Exocrine Pancreatic Insufficiency Treatment Market Outlook:

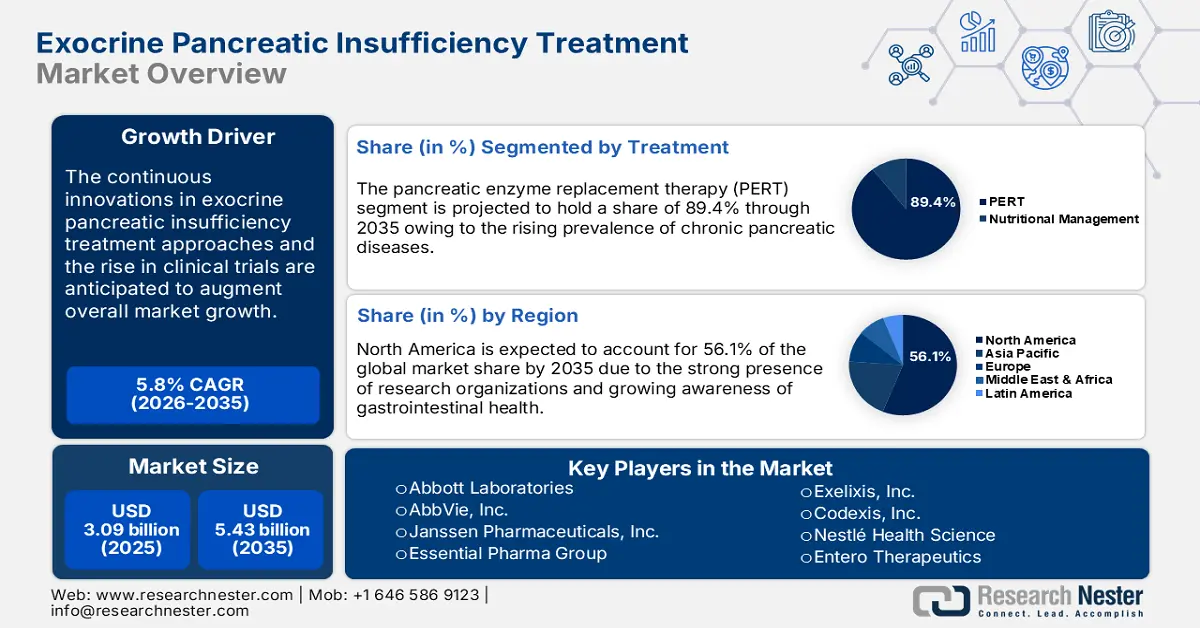

Exocrine Pancreatic Insufficiency Treatment Market size was over USD 3.09 billion in 2025 and is poised to exceed USD 5.43 billion by 2035, growing at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of exocrine pancreatic insufficiency treatment is estimated at USD 3.25 billion.

The increasing incidence of conditions such as cystic fibrosis, chronic pancreatitis, and pancreatic cancer, which are leading causes of exocrine pancreatic insufficiency (EPI) are anticipated to augment the demand for EPI therapeutic approaches in the coming years. The Cystic Fibrosis Foundation study across 94 countries reveals that there are over 105,000 individuals living with cystic fibrosis. Furthermore, the National Center for Biotechnology Information (NCBI) reveals that chronic pancreatitis leads to 30% to 90% of EPI prevalence rates. The long disease duration and alcoholic etiology are prime factors associated with exocrine pancreatic insufficiency occurrence. The older population who are more susceptible to conditions such as chronic pancreatitis and pancreatic cancer are also the prime contributors to EPI drug sales.

The expansion of immunology and gut health product offerings is aiding the market players in uplifting their revenue shares. For instance, in October 2024, AbbVie, Inc. revealed its third quarter 2024 financial results. As per the report, the company totaled global net revenues of 14.46 billion with a rise of 3.8% on a reported basis and 4.9% on an operational basis. The worldwide immunology portfolio's net revenues were evaluated at USD 7.04 billion an increase of 4.8% on an operation basis and 3.9% on a reported basis. Furthermore, the R&D expense on the generally accepted accounting principle (GAAP) basis was 14.7% of net revenues.

Key Exocrine Pancreatic Insufficiency Treatment Market Insights Summary:

Regional Highlights:

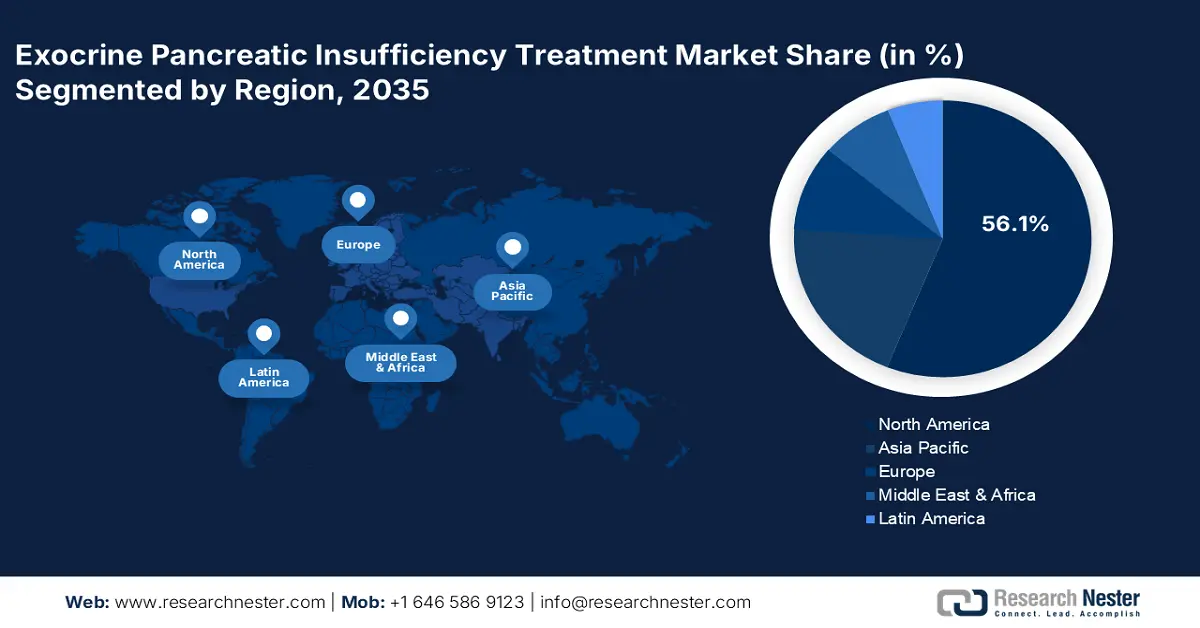

- North America dominates the Exocrine Pancreatic Insufficiency Treatment Market with a 56.10% share, propelled by the presence of advanced healthcare infrastructure, research organizations, and rising disease prevalence, ensuring strong growth through 2035.

Segment Insights:

- The Diarrhea segment is projected to hold more than 28% market share by 2035, driven by the effectiveness of PERT in mitigating diarrheal symptoms.

- The PERT segment of the Exocrine Pancreatic Insufficiency Treatment Market is projected to dominate with over 89.4% share by 2035, fueled by the rising prevalence of chronic pancreatic diseases and improved formulations.

Key Growth Trends:

- Innovation strategies

- Rise in clinical trials

Major Challenges:

- Regulatory challenges

- Lack of awareness

- Key Players: Abbott Laboratories, AbbVie, Inc., Janssen Pharmaceuticals, Inc., Exelixis, Inc., and Codexis, Inc.

Global Exocrine Pancreatic Insufficiency Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.09 billion

- 2026 Market Size: USD 3.25 billion

- Projected Market Size: USD 5.43 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (56.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Exocrine Pancreatic Insufficiency Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Innovation strategies: Innovations in exocrine pancreatic insufficiency therapies are a significant factor estimated to augment the revenue shares of the key players in the coming years. New formulations such as delayed-release capsules and a shift towards the development of more advanced and effective enzyme therapies to improve patient outcomes are the current trends observed in the exocrine pancreatic insufficiency treatment market. Innovations are focused on both increasing the stability of the enzymes to enhance their effectiveness and mitigate the side effects associated with conventional therapies. For instance, according to the National Institute for Health Research (NIHR), liprotamase has emerged as a new drug for exocrine pancreatic insufficiency (EPI) treatment. Thus, innovation strategies are set to double the profit gains of the key market players in the coming years.

- Rise in clinical trials: The increase in the clinical trials for new exocrine pancreatic insufficiency treatment is set to propel the overall exocrine pancreatic insufficiency treatment market growth in the coming years. The increasing funding for pancreatic medication clinical trials & research and the growing awareness of gut & gastrointestinal health are currently driving the overall market growth. For instance, in January 2023, Entero Therapeutics formerly known as First Wave BioPharma announced the start of a phase 2 trial investigation of enhanced adrulipase formulation. The company estimates this enhanced enteric microgranule delivery formulation is anticipated to be effective for exocrine pancreatic insufficiency (EPI) treatment in patients with cystic fibrosis (CF). Thus, the rising number of clinical trials is foreseen to positively influence the development of exocrine pancreatic insufficiency drugs.

Challenges

- Regulatory challenges: The strict and long regulatory approval processes for new drugs or treatment launches are a prevalent factor affecting the exocrine pancreatic insufficiency treatment market growth. Delays in approvals slow the pace of innovation and become expensive. This factor majorly hampers small-scale players and start-ups entering the market as they are working on limited budgets.

- Lack of awareness: The limited understanding of exocrine pancreatic insufficiency condition hampers the sales of drugs to some extent. Most often these conditions are undiagnosed or misdiagnosed with other conditions such as irritable bowel condition or celiac disease. Thus, lack of awareness or improper treatment approaches can lower the consumption of exocrine pancreatic insufficiency solutions.

Exocrine Pancreatic Insufficiency Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 3.09 billion |

|

Forecast Year Market Size (2035) |

USD 5.43 billion |

|

Regional Scope |

|

Exocrine Pancreatic Insufficiency Treatment Market Segmentation:

Treatment (Nutritional Management, Pancreatic Enzyme Replacement Therapy (PERT))

By 2035, pancreatic enzyme replacement therapy (PERT) segment is estimated to hold more than 89.4% exocrine pancreatic insufficiency treatment market share. The rising prevalence of chronic pancreatic diseases such as cystic fibrosis and pancreatic cancer are prime factors driving the adoption of pancreatic enzyme replacement therapies (PERT). For instance, in August 2024, Exelixis, Inc. announced that it received approval from the U.S. Food and Drug Administration for its supplemental New Drug Application (sNDA) for cabozantinib (CABOMETYX). This drug is effective for the treatment of well- or moderately differentiated pancreatic neuroendocrine tumors (pNET), and extra-pancreatic NET (epNET) in adults. Continuous improvements in the formulations of pancreatic enzymes are further enhancing PERT’s effectiveness. The development of pancreatic micro-tablets and capsules is making the therapy more efficient, leading to better patient outcomes and high demand.

Symptom (Abdominal Pain, Constipation, Diarrhea, Fatty Stools, Weight Loss, Others)

In exocrine pancreatic insufficiency treatment market, diarrhea segment is expected to hold more than 28% revenue share by 2035. Diarrhea is the prime symptom leading to exocrine pancreatic insufficiency issues. The World Health Organization (WHO) report reveals that diarrhea is the leading cause of malnutrition among children and around 1.7 billion cases of diarrheal disease are diagnosed each year, across the world. Pancreatic enzyme replacement therapy effectively improves digestion, especially of fats by providing exogenous enzymes, leading to mitigation of occurrence and severity of diarrhea.

Our in-depth analysis of the global exocrine pancreatic insufficiency treatment market includes the following segments:

|

Treatment |

|

|

Drug Type |

|

|

Symptom |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Exocrine Pancreatic Insufficiency Treatment Market Regional Analysis:

North America Market Forecast

North America exocrine pancreatic insufficiency treatment market is expected to capture revenue share of over 56.1% by 2035. The presence of research organizations, the existence of advanced healthcare infrastructure and pharma companies, and increasing public investments in research and development activities are collectively contributing to the overall market growth. Both the U.S. and Canada are foreseen to offer lucrative opportunities to exocrine pancreatic insufficiency drug manufacturers owing to the rising prevalence of pancreatic conditions.

In the U.S., according to the American Cancer Society, around 66,440 individuals were diagnosed with pancreatic cancer in 2024. Furthermore, pancreatic cancer accounts for 3.0% of the overall cancer types. Such rising cancer incidence rates are fueling the demand for exocrine pancreatic insufficiency therapeutic solutions. The increasing awareness programs of gastrointestinal health are leading to early diagnosis and treatment of exocrine pancreatic insufficiency.

In Canada, the government’s supportive role in advancing its healthcare system is leading to increasing access to essential treatments including exocrine pancreatic insufficiency for a larger population. The increasing funding for research and development activities is also anticipated to drive the exocrine pancreatic insufficiency treatment market growth in the country. For instance, the Canadian Institutes of Health Research (CHIR) contributed around USD 352,57o to a project titled - Pancreatic Enzyme Replacement Therapy to Improve Quality of Life in Patients Undergoing Pancreatoduodenectomy: A Pilot Randomized Controlled Trial (PERQ-UP Pilot) with April 2021 completion date.

Asia Pacific Market Statistics

The Asia Pacific exocrine pancreatic insufficiency treatment market is forecast to increase at a robust pace during the study period. The increasing investments in the advancements of healthcare infrastructure, gut health awareness programs, and initiatives to mitigate cancer cases are augmenting the demand for advanced exocrine pancreatic insufficiency therapeutic solutions. China, India, Japan, and South Korea are offering win-win opportunities for exocrine pancreatic insufficiency drug producers.

In China, rising technological advancements in the field of diagnosis and treatment are set to drive overall exocrine pancreatic insufficiency treatment market growth in the coming years. The rising cases of pancreatic cancer and gastrointestinal disorders are increasing the consumption of exocrine pancreatic insufficiency medications. For instance, the National Center for Biotechnology Information (NCBI) reveals that the prevalence of gastrointestinal discomfort such as constipation is more than 30% in the elderly population.

In India, supportive government policies and initiatives to enhance national health are set to increase the sales of exocrine pancreatic insufficiency drugs in the coming years. For instance, in December 2024, the India Brand Equity Foundation (IBEF) revealed that the government is focusing on improving R&D in the pharma and MedTech sector by investing around USD 82.5 million. The country is also emerging as a global hub for generic drug production, which is leading to the easy availability of cost-effective pancreatic enzyme replacement therapies and drugs.

Key Exocrine Pancreatic Insufficiency Treatment Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AbbVie, Inc.

- Janssen Pharmaceuticals, Inc.

- Essential Pharma Group

- Exelixis, Inc.

- Codexis, Inc.

- Nestlé Health Science

- Entero Therapeutics (First Wave BioPharma)

- Nordmark Pharma GmbH

- Sun Pharmaceutical Industries

- Viatris

- Vivus LLC

- Zentiva Pharma UK

- Synspira Therapeutics, Inc.

The exocrine pancreatic insufficiency treatment market is characterized by the presence of industry giants and the emergence of start-ups. The new companies invest heavily in research and development activities to introduce innovative exocrine pancreatic insufficiency treatment options, which aids them to stand out in the crowd. Leading companies are more focused on strategic collaborations with research organizations and other players to expand their product offerings by adding state-of-the-art therapies. This not only increases their market reach but also boosts their revenue shares. Mergers & acquisitions and regional expansion strategies are further aiding them to enhance their market position by adding new products into their product folio and grabbing untapped opportunities in the high-potential economies.

Some of the key players include in exocrine pancreatic insufficiency treatment market:

Recent Developments

- In November 2023, the U.S. Food and Drug Administration (FDA) announced that it approved Zepbound (tirzepatide) injection for chronic weight management in adults with obesity. This drug approval is striding ways in the nutrition management segment.

- In February 2023, Codexis, Inc. and Nestlé Health Science announced interim results from a Phase 1 study of CDX-7108 for exocrine pancreatic insufficiency. No safety issues were noted in the 48 subjects who participated in the single ascending dose and multiple ascending dose portion of the study.

- Report ID: 6867

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Exocrine Pancreatic Insufficiency Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.