Ethylene Glycol Market Outlook:

Ethylene Glycol Market size was over USD 21.81 Billion in 2025 and is projected to reach USD 34.86 Billion by 2035, growing at around 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethylene glycol is evaluated at USD 22.75 Billion.

The primary growth factor for the market is the expansion of the automotive sector. The various kinds of benefits offered by ethylene glycol are very much beneficial for varied purposes in the automobile sector. The latest report suggests that the revenue generation by the global automotive industry to reach approximately USD 9 trillion by 2030.

Ethylene glycol is being used to manufacture polyester fibers as a raw material. This raw material works efficiently as a coolant in automobile engines. Further, being a heat transfer agent, it helps in cooling down the parts of a vehicle. Furthermore, mixing ethylene glycol with water has the added advantage of eliminating corrosion, preventing acid degradation, and the growth of certain bacteria. Thus, the rise in the number of vehicles across the world is anticipated to garner high revenues in the ethylene glycol market by 2033. Recent reports estimated that by the end of the first quarter of 2022, approximately 1.50 billion vehicles were on roads worldwide. Out of these, around 1 billion were estimated to be passenger cars. In addition to the other factors, ethylene glycol is being heavily used as feedstock in a wide range of many end-use industries. It is also being used as PET bottle resins, polyester fiber, and films. Also, it has usage in the textile sector and apparel industries as well as manufacturing, home furnishings, carpets, and rugs. Hence, the wide utilization of ethylene glycol owing to the high potential for polyester applications in the upcoming years.

Key Ethylene Glycol Market Insights Summary:

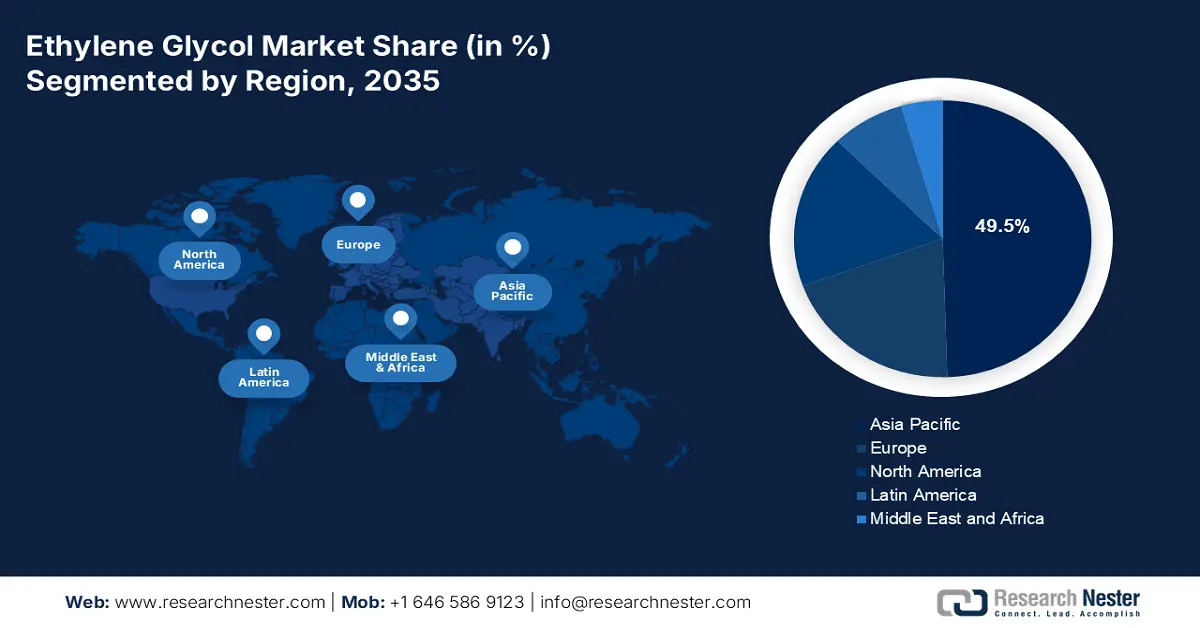

Regional Highlights:

- The Asia Pacific ethylene glycol market will hold around 49.5% share by 2035, attributed to rising population and demand in textile and automotive sectors.

- The North America market will register significant growth from 2026 to 2035, driven by rising R&D investments and government support.

Segment Insights:

- The pet segment in the ethylene glycol market is expected to achieve a remarkable CAGR through 2035, influenced by changing consumer lifestyles and rapid expansion of the packaging industry.

- The textile segment in the ethylene glycol market is expected to hold the highest market share by 2035, driven by large production of textile fibers and rapid adoption of polyester fibers.

Key Growth Trends:

- Boom in Chemical Industry

- Increased Expenditure in Research & Development

Major Challenges:

- High Manufacturing Costs

- Fluctuation in Prices of Raw Materials

Key Players: Reliance Industries Limited, LOTTE Chemical Corporation, Kuwait Petroleum Corporation, Akzo Nobel N.V., Clariant International Ltd, Formosa Plastics Corporation, U.S.A., Exxon Mobil Corporation, Huntsman International LLC, SABIC, BASF.

Global Ethylene Glycol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.81 Billion

- 2026 Market Size: USD 22.75 Billion

- Projected Market Size: USD 34.86 Billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 9 September, 2025

Ethylene Glycol Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid Extension in Textile Industry - Ethylene glycol is the primary component in producing mono-ethylene glycol which is essential for producing polyester fabrics. These are then utilized in textile and apparel manufacturing, as well as garment manufacturing, home furnishings, carpets, and rugs. Hence, the expansion of the textile industry is expected to bring high potential to the market. For instance, the global textile industry accounted for around USD 920 billion in 2018, and is further projected to reach approximately USD 1,230 billion by 2024.

-

Rise in Demand and Production of Vehicles - Ethylene glycol is being widely used as an antifreeze in automobile engines. Another advantage such as a lower freezing point than water is being used in cooling automobile radiators throughout the winter. Thus, growing vehicle production and sales volumes of vehicles are responsible for the increase in ethylene glycol consumption. As per the Organization of Motor Vehicle Manufacturers (OICA), the global production of vehicles was 80,145,988 units in 2021 around the world. This is an increase from 77,711,725 units of vehicles in 2020.

-

Boom in Chemical Industry – Rapid industrialization and development in India have propelled the Indian chemical industry to reach a revenue of USD 300 billion by 2025.

-

Increased Expenditure in Research & Development – Key players of the global market is investing huge amounts in developing technologically developed activities such as ethylene glycol in the upcoming years. Thus, the high expenditure on research and development activities is expected to create a positive outlook in the upcoming years. The World Bank released the global expenditure made in the Research & Development (R&D) sector which showed that in 2020 it was 2.63% of the total GDP. This is an increase from year 2.14% of the total GDP in 2016.

Challenges

-

High Manufacturing Costs – Although ethylene glycol has many benefits, the production process requires huge investments. Such high manufacturing costs subsequently result in increased costs for the end users. This trend is anticipated to lower the adoption rate of products manufactured with ethylene glycol owing to the presence of a large population base with low and middle income. Hence, it is estimated to hamper the market growth during the assessment period.

-

Fluctuation in Prices of Raw Materials

-

Stringent Regulatory Policies

Ethylene Glycol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 21.81 Billion |

|

Forecast Year Market Size (2035) |

USD 34.86 Billion |

|

Regional Scope |

|

Ethylene Glycol Market Segmentation:

End-user Segment Analysis

The global ethylene glycol market is segmented and analyzed for demand and supply by end-use industry into textile, automotive, packaging, oil & gas, transportation, medical, and others. Out of these, the textile segment is expected to garner the highest market shares by 2035, owing to the large production of textile production. According to recent data, the worldwide production volume of textile fibers rose from 100 thousand metric tons in 2017 to 110 thousand metric tons in 2020. In addition, the rapid adoption of polyester fibers owing to its usage as a cushioning material in pillows, comforters, and upholstery padding is consequently projected to drive the segment for ethylene glycol in the forecast.

Application Segment Analysis

The global ethylene glycol market is also segmented and analyzed for demand and supply by application into polyester fibers, PET, antifreeze & coolants, films, and others. Out of these, the PET segment is projected to hold the most significant share of the market with a remarkable CAGR value during the forecast period. As a result of changing lifestyles of consumers and the rapid expansion of the packaging industry, the usage of polyethylene terephthalate (PET) is estimated to grow for a variety of consumer goods products. PET is being widely used for producing food containers and bottles which is effective in storing food items for a long period of time. Also, various advantages offered by PET containers such as low toxicity, high longevity, enhanced strength, and robust durability make it an ideal option for manufacturers and producers.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Manufacturing Process |

|

|

By Application |

|

|

By End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylene Glycol Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 49.5% market share by 2035. The primary reason for the market growth in the region is the rising population along with the increasing demand and manufacturing of textiles. The recent statistics revealed that China was the top-ranked global textile exporter in 2021 with a value of approximately USD 120 billion, which is equivalent to 55% of the total textile export sector in Asia. Bangladesh is also a leading textile exporter with a value of around USD 40 billion. Further, the expansion of the automotive industry in the region is another growth factor for the utilization of ethylene glycol. As per recent estimates, India is set to become 3rd largest automotive industry in the world. Also, India’s automotive industry generated almost USD 220 billion in 2021, which is equivalent to 7% of total India’s GDP.

North American Market Insights

On the other hand, the North American ethylene glycol market is also projected to grow significantly on the account of the presence of major key players and the various end-use industries in the region. Furthermore, the rising investments in the research and development activities in the region along with the rising government support for aiding the development of manufacturing facilities of ethylene glycol is considered to impetus a significant revenue generation in the forecast period.

Ethylene Glycol Market Players:

- Reliance Industries Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LOTTE Chemical Corporation

- Kuwait Petroleum Corporation

- Akzo Nobel N.V.

- Clariant International Ltd

- Formosa Plastics Corporation, U.S.A.

- Exxon Mobil Corporation

- Huntsman International LLC

- SABIC

- BASF

Recent Developments

-

Reliance Industries Ltd has agreed to acquire a majority stake in SenseHawk Inc. for a total transaction amount of USD 32 million.

-

LOTTE Chemical Corporation joined hands with joint tests Syzygy and Sumitomo for ammonia photolysis. This partnership will execute the world’s largest ammonia pyrolysis technology test.

- Report ID: 4409

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethylene Glycol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.