Fabless IC Market Outlook:

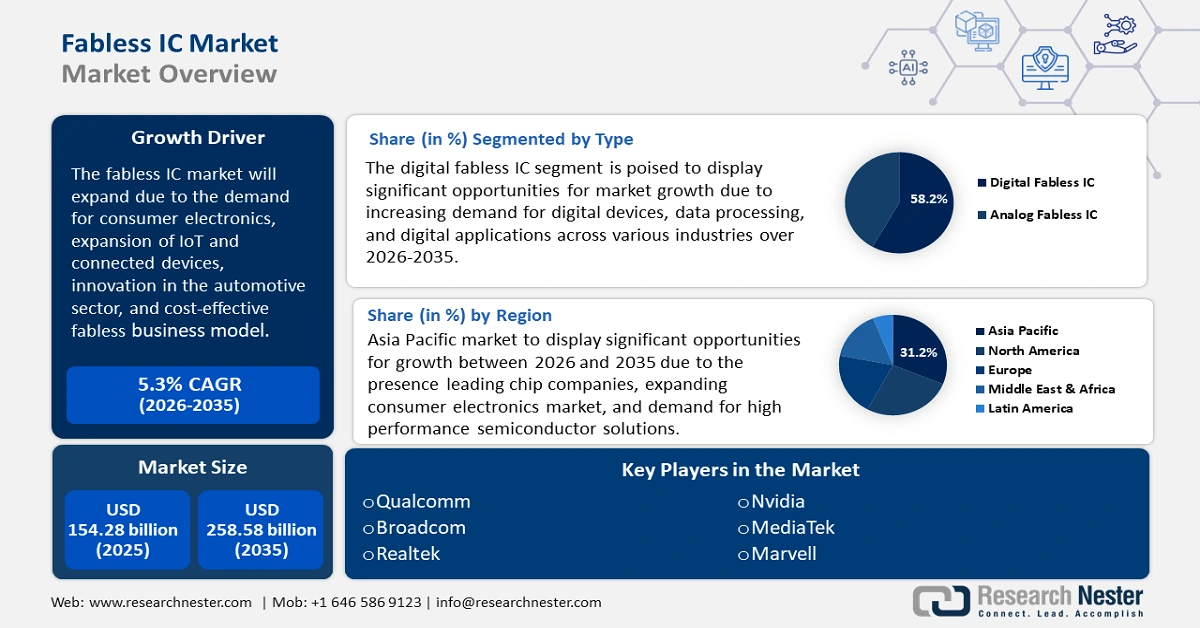

Fabless IC Market size was over USD 154.28 billion in 2025 and is poised to exceed USD 258.58 billion by 2035, growing at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fabless IC is estimated at USD 161.64 billion.

The major growth driver of the fabless IC market is the rising demand for consumer electronics such as smartphones, wearables, gaming consoles, and smart home devices. Technological progress in consumer electronics has increased the demand for high performance ICs in smartphones, tablets, and gaming sets. According to the report by Observatory of Economic Complexity 2022, ICs were the world's 3rd most traded product, with a total trade value of USD 961 billion. Between 2021 and 2022 the exports of integrated circuits grew by 7.31%, rising from USD 896 billion to USD 961 billion.

As the consumer electronics market is growing, it is evidently increasing the semiconductor market. In 2022, the U.S reported USD 49.8 billion in ICs exports, making it the 6th largest exporter in the world. In general, integrated circuits were outbound to Mexico (USD 9.94 billion), China (USD 9.61 billion), Chinese Taipei (USD 5.34 billion), Malaysia (USD 4.67 billion), and Hong Kong (USD 3.35 billion). Additionally, increasing global trade has also led to a rise in demand for integrated circuits.

Key Fabless IC Market Insights Summary:

Regional Highlights:

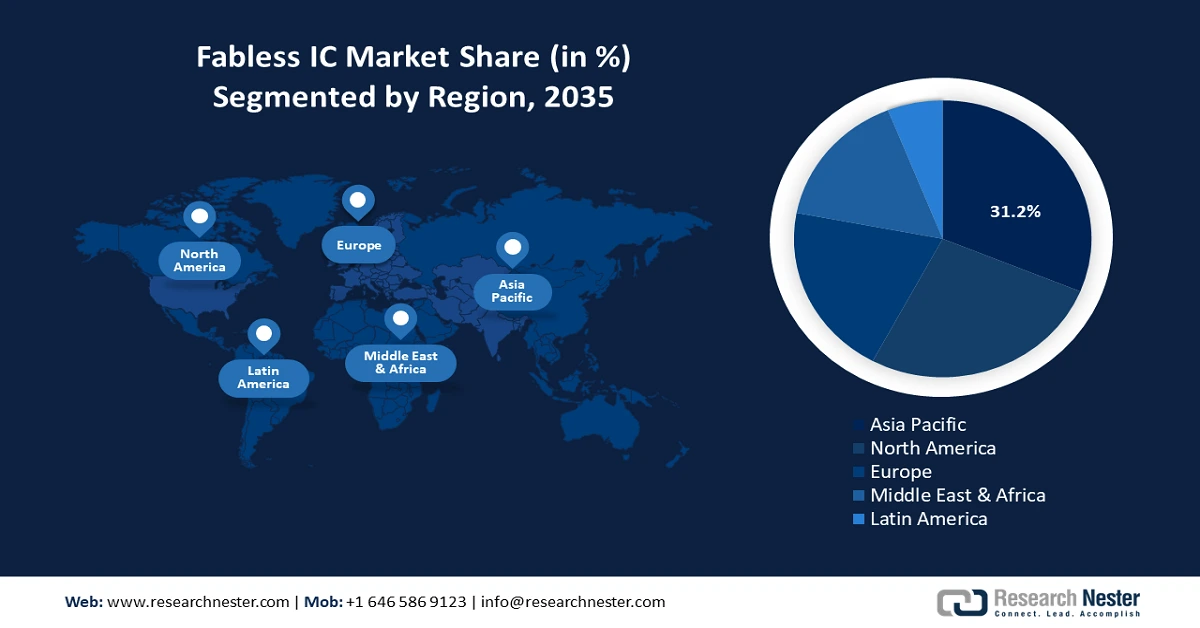

- Asia Pacific's 31.2% share in the Fabless IC Market is driven by the growing consumer electronics market and the demand for high-performance semiconductor solutions, positioning it for strong growth through 2026–2035.

- North America's Fabless IC Market is poised for the fastest growth by 2035, fueled by its robust technological infrastructure, thriving semiconductor industry, and large consumer base.

Segment Insights:

- The Digital Fabless IC segment of the Fabless IC Market is expected to grow significantly through 2035, driven by rising demand for digital devices and online applications across industries.

- The Automotive segment of the Fabless IC Market is expected to be the fastest-growing through 2035, propelled by the automotive industry's increasing reliance on advanced semiconductor technologies for electric vehicles, autonomous driving, and connected car features.

Key Growth Trends:

- Innovation in the automotive sector

- Flexibility and cost-effectiveness of the fabless business model

Major Challenges:

- Supply chain issues

- Key Players: Qualcomm, Nvidia, Broadcom, MediaTek, AMD, Marvell, Realtek, Xilinx, Altera.

Global Fabless IC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 154.28 billion

- 2026 Market Size: USD 161.64 billion

- Projected Market Size: USD 258.58 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31.2% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Taiwan, South Korea, Japan

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Fabless IC Market Growth Drivers and Challenges:

Growth Drivers

-

Innovation in the automotive sector: ICs are integrated into cars for enhancing audio amplifiers and various systems, including crash bags, air sensing, stability control, fuel injection, GPS, automated driving, and collision detection, among others. The automobile industry in India for instance is shifting its focus to electric vehicles to reduce carbon emissions. According to the IEA, India is on the way to becoming the largest EV market by 2030, with a total investment of more than USD 200 billion over the next 8-10 years. To further fuel this innovation, the government has launched the PM E-Drive scheme with a budget of USD 1.30 billion from October 2024 to March 2026 to accelerate the adoption of EVs, and establish charging stations and a manufacturing ecosystem in India. According to the IBEF report, the Indian government has pledged that by 2030, 30% of all new vehicle sales in the country will be electric vehicles.

-

Flexibility and cost-effectiveness of the fabless business model: Another growth of the fabless IC market is the dependence on third-party foundries. Fabless companies focus solely on IC design, reducing capital expenditures, compared to integrated device manufacturers (IDMs). Thus, collaboration with foundries allows for rapid prototyping and production scaling. Fabless companies focus on design and innovation while outsourcing manufacturing to specialized foundries. This approach reduces manufacturing costs and speeds up product development cycles. In September 2024, Apple Inc. officially expanded its manufacturing base to India. The whole iPhone 16 Pro and Pro Max lineup is being manufactured in India. Apart from India and China, Apple also outsources several components from South Korean tech giants such as Samsung and LG. The iPhone 16 uses OLED displays from Samsung and LG for its advanced screen technology. This strategic outsourcing by Apple maintains a steady supply of critical components without managing costs or handling risks created by geopolitical tensions.

Challenges

-

Supply chain issues: The fabless model is vulnerable to geopolitical tensions and disruptions in the global supply chain. Global events such as COVID-19 pandemic, trade restrictions, and natural disasters can hamper the overall semiconductor supply chain. The growth of AI and the internet of things and demands from the smartphone sector along with other hi-tech industries can burden the supply chain of semiconductors. This challenge can be further increased by the ongoing trade disputes which can in turn lead to a rise in the prices of semiconductor materials and interfere with the pricing within various industries.

Fabless IC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 154.28 billion |

|

Forecast Year Market Size (2035) |

USD 258.58 billion |

|

Regional Scope |

|

Fabless IC Market Segmentation:

By Type (Digital Fabless IC and Analog Fabless IC)

Digital fabless IC segment is expected to capture over 58.2% fabless IC market share by 2035. The digital segment has been experiencing steady growth due to the increasing demand for digital devices, data processing, and online applications across various industries. The transition to digital technologies and the rising need for high-performance processors and integrated circuits contributed to the segment demand.

The growing adoption of smartphones and tablets is expected to fuel the demand for digital fabless ICs going ahead. Mobile phones are the most popular electronic devices and 97.7% of consumers own mobile phones. In addition to smartphones, 59% of consumers own laptops, and desktop computers making it the second most used electronic device.

By Application (Automotive, Wireless Communications, Memory, Consumer Electronics, Industrial Electronics, Wired Communications, FPGA, Storage/Printer)

The automotive sector is the fastest-growing segment of the fabless IC market. This rapid expansion results from the automotive industry's increasing dependence on cutting-edge semiconductor technologies, integrating them into electric vehicles, autonomous driving systems, and connected features such as safety, touchscreen displays, and entertainment systems in cars.

The latest and most prominent development in the automobile space is the emergence of electric and autonomous vehicles. The automotive sector's transformation is marked by the combination of cutting-edge ICs for enhanced performance and safety, making it the fabless IC market's fastest-advancing category. The integration of IoT technology in automobiles has fueled the need for ICs that support safety features such as remote vehicle monitoring, predictive maintenance, real-time traffic updates, and gesture controls. Additionally, the integration of IoT technology improves vehicle performance and enhances the overall driving experience.

Our in-depth analysis of the global fabless IC market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fabless IC Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific fabless IC market is projected to capture revenue share of around 31.2% by the end of 2035. The growth can be attributed to the expanding consumer electronics market, the high mobile device purchases, and the demand for high-performance semiconductor solutions. The market is also driven by technological innovations, an expanding middle-class population, and the adoption of electronics in various applications. Asia Pacific is becoming a pivotal player in shaping global fabless IC market trends, encouraging innovative ideas, and driving advancements in the semiconductor sector.

China is the world's largest and fastest-growing integrated chip (IC) market globally. The country accounts for nearly 50% of the global market share in ICs. According to OEC, in November 2024 China's integrated circuits exports accounted for up to USD 13.8 billion and imports accounted for up to USD 33.9 billion. Between November 2023 and November 2024, the exports of China's integrated circuits have increased by USD 1.37 billion (11.1%) from USD 12.4 billion to USD 13.8 billion, while imports increased by USD 1.21 billion (3.69%) from USD 32.7 billion to USD 33.9 billion. As semiconductors represent one of the most important industries, it is the core technology powering modern digital solutions and empowering innovation and productivity growth across every industry.

The integrated circuit market in India is also seeing a huge rise as India imported USD 15.4 billion in integrated circuits, becoming the 13th largest importer of integrated circuits. The India fabless IC market has showcased proliferation of the 5G network, low internet cost, and increasing adoption of AI and machine learning (ML) technologies. For instance, according to a press release by PIB, internet connections in India jumped from 25.15 crore in March 2014 to 96.96 crore in June 2024, registering a growth of 285.53%. Additionally, broadband connections also rose by 1452% from 6.1 crores in March 2014 to 94.92 in August 2024. The integration of AI & ML technologies requires powerful and specialized integrated circuits thus increasing the demand for the fabless IC market. The demand for AI-enabled devices, such as smart speakers, autonomous vehicles, and robotics, is also driving the growth of the integrated circuits market in India.

The government in India is also making significant efforts to boost its position within the global supply chain. In December 2021, the government announced a USD 10 billion semiconductor incentive package to attract investments in chip manufacturing, assembly testing, packaging, and chip design. This investment is likely boost the development of fabless IC market in India.

North America Market Forecast

The fabless IC market in North America is expected to grow the fastest by 2035. This is ascribed to its robust technological infrastructure, a thriving semiconductor industry, a large consumer base, and innovative electronic devices. Over decades, North America has led the global fabless IC market, shaping industry trends, encouraging research and development, and driving technological advancements in the semiconductor sector.

The U.S. has a well-established system of fabless IC companies and semiconductor manufacturers, driving the region's significant market size. According to the SIA, the U.S. owns 46% of the revenue share for cumulative semiconductor sales. The U.S houses the top five semiconductor industry leaders such as Intel Corporation (USD 241.88 billion), NVIDIA Corporation (USD 152.88 billion), Texas Instruments Incorporated (USD 113.83 billion), and Broadcom Inc. (USD 108.13 billion). Moreover, supportive government initiatives encourage the further growth. For instance, in February 2024, the Biden-Harris Administration announced an investment of over USD 5 billion in semiconductor-related research, development, and workforce needs, including the National Semiconductor Technology Center (NSTC). Another major reason for rise in the U.S. is, its increasing number of internet users. According to the National Telecommunication and Information Administration (NTIA), 13 million more people are found to be using the internet in the U.S. in 2023 as compared to 2021.

The fabless IC market in Canada is experiencing steady growth, supported by various factors including adoption of modern technologies and demand for innovation and state of the art infrastructure. The global semiconductor industry is in the midst of technological, geopolitical and economic change, with firms and governments making multi-billion-dollar investments to generate and secure advantage. Canada’s semiconductor industry has about 500 firms. The vast majority (86%) are small firms employing between 1 and 99 people, while 13% are medium having 100 to 499 employees, and 1% are large having 500+ employees. Semiconductor forms in Canada are strong contributors to the global semiconductor value chains. According to a report by CSA Group, semiconductor firms are found throughout the country but are majorly located in Ontario (49%), Quebec (28%), British Columbia (11%) and Alberta (7%).

Key Fabless IC Market Players:

- Qualcomm

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nvidia

- Broadcom

- MediaTek

- AMD

- Marvell

- Realtek

- Xilinx

- Altera

- Avago

- LSI

- Himax

- Rambus

- Apple

- ATI Technologies

- MegaChips

- Novatek

- Ricktek

- Mstar

- Taiwan Semiconductor Manufacturing

Key players are driving growth in the fabless IC market through a combination of technological innovation, strategic partnerships, and expanding product offerings. These players are particularly focusing on integrating features like automated technologies, integration of IoT, AI, and ML, which improve safety and efficiency in all sectors. Fabless companies focus just on chip design and development and outsource their production. This business approach allows them to avoid the high costs of owning manufacturing facilities, allocating resources instead to invest heavily in research & development and act more quickly towards technological advances and adapt to the changing fabless IC market dynamics.

Recent Developments

- In October 2024, Infineon launched a new fingerprint sensor IC for identification and authentication in automotive applications. The sensors provide powerful fingerprint identification and authentication capabilities making them ideal for in-vehicle personalization and payment authentication, such as charging, and parking, as well as for authentication and identification applications outside the automotive sector.

- In August 2024, SMHX announced its plans to target fabless semiconductor companies that focus on design and R&D rather than manufacturing, and builds on VanEck’s suite of thematic equity ETFs.

- Report ID: 7117

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fabless IC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.