Expanded Polystyrene for Packaging Market Outlook:

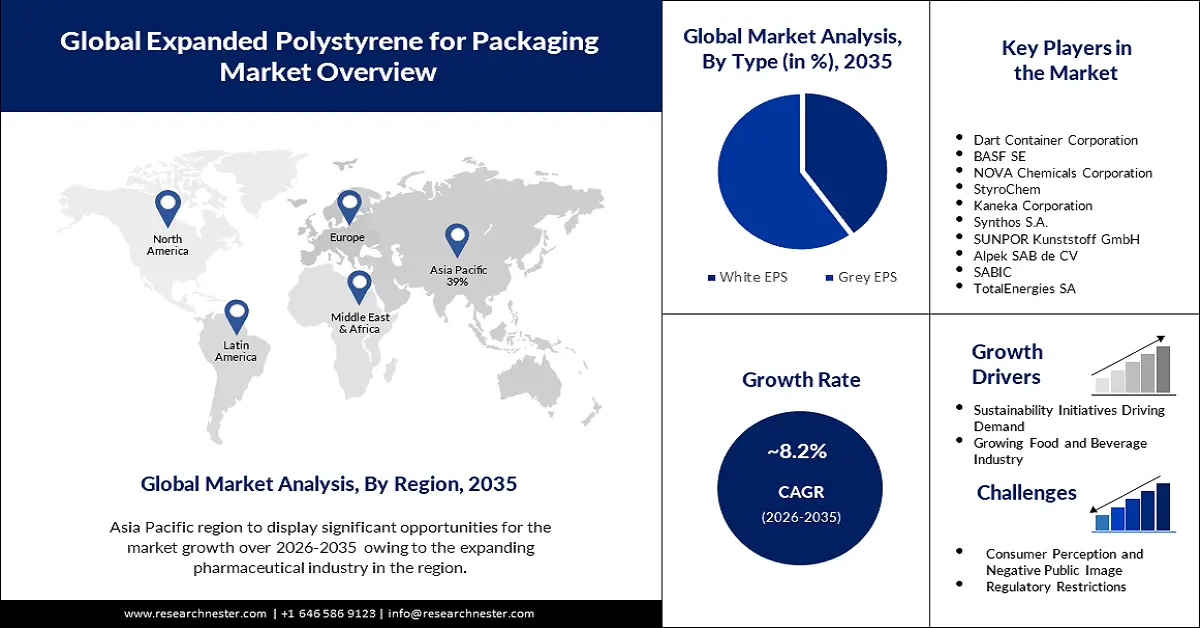

Expanded Polystyrene for Packaging Market size was over USD 10.66 billion in 2025 and is projected to reach USD 23.44 billion by 2035, witnessing around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of expanded polystyrene for packaging is evaluated at USD 11.45 billion.

The primary growth driver propelling the Expanded Polystyrene (EPS) for Packaging Market is the escalating demand for sustainable packaging solutions. As environmental consciousness becomes ingrained in consumer behavior and regulatory frameworks, businesses are under mounting pressure to adopt eco-friendly practices throughout their operations, including packaging. EPS, with its lightweight nature and recyclability, emerges as a compelling choice to meet these sustainability imperatives. EPS is renowned for its capacity to minimize environmental impact, particularly when compared to non-recyclable alternatives. The material's recyclability not only aligns with corporate sustainability goals but also caters to the burgeoning consumer preference for environmentally friendly products. As companies strive to enhance their green credentials and reduce their carbon footprint, the adoption of EPS for packaging gains momentum.

Expanded Polystyrene (EPS) is a lightweight, rigid, and versatile foam plastic material commonly used in packaging applications. It is known for its excellent insulation properties, impact resistance, and cost-effectiveness. EPS is often used in the packaging industry for various purposes, including protective packaging, cushioning, and insulation.

Key Expanded Polystyrene for Packaging Market Insights Summary:

Regional Highlights:

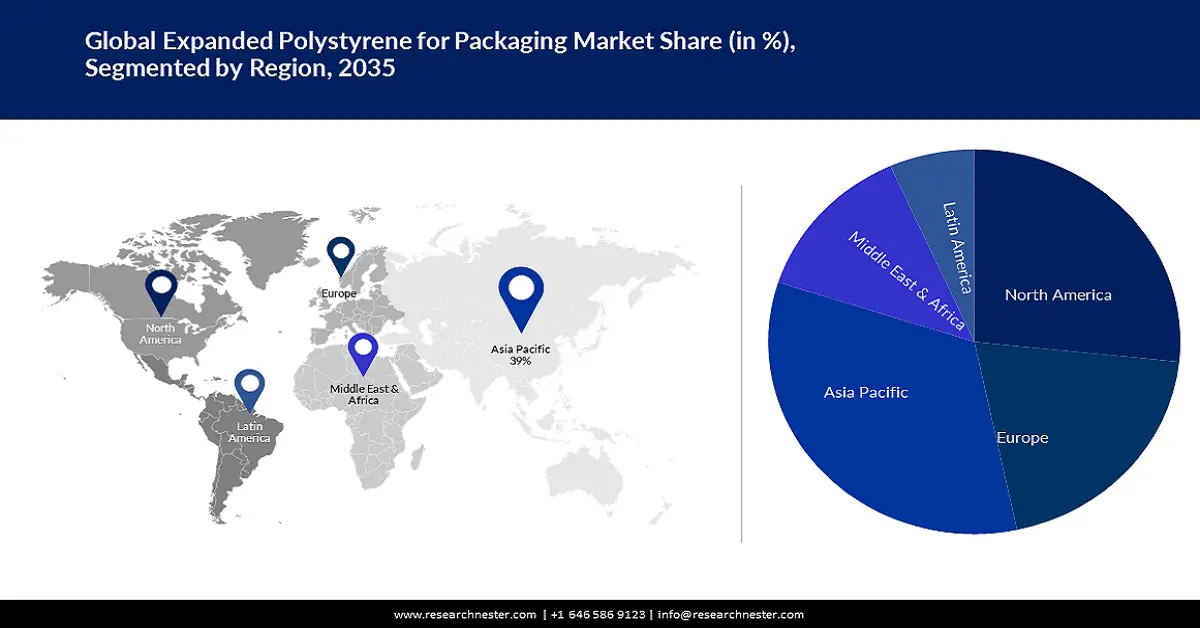

- Asia Pacific expanded polystyrene for packaging market will secure over 39% share by 2035, fueled by booming e-commerce and demand for protective packaging.

- North America market gains the second largest share by 2035, driven by growing emphasis on sustainability and e-commerce.

Segment Insights:

- The grey eps (type) segment in the expanded polystyrene for packaging market is projected to secure a 60% share by 2035, driven by the construction industry's focus on sustainability and energy conservation.

Key Growth Trends:

- Sustainability Initiatives Driving Demand

- Technological Advancements in EPS Manufacturing

Major Challenges:

- Sustainability Initiatives Driving Demand

- Technological Advancements in EPS Manufacturing

Key Players: Dart Container Corporation, BASF SE, NOVA Chemicals Corporation, StyroChem, Kaneka Corporation, Synthos S.A.

Global Expanded Polystyrene for Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.66 billion

- 2026 Market Size: USD 11.45 billion

- Projected Market Size: USD 23.44 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Indonesia, Thailand, Malaysia

Last updated on : 16 September, 2025

Expanded Polystyrene for Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Sustainability Initiatives Driving Demand: Sustainable packaging is a critical concern across industries, with an increasing number of businesses adopting eco-friendly alternatives. Expanded Polystyrene (EPS) has gained prominence as a packaging material due to its recyclability and low environmental impact. According to a study, there has been a 46% increase in companies actively pursuing sustainable packaging initiatives. This growth driver is fueled by the growing consumer preference for environmentally friendly products, pressuring businesses to incorporate sustainable materials into their packaging strategies.

-

Technological Advancements in EPS Manufacturing: Continuous innovations in EPS manufacturing processes have enhanced the material's properties, making it more versatile and customizable. Advanced molding technologies have allowed for the production of intricate and tailor-made packaging solutions. The implementation of advanced EPS manufacturing processes has resulted in a 30% improvement in material efficiency, reducing waste and enhancing cost-effectiveness for businesses. This growth driver emphasizes the role of technology in propelling the EPS market forward.

- Expansion of Food and Beverage Industry: The food and beverage industry represent a substantial market for EPS in packaging. The material's insulating properties make it ideal for preserving the freshness and quality of perishable goods. The global food and beverage packaging industry is predicted to grow by 5.6% from 2019 to 2025, creating a significant demand for reliable and efficient packaging materials. EPS is expected to witness increased adoption in this sector due to its ability to meet the stringent requirements of food safety and preservation.

Challenges

-

Environmental Concerns and Recycling Challenges: One of the primary challenges facing the expanded polystyrene for packaging market is the environmental impact of EPS waste. Despite being recyclable, the recycling rate for EPS remains relatively low. The challenge lies in creating efficient and widespread recycling infrastructure to address the environmental concerns associated with EPS and improve its overall sustainability. EPS has faced criticism for its association with single-use and disposable packaging, contributing to negative public perception. Misconceptions about EPS being non-biodegradable have led to calls for bans in certain regions. Overcoming these challenges requires industry efforts to educate consumers about the recyclability of EPS and its potential for reuse, dispelling myths and fostering a more positive public image.

-

Consumer Perception and Negative Public Image

- Regulatory Restrictions and Potential Bans

Expanded Polystyrene for Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 10.66 billion |

|

Forecast Year Market Size (2035) |

USD 23.44 billion |

|

Regional Scope |

|

Expanded Polystyrene for Packaging Market Segmentation:

Type Segment Analysis

The grey EPS segment in the expanded polystyrene for packaging market is estimated to gain the largest revenue share of 60% in the year 2035. The construction industry's rising focus on sustainability has become a significant driver for the increased demand for grey expanded polystyrene (EPS). As per the U.S. Green Building Council, the construction sector is responsible for 39% of global carbon emissions. Grey EPS, with its enhanced insulation properties, contributes to energy-efficient buildings and aligns with the industry's sustainability goals. According to a study by the National Institute of Standards and Technology (NIST), buildings with proper insulation can achieve energy savings ranging from 10% to 50%. This statistic highlights the potential impact of using Grey EPS in construction for improved energy efficiency. The growth of the Grey EPS segment is driven by the construction industry's focus on sustainability, the global emphasis on energy conservation, its adoption in cold chain logistics, compliance with stringent building codes, and the ongoing rise in infrastructure development.

End User Segment Analysis

Expanded polystyrene for packaging market from the pharmaceutical segment is expected to garner a significant share in the year 2035. The consistent rise in global spending on pharmaceuticals is a significant driver for the growth of Expanded Polystyrene (EPS) in the pharmaceutical segment. With an aging population and the prevalence of chronic diseases, pharmaceutical companies are investing in packaging materials that ensure the integrity and safety of medications during transportation. This upward trend in pharmaceutical expenditure underscores the demand for reliable and efficient packaging solutions, positioning EPS as a key player in this sector. The pharmaceutical segment's growth in the expanded polystyrene market is further propelled by increasing global pharmaceutical spending, regulatory emphasis on drug safety, the expansion of biopharmaceuticals, the rise of cold chain logistics, and the industry's focus on sustainable packaging. These factors collectively position EPS as a reliable and versatile material that addresses the evolving needs and challenges within the pharmaceutical sector.

Our in-depth analysis of the global expanded polystyrene for packaging market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Expanded Polystyrene for Packaging Market Regional Analysis:

APAC Market Insights

The expanded polystyrene for packaging market in the Asia Pacific region is projected to hold the largest market share of 39% by the end of 2035. The exponential growth of e-commerce in the Asia Pacific region is a key driver for the market. The region has witnessed a substantial increase in online shopping activities, driven by factors such as increased internet penetration, smartphone usage, and changing consumer preferences. According to a report, the Asia Pacific region accounted for the highest share of global e-commerce sales in 2020, with China alone contributing to over half of the total e-commerce retail sales. This surge in online retailing necessitates efficient and protective packaging solutions, with EPS being a preferred choice for its lightweight and cushioning properties. Asia Pacific region market is further driven by the booming e-commerce sector, rapid urbanization, increased awareness of sustainable packaging, growth in the food and beverage industry, technological advancements, and supportive government initiatives. These factors collectively contribute to the widespread adoption of EPS as a versatile and reliable packaging material in the dynamic and rapidly growing markets of the Asia Pacific.

North American Market Insigts

The expanded polystyrene for packaging market in the North America region is projected to hold the second largest share during the forecast period. The increasing emphasis on sustainability and the circular economy in North America has been a significant driver for the market. With a growing awareness of environmental concerns, there is a concerted effort to adopt packaging materials that are recyclable and have a lower environmental impact. The continual growth of e-commerce in North America has driven the demand for efficient and protective packaging solutions. EPS, with its lightweight nature and excellent cushioning properties, is well-suited for safeguarding products during transit, contributing to its increased adoption in the packaging of goods for online retail. The U.S. Census Bureau reported that e-commerce sales in the United States increased by 44% in the first quarter of the year 2020 compared to the same period in the previous year. This surge in online sales amplifies the need for reliable packaging materials, positioning EPS as a preferred choice.

Expanded Polystyrene for Packaging Market Players:

- Dart Container Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- NOVA Chemicals Corporation

- StyroChem

- Kaneka Corporation

- Synthos S.A.

- SUNPOR Kunststoff GmbH

- Alpek SAB de CV

- SABIC

- TotalEnergies SA

Recent Developments

- BASF acquired ASL, a leading French manufacturer of specialty lubricants for the automotive and industrial sectors. This acquisition strengthens BASF's position in the high-performance lubricants market and expands its geographical reach.

- BASF successfully closed the acquisition of a range of businesses and assets from Bayer, including crop protection, biotech and digital farming activities, seeds, non-selective herbicides, and nematicide seed treatments. This significantly expanded BASF's agricultural solutions portfolio and created new opportunities for growth.

- Report ID: 5578

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Expanded Polystyrene for Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.