EV Platform Market Outlook:

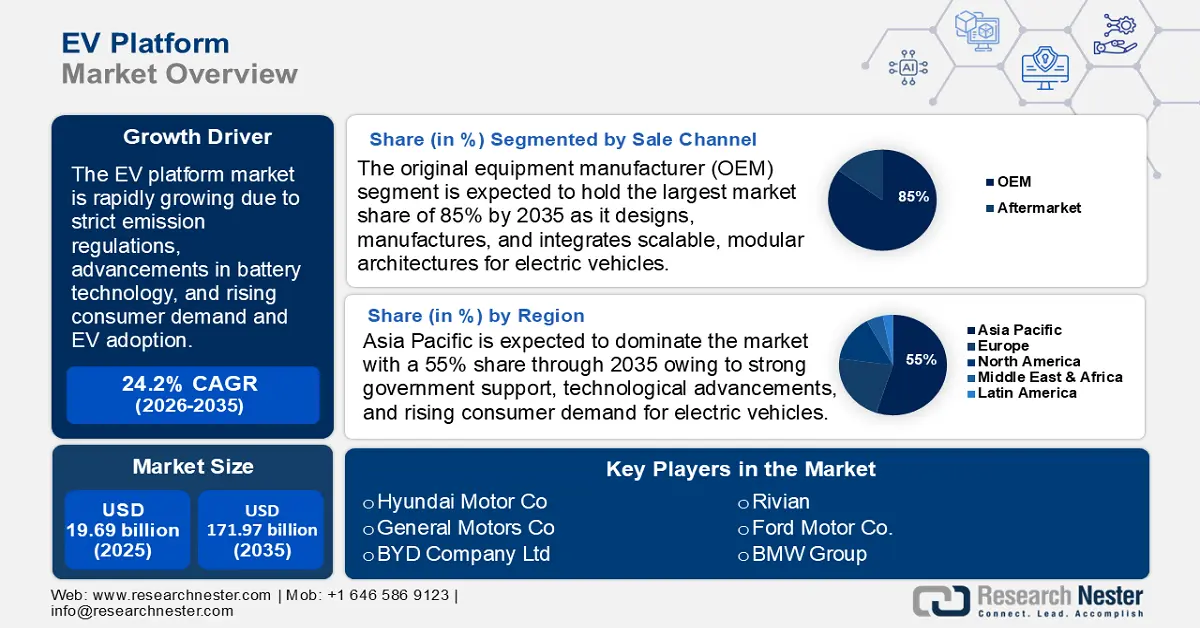

EV Platform Market size was valued at USD 19.69 billion in 2025 and is expected to reach USD 171.97 billion by 2035, expanding at around 24.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of EV platform is evaluated at USD 23.98 billion.

The global EV platform market is rapidly expanding due to strict emission regulations and net zero carbon goals set by the regulatory authorities. Emission rules such as the EU’s Fit for 55 packages, China’s New Energy Vehicle (NEV) mandate, and the U.S. tax credit are accelerating the market. These policies and regulatory support for EV adoption are pushing automakers to shift towards dedicated EV platforms. Recent government policies and regulatory support have significantly influenced the EV platform market. A notable example is India’s approval of the E-vehicle policy worth USD 500 million in March 2024, aiming to position the country as a manufacturing hub for EVs. To qualify for incentives, companies must invest a minimum of US 500 million in manufacturing electric four-wheelers within India. Eligible companies receive various duty concessions that enhance the local production of EVs. This policy aligns with India’s broader goals of reducing crude oil imports, lowering the trade deficit, and reducing urban air pollution.

The electrification of commercial fleets, delivery vehicles, and public transport is a major driver for EV platforms market. Logistics companies, ride-hailing services, and transit agencies are seeking cost-effective and sustainable solutions to meet emission reduction targets. In January 2025, Amazon placed the UK’s largest-ever order for electric trucks to reduce the carbon footprint of its delivery operations. The company plans to add over 140 Mercedes Benz electric HGVs and 8 Volvo lorries capable of handling loads up to 40 tonnes and deliver more than 350 million packages every year. This initiative is a part of Amazon’s USD 300 million green transport investment aligning with its goal to achieve net zero carbon emissions by 2040.

Key EV Platform Market Insights Summary:

Regional Highlights:

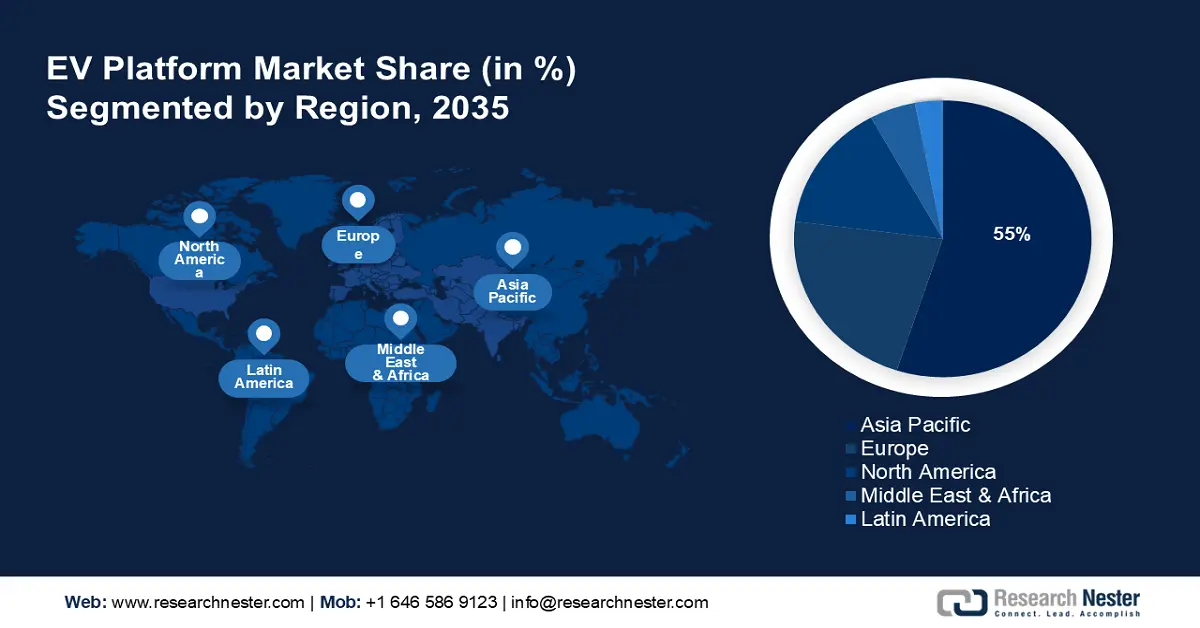

- Asia Pacific dominates the EV Platform Market with a 55% share, fueled by strong government support and EV demand, positioning it as a global leader in electric vehicle production through 2026–2035.

Segment Insights:

- The OEM segment is expected to capture 85% market share by 2035, driven by automakers' focus on scalable EV architectures and strategic collaborations.

Key Growth Trends:

- Advancements in battery technology

- Rising consumer demand and EV adoption

Major Challenges:

- High initial development costs and supply chain constraints

- Charging infrastructure and grid readiness

- Key Players: Open Motors, REE Auto, Saic Motor, XAOS Motors, BMW, BYD, Canoo, Volkswagen, Volvo.

Global EV Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.69 billion

- 2026 Market Size: USD 23.98 billion

- Projected Market Size: USD 171.97 billion by 2035

- Growth Forecasts: 24.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

EV Platform Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in battery technology: The improvement in battery energy density, fast charging capabilities, and cost reduction make EV platforms more viable. The emergence of solid-state batteries and lithium-iron-phosphate chemistry enhances platform efficiency and scalability. For instance, in March 2025, BYD introduced an ultra-fast charging system capable of delivering a full charge within five to eight minutes comparable to refueling a gasoline vehicle. This breakthrough utilizes silicon carbide power chips and BYDs Blade lithium iron phosphate battery known for its safety and efficiency. The company plans to deploy over 4,000 of these new charging stations across China, positioning itself ahead of competitors in fast charging technology. Further, integrated battery structures such as cell-to-pack (CTP), cell-to-chasis (CTC), and cell-to-body (CTB) designs are enhancing space utilization and vehicle efficiency reducing weight and improving safety.

-

Rising consumer demand and EV adoption: The growing availability of affordable and long-range EVs is fueling demand for advanced platforms. Consumer preference for sustainability, lower operating costs, and high-performance EVs is driving innovation. Additionally, the expansion of charging infrastructure worldwide supports easy EV adoption. For instance, in India, the Ministry of Heavy Industries approved a subsidy of USD 96.13 million to build 7,432 Electric Vehicle Public Charging Stations under the FAME India scheme. With the rising number of charging stations and demand for fuel-efficient vehicles, the EV platform market is set to grow.

Challenges

-

High initial development costs and supply chain constraints: Developing dedicated EV platforms requires substantial upfront investment in research, engineering, and production infrastructure. Automakers must allocate significant capital to design scalable skateboard architectures, integrate advanced battery technologies, and develop new vehicle software systems. Additionally, fluctuating prices and geopolitical risks disrupt the global supply chain and lead to raw material shortages.

-

Charging infrastructure and grid readiness: While EV adoption is rising, inadequate charging infrastructure remains a key challenge, particularly in developing regions as they still lack sufficient fast charging networks. Additionally, mass EV adoption increases electricity demand, requiring significant upgrades to power grids, renewable energy integration, and energy storage solutions. Without proper infrastructure, range anxiety and long charging times will continue to hinder consumer confidence and large-scale EV platform adoption.

EV Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.2% |

|

Base Year Market Size (2025) |

USD 19.69 billion |

|

Forecast Year Market Size (2035) |

USD 171.97 billion |

|

Regional Scope |

|

EV Platform Market Segmentation:

Sale Channel (OEM, Aftermarket)

Original equipment manufacturer (OEM) segment is set to dominate over 85% EV platform market share by 2035, as it designs, manufactures, and integrates scalable, modular architectures for electric vehicles. Major automakers such as Toyota, Nissan, and Honda utilize proprietary EV platforms to develop diverse vehicle models that improve cost efficiency and enable flexible production. Additionally, OEMs also collaborate with third-party suppliers and technology firms to enhance battery performance, charging capabilities, and software integration. For instance, a recent example of an OEM collaborating to enhance EV platform development is the joint venture between Rivian and Volkswagen Group. In November 2024, they launched a partnership worth USD 5.8 billion to reduce EV development costs and scale up new technologies including software and electronics architectures. This approach enables OEMs to leverage shared expertise ensuring faster market adoption, and a competitive edge in the evolving EV landscape.

Electric Vehicle Type (Battery Electric Vehicles, Hybrid Electric Vehicles)

The battery electric vehicle segment is predicted to hold a significant EV platform market share through 2035 as it relies entirely on electric power with no internal combustion engine. Automakers are developing dedicated BEV platforms to optimize battery integration, enhance energy efficiency, and extend driving range. Top companies such as Tesla, BYD, and Volkswagen are advancing battery technology and charging infrastructure to improve BEV adoption. The shift towards zero- emission mobility and stricter environmental regulations enhances BEV market growth.

Our in-depth analysis of the global EV platform market includes the following segments:

|

Sale Channel |

|

|

Electric Vehicle Type |

|

|

Component |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

EV Platform Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific EV platform market is estimated to capture revenue share of over 55% by 2035. The growth can be attributed to strong government support, technological advancements, and rising consumer demand for electric vehicles. China, Japan, and South Korea lead the market by investing heavily in battery technology, charging infrastructure, and EV manufacturing. Government incentives, subsidies, and strict emission regulations are accelerating EV adoption across the region. The presence of major automakers and battery manufacturers is driving innovation and cost optimization making EV platforms scalable and affordable.

The EV platform market in China is expanding rapidly due to strong government policies, aggressive investments in EV technology, and a well-developed supply chain. The country leads in battery production and vehicle electrification with automakers such as BYD, NIO, and Geely developing advanced modular EV platforms. The country’s extensive expansion of charging infrastructure and consumer incentives are accelerating EV adoption nationwide. Additionally, China’s focus on export-driven EV production is strengthening its global position in the electric mobility industry.

The EV platform market in South Korea is poised to register remarkable growth due to strong technological innovation, leading battery manufacturers, and government-backed electrification initiatives. Hyundai and Kia are developing advanced modular EV platforms such as E-GMP, a dedicated battery electric vehicle platform to enhance efficiency and scalability. For instance, the top automaker of South Korea, Hyundai Motor Group increased its domestic investment by 19% in January 2025, reaching USD 16.65 billion for research and development for next-generation products, electrification of vehicles, and technology. The country’s dominance in lithium-ion battery production led by LG Energy Solution and SK On is driving platform advancements. Additionally, South Korea’s push for smart mobility and autonomous EVs is encouraging the adoption of next-generation EV platforms.

Europe Market Analysis

Europe's EV platform market is anticipated to garner a significant market share from 2026 to 2035 due to strict emission regulations, ambitious climate targets, and strong government incentives for electrification. Automakers such as Volkswagen, Stellantis, and Renault are investing in dedicated EV architectures to comply with the EU’s Fit for 55 policies. The rapid development of gigafactories and localized battery production is enhancing supply chain efficiency. Additionally, growing consumer demand for sustainable mobility and premium electric models is driving innovation in the region.

The EV platform market in Germany is growing due to strict government policies, heavy investments in R&D, and a well-established automotive industry. Leading automakers such as Volkswagen, BMW, and Mercedes Benz are developing dedicated EV platforms such as Volkswagen’s MEB and BMW’s Neue Klasse, to enhance efficiency and scalability. A recent example of Germany’s expanding EV platform market is Volkswagen’s unveiling of the ID. EVERY 1 on March 2025, an affordable electric vehicle priced around USD 20,800. This model aims to rejuvenate Volkswagen’s business and compete against an influx of budget-friendly China’s EVs. In addition, the government’s push for carbon neutrality by 2045, along with incentives for EV buyers and manufacturers is accelerating market growth.

The UK EV platform market is growing due to stringent emissions regulations, bans on new petrol and diesel cars by 2035, and increasing investment in electrification. Companies such as Jaguar Land Rover and Aston Martin are transitioning to fully electric models, relying on new EV platforms to compete in the premium segment. The government’s support for battery manufacturing including funding for gigafactories is enhancing local production capabilities. Additionally, the rising adoption of EVs in fleet and commercial sectors along with expanding charging infrastructure is fueling demand for advanced EV platforms.

Key EV Platform Market Players:

- Rivian

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Developments

- Regional Presence

- SWOT Analysis

- Open Motors

- REE Auto

- Saic Motor

- XAOS Motors

- BMW Group

- BYD Company Ltd

- Byton

- Canoo

- Volkswagen

- Volvo

- Chery

- Daimler

- Faraday Future

- Fisker

- Ford

- Geely

- Zotye

The EV platform market is highly competitive with major automakers such as Tesla, Volkswagen, and BYD leading the industry through dedicated architectures and advanced battery technology. Traditional OEMs such as General Motors, Hyundai, and Stellantis are investing heavily in scalable EV platforms to compete with emerging EV startups. Additionally, collaborations between automakers and battery manufacturers are driving innovation, efficiency and cost reductions in platform development. Here are some leading players in the EV platform market:

Recent Developments

- In March 2025, BYD, introduced an ultra-fast charging technology Super e-Platform, that includes a 1,000kW charging system. The new technology is capable of charging EVs to cover 470km of range in just five minutes, similar to the time to refuel a conventional internal combustion engine (ICE) car. The new charging system supports charging up to 1,000 volts and currents of up to 1,000 amps, enabling a charging power of 1,000 kW.

- In March 2025, Perseus, a British-headquartered premium EV brand, announced its entry into the market with a compact SUV, set to launch in Europe by late 2027. The company will use a scalable, cost-efficient business model and partner with major OEMs and tier-1 suppliers for production.

- Report ID: 7389

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

EV Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.