Extrusion Sheet Market Outlook:

Extrusion Sheet Market size was valued at USD 108.11 billion in 2025 and is expected to reach USD 186.43 billion by 2035, expanding at around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of extrusion sheet is evaluated at USD 113.56 billion.

The primary growth driver for the extrusion sheet market is the increasing demand for lightweight, durable, and cost-effective materials across various industries. Key sectors such as automotive, construction, packaging, and electronics are driving the demand due to the benefits of extrusion sheets, including their versatility, ease of processing, and recyclability.

Key Extrusion Sheet Market Insights Summary:

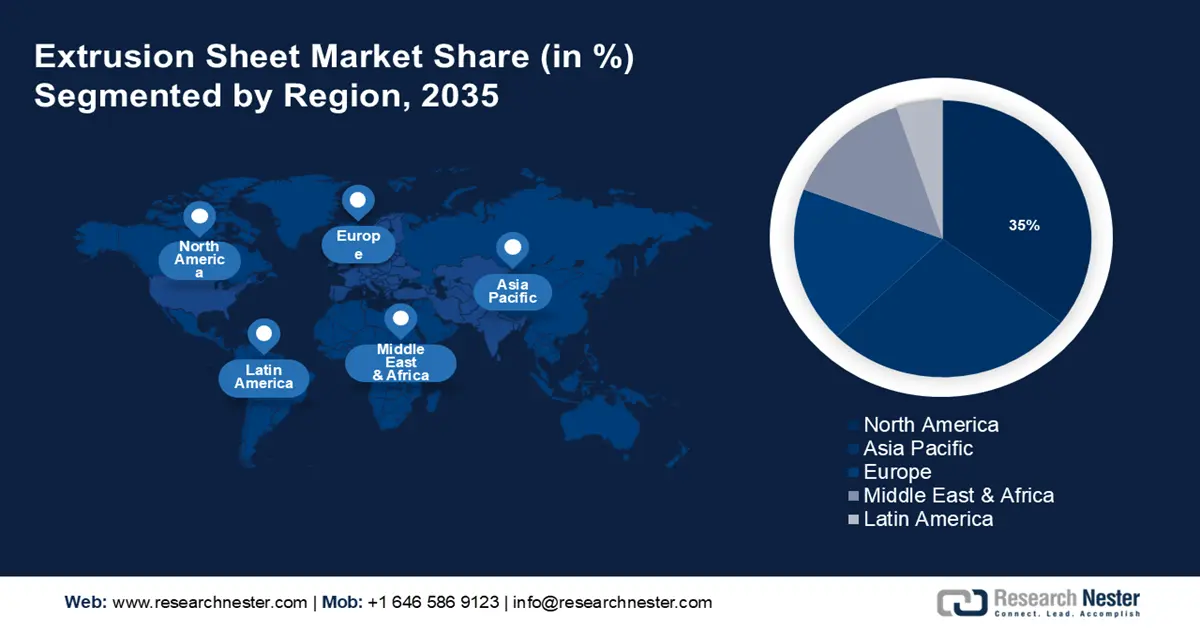

Regional Highlights:

- North America extrusion sheet market is anticipated to capture 35% share by 2035, driven by strong industrial sector and continued manufacturing activities.

- Asia Pacific market will register huge growth during the forecast timeline, driven by rapid industrialization and expanding manufacturing sector.

Segment Insights:

- The polypropylene (pp) segment segment in the extrusion sheet market is expected to secure a 38.10% share by 2035, driven by durability, affordability, and superior mechanical properties in applications.

- The packaging application segment in the extrusion sheet market is forecasted to secure a 34.20% share by 2035, influenced by demand for high-quality, reliable packaging in medical and other industries.

Key Growth Trends:

- Increasing popularity of lightweight and high-strength materials

- Augment of precision extrusion and innovative die designs

Major Challenges:

- Intense competition among market players

- Fluctuating raw material prices

Key Players: Owens Corning, Formosa Platsics Corporation, Karton S.p.A., Arla Plast AB, SML Maschinengesellschaft mbH, Corex Plastics Pty Ltd, Covestro AG, DS Smith plc, Evonik Industries AG, Ensinger GmbH.

Global Extrusion Sheet Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 108.11 billion

- 2026 Market Size: USD 113.56 billion

- Projected Market Size: USD 186.43 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Extrusion Sheet Market Growth Drivers and Challenges:

Growth Drivers

- Increasing popularity of lightweight and high-strength materials: Car makers have been under constant pressure to reduce vehicle weight to meet strict emission rules and increase fuel efficiency. In the automobile sector, this has increased the demand for strong and lightweight materials like aluminum, magnesium, and high-performance polymers. Because these materials offer qualities like energy absorption, flexibility in design, and resistance to corrosion, extruded sheets constructed of them have become attractive alternatives to traditional steel components.

Aluminum and magnesium extruded sheets are being used more often in airframe components in the aerospace sector to lighten airplanes. Even in the transportation and logistics industries, the focus on payload capabilities and fuel economy has increased the use of extruded thin sheets. - Augment of precision extrusion and innovative die designs: The manufacturing of miniature, microscale plastic components for application in electronics, optical, and medical devices is made possible by precision extrusion technology. The precision extrusion's flexibility is being improved with the use of creative die designs, such as spiral or adjustable dies, which enable fast modifications and shorter setup times.

Also, various companies are introducing new products to meet the extrusion sheet market demands. For instance, in December 2022, NematX announced the NEX 01, a high-precision extrusion platform that is compatible with proprietary filaments made from liquid crystal polymers. According to the business, the platform provides a complete manufacturing solution for end-use items that can withstand extreme environments. - Rapid shift towards eco-friendly materials: Manufacturers are creating product grades composed of recyclable plastic materials and bio-based plastics in response to the increased emphasis on renewable energy and biodegradable materials. According to the European Environment Agency, 2.2 million metric tons, or 0.5%, of plastics worldwide were bio-based in 2022. The percentage of bio-based plastics produced overall is only marginally rising annually (from 0.54% in 2013 to 0.56% in 2022).

These environmentally friendly extrusion sheets are ideal for solar wind turbines and solar uses. Numerous nations in North America and Europe have passed laws requiring the use of bioplastics and renewable energy sources, which is driving up demand. Furthermore, extrusion sheets are becoming more widely used in novel applications such as 3D printing where their accuracy and caliber are well-suited.

Challenges

- Intense competition among market players: The market is characterized by fierce competition from long-standing competitors and recent newcomers. There are substantial financial obstacles for newcomers to overcome when starting production facilities. However, many new competitors can maintain competitive rates, which puts a lot of pressure on prices. Prices are being hard negotiated by buyers, reducing manufacturers' profits. There is fierce competition among key players in the worldwide extrusion sheet market, with none holding a dominant position.

- Fluctuating raw material prices: Some vital components in the extrusion sheet industry are polycarbonate, petrochemical-based plastics, and PET resins. These raw materials are utilized to create premium, adaptable sheets that are used in various applications. However, the volatility in prices of these raw materials may hinder the growth of the extrusion sheet market.

Extrusion Sheet Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 108.11 billion |

|

Forecast Year Market Size (2035) |

USD 186.43 billion |

|

Regional Scope |

|

Extrusion Sheet Market Segmentation:

Material Type Segment Analysis

In extrusion sheet market, polypropylene (PP) segment is projected to hold revenue share of more than 38.1% by 2035, owing to its durability and affordability. Even after undergoing repeated bending and stretching, the sheets retain their mechanical properties and original form, making them well-suited for persistent use in construction, packaging, and various industrial applications due to their robustness. In addition, PP sheets are less expensive than other polymers including ABS, PVC, and polyethylene. They demand less money up front and for ongoing operations to produce.

Furthermore, recycling PP is less expensive than recycling other plastics. Because of its robustness and low cost of production, PP offers customers exceptional value for money. These characteristics help PP outperform other plastics and encourage its broad use in various sectors.

Application Segment Analysis

By the end of 2035, packaging segment is anticipated to dominate extrusion sheet market share of around 34.2%. The packaging segment is a major driver of the extrusion sheet market, leveraging the material’s properties for a variety of applications. For instance, in the medical industry, extrusion sheets are used for sterile packaging of medical devices and pharmaceuticals. The medical packaging sector was valued at USD 60 billion in 2022 and is projected to grow at a CAGR of 6.2% by 2030. The sector’s need for high-quality, reliable packaging solutions boosts the demand for extrusion sheets.

Our in-depth analysis of the extrusion sheet market includes the following segments:

|

Material Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Extrusion Sheet Market Regional Analysis:

North America Market Insights

North America in extrusion sheet market is projected to hold more than 35% revenue share by 2035. The market growth can be credited to the strong industrial sector and continued manufacturing activities across various end use industries such as construction, automotive, and consumer goods. Additionally, manufacturers have developed advanced extrusion sheet grades that cater to niche applications due to an increased focus on research and development operations. For instance, in May 2024, the premier supplier of customized and sustainable materials solutions and services, Avient Corporation, introduced its CesaTM Non-PFAS Process Aid for Extrusion at NPE 2024.

The U.S. is a leader in the creative application of multiwall and corrugated plastic sheets in buildings, focusing on sustainability and energy efficiency that complies with the strict environmental laws in the country. For instance, the 2021 International Green Construction Code (IgCC) offers the design and construction industry the most effective method for delivering sustainable, resilient, high-performance buildings.

In Canada, growing investments in infrastructure and the increased use of extrusion sheets in packaging and healthcare industries are two major factors propelling the market growth in the region. For instance, under the Investing in Canada Plan, the government has invested more than USD 151 billion into 96,000 infrastructure projects.

APAC Market Insights

Asia Pacific will encounter huge growth in the extrusion sheet market during the forecast period. The market is growing in the region owing to the rapid industrialization and expanding manufacturing sector. Also, plastic extrusion sheets are widely used in consumer electronics, automotive components, and packaging solutions, all of which have strong demand in the region.

The increased focus on food safety and consumer health in China is escalating the growth of the extrusion sheet market. Monitoring data from the China National Center for Food Safety Risk Assessment show that, between 2010 and 2022, foodborne illness outbreaks were documented in over 46,000 cases nationally, mostly in homes and catering services.

Therefore, the demand for extrusion sheets is increasing due to their robustness; products are shielded against harm during storage and transit from external forces like impact, pressure, moisture, and chemicals.

Rapid urbanization in India has consequently surged the demand for extrusion sheets in the construction industry for insulated roofing and façade applications. According to the World Bank Group, 600 million people, or 40% of the population, will live in towns and cities by 2035 (compared to 31% in 2011), and urban regions will account for about 70% of the country's GDP.

In South Korea, technological advancements and boosting construction activities are increasing demand for high-end machinery in the food and beverage industry. For instance, as of 2021, there were approximately 31,300 food processing businesses in Korea, with sales of USD 63.3 billion.

Extrusion Sheet Market Players:

- Owens Corning

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Formosa Plastics Corporation

- Karton S.p.A.

- Arla Plast AB

- SML Maschinengesellschaft mbH

- Corex Plastics Pty Ltd

- Covestro AG

- DS Smith plc

- Evonik Industries AG

- Ensinger Holding GmbH & Co. Kg

Extrusion sheet market Key players invest in the development of advanced extrusion technologies that improve the quality, efficiency, and versatility of sheet production. This includes innovations in equipment, materials, and processes. Moreover, key players provide customized solutions to meet specific requirements of different industries, such as automotive, packaging, construction, and electronics.

Some of the major key layers include:

Recent Developments

- In June 2024, SML Maschinengesellschaft mbH introduced an applicator unit for anti-block liquid. It comprises an aluminum gap roller and a rubberized application roller that is used to apply anti-block emulsion to a sheet. The liquid is dosed into the roller gap via a moveable tank container equipped with a pump that conveys and continuously mixes the emulsion.

- In August 2020, Owens Corning introduced a new product line called FOAMULAR® NGX (Next Generation Extruded). This new line of extruded polystyrene (XPS) foam products features a patented blowing agent that reduces global warming potential (GWP) by 90% while maintaining product performance.

- Report ID: 6446

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Extrusion Sheet Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.