Farm Equipment Rental Market Outlook:

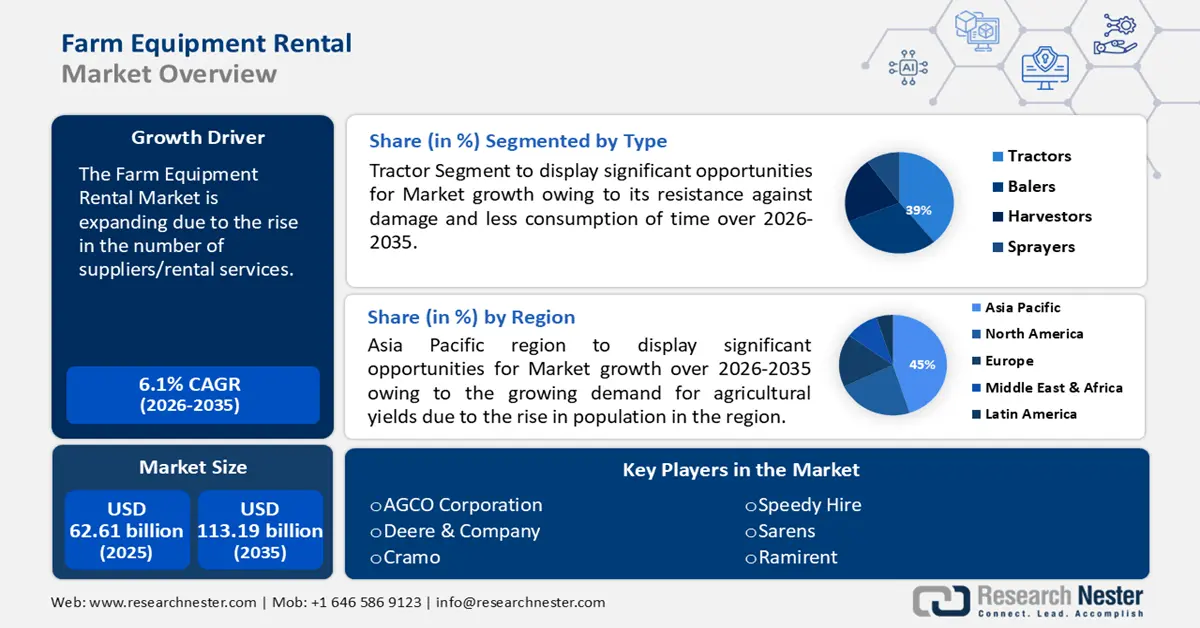

Farm Equipment Rental Market size was valued at USD 62.61 billion in 2025 and is set to exceed USD 113.19 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of farm equipment rental is estimated at USD 66.05 billion.

The growth driver for the market is the rise in the number of suppliers/ rental services, and initiatives by the government to support farmers.Mukhyamantri Harit Krishi Sanyantra Yojana initiated by the State of Bihar aims to help farmers in increasing agriculture yields, providing rental equipment and financial support. Moreover, any single farmer or group of farmers from Bihar can apply for this yojana, particularly those who have owned land. Further, a 50% subsidy will be provided for renting machinery.

Key Farm Equipment Rental Market Insights Summary:

Regional Highlights:

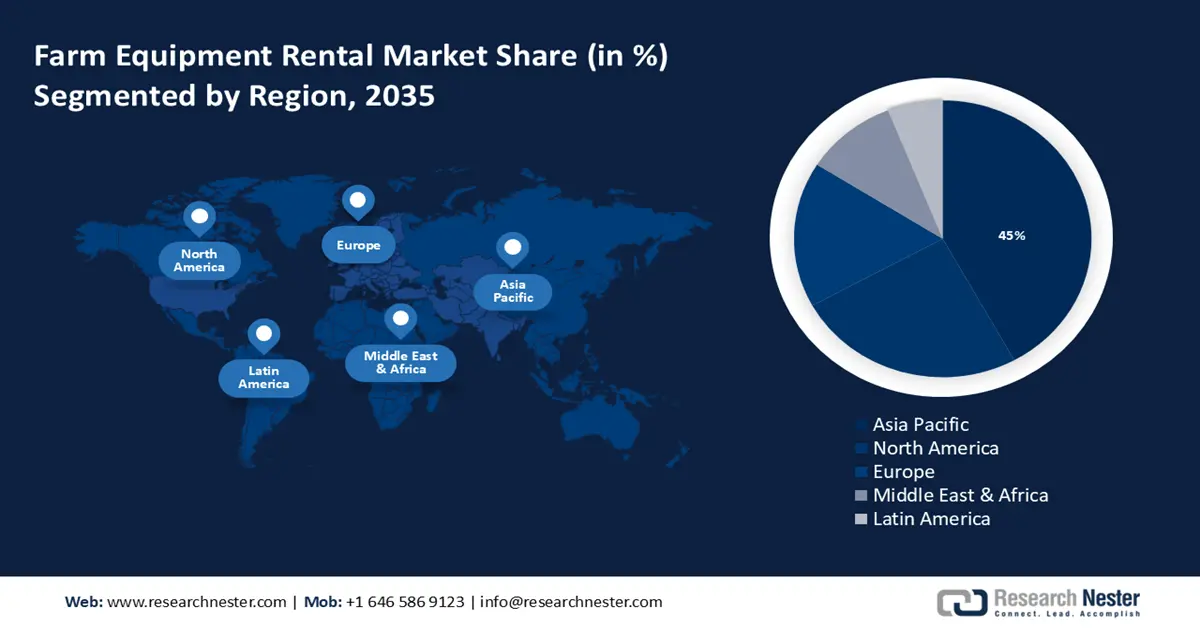

- Asia Pacific farm equipment rental market will dominate around 45% share by 2035, driven by rising demand for agricultural yields and equipment accessibility.

- North America market will experience substantial CAGR during 2026-2035, driven by technological advancements and rising equipment costs encouraging rentals.

Segment Insights:

- The 71–130 hp segment segment in the farm equipment rental market is anticipated to achieve robust growth till 2035, driven by high demand for power and large land cultivation efficiency.

- The tractors segment in the farm equipment rental market is expected to achieve notable growth till 2035, driven by tractors' time efficiency and affordability for small landholders.

Key Growth Trends:

- High market value of agriculture equipment

- Increasing demand for food

Major Challenges:

- Fluctuations in demand due to changing seasons

- High-value investments

Key Players: AGCO Corporation, Deere & Company, Cramo, Speedy Hire, Sarens, Titan Machinery, H & E Equipment Services, Friesen Sales & Rentals.

Global Farm Equipment Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62.61 billion

- 2026 Market Size: USD 66.05 billion

- Projected Market Size: USD 113.19 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Canada, China, Japan

- Emerging Countries: China, India, Japan, Thailand, Brazil

Last updated on : 17 September, 2025

Farm Equipment Rental Market Growth Drivers and Challenges:

Growth Drivers

- High market value of agriculture equipment - The requirement of equipment is basic for the agriculture sector. Therefore, the world's shift towards precise farming and mechanization eventually increased the demand for high-value equipment. This resulted in affecting agriculture production and no savings since the farmers had to invest their hard-earned money in buying expensive machinery.

- Increasing demand for food - With the rise in population, the demand for food is also increasing. To meet these demands, the adoption of new techniques and equipment must be acknowledged. With the assistance of rental equipment, farmers can easily increase productivity and maintain the global food demand. Further, the subsidies provided by the government such as Yantra Laxmi Scheme, help the farmer in accessing necessary elements required for the field.

- Increasing number of rental services - The farm equipment rental market is rapidly expanding in the world since the rental sector has various equipment to offer whether it is related to construction or farming. The construction equipment rental is also in high demand due to the increasing industry awareness. As in the 2022-23 budget of the Indian Government, nearly USD 26 billion is anticipated to be invested to develop highways for better transport and connectivity. The suppliers of the farm equipment rental market had to take risks since the seasonal variations hinder growth.

Challenges

- Fluctuations in demand due to changing seasons - Planting, harvesting and other such type of seasonal events are a barrier to the growth of the market. Rental equipment suppliers may find difficulty in generating a fixed income throughout the year resulting in huge losses.

- High-value investments - The farm equipment rental market requires high-value investments. Businesses that step into this field face difficulty in paying huge amounts for stocking machinery and other necessary equipment.

Farm Equipment Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 62.61 billion |

|

Forecast Year Market Size (2035) |

USD 113.19 billion |

|

Regional Scope |

|

Farm Equipment Rental Market Segmentation:

Type Segment Analysis

Tractors segment is poised to hold farm equipment rental market share of over 39% by the end of 2035. The segment growth is growing because tractors are resistant to damage and consume less time in cultivation. Further, 4-wheel drive tractors are highly demanded due to the large number of farmers.

Additionally, in a country like India where a majority of revenue is generated from farming, the role of tractors in their life is very crucial as not every small landholder can afford advanced machinery. Therefore, the farm equipment companies in India are supporting the needs of farmers by offering low-cost and high-quality tractors. On average, USD 0.3 million to USD 3 million one has to spend for a tractor which is the most common and widely used farm equipment in India. The price may differ as per the brands.

Drive Segment Analysis

4-wheel drive segment in the farm equipment rental market is likely to observe significant growth through 2035. Since the 4-wheel drive helps in large-scale commercial farming and can work in different field conditions. Moreover, 4-wheel drive equipment provides stability and grip such as Mahindra Tractor which performs efficiently for all your agricultural activities. Another important factor contributing to the growth of the market is the growing need for highly advanced machinery that can help in precise farming and adapt to various farming methods.

Power Output Segment Analysis

In farm equipment rental market, 71-130 HP segment is anticipated to hold revenue share of over 44% by the end of 2035. These consist of 4 WD and 2 WD tractor models. Such as the 6R 130 utility tractor by Deere & Company. The 71-130 HP segment is growing due to the high consumption rates, demand for power, large land and food production necessities at a higher rate.

Our in-depth analysis of the global market includes the following segments:

|

Equipment Type |

|

|

Drive |

|

|

Power Output |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Farm Equipment Rental Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is set to account for largest revenue share of 45% by 2035. In the region the demand for agricultural yields is increasing with the rise in population.

Additionally, there are many startups in India for instance EM3 Agri Services, that are providing cost-effective solutions such as rentals. As in India, land area is scattered ranging from small to large which becomes a hurdle for farmers to buy a full range of farming equipment just for a small piece of land. The agriculture machinery industry of Korea is set to level up with other competitors in developed countries.

With the introduction of advanced technology and smart farming, the farm equipment rental market in Korea is flourishing. As per a report, the market size of smart farming in South Korea reached USD 5.4 trillion won in 2020. In China, farmers find difficulty in purchasing high-cost agriculture machinery since they remain idle for a long time due to seasonal variations, therefore renting out a piece of farm equipment is the best choice as it increases the utilization rate and supports the economy.

North America Market Insights

North America region is projected to register substantial growth through 2035. The market in the North American region is growing due to technological developments in the agriculture field.

However, yearly increasing prices of agricultural equipment are supporting the market in the USA. As the farmers prefer renting equipment instead of buying them. As per an analysis, a particular tractor has also hiked nearly 50% from 2020 to 2023 in the US.

In Canada, the market is growing due to high interest rates and expensive equipment and drought. According to the National Agroclimatic Risk Report by the Government of Canada, an April- May analysis reports, more than 90% of the farmland available in Alberta is affected by the drought.

Farm Equipment Rental Market Players:

- AGCO Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Deere & Company

- Ashtead Group

- Cramo

- Ramirent

- H & E Equipment Services

- Speedy Hire

- Sarens

- Titan Machinery

- Friesen Sales & Rentals

The farm equipment rental market is dominated by key market players who are gaining traction in the market by the high-end prices of agriculture equipment.

Recent Developments

- AGCO Corporation a well-known name in the field of advanced machinery and agricultural equipment invested in Innova Ag Innovation Fund VI to push the agriculture sector towards sustainability with more advanced solutions.

- AGCO Agriculture Foundation which holds a vision of sustainable development partners with The Do More Agriculture Foundation to enhance the mental health of farmers with a funding of USD 0.5 million.

- Aktio invested in AI technology for asset value calculation named ‘i- rental AI’ developed by Sorabito and PKSHA Technology.

- Report ID: 6163

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Farm Equipment Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.