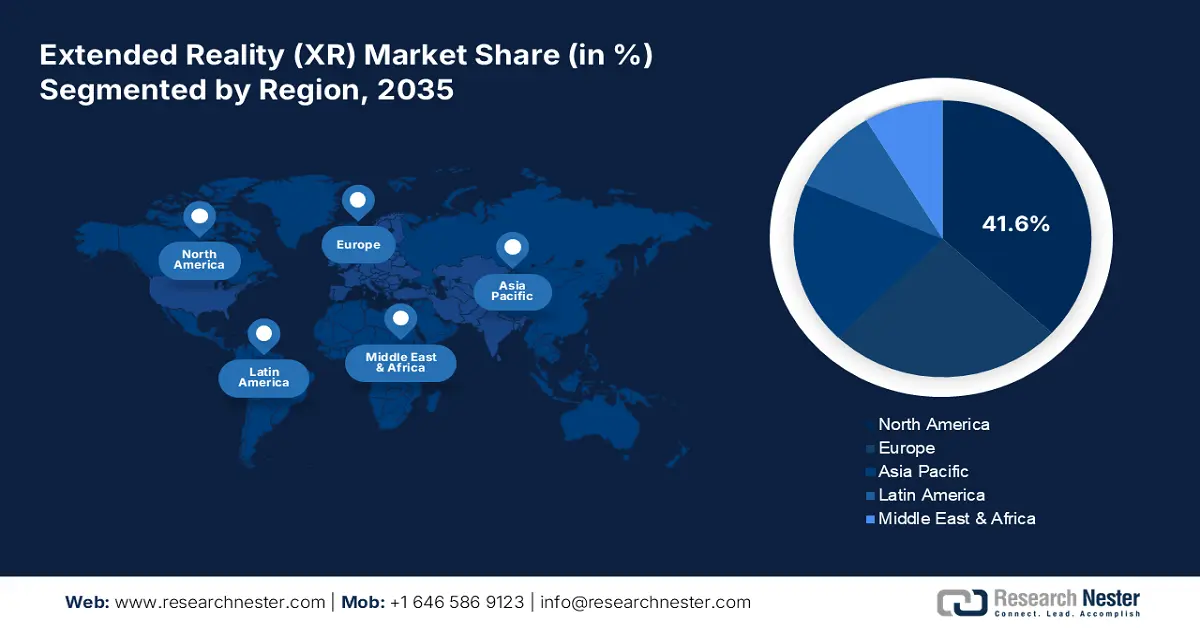

Extended Reality Market - Regional Analysis

North America Market Insights

North America extended reality market is expected to account for 41.6% of the global revenue share through 2035. The rapid government investment in ICT infrastructure is estimated to bolster the adoption of XR-based products and services. The easy availability of wireless connectivity networks and early adopters is also estimated to fuel the sales of extended reality technologies. For example, under the CHIPS Act, enacted in August 2022, the U.S. government announced the International Technology Security and Innovation (ITSI) fund of USD 500 million for the promotion of secure telecommunication networks and to ensure security and diversification of semiconductor manufacturing. With the rising availability of semiconductors, the production of XR-based products and services is expected to become increasingly convenient.

The large-scale defense contracts and immersive content creation activities are likely to amplify the sales of extended reality solutions in the U.S. The rise in edge computing infrastructure is also contributing to the increasing demand for extended reality solutions. Strategic government-private partnerships are also taking place to obtain the advantage of VR, accelerating the use of XR-based products and services. As reported by the National Training and Simulation Association in December 2022, HTX Labs took the responsibility of modernizing the critical training facility at Sheppard Air Force Base with the use of VR in November of the same fiscal year.

Canada extended reality (XR) market is projected to witness a robust CAGR throughout the forecast timeline, due to government support, making the adoption of the technology convenient. Start-up innovation is another factor expected to fuel market growth. As disclosed by the Centre for International Governance Innovation in March 2024, around 253 VR start-ups were in Canada as of June 2023. A wide range of technology companies based in Canada are redefining the convergence of XR breakthroughs. The adoption of XR-based products and services is at its peak in the healthcare and education sectors across Canada.

Europe Market Insights

Europe extended reality market is estimated to account for a remarkable revenue share during the stipulated timeframe, attributed to the robust government support and growing digital infrastructure investments. For instance, in March 2025, the European Commission announced a financial grant of USD 1.5 billion for the deployment of the critical technologies that are essential for the future of the region strategically. Access to such funding is expected to make the adoption of XR-based products and services easier for organizations. Rapid advancements of XR solutions by SMEs are expected to boost the market growth in the years ahead. The European Commission also reported in July 2025 that the proportion of SMEs working on XR is 90% in Europe. With the development of technologies such as AI, 5G or 6G, edge computing, and cloud computing, XR-based products and services are expected to be more powerful over time.

Germany holds a dominant Europe extended reality (XR) market share owing to a robust industrial base and consistent public-sector investments. The digital transformation agents operating in Germany are accelerating the production and advancement of extended reality technologies. One such example is Theorem Solution’s update of TheoremXR. The update is allowing users to leverage the power of mixed and virtual reality for conducting appropriate time and motion studies. The automotive, manufacturing, and healthcare sectors are expected to continue to emerge as the prime end users of extended reality solutions in Germany.

The extended reality (XR) market in the UK is anticipated to undergo robust growth from 2026 to 2035, on account of the public-private collaboration partnership in the adoption of advanced extended reality solutions. For example, in March 2025, Varjo revealed that it received approval from the UK Ministry of Defense and NATO accreditation for XR-4 series headsets, developed by UK-based company Inzpire. The XR solutions were integrated into a Joint Terminal Attack Controller (JTAC) training solution. The rapid expansion of the 5G infrastructure across the country is also expected to improve the user experience of XR solutions.

APAC Market Insights

Asia Pacific extended reality (XR) market is foreseen to acquire a remarkable revenue share during the forecast timeline, due to large-scale government investments, swift digitalization, and widespread enterprise adoption. Substantial ICT allocations toward XR hardware, a rise in digital learning, and automation trends are propelling the sales of extended reality solutions during the forecast period. The favorable government policies and investments are further expected to accelerate the manufacturing and commercialization of extended reality solutions. In March 2025, the International Federation of Robotics reported that the National Development and Reform Commission of China announced an investment of USD 138 billion for the advancement of AI, robotics, and cutting-edge innovation. Similarly, South Korea introduced a Digital New Deal worth USD 44.6 billion to leverage new technologies that include XR solutions.

The government-led industrial automation, smart city programs, and educational digitization moves are expected to boost the sales of extended reality technologies in China. In July 2025, the Cheung Kong Graduate School of Business (CKGSB) revealed that augmented reality is playing a crucial role in smart city management and public services across China. The healthcare sector is also driving the adoption of XR solutions. As reported in April 2023, China has plenty of use cases of XR solutions and remote medical devices, surrounding trials and deployments, including autonomous medical delivery and remote medical consultation. The strong presence of high-tech end users is poised to double the revenues of key players in the years ahead.

India is set to emerge as an expanding extended reality (XR) market at a high CAGR between 2026 and 2035, backed by the regulatory push for digitalization. This is likely to accelerate the adoption of the XR solutions across the country. In June 2025, the Press Information Bureau revealed that the contribution from the digital economy of the country is expected to surge to 13.42% by the end of 2025 from 11.7% in 2022-2023, positioning India third in the global digitalization index. Rapid 5G rollout in India is also anticipated to increase the market attractiveness of XR solutions. The affordability of the relevant hardware can fuel the production of the XR-based products in India.