EV Relay Market Outlook:

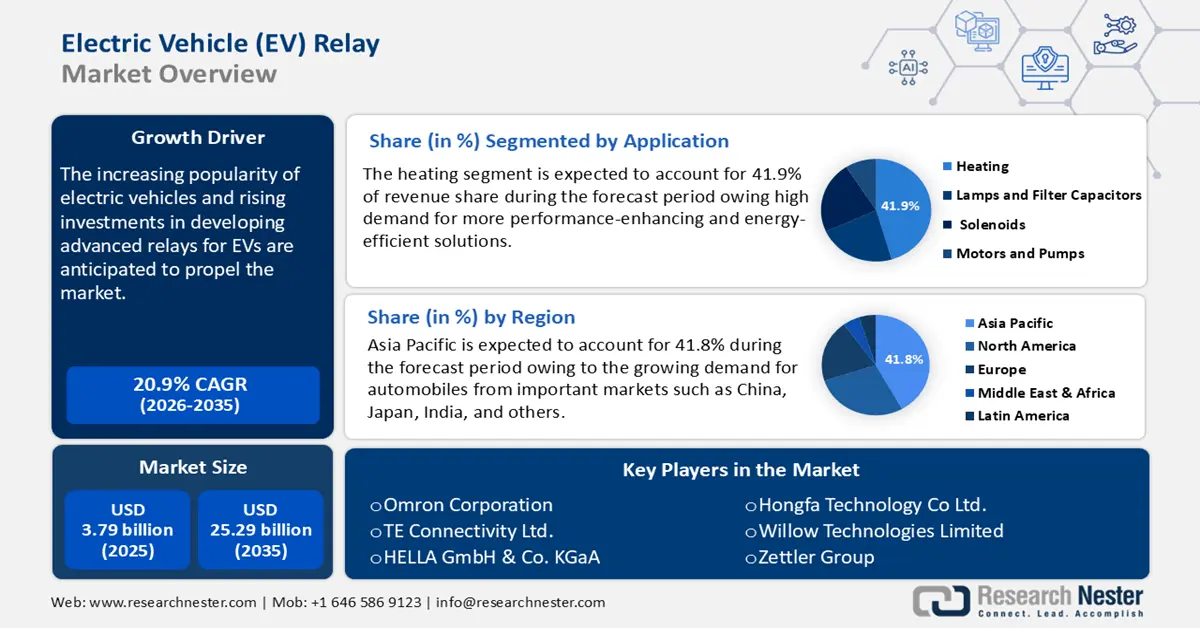

EV Relay Market size was over USD 3.79 billion in 2025 and is projected to reach USD 25.29 billion by 2035, witnessing around 20.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of EV relay is evaluated at USD 4.5 billion.

The increasing popularity of electric vehicles is anticipated to propel the EV relay market. For example, the International Energy Agency (IEA) projected that global sales of electric cars were 10 million in 2022 and increased by an additional 35% to reach 14 million in 2023. The automobile industry is predicted to experience certain structural changes in the near future due to the rapid development of new technology. Precision, robotic effectiveness, and consistency in the manufacturing process will all be significantly increased by artificial intelligence (AI) and machine learning (ML). Manufacturers can offer attractive features and boost revenue in the EV relay market owing to level 2 automation, which includes driver assistance and active safety systems.

Key EV Relay Market Insights Summary:

Regional Highlights:

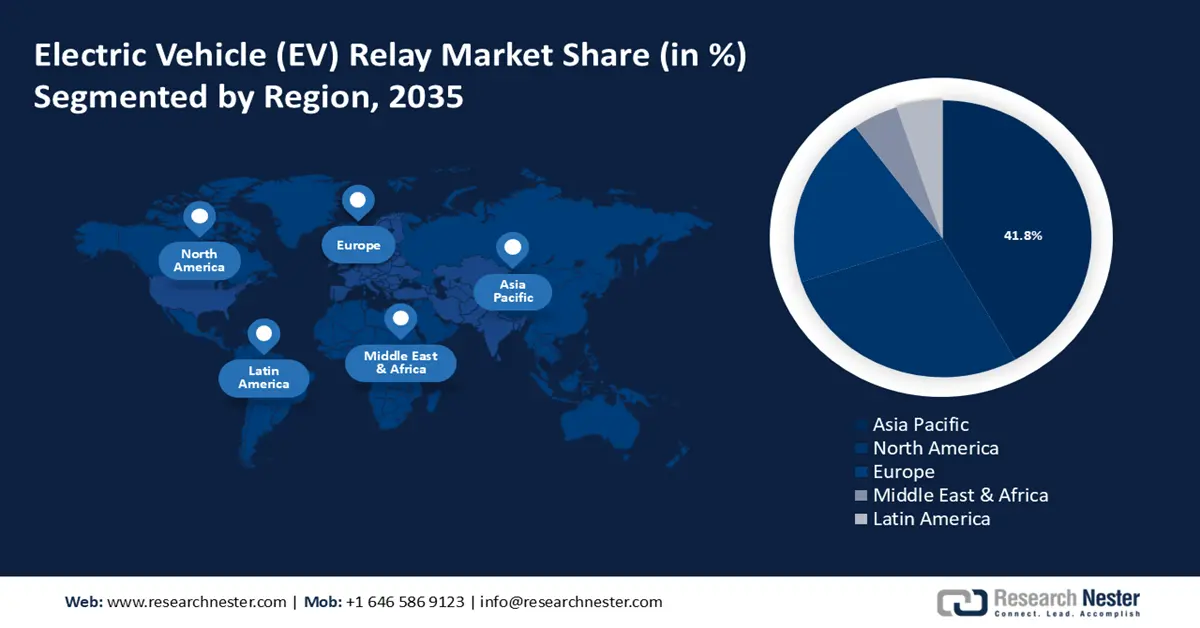

- Asia Pacific EV relay market will account for 41.80% share by 2035, driven by strong demand from major automotive markets like China, Japan, and India, coupled with rising middle-class wealth.

- North America market will register significant growth during the forecast timeline, driven by OEM adoption growth and increasing consumer awareness of eco-friendly vehicles.

Segment Insights:

- The heating segment in the ev relay market is anticipated to achieve notable growth till 2035, driven by demand for performance-enhancing, energy-efficient relay products in electric vehicles.

- The passenger car segment in the ev relay market is projected to achieve the largest share by 2035, driven by the popularity of passenger cars due to their styling, size, affordability, and increased safety features.

Key Growth Trends:

- Increasing adoption of reliable and advanced safety features

- Governmental efforts and rising awareness

Major Challenges:

- Expensive upkeep and upfront investment

- Limited switching capacity and inconsistent design

Key Players: Omron Corporation, TE Connectivity Ltd., HELLA GmbH & Co. KgaA, Hongfa Technology Co Ltd., Willow Technologies Limited, Zettler Group, Tara Relays Private Limited, Song Chuan Group Company, Jiangxi Weiqi Electric Co., Ltd.

Global EV Relay Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.79 billion

- 2026 Market Size: USD 4.5 billion

- Projected Market Size: USD 25.29 billion by 2035

- Growth Forecasts: 20.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, South Korea, Thailand, Mexico

Last updated on : 18 September, 2025

EV Relay Market Growth Drivers and Challenges:

Growth Drivers:

-

Increasing adoption of reliable and advanced safety features: Manufacturers have identified consumer preference for cars equipped with cutting-edge safety technologies. Relays are now used more frequently in these kinds of electronic systems. The increase is linked to the growing use of cutting-edge technologies like adaptive cruise control (ADAS), which offers lane-keeping assistance, automated emergency braking, blind-spot identification, and other features that are becoming more popular in contemporary technology. These devices reduce the likelihood of accidents and help drivers, which improves safety.

For example, MG Motor India unveiled a new version of their ZS electric car in July 2023. The new car offers a new Autonomous Level-2; the haptic, aural, and visual warning levels can be adjusted to low, medium, or high. Traffic Jam Assist (TJA), Forward Collision Warning (FCW), and Speed Assist System (SAS) are all part of the ADAS package. The demand for relays is directly correlated with the use of new technology. The EV relay market will expand during the forecast period due to the growing demand for these applications in upcoming electric vehicles and ongoing developments for such cutting-edge features. - Governmental efforts and rising awareness: The EV relay market is driven by rising government incentives and increasing consciousness regarding transportation emissions. Several governments are enacting rules and norms about carbon dioxide emissions and encouraging and supporting the quick commercialization of zero-emission vehicles (ZEVs). Electric vehicle relays, which are used to switch several objects at once using a single output, are predicted to become popular globally as electric cars become more commonplace. This would in turn increase demand for zero-emission vehicles.

- Growing need for relays with greater switching capacity for electric and hybrid cars: The producers of relays for electric vehicles have been concentrating on improving the effectiveness and functionality of their goods. To fulfill the need for electric vehicles, the firms are concentrating on lowering power losses, improving switching capabilities, raising dependability, and prolonging the lifespan of relays. High-voltage DC parts are necessary for hybrid and electric cars. In electric vehicles such as trucks, vans, and buses, the HVDC relay is essential.

Ensuring safety and safeguarding electronics, the Battery Disconnect Unit (BDU) comprises the main contractors and the pre-charge relay. This growth expands the size of the global EV relay market. Furthermore, given the global trend of renewable energy expansion, it is expected that the demand for HVDC relays will rise rapidly. The relays are used in many different electric vehicle applications. These include safety systems, electric power steering, HVAC, battery management systems, and inverter control, among others, which call for a suitable design to turn the relay on or off.

Challenges

-

Expensive upkeep and upfront investment: The high initial and ongoing expenses of EV relay systems are one of the biggest obstacles facing the global for EV relay market. With every new model, electric vehicles gain more sophisticated technology, which means that the quantity and intricacy of electronic parts and relays within an EV are always growing. Due to this, the cost of installing and purchasing relays during the production of electric vehicles is greatly increased. Furthermore, when comparing advanced electric car relay systems to conventional internal combustion engine vehicles, the maintenance and repair expenses are higher. Since EVs currently make up a relatively small portion of the automobile market overall, there hasn't been much mass production to take advantage of economies of scale.

-

Limited switching capacity and inconsistent design: Compatibility problems may arise from an unstandardized relay design. There may be differences between manufacturers' relays in terms of mounting options, terminal assignments, and pin configurations. Owing to this, switching out relays made by various manufacturers or even within the same car model might be difficult. To fit a particular relay into an exciting system, it might be necessary to make additional modifications or adapters, which could add to the complexity and increase the chance of mistakes during installation or replacement. Relays' incompatibility hinders the market's expansion as a result.

EV Relay Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.9% |

|

Base Year Market Size (2025) |

USD 3.79 billion |

|

Forecast Year Market Size (2035) |

USD 25.29 billion |

|

Regional Scope |

|

EV Relay Market Segmentation:

Vehicle Type Segment Analysis

The passenger car segment is likely to account for largest EV relay market share by 2035. Passenger cars have been increasingly popular among drivers due to their fashionable styling, small size, and affordability. In many developed nations, passenger vehicles are the most popular form of transportation. Global customer preferences are changing due to improved lifestyles, more disposable income, increased brand recognition, and a strengthening economy driving up passenger car sales.

In light of this, automakers are putting more of an emphasis on cutting-edge safety measures for cars to meet the growing demand for them. An anti-lock braking system (ABS), electronic stability control (ESC), tire pressure monitoring system (TPMS), lane departure warning system (LDWS), etc. are a few examples of common active safety systems. Furthermore, government initiatives to encourage the manufacture of far safer automobiles fuel the EV relay market's expansion. For example, the Bharat New Car Assessment Programme (Bharat NCAP) was introduced by the Ministry of Road Transport & Highways in August 2023. The government's initiative to increase road safety by bringing India's motor vehicle safety standards up to 3.5 tons is a major advancement in that direction.

Application Segment Analysis

In EV relay market, heating segment is set to capture revenue share of over 41.9% by 2035. The demand for more performance-enhancing and energy-efficient solutions will push the usage of relay products in a variety of applications. In electric vehicles, EV relays guard against open-circuit and short-circuit situations that could harm the electrical system or result in injuries if they come into contact with excessive voltage.

Furthermore, by offering controlled switching between two modes, which lowers engine load, these devices, in comparison to conventional systems, assist limit power usage. During the forecast period, these factors are anticipated to propel industry growth, especially in North America and Europe, where demand has been steadily increasing due to increased production of electric vehicles, growing consumer awareness of better driving experiences, as well environmental benefits associated with lower carbon emissions from automobile manufacturing plants worldwide.

Our in-depth analysis of the EV relay market includes the following segments:

|

Application |

|

|

Product |

|

|

Vehicle Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

EV Relay Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is likely to account for largest revenue share of 41.8% by 2035, owing to the growing demand from important markets such as China, Japan, India, and others. China and India are widely regarded as the world's largest automotive customers, accounting for a substantial portion of the global automotive demand. There will be a high demand due to factors including a large youth population and rising middle-class wealth.

For example, research conducted by the CEEW Centre for Energy Finance estimated that India might see a USD 206 billion for EV relay market by 2030.

The government in India is concentrating on policies to encourage sales of electric vehicles and establish initiatives for electric vehicles to become a global leader in the EV business. In addition, the government has created several initiatives and incentives to boost the EV relay market for electric vehicles. The R&D of electric vehicles and associated infrastructure is being funded by automakers. The Indian government plans to implement cheaper road fees, scrapping, and retrofit incentives to achieve its 2030 target of 30% EVs.

The electric vehicle (EV) revolution has made China the world leader, with an astounding 1.8 million public charging stations spread across the nation. When it comes to constructing the necessary infrastructure for the transition to electric vehicles, China is outperforming other nations. 1.76 million functioning, publicly accessible electric vehicle chargers have already been built by Chinese authorities.

North America Market Insights

North America in EV relay market is expected to experience a significant CAGR during the forecast period due to OEM adoption increases and consumer awareness of environmentally friendly cars rises. For instance, in keeping to engineer a sustainable future, Honda plans to sell only zero-emission cars in North America by the year 2040. The company plans to introduce two brand-new fully electric SUVs in 2024 as part of our journey toward 2040, beginning with the Honda Prologue.

Well-established automakers in the U.S. are in high demand for relays due to the development of the electric car industry. The presence of large relay manufacturers and government measures supporting electric vehicles have greatly expanded the market in this country. The industry is supported by the growing sales of high-end electric cars, which use more sophisticated relays per vehicle.

EV Relay Market Players:

- FCL Components America, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Omron Corporation

- TE Connectivity Ltd.

- HELLA GmbH & Co. KGaA

- Hongfa Technology Co Ltd.

- Willow Technologies Limited

- Zettler Group

- Tara Relays Private Limited

- Song Chuan Group Company

- Jiangxi Weiqi Electric Co., Ltd.

Leading competitors in the worldwide and regional markets for electric vehicle relays are consolidating and leading the EV relay market. To maintain their market positions, the businesses use tactics including partnerships and the introduction of new products. For example, LS e-Mobility Solutions, an EV component-focused subsidiary of LS Electric Co., was awarded a USD 187 million supply contract in August 2023 to supply relays for electric vehicles produced by Hyundai Motor Co. and Kia Corp. The supply of EV relays for electric vehicles is covered by the agreement. Delivery of the components is expected to occur in the first half of 2025.

Here are some leading players in the EV relay market:

Recent Developments

- In July 2024, Omron Electronic Components Europe announced a new high-capacity printed circuit board (PCB) relay designed exclusively for Mode 3 AC electric vehicle (EV) charging stations installed in AC wall boxes. The G9KC relay has the highest minimal contact resistance currently available on the market and creates much less heat at the load terminal during operation than similar devices.

- In June 2024, FCL Components America, Inc. introduced the industry's smallest low-power 40A automotive-grade PCB-mounted relay, the FBR53-LE. This relay contributes to more compact designs as it is more than 2 mm in height than others in its class. Its nominal coil power is 640mW, and its contact rating is 14VDC, 40A. Due to its wide operating temperature range (-40 to +125 degrees Celsius), it is perfect for engine compartments.

- Report ID: 6456

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

EV Relay Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.