Ethernet PHY Chip Market Outlook:

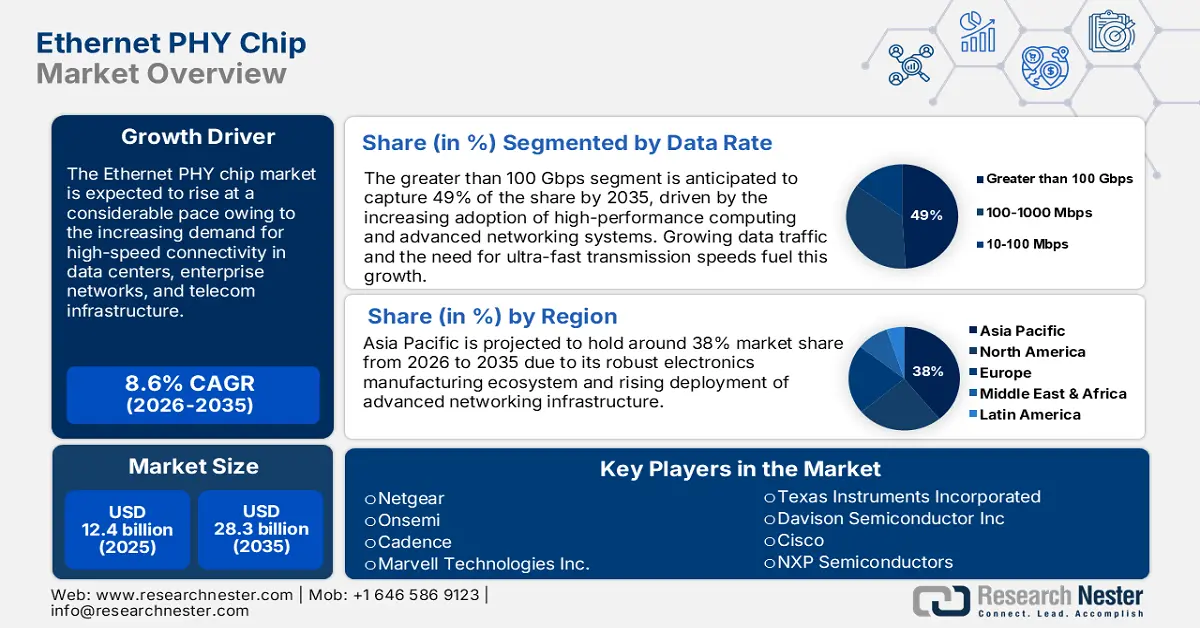

Ethernet PHY Chip Market size was over USD 12.4 billion in 2025 and is anticipated to cross USD 28.3 billion by 2035, growing at more than 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethernet PHY chip is assessed at USD 13.36 billion.

The ethernet PHY chip market shows significant expansion owing to high-speed networking improvements as well as rising IoT device needs alongside digital infrastructure development. In August 2024, the LAN887x PHY transceivers became part of Microchip Technology's Single-Pair Ethernet (SPE) lineup to deliver 1000 Mbps speeds along with increased cable reach of up to 40 meters. These transceivers meet automotive and industrial application demands through functional safety compliance with ISO 26262 and deliver advanced diagnostics together with reduced power consumption. The industry demonstrates its commitment to scalable networking solutions throughout multiple sectors through the integration of complete SPE systems that feature microcontrollers along with development tools.

The ethernet PHY chip market landscape continues to evolve due to strategic government initiatives and essential partnerships. Synopsys launched the first 1.6T ethernet IP solution on the market in February 2024 to support high-bandwidth requirements of hyperscale data centers and artificial intelligence systems. The innovation delivers high performance alongside energy efficiency, which results in improved data transmission speeds. Digital infrastructure receives top investment priority from governments across different nations. According to Research Nester, there was a 20% growth in worldwide telecommunication investment in 2023, indicating stronger demand for next-generation ethernet PHY chips to fulfill expanding connectivity needs.

Key Ethernet PHY Chip Market Insights Summary:

Regional Highlights:

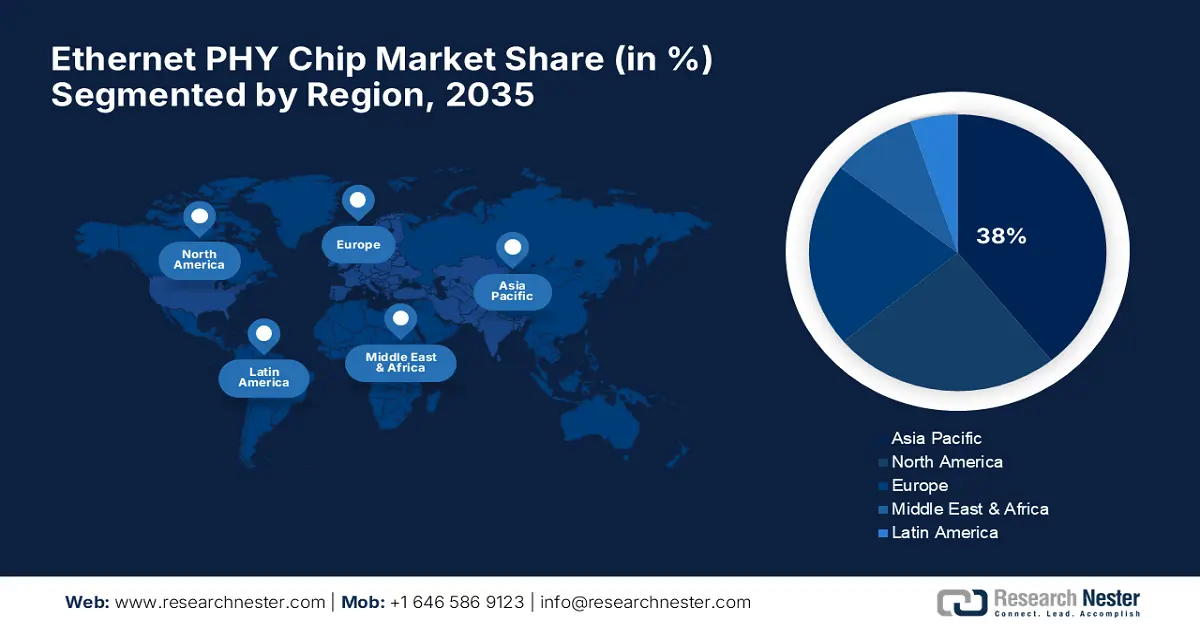

- Asia Pacific leads the Ethernet PHY Chip Market with a 38% share, driven by strong growth in telecommunications and automotive industries, ensuring robust growth through 2026–2035.

- The ethernet PHY chip market in North America is poised for substantial growth by 2035, attributed to progress in data center technology, automotive advancements, and industrial automation.

Segment Insights:

- The Automotive segment is projected to hold over 35% share by 2035, driven by the growth of connected and autonomous vehicles requiring advanced Ethernet PHY chips.

- The Greater than 100 Gbps segment is projected to achieve over 49% share by 2035, fueled by demand from hyperscale data centers and AI-driven workloads.

Key Growth Trends:

- Rising demand for high-speed networking

- Increasing adoption of IoT devices

Major Challenges:

- Data privacy and security concerns

- Supply chain disruptions

- Key Players: Netgear, Onsemi, Cisco, NXP Semiconductors, Renesas Electronics Corp, Microchip Technology Inc., Cadence, Marvell Technologies Inc, Texas Instruments Incorporated, Davison Semiconductor Inc, Barefoot Networks, and Silicon Laboratories.

Global Ethernet PHY Chip Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.4 billion

- 2026 Market Size: USD 13.36 billion

- Projected Market Size: USD 28.3 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, South Korea, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Ethernet PHY Chip Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for high-speed networking: Data traffic expansion owing to cloud computing, along with video streaming services and artificial intelligence workloads, requires more high-speed ethernet PHY chips. The launch of Synopsys's 1.6T Ethernet IP solution in February 2024 targeted the requirements of data-intensive applications. The growth of global 5G networks, along with Wi-Fi 7 technologies, creates essential demand for ethernet PHY chips that support higher bandwidth applications in enterprise and consumer markets. The shift demonstrates how next-generation digital ecosystems depend increasingly on networks that combine high throughput with low latency.

- Increasing adoption of IoT devices: Advanced ethernet PHY chips have become necessary due to widespread IoT growth in the healthcare and automotive sectors along with industrial automation. MaxLinear launched 2.5G multi-port switches and octal-port PHYs that cater to IoT environments during May 2024. The functionalities of these chips deliver both dependable connectivity solutions and scalable network performance for IoT network requirements. The growing number of IoT devices necessitates ethernet PHY chips to serve as key enablers for smooth communication in expanding connected ecosystems.

- Automotive ethernet expansion: Ethernet PHY technologies have discovered vast new opportunities attributed to the automotive industry's swift transformation toward vehicles that are both connected and autonomous. Texas Instruments launched its DP83TG721-Q1 transceiver in December 2024 for automotive ethernet high-speed communication support. The device features both a small footprint and minimal power usage, which makes it ideal for sophisticated in-vehicle networking systems. The automotive industry adopts ethernet-based solutions across multiple domains because they support safety features together with infotainment and autonomous driving capabilities to define the next generation of vehicle connectivity.

Challenges

- Data privacy and security concerns: The growing integration of ethernet PHY chips into connected systems leads to mounting worries about data privacy and cybersecurity threats. When connected devices contain security flaws, they enable unauthorized access and data breaches that lead to system failures and create substantial organizational risks. Manufacturers and users must prioritize security through advanced encryption protocols while implementing secure firmware updates and following strict regulatory standards to tackle these challenges.

- Supply chain disruptions: Ethernet PHY chip production faces continuous challenges from supply chain problems, which create manufacturing delays due to essential component shortages. International semiconductor production shortages and geopolitical disputes alongside logistical hurdles add more difficulties to these production problems. Businesses are building regional production sites and spreading their supplier networks to strengthen operational stability and satisfy rising ethernet PHY chip requests from multiple sectors.

Ethernet PHY Chip Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 12.4 billion |

|

Forecast Year Market Size (2035) |

USD 28.3 billion |

|

Regional Scope |

|

Ethernet PHY Chip Market Segmentation:

Data Rate (10-100Mbps, 100-1000Mbps, and Greater than 100 Gbps)

Greater than 100 Gbps segment is set to hold ethernet PHY chip market share of over 49% by the end of 2035, as hyperscale data centers and AI-driven workloads depend heavily on the speed. In February 2024, Synopsys launched its 1.6T ethernet IP solution which achieves ultra-high-speed data transmission through unmatched throughput performance and minimal latency. As 5G networks grow rapidly alongside edge computing development this segment proves vital for handling next-generation connectivity requirements. The rising demand for real-time analytics across financial and healthcare sectors shows why ethernet PHY chips that deliver more than 100 Gbps speeds are essential.

Application (Telecom, Consumer Electronics, Automotive, Enterprise Networking, and Industrial Automation)

By 2035, automotive segment is set to capture over 35% ethernet PHY chip market share by leveraging ethernet-based networks to support connected and autonomous vehicles. In December 2024, Texas Instruments launched a small-scale ethernet PHY transceiver specifically designed for fast automotive communications which enables flawless data transmission in sophisticated systems. The development of electric vehicles and intelligent mobility systems demonstrates modern cars need powerful networking systems. Vehicle-to-everything (V2X) communication systems adoption highlights the important position ethernet PHY chips occupy in the development of automotive connection networks.

Our in-depth analysis of the global ethernet PHY chip market includes the following segments:

|

Data Rate |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethernet PHY Chip Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific ethernet PHY chip market is set to hold revenue share of more than 38% by 2035, as it has experienced strong growth in both the telecommunications and automotive industries. The region’s digital transformation agenda, which includes 5G deployments and industrial IoT development, drives high-performance ethernet solution requirements. Regional governments are pouring resources into smart manufacturing projects which speeds up adoption rates. Asia Pacific stays at the forefront of developing ethernet technologies while driving global innovation through major investments in research and development and semiconductor production.

India ethernet PHY chip market shows significant growth owing to government-supported programs that strengthen the semiconductor and networking sectors. The swift expansion of 5G network structures has intensified the need for sophisticated ethernet solutions. The Indian government launched a USD 1.6 billion Production Linked Incentive (PLI) scheme investment in August 2024 to support electronics manufacturing, including semiconductor components. The expanding implementation of smart city and industrial automation systems speeds up ethernet PHY chip adoption because these chips provide essential seamless connectivity capabilities. Global tech giants are showing greater interest in India while the country establishes itself as an important center for networking development.

China strengthens its position as a key player in the ethernet PHY chip market while technological progress in automotive systems and industrial automation continues. The Chinese government initiated a national semiconductor R&D program in October 2024 with a USD 5 billion investment to speed up networking hardware innovation development. The expanding IoT applications combined with a strong 5G ecosystem within the country present important opportunities for ethernet technology developments. The smart manufacturing sector of China keeps implementing ethernet solutions that improve productivity while lowering latency as part of their Industry 4.0 strategy. The expansion of native semiconductor production capabilities strengthens national market leadership on the world stage.

North America Market Analysis

North America ethernet PHY chip market is poised to register a steady growth rate till 2035, due to progress in data center technology along with automotive advancements and industrial automation systems. The deployment of AI technologies alongside cloud infrastructure development increases the need for ethernet solutions to support both high speed and low latency. 5G deployment and IoT development across the region continue to support the expansion potential of the ethernet PHY chip market. The development of ethernet chip technologies benefits from growing partnerships between technology companies and government organizations. Current trends develop North America into a leading center for advanced semiconductor technology development which opens new markets for producers.

The U.S. leads technological progress through projects like the January 2025 Stargate artificial intelligence initiative, which intends to build 20 data centers driven by artificial intelligence. The project reveals critical requirements for superior networking solutions that increase market demand for ethernet PHY chips. U.S. stands as a worldwide leader in ethernet innovation due to the spread of AI, IoT, and cloud computing throughout various industries. Substantial investments are flowing into semiconductor manufacturing due to government incentives, which enhance the domestic market's strength.

Players in North America ethernet PHY chip market see Canada as an essential player owing to its funding of smart city developments and 5G network construction. In December 2024 the government announced a digital transformation initiative worth USD 2 billion that allocates funds to develop high-speed communication networks. Healthcare expansions, along with smart transportation systems, generate new needs for sophisticated networking technology. Canada demonstrates its dedication to Ethernet-based innovation through its promotion of sustainable data centers that use renewable energy sources.

Key Ethernet PHY Chip Market Players:

- Netgear

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Onsemi

- Cadence

- Marvell Technologies Inc.

- Texas Instruments Incorporated

- Davison Semiconductor Inc

- Cisco

- NXP Semiconductors

- Renesas Electronics Corp

- Microchip Technology Inc.

- Barefoot Networks

- Silicon Laboratories

The ethernet PHY chip market operates under intense competition where Netgear, Onsemi, Cisco, NXP Semiconductors, Microchip Technology Inc., and Marvell Technologies dominate as key market leaders. Leading companies channel their R&D efforts into creating advanced high-speed networking technology alongside efficient energy designs to serve multiple industry needs. These companies use AI and machine learning to improve product performance while shortening communication delays as the ethernet PHY chip market continues to progress.

Aquantia introduced the first FPGA-programmable multi-gigabit ethernet PHY device to the industry in November 2024. The innovation presents developers with flexible tools to modify Ethernet setups according to changing network standards. The development of these technologies shows how competitive markets strive to create robust and adaptable solutions for contemporary network systems and digital applications. FPGA programmability trends represent an industrial transition to adaptable devices that will meet future requirements across international markets.

Here are some leading players in the ethernet PHY chip market:

Recent Developments

- In December 2024, Synopsys launched a complete 1.6-terabit Ethernet IP solution, designed to meet the high-bandwidth requirements of AI and hyperscale data center chips. This comprehensive solution facilitates faster data processing for AI-driven workloads. It addresses critical bottlenecks in hyperscale environments, enabling seamless scalability.

- In November 2024, Siliconally GmbH introduced the SinglePHY 100BASE-T1 22FDX, an automotive Ethernet PHY IP designed for energy efficiency and compactness. The IP complies with IEEE 802.3-2022 standards and offers ultra-low power consumption. This makes it a perfect fit for space-constrained automotive designs requiring advanced connectivity solutions.

- Report ID: 7072

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethernet PHY Chip Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.