Ethylene Tetrafluoroethylene Market Outlook:

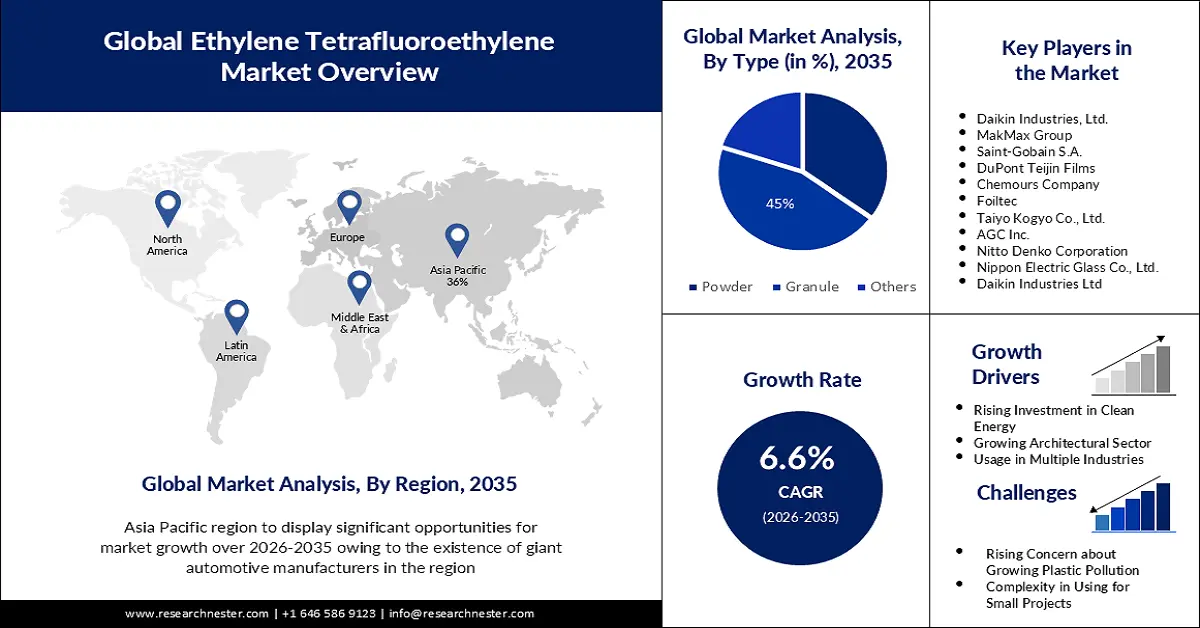

Ethylene Tetrafluoroethylene Market size was over USD 489.55 million in 2025 and is anticipated to cross USD 927.62 million by 2035, growing at more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethylene tetrafluoroethylene is assessed at USD 518.63 million.

The growth of the market can be attributed to the increasing demand for ETFE as a substitute for glass and conventional materials in various end-use industries as the ETFE foil is considered a more ecological and environmentally sustainable solution than glass because it requires much less energy than glass production and needs fewer structure materials to support the whole system. Also, as per findings, ETFE transmits more light, and insulates better, and its installation costs are about 20 to 70% less than glass.

The growth in the nuclear industry as well as the increasing demand for electricity worldwide is predicted to present the potential for expansion for global ethylene tetrafluoroethylene market over the projected period. It was observed that electricity consumption worldwide has been growing persistently over the past half a century, reaching more than 25,000 terawatt-hours in 2021.

Key Ethylene Tetrafluoroethylene Market Insights Summary:

Regional Highlights:

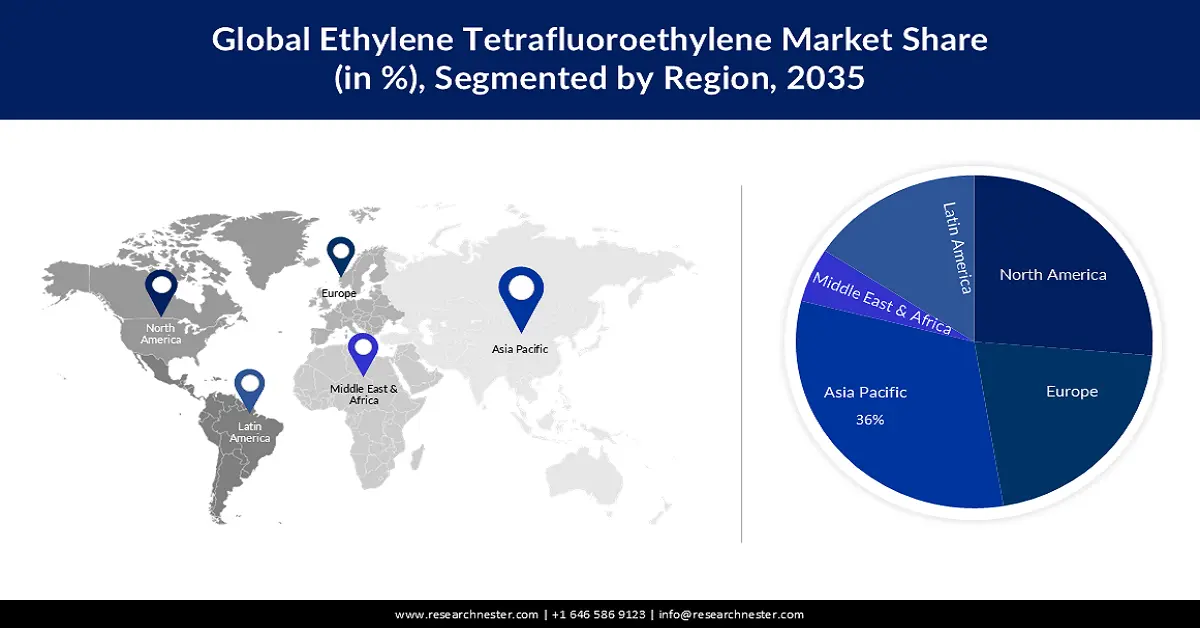

- Asia Pacific ethylene tetrafluoroethylene (ETFE) market will secure around 36% share by 2035, driven by demand for fluoropolymers in the automotive sector, especially in EV battery parts.

- North America market will achieve a 30% share by 2035, driven by infrastructural development and rising use of ETFE in industrial applications.

Segment Insights:

- The granule segment in the ethylene tetrafluoroethylene market is projected to achieve a 45% share by 2035, fueled by the growing electronics and construction industries' demand for corrosion-resistant and durable materials.

- The films & sheets segment in the ethylene tetrafluoroethylene market is forecasted to secure a 35% share by 2035, driven by increasing spending on renewable energy and the use of ETFE in recyclable photovoltaic films.

Key Growth Trends:

- Growing Demand from the Aviation and Aerospace Industries

- Increasing Investment in Clean Energy

Major Challenges:

- Concern About Plastic Pollution

- Inability to Curb Sound Transmission

Key Players: Daikin Industries, Ltd., Saint-Gobain S.A., DuPont Teijin Films, Chemours Company, Foiltec, Taiyo Kogyo Co., Ltd., AGC Inc., Nitto Denko Corporation, Nippon Electric Glass Co., Ltd., Daikin Industries Ltd, MakMax Group.

Global Ethylene Tetrafluoroethylene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 489.55 million

- 2026 Market Size: USD 518.63 million

- Projected Market Size: USD 927.62 million by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Ethylene Tetrafluoroethylene Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand from the Aviation and Aerospace Industries – These industries use ETFE for wire coatings and fuel efficiency. The demand for fluoropolymers such as ETFE is heightening in the aerospace industry with the rising need to employ far lighter materials for aerospace construction so as to reduce the jet fuel demand globally. Lighter materials reduce the weight, improving the agility and speed of aerospace craft besides reduction of needed fuel quantities. The International Energy Agency predicts that jet fuel demand is anticipated to rise at an annual average of 7.2 million barrels a day in 2023 worldwide, compared to 6.1 million in 2022.

- Increasing Investment in Clean Energy – for instance, it was found that the energy investment globally increased by 8% in 2022 to reach USD 2.4 trillion with the anticipated rise coming mainly in clean energy. Moreover, solar PV was observed to account for 3.6% of total global electricity generation in 2021, remaining the third largest renewable electricity technology behind hydropower and wind. This transition is expected to boost the ETFE market growth as ETFE solar panels have widespread applications from small solar collectors to industrial PV systems.

- Prospering Architectural Sector – The boom in the architectural sector can be affirmed by the rising employment opportunities in the sector. For instance, according to the U.S. Bureau of Labor Statistics (BLS), architecture design careers are projected to grow by 3% between 2022-2030. Moreover, the growing use of ETFE in modern architectural projects to build stadiums, polytunnels, and other such structures owing to its cost-efficiency and toughness is anticipated to propel the global ethylene tetrafluoroethylene market in the upcoming years. For instance, as per studies, it is found that ETFE has high strength and is expected to bear a weight that is 400 times its own weight.

Challenges

- Concern About Plastic Pollution – ETFE though claimed "natural" building material is plastic in reality owing to which its widespread utilization is debatable, hampering its market growth. With plastic pollution becoming a major global threat the demand for ETFE is anticipated to hamper over the forecast period. It is observed that of all plastic waste generated worldwide only 9% of plastic gets recycled. Moreover, 24 billion pounds of plastic enter the oceans every year gradually creating a plastic ocean that is responsible for killing over 1 million marine animals.

- Inability to Curb Sound Transmission

- Complexity in Use for Small Projects

Ethylene Tetrafluoroethylene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 489.55 million |

|

Forecast Year Market Size (2035) |

USD 927.62 million |

|

Regional Scope |

|

Ethylene Tetrafluoroethylene Market Segmentation:

Application Segment Analysis

By the end of 2035, Films & sheets segment is set to hold ethylene tetrafluoroethylene market share of over 35%, attributed to the rising spending on renewable energy worldwide as well as the increasing use of ETFE in photovoltaic (PV) top-sheet films as these films are known for their self-cleaning property and are recyclable. It was found that in the United States, nearly 2.8% of the electricity generated was powered by solar energy, with solar accounting for over 13% of electricity generated by renewable sources in 2021.

Product Type Segment Analysis

By the end of 2035, powder segment is set to capture ETFE market share of around 45%. attributed to the growing electronics as well as the construction industry worldwide with skyrocketing demand for corrosion resistance parts, insulation parts, wires and cables insulation jackets, construction films, valve lining, and many such products worldwide. For instance, it was found that the construction industry in the United States accounted for around 4.3% of the U.S. GDP in 2021. Moreover, as ETFE foils are known to have a lifespan of more than 30 years and are unaffected by UV light, environmental weathering, and pollution, it is widely becoming the most important building material for the construction industry.

By the end of 2035, Granule segment is set to capture ETFE market share of around 45%, attributed to the growing electronics as well as the construction industry worldwide with skyrocketing demand for corrosion resistance parts, insulation parts, wires and cables insulation jackets, construction films, valve lining, and many such products worldwide. For instance, it was found that the construction industry in the United States accounted for around 4.3% of the U.S. GDP in 2021. Moreover, as ETFE foils are known to have a lifespan of more than 30 years and are unaffected by UV light, environmental weathering, and pollution, it is widely becoming the most important building material for the construction industry.

Our in-depth analysis of the global ethylene tetrafluoroethylene market includes the following segments:

|

By Technology |

|

|

By Product Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylene Tetrafluoroethylene Market Regional Analysis:

APAC Market Insights

The ETFE market in Asia Pacific is projected to be the largest with a share of about 36% by the end of 2035, attributed majorly to the increasing demand for fluoropolymers such as PVDF, PTFE, ETFE, and others from the automotive industries as these materials are widely used in lithium-ion batteries (LiB), fuel systems, brake systems, and for brake wear sensors respectively. As per findings, in 2022, Mainland China was the dominant consumer of global fluoropolymers, representing 37% of PTFE consumption and around 48% of another fluoropolymer consumption. Hence, with the growing presence of giant automotive manufacturers in the region as well as the increasing production volume of vehicles, the market for ethylene tetrafluoroethylene in the region is also anticipated to surge together with other types of fluoropolymer market.

North American Market Insights

North American region is projected to account for ethylene tetrafluoroethylene market share of more than 30% by the end of 2035, attributed majorly to the radically increasing infrastructural development as well as the growing technological advancements in the construction industries. In addition to this, the increasing demand for ETFE for industrial coatings as well as its rising use as oil and gas downhole cable and umbilical is also expected to accelerate the market growth in the region in the coming years. Around 1.8 trillion dollars were estimated to be the size of the U.S. construction sector in 2022.

Ethylene Tetrafluoroethylene Market Players:

- MakMax Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Daikin Industries, Ltd.

- Saint-Gobain S.A.

- DuPont Teijin Films

- Chemours Company

- Foiltec

Recent Developments

- February 2021 - Compagnie de Saint-Gobain S.A. a French multinational corporation announced its plan to invest more than USD 400 million to expand its production capacities in the United States at 4 locations in the Southern US and in California.

- December 2020 - For the design, creation, and installation of the ETFE film cushion roof at Macquarie University in Northeast Sydney, MakMax Australia was hired.

- Report ID: 3776

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethylene Tetrafluoroethylene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.