Excessive Daytime Sleepiness Market Outlook:

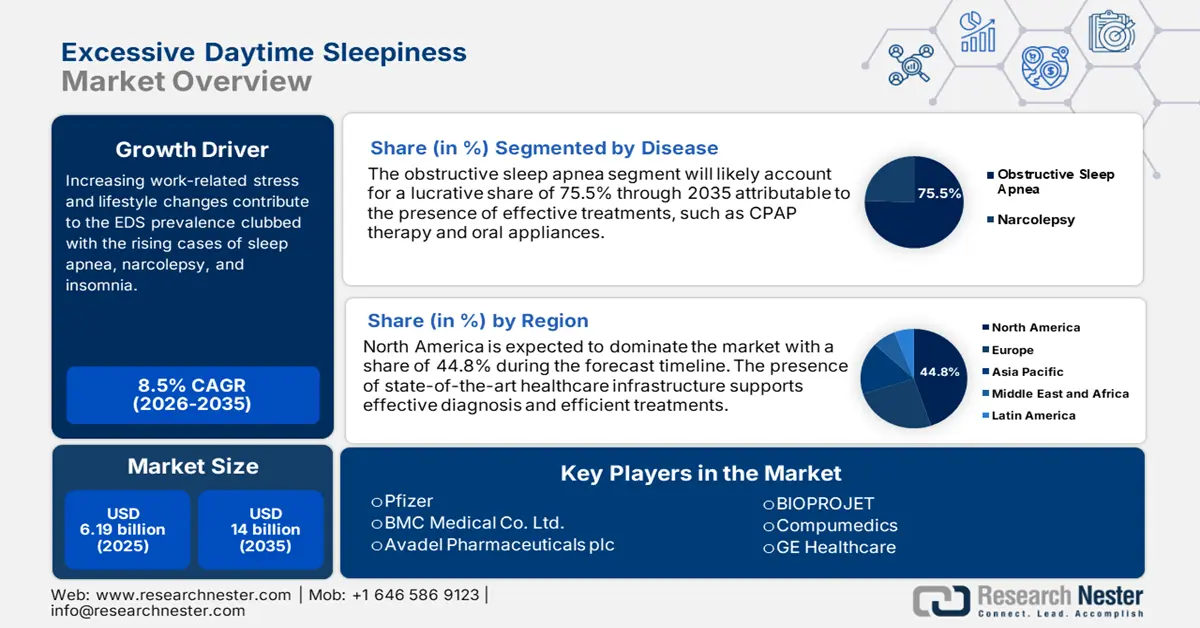

Excessive Daytime Sleepiness Market size was over USD 6.19 billion in 2025 and is projected to reach USD 14 billion by 2035, witnessing around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of excessive daytime sleepiness is evaluated at USD 6.66 billion.

The growth of the excessive daytime sleepiness market can be characterized of contemporary lifestyle and social changes. There is a fast-rising prevalence of disorders related to sleep such as obstructive sleep apnea and insomnia that have been linked with rising obesity levels and sedentary lifestyles that encourage broken sleep patterns and poor sleep quality. For instance, in December 2024, the Sleep Foundation revealed that there is a reciprocal relationship between obesity and depression. Insomnia occurs in people with depression up to 75%. Furthermore, in addition to this case people who consumed food between 30 to 60 minutes before going to bed face sleeping issues. Furthermore, changes in sleep architecture in old age make it susceptible to EDS.

In addition, excessive use of electronic devices and screens in the evening has added to other issues caused by blue light emission, thereby contributing to sleep disturbances. For instance, in December 2019, the National Institutes of Health revealed that 97.3% of students used light-emitting blue devices at bedtime. Among them, 35.3% complained of poor sleep quality (PSQI > 5). They reported perceived sleep disturbances as a result of night use of these devices among 188 participants (65.7%) out of 294 students. These factors are illustrative of the multi-factorial nature of EDS pathogenesis and present an imperative case for targeted intervention toward betterment in sleep hygiene and the health status of the affected population.

Key Excessive Daytime Sleepiness Market Insights Summary:

Regional Highlights:

- North America dominates the Excessive Daytime Sleepiness Market with a 44.8% share, fueled by the shift to remote work and flexible schedules, supporting strong growth through 2035.

- Asia Pacific's excessive daytime sleepiness market anticipates lucrative growth by 2035, attributed to rising integration of sleep medicine in healthcare practices.

Segment Insights:

- The Obstructive Sleep Apnea segment is forecasted to dominate with over 75.5% share in the Excessive Daytime Sleepiness Market by 2035, driven by increased recognition of OSA as a major contributor.

- The Therapeutic Drugs segment of the Excessive Daytime Sleepiness Market is anticipated to dominate by 2035, driven by growing adoption of stimulant medications to treat excessive daytime sleepiness.

Key Growth Trends:

- Cutting-edge technological breakthroughs

- Pharmaceutical developments

Major Challenges:

- Underdiagnosis & misdiagnosis

- Insurance coverage limitation

- Key Players: GE Healthcare, Jazz Pharmaceuticals, Compumedics, Fisher & Paykel Healthcare, and more.

Global Excessive Daytime Sleepiness Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.19 billion

- 2026 Market Size: USD 6.66 billion

- Projected Market Size: USD 14 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.8% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Excessive Daytime Sleepiness Market Growth Drivers and Challenges:

Growth Drivers

- Cutting-edge technological breakthroughs: The major driver of the excessive daytime sleepiness market, is the new diagnostics and advanced wearables aid sleep monitoring and evaluation. For instance, in January 2025, ResMed announced the release of AirSense 11 to the Indian market. This device is next-generation CPAP equipment designed to provide a seamless process for patients living with Obstructive Sleep Apnea (OSA). These technologies help them to carry out interventions appropriately. Heightened awareness of sleep health encourages healthcare providers to make more accurate diagnoses, which leads to a rising demand for better management strategies over EDS.

- Pharmaceutical developments: The principal driver for the excessive daytime sleepiness market is pharmaceutical development. This would allow treatments of EDS aside from the standard stimulants, bringing targeted therapies to patients, treating the source of sleepiness and lessening side effects. For instance, in July 2023, Idorsia Pharmaceuticals U.S. Inc. announced that CVS covered QUVIVIQ (daridorexant) CIV, effective immediately, on the Performance Drug List (PDL). Such innovative solutions in pharmacological treatment are properly regulatory-approved and clinically acceptable, they fuel the market growth through catering to the ever-increasing interest in the effective treatment of EDS.

Challenges

- Underdiagnosis & misdiagnosis: The main bottleneck in the excessive daytime sleepiness market is mainly the non-specific characteristic of EDS itself, which quite often is confused with run-of-the-mill fatigue syndrome or lifestyle elements. This lack of recognition can lead to inadequate evaluation and treatment of underlying sleep disorders, resulting in a substantial number of individuals remaining untreated. The inability to diagnose EDS appropriately denies the proper access to therapies but ensures that this cycle of poor health outcomes is tied to failing treatment. Not treating sleep-related issues, diminishes market growth and awareness worldwide.

- Insurance coverage limitation: The major limiting factor in the excessive daytime sleepiness market is insurance coverage, primarily due to poor reimbursement of diagnostic tests and treatments that go with sleep disorders. Most health insurance packages are inadequate for fully funding basic tests such as polysomnography or home sleep apnea testing. Thus, some people who really require proper attention do not access these due to such an economic deterrent, thus not only locking people out from full and effective care but further accentuating underdiagnosis and improper treatment of EDS that actually widens disparities in health in communities.

Excessive Daytime Sleepiness Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 6.19 billion |

|

Forecast Year Market Size (2035) |

USD 14 billion |

|

Regional Scope |

|

Excessive Daytime Sleepiness Market Segmentation:

Disease (Obstructive Sleep Apnea, Narcolepsy)

Based on the disease, the obstructive sleep apnea segment is predicted to dominate excessive daytime sleepiness market share of over 75.5% by 2035. OSA is characterized by recurrent episodes of airway obstruction during sleep, leading to disrupted sleep patterns and significant daytime drowsiness. The growing recognition of OSA as a major contributor to EDS has spurred increased demand for diagnostic tools and treatment options, such as continuous positive airway pressure (CPAP) therapy. For instance, in the year 2020, according to ERS Publications, OSA occurred in at least 24% of males and 9% of females. Even with advances in alternative treatment options, CPAP therapy remains the first-line treatment in moderate to severe OSA.

Treatment (Devices, Therapeutic Drugs- Stimulants, Anti-Depressants, Amphetamine salts, Sodium Oxybate)

The therapeutic drugs segment is anticipated to dominate the excessive daytime sleepiness market by 2035, attributable to the growing sleep disorder which increases an individual's potential for alertness. This is an area of growth because, increasingly, prescribers in the health industry are using wakefulness-promoting agents and stimulant medications for treating excessive daytime sleepiness. For instance, in December 2024, Eli Lilly and Company announced that Zepbound (tirzepatide) was approved by the U.S. FDA. It is the first and only prescription medicine for adults with moderate-to-severe obstructive sleep apnea (OSA) and obesity. Research into new drug formulations prove to be helpful, hence, entrench the use of therapeutics drugs in managing excessive daytime sleepiness.

Our in-depth analysis of the excessive daytime sleepiness market includes the following segments:

|

Diseases |

|

|

Distribution Channel |

|

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Excessive Daytime Sleepiness Market Regional Analysis:

North America Market Statistics

North America in excessive daytime sleepiness market is likely to dominate around 44.8% revenue share by the end of 2035, driven by the shift to remote work and flexible schedules that change the sleep habits people used to follow. The more people work from home, the more irregular their sleep patterns are, and the more hours they spend looking at screens, translating into higher cases of sleep disorders such as insomnia and obstructive sleep apnea. This trend has heightened awareness among both healthcare providers and patients about the need to address excessive daytime sleepiness as a critical health issue.

The U.S. excessive daytime sleepiness market is unfolding remarkable growth opportunities attributable to the increased healthcare spendings due to the increasing instances of sleeping disorders. For instance, in January 2023, National Center for Health Statistics revealed that in 2020, 8.4% of adults used sleep medication in the U.S. or stay asleep. Amongst them women were more likely than men to use medication for sleep, at 10.2% compared with 6.6%. In addition, in October 2021, overall, incremental healthcare expenditures for sleep disorders in the U.S. equal USD 94.9 billion.

The excessive daytime sleepiness market in Canada is witnessing significant growth due to the growing instances of mental health deterioration, impact of stress, anxiety, and depression. In addition, government support to improve this health condition through its fundings. For instance, in June 2022, Minister of Health, Canada announced a total of USD 3.8 million in funding for research on sleep health and insomnia. The Government of Canada is backing this research through the Canadian Institutes of Health Research (CIHR) in collaboration with Eisai Limited and Mitacs.

Asia Pacific Market Analysis

The excessive daytime sleepiness market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline i.e. 2025-2035. Health professionals are increasingly finding a place for sleep medicine within their practices which has resulted in a context that encourages developing effective treatment to improve quality of life. Consequently, the need for proper sleep evaluation and intervention encompassing both the psychological and physiological aspects of sleep health has become more prominent in this region.

The excessive daytime sleepiness market in India is expecting substantial growth owing to the accelerating urbanization and work demands leading to sedentary lifestyle with distorted sleep patterns and no rest time. To manage such condition to become more intense, the local governments are initiating several steps by reforming the regulatory and legal framework. For instance, the Occupational Safety, Health, and Working Conditions (OSH Code), Act 2020 states that employees are required generally to work no more than 8 to 9 hours per day, while in some regions it is allowed up to 12 hours. Generally, a workweek will be 48 hours with 30-60 mins rest interval for every 5 hours.

The excessive daytime sleepiness market in China is gaining traction due to growing collaborations between healthcare professionals and companies with a collective goal of improving sleeping quality through their inventions. For instance, in January 2025, Jiangsu Hengrui Pharmaceuticals Co., Ltd. and Kailera Therapeutics, Inc. announced positive topline data from the 8 mg dose of Hengrui Pharma's Phase 2 clinical trial, HRS9531-203, of HRS9531, a GLP-1/GIP receptor dual agonist, in individuals living with obesity or overweight.

Key Excessive Daytime Sleepiness Market Players:

- Pfizer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd.

- GE Healthcare

- Jazz Pharmaceuticals

- Compumedics

- Fisher & Paykel Healthcare

- BIOPROJET

- BMC Medical Co. Ltd.

- Avadel Pharmaceuticals plc

- Cadwell Laboratories Inc. Ltd

- GlaxoSmithKline plc

- Braebon Medical Corporation

The companies landscape in the excessive daytime sleepiness market is rapidly changing, mainly because of the growing recognition of employee wellness as a critical factor in enhancing productivity and reducing health care costs. This has been translated into the incorporation of sleep assessments and interventions into corporate health strategies and adopting a more proactive approach to addressing excessive daytime sleepiness among employees. For instance, in September 2024, AirPods Pro 2 offered the world's first all-in-one hearing health experience with a clinical-grade, over-the-counter Hearing Aid feature with new sleep apnea notifications.

Here's the list of some key players:

Recent Developments

- In June 2024, Zevra Therapeutics announced that KP1077 was safe and associated with significant clinical improvement in patient-report assessments of day sleepiness, sleep inertia, and brain fog.

- In April 2022, Harmony Biosciences Holdings, Inc. initiated the INTUNE research, a Phase 3 trial evaluating the efficacy and safety of pitolisant in adult patients with idiopathic hypersomnia (IH).

- Report ID: 7012

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Excessive Daytime Sleepiness Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.