over the forecast period. Cloud has proved to be very effective in agriculture. It has made gathering data easier for experts in order to guide farmers on what to plant next. They also receive regional weather information and forecasts for the coming days. Based on the data they receive via cloud computing; farmers could make decisions about their crops. Hence, this saves crops from spoiling. Farmers in rural areas have been exploited for a long time as a result of middlemen that prevent them from selling their produce directly to the consumer. However modern technology, including cloud computing, has made it possible for farmers to sell directly to customers and retailers.

Our in-depth analysis of the global farm management software market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Farm Management Software Market Regional Analysis:

APAC Market Insights

The share of farm management software market in Asia Pacific, amongst the market in all the other regions, is projected to have the highest growth by the end of 2035, backed by growing population along with growing demand for food in this region. However, a population shift away from agriculture is a foreseeable aspect of contemporary economic development. The percentage of people living in rural areas in Asia region has decreased significantly from 80% in 1970 to 52% in 2020 and is expected to drop to 38% by 2050 owing to the lure of higher-paying manufacturing and service jobs in cities. Hence, agriculture is becoming more dependent on female laborers, who frequently have less access to resources and financing, as more males migrate to urban areas. Moreover, to boost labor productivity and provide smallholder farmers in Asia with access to agricultural machine services, new strategies have been developed. Farmers have been made more productive while using less water and chemical inputs since of improved technologies and methods in this region. Hence, this factor is estimated to boost the growth of the farm management software market software in this region.

North American Market Insights

The North America farm management software market is estimated to be the second largest, to have the highest growth. Owing to the region's leading industrial automation industry and widespread use of artificial intelligence products, the market has been expanding. In industrialized countries versus underdeveloped countries, contemporary technology is adopted more quickly owing to larger farms and farmer awareness. The market for farm management software market technology is thus growing in the North American continent.

Europe Market Insights

Additionally, the farm management software market in Europe region is also estimated to have the significant growth over the forecast period. The growth of the market in this region can be attributed to growing investment in digitalizing agriculture in this region. The funding was intended to advance the creation and application of digital technologies that may support sustainable agriculture, precision farming, and more effective food production. Moreover, the agriculture industry has been transformed by the Internet of Things (IoT) technology, which gives farmers access to real-time data on machine and environmental conditions. With the use of these data, farmers could make wiser judgements and enhance all facets of their business, such as crop farming and livestock management.

Farm Management Software Market Players:

- Trimble, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Raven Industries, Inc.

- Topcon Positioning Systems, Inc.

- Corteva Agriscience

- Agrivi

- AgJunction

- Farmers Edge, Inc.

- Agworld Pty Ltd

- Deere & Company

- IBM Corporation

Recent Developments

-

Sonata Software and AGRIVI collaborated to promote global agriculture ecosystem digitalization initiatives. Together, Sonata and AGRIVI were thought to be able to provide customers in the US, Europe, and the Middle East with the best digital agriculture solutions on the market owing to Sonata's power and influence as well as AGRIVI's knowledge of the farm management sector.

-

The Watson Decision Platform for Agriculture is being implemented with farmers by Heifer International, IBM Corporation, and CATIE, a global organisation focused on inclusive and sustainable human well-being in Latin America. The solution creates a thorough dashboard customised to a farmer's land by fusing predictive AI technology with geospatial, weather, environmental, and IoT field data.

- Report ID: 4827

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Farm Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.