EV Charger Cellular Connectivity Market Outlook:

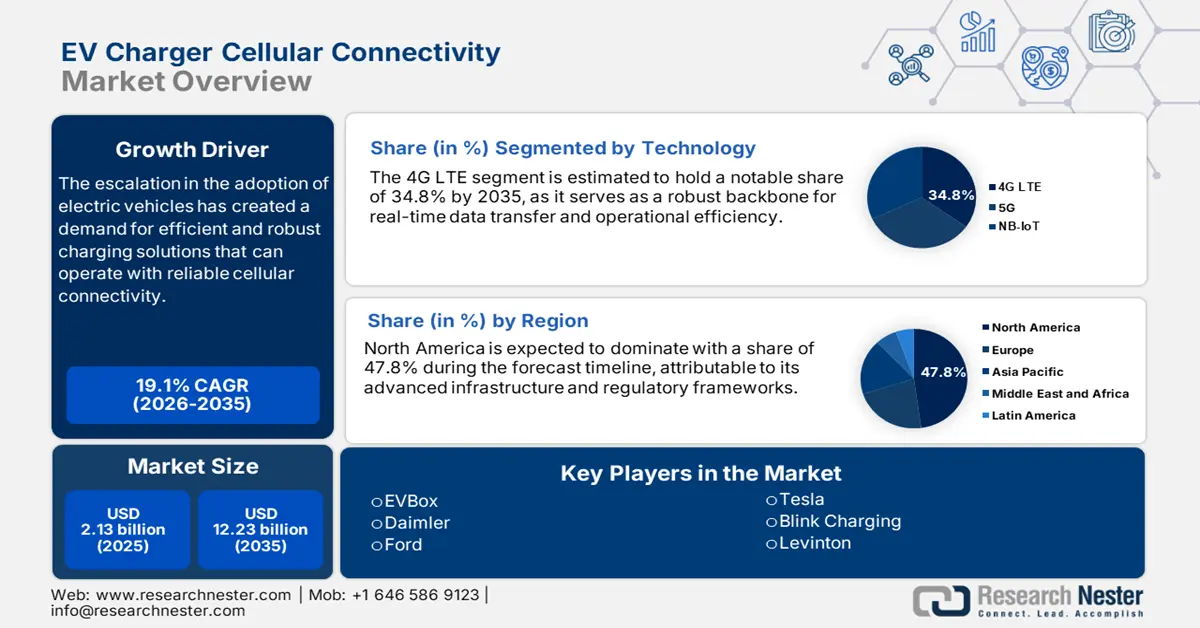

EV Charger Cellular Connectivity Market size was over USD 2.13 billion in 2025 and is anticipated to cross USD 12.23 billion by 2035, witnessing more than 19.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of EV charger cellular connectivity is estimated at USD 2.5 billion.

This rising traction in the market has increased due to the growth in electric vehicles and the expanding need for smart, networked charging solutions. For instance, according to the reports of the International Energy Agency, the sale of EVs in 2023 has increased up to 3.5 million compared to 2022, with a 35% surge with 14 million registered electric cars.

Furthermore, cellular connectivity plays a critical role in enabling real-time communication between the EV chargers and the central networks, thus making way for remote monitoring, diagnostics, and management of the charging infrastructure. This further boost market growth by incorporating support features such as dynamic pricing, load balancing, and over-the-air software updates. For instance, in September 2023, FLO tested and developed plug-and-charge and wireless charging technologies in collaboration with industry leaders Hubject and WiTricity, advancing the future of EV charging. In addition, with ambitious electrification and sustainability targets set by most major economies, the demand for robust, scalable, and secure charging networks will rise, especially considering the growing presence of the EV market worldwide.

Coupled with 5G technology and advancements in IoT, cellular connectivity further accelerates the ability to support the increasing complexity and scale of the EV charging ecosystem, from reliable, high-speed data transmission to critical real-time information exchange. These factors combine to position the cellular connectivity market for EV chargers as a central, driving factor in the electric mobility revolution more broadly. Another market-boosting factor is the need for environmental protection. In May 2023, the EU passed a landmark law requiring all new cars sold to have zero CO2 emissions by 2035. European countries are racing to prepare the infrastructure needed for fossil fuel-free mobility. Sweden is all set to build the world's first e-motorway as the stepping stone to an expansion of another further 3,000 km of electric roads by 2035.

Key EV Charger Cellular Connectivity Market Insights Summary:

Regional Highlights:

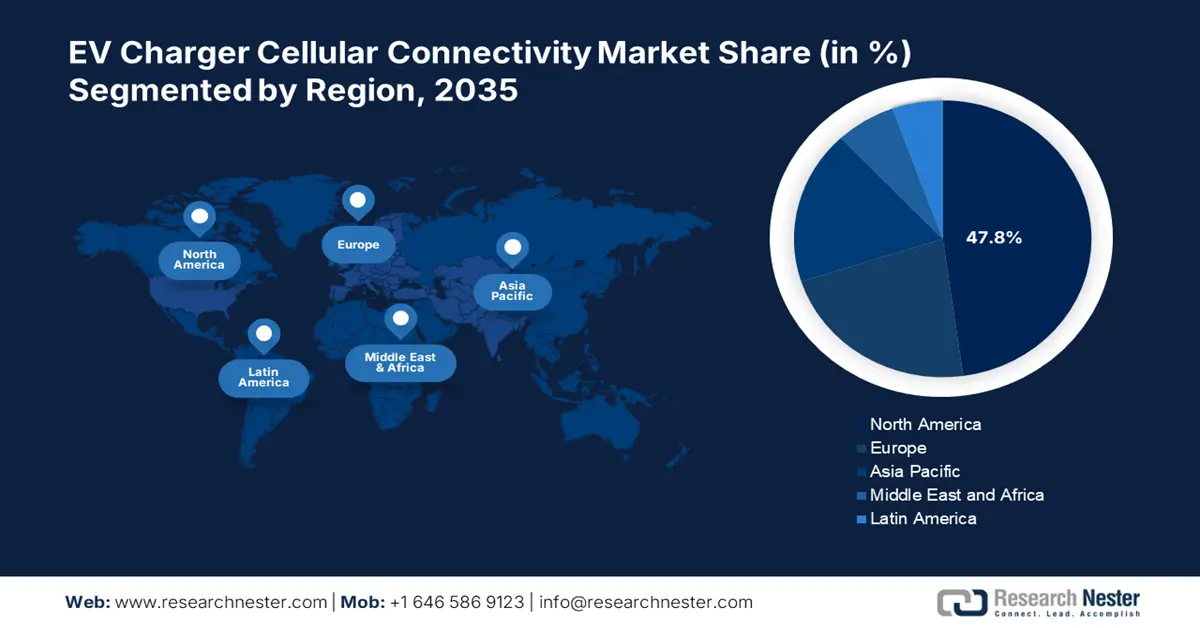

- North America leads the EV Charger Cellular Connectivity Market with a 47.8% share, supported by robust government initiatives and expanding EV infrastructure, enhancing growth prospects through 2026–2035.

- Asia Pacific’s EV charger cellular connectivity market is anticipated to grow rapidly by 2035, driven by investments in IoT, 5G, and connected EV infrastructure.

Segment Insights:

- The AC charger segment is projected to dominate from 2026 to 2035, driven by lower installation costs and seamless integration into existing electrical infrastructure.

- 4G LTE segment is expected to hold over a 34.8% share by 2035, driven by extensive network infrastructure supporting reliable, high-speed connectivity.

Key Growth Trends:

- Increasing focus on vehicle-to-grid (V2G) technology

- Expanding public charging infrastructure

Major Challenges:

- Interoperability issues

- Network coverage and reliability concerns

- Key Players: Leviton, Enel X, Blink Charging, Wallbox, Daimler, NIO, EVBox.

Global EV Charger Cellular Connectivity Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.13 billion

- 2026 Market Size: USD 2.5 billion

- Projected Market Size: USD 12.23 billion by 2035

- Growth Forecasts: 19.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

EV Charger Cellular Connectivity Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing focus on vehicle-to-grid (V2G) technology: With increasing developments and investments in V2G technology, the EV charger cellular connectivity market is likely to witness a boom. For instance, in November 2024, Nissan announced offering reasonably priced bidirectional charging on a few EV models by 2026. It developed vehicle-to-grid (V2G) technology to power their houses or sell the electricity stored in their car's battery back to the grid. Moreover, utilities are increasingly embracing the deployment of V2G technologies for enhancing energy security and sustainability. The inbuilt rising demand for low-latency cellular networks that can handle V2G interactions is likely to fuel the growth of EV charger cellular connectivity further.

- Expanding public charging infrastructure: As EV adoption accelerates, it is increasingly pivotal that public charging stations be extensively distributed and easily accessible. It facilitates EV owners' convenience and achieves the widespread deployment of vehicles. In addition, it provides data-driven insights to maximize charging station efficiency, reduce downtime, and improve charging station operations overall. For instance, in October 2024, Ensmart Power and Servotech collaborated to develop EV charging infrastructure. By pooling cutting-edge technology, the partnership sought to enhance the distribution network of EV chargers to meet the rising demand for environmentally friendly electric mobility options.

Challenges

-

Interoperability issues: The greatest issue with the EV charger cellular connectivity market is interoperability which makes it challenging to manage the integration of varied charging networks, vehicles, and service providers. In some cases, the same players produce different types of chargers and vehicles, interference results in communication protocols applied for all of them and the hardware and software standards contribute to the creation of compatibility barriers. This lack of standardization complicates the user experience, especially for cross-network charging, as customers may face problems in accessing and utilizing charging stations using different technologies.

- Network coverage and reliability concerns: Charging stations would undoubtedly encounter outages, delayed maintenance responses, or ineffective energy management as a result of disrupted service availability in such places with poor cellular coverage. Consequently, user trust in the infrastructure is being undermined. Further, network performance variability will affect such critical operations as load balancing, dynamic pricing, and integration of V2G (Vehicle to Grid) that would rely on high data transfer at a constant quality.

EV Charger Cellular Connectivity Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.1% |

|

Base Year Market Size (2025) |

USD 2.13 billion |

|

Forecast Year Market Size (2035) |

USD 12.23 billion |

|

Regional Scope |

|

EV Charger Cellular Connectivity Market Segmentation:

Technology (4G LTE, 5G, NB-IoT)

4G LTE segment is projected to capture EV charger cellular connectivity market share of over 34.8% by 2035, owing to an extensive 4G network infrastructure in all urban and rural geographies. As a relatively mature technology, 4G LTE supports reliable, high-speed connectivity, allowing real-time monitoring, payment processing, load balancing, and remote diagnostics. For instance, in November 2022, Blink by introducing 30 kW DCFC highlighted size and power output up to 100 amps and 1000 volts. Its architecture and responsiveness delivered more than 99% uptime and over-the-air firmware updates to the charging station that connects either with a 4G LTE cellular or Wi-Fi connection. Thus, 4G LTE remains the leading cellular connectivity option based on established coverage, reliability, and data capacity.

Charger Type (AC charger, DC charger, Wireless charger)

In the EV charger cellular connectivity market, AC chargers are projected to dominate through the forecast timeline attributable to the lower installation costs and easy fixation into existing electrical infrastructure. For instance, in January 2024, BT Group proposed an idea that could ensure that EVs are always within range of AC chargers. They begin piloting retrofits of the street to deploy around 60,000 curbside cabinets. Moreover, cellular connectivity in AC chargers supports functionalities such as remote monitoring, fault detection, dynamic pricing, and user authentication, which enhance operational efficiency and the user experience. Furthermore, AC electric vehicle charging stations are cheaper. Thus, AC chargers are preferred due to are mature and wide, leading to low costs of equipment.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Charger Type |

|

|

Connectivity Type |

|

|

Installation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

EV Charger Cellular Connectivity Market Regional Analysis:

North America Market Statistics

North America industry is anticipated to hold largest revenue share of 47.8% by 2035. In addition, advanced telecommunications infrastructure in the region provides reliable and scalable cellular connectivity solutions for charging stations in urban and rural settings. Thus, the market is likely to surge and witness an upscaling growth over the foreseeable years.

Robust government initiatives, the high penetration of EVs in the U.S., and ongoing infrastructure development are all likely to create a significant opportunity for growth in the market. For instance, in April 2023, the government announced building EV infrastructure, bringing supply chains home, and unleashing unprecedented private sector investments. In addition, USD 100 billion has already been announced for battery manufacturing to have 50 percent of all new vehicle sales be electric by 2030.

The market in Canada is growing because of a strong commitment to sustainability and government incentives. The federal and provincial governments of Canada have enacted a range of policies, including tax rebates, grants, and significant investment in public charging infrastructure. For instance, in September 2024, the Minister of Energy and Natural Resources announced federal investments of $14.9 million for 20 projects that will install more than 3,000 EV chargers across Canada.

Asia Pacific Market Analysis

Asia Pacific is the most rapidly growing region in the EV charger cellular connectivity market, driven by extensive charging infrastructure and technological developments of IoT, 5G, and cloud-based services making charging even more efficient and user-friendly. In addition, it is highly growing by having lots of electric vehicles and the demand for intelligent, connected infrastructures. Moreover, the local government has been promoting stricter emissions regulations and investing in incentives for adopting EVs, thereby increasing the demand for advanced charging solutions with cellular connectivity to monitor and manage in real-time.

China's market improvements in 5G technology and IoT are further enhancing the efficiency and scalability of EV chargers. Moreover, its favorable ecosystem helps the market to penetrate. For instance, in May 2024, BEV penetration (25% in the first quarter of 2024) is rising rapidly because of low manufacturing costs, fair-to-generous government support, and abundant affordable products. Thus, is expected to lead the market during the forecast period.

While the India EV charger cellular connectivity market is still in its nascent stage, demand for connected and scalable charging solutions will grow along with urbanization requiring efficient charging networks. In addition, the players in the country aim to expand their EVs. For instance, in December 2023, it was published in the report of Bain & Company that by 2030, EVs may capture more than 40% of India's car market and also reach revenues above $100 billion.

Key EV Charger Cellular Connectivity Market Players:

- Schneider Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EVBox

- NIO

- Daimler

- Tesla

- Blink Charging

- Enel X

- Leviton

- ChargePoint

The competitive environment in the EV charger cellular connectivity market is largely driven by well-established telecom companies, technology providers, and specialized firms rendering a collaborative approach toward efficient IoT solutions. For instance, in April 2024, Schneider Electric announced three eMobility solutions for the company, EVlink Pro DC 180kW charging stations, EcoStruxure, and EV Advisor EV charging management platform with added functionality for improving uptime and performance. They also focus on embedding smart connectivity functions into charging infrastructure to refine users' experience.

Here’s the list of some key players:

Recent Developments

- In October 2024, Evology Charging and CSL Group expanded their partnership through the roll-out of rSIM technology to revolutionize operations of electric vehicle charge points and drive new heights in reliability and efficiency. Over 9 million electric vehicles are forecasted to be on UK roads by 2030.

- In August 2024, SAMSUNG SDI and General Motors finalized an agreement to establish a battery joint venture in the U.S. These two companies strategized to invest around USD 3.5 billion in an EV battery plant with an initial capacity of 27GWh up to 36GWh and a production target of 2027.

- Report ID: 6682

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.