Ethanol Vehicle Market Outlook:

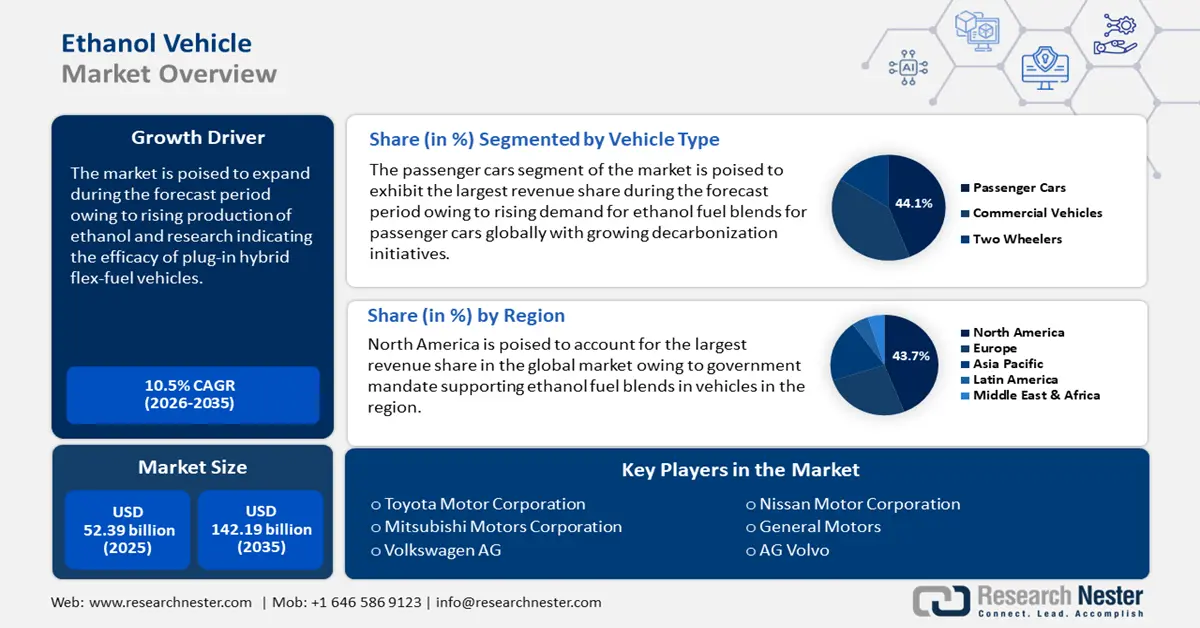

Ethanol Vehicle Market size was over USD 52.39 billion in 2025 and is poised to exceed USD 142.19 billion by 2035, witnessing over 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ethanol vehicle is estimated at USD 57.34 billion.

A major driver of the ethanol vehicle market is the advancements in flexible-fuel vehicles (FFVs) designed to operate on gasoline, ethanol, or any blend. The increase in adoption of FFVs is expected to drive the production demand for ethanol fuel blends boosting the sector’s growth. In June 2024, the Renewable Fuels Association released a study documenting the environmental and economic benefits of the world’s first plug-in electric hybrid flex fuel vehicle (PHEFFV). The study took into account rigorous emissions testing, 34 thousand miles of real-world driving, and lifecycle greenhouse gas analysis to offer results that PHEFFV offers benefits over electric vehicles (EVs). With the global push to radically reduce emissions, the commercial production of PHEFFVs is projected to drive adoption owing to the benefits it provides over EVs which augurs well for the ethanol vehicle sector.

Increasing government support is a significant factor in the ethanol vehicle market’s growth. With studies indicating the benefits of ethanol blends, governments have amped their programs to incentivize ethanol projects. The U.S. Department of Energy states that E8 with 83 ethanol content has about 27 less energy per gallon than gasoline, and ethanol vehicles running on higher ethanol blends are poised to boost the fuel economy owing to heightened engine efficiency. In terms of government-backed incentives, in April 2023, the U.S. Environmental Protection Agency (EPA) issued an emergency fuel waiver for E15 gasoline blended with 15% ethanol to be sold during the summer driving season in a bid to offer consumers more choices at the pump and mitigate the impact of the Russia and Ukraine conflict in fuel prices.

E15 is comparatively cheaper than gasoline which is expected to drive adoption and benefit the ethanol vehicle market. Furthermore, the U.S. remains a major market in ethanol vehicles, and favorable market trends in the U.S. stand to impact the global market. Additionally, countries are investing to improve the supply chain of ethanol to mitigate dependence on imports and build a robust domestic supply chain. For instance, in October 2024, the U.S. Department of Agriculture (USDA) announced grants worth USD 239 million to improve access to domestic biofuels in the country. The ethanol vehicle industry is expected to leverage the favorable trends of countries investing to increase biofuel production and increasing push for FFVs to maintain its robust growth by the end of the forecast period.

Key Ethanol Vehicle Market Insights Summary:

Regional Highlights:

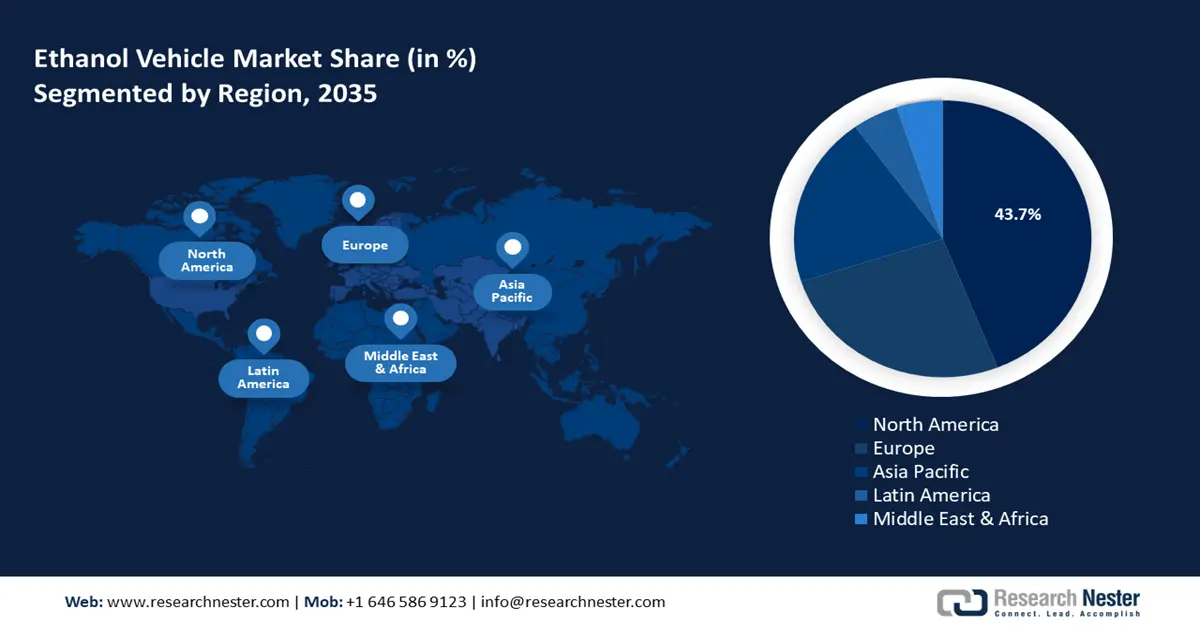

- North America ethanol vehicle market will account for 43.70% share by 2035, driven by rising government support and investment to increase ethanol production.

- Europe market grows rapidly CAGR during the forecast period 2026-2035, attributed to mandates supporting ethanol blends in fuel driving adoption of biofuels.

Segment Insights:

- The passenger cars segment in the ethanol vehicle market is forecasted to attain a 44.10% share by 2035, fueled by rising demand for ethanol blend fuels and government mandates worldwide.

Key Growth Trends:

- Growing adoption of renewable fuels & strict emission reduction goals

- Integration with circular economy models

Major Challenges:

- Trade barriers and tariffs

- Competition from EVs

Key Players: TOYOTA MOTOR CORPORATION, EID Parry, Raizen, Valero Energy, Mitsubishi Motors Corporation, Volkswagen AG, General Motors, Ford Motor Company, Daimler AG, Nissan Motor Corporation, AG Volvo, John Deere.

Global Ethanol Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 52.39 billion

- 2026 Market Size: USD 57.34 billion

- Projected Market Size: USD 142.19 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Brazil, United States, China, India, Germany

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Ethanol Vehicle Market Growth Drivers and Challenges:

Growth Drivers

-

Growing adoption of renewable fuels & strict emission reduction goals: Successful studies on the efficacy of ethanol as a renewable biofuel with lower greenhouse gas (GHG) emissions drive demand for ethanol vehicles. The Renewable Fuels Association has intensified its push for the adoption of flex-fuel vehicles which is poised to be a major driver of the ethanol vehicle market. In July 2024, the Renewable Fuels Association urged the California Air Resources Board (CARB) to require that all new vehicles with internal combustion engines sold within the state be flex-fuel capable, to achieve California’s carbon emissions goals.

Furthermore, with the Zero Emission Vehicle (ZEV) mandate by 2035, flex-fuel capable vehicle adoption is poised to increase assisting the rapid growth of the ethanol vehicle sector. In September 2022, research published by IFPEN measured and compared the GHG emissions of vehicles powered solely by petrol, plug-in flex-fuel hybrids running on E85, and all-electric cars, based on a full life cycle analysis to highlight results that plug-in flex-fuel hybrids on E85 ethanol blend are as climate-friendly as battery EVs. - Integration with circular economy models: The ethanol vehicle market is poised to benefit from growing investments in creating circular economy models. The use of agricultural by-products such as sugarcane bagasse, corn stover, and other biomass in ethanol production aligns with circular economy strategies. Sustainable production reduces environmental impact while supporting economic growth by creating value from waste materials. In October 2024, Lummus Technology and Next Wave Energy Partners announced the production of the world’s first renewable alkylate derived from ethanol a bio-based, low-carbon intensity fuel blending component.

Furthermore, the circular economy initiatives drive the production of ethanol benefiting the ethanol vehicle market. In July 2020, NextChem and Lanzatech signed an agreement to promote circular ethanol production by licensing the Waste to Ethanol process line. - Expansion of biofuel production in emerging markets: In emerging economies, biofuel production has increased which benefits the global supply chains. For instance, in February 2024, the International Energy Agency (IEA) released a report stating that India had become a major consumer and producer of biofuel by leveraging the abundance of feedstocks and has the potential to triple production by removing roadblocks to higher ethanol blends.

Additionally, in October 2024, the Government of India announced 15% ethanol blending in 2024 and targets 20% by 2025 which is poised to assist the growth of the ethanol vehicle sector. The increase in ethanol production in emerging economies bodes well for the global supply chain. For instance, from the period of January to August 2022, Brazil shipped around 427 million liters of ethanol to Europe, a 435% increase in exports from the previous year indicating favorable trends which are positioned to boost the global ethanol supply chain.

Challenges

-

Trade barriers and tariffs: The ethanol vehicle sector’s growth can be affected by tariffs and restrictions disrupting the global supply chains. For instance, Brazil has imposed an 18% tariff on ethanol imports to Brazil from the U.S. while India has banned imported ethanol for fuel blending. The barrier of entry in lucrative ethanol vehicle markets such as India via exports can cause challenges in the ethanol vehicle sector.

- Competition from EVs: The market faces heightened challenges from the rising adoption of EVs. Governments and manufacturers are heavily investing in EVs, which can cause consumer interest to decline in ethanol-powered vehicles. Reduced consumer interest can lead to a decline in ethanol vehicle market share.

Ethanol Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 52.39 billion |

|

Forecast Year Market Size (2035) |

USD 142.19 billion |

|

Regional Scope |

|

Ethanol Vehicle Market Segmentation:

Vehicle Type

Passenger cars segment is expected to capture over 44.1% ethanol vehicle market share by 2035. The segment’s growth is attributed to rising demand for ethanol blend fuels for passenger cars with governments across the world releasing mandates for oil wholesalers to forward ethanol blended fuel solutions. For instance, in November 2024, Japan announced the decision to urge automakers to make all new passenger cars compatible with biofuel from 2030.

Furthermore, flexible-fuel passenger cars are proven to have lesser emissions and ethanol improves the engine life which benefits the fuel economy while assisting reduction in emissions. The favorable trends drive adoption boosting the segment’s growth. For instance, in August 2023, a 100% ethanol-powered car by Toyota was unveiled in India that is deemed as the world’s first BS-VI electrified flex-fuel vehicle.

Fuel Source

The corn ethanol segment of the ethanol vehicle market is poised to register a dominant share by fuel source. The segment’s growth is attributed to rising demand for renewable fuels amid environmental concerns. Corn ethanol serves as a cleaner burning alternative to traditional gasoline, assisting in curbing GHG emissions which drives demand. Furthermore, research indicating the positive energy balance of corn ethanol is poised to drive production. For instance, in April 2022, the Renewable Fuels Association published results of their research indicating that corn ethanol provides energy that is nearly three times the energy used to produce it.

Additionally, the segment’s growth is evident from rising government investments to increase corn ethanol production. For instance, in October 2024, the Advanced Research Projects Agency-Energy (ARPA-E) announced up to USD 36 million in funding to develop technologies to lower nitrous oxide (N2O) emissions by 50% from the cultivation of corn and sorghum used for U.S. ethanol production.

The cellulosic ethanol segment of the ethanol vehicle market is poised to expand its revenue share by the end of the forecast period. Unlike first-generation biofuels, cellulosic ethanol utilizes diverse feedstocks which reduces competition with food resources. Increasing production, led by India, is poised to benefit the global supply chain. Furthermore, companies operating in the sector are leveraging strategic agreements to expand their cellulosic ethanol portfolio to cater to rising ethanol vehicle market demand. For instance, in November 2022, Shell and Raizen announced an agreement to sign a cellulosic ethanol deal where the former agreed to buy 3.2 billion liters of sugar-cane cellulosic ethanol, and the low-carbon fuel is poised to be produced in large amounts by five plants that Raizen plans to build in Brazil to increase its portfolio.

Additionally, the advent of commercial production of cellulosic ethanol by emerging ethanol vehicle market players is beneficial for the sector’s growth. For instance, in March 2024, Blue Biofuels Inc. announced the production of its first batch of cellulosic ethanol by advancing its cellulose-to-sugar technology towards commercial scale.

Our in-depth analysis of the ethanol vehicle market includes the following segments:

|

Vehicle Type |

|

|

Fuel Source |

|

|

Engine Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethanol Vehicle Market Regional Analysis:

North America Market Insights

North America ethanol vehicle market is set to dominate revenue share of around 43.7% by the end of 2035. The market’s growth in the region is attributed to rising government support and investment to increase ethanol production and support ethanol fuel blends. Additionally, the abundance of agriculture in North America ensures a steady supply of feedstocks for ethanol production creating a robust regional supply chain.

Furthermore, companies are investing to expand ethanol production in the region which benefits the North America ethanol vehicle industry. For instance, in August 2024, Verbio North America Holdings Corporation announced the commencement of the commercial production of corn-based ethanol at its biorefinery facility in the U.S. with a total capacity to produce 60 million gallons of corn-based ethanol per year.

The U.S. ethanol vehicle market is poised to hold a dominant revenue share in North America. The market’s growth is fueled by federal mandates such as the Renewable Fuel Standard (RFS) requiring a specific volume of renewable fuel to be incorporated into transportation fuel. This has led to a substantial increase in ethanol production, with the U.S. becoming a major producer and exporter of ethanol which assists the growth of the ethanol vehicle sector. For instance, in November 2024, the U.S. Energy Information Administration reported that U.S. fuel ethanol exports have increased due to strong international demands and low prices with the country averaging 121,000 barrels per day of ethanol exports in the first eight months of 2024. Furthermore, in October 2024, the U.S. Energy Information Administration stated that the U.S. capacity to produce biofuels has increased by 7% in 2023, reaching 24 billion gallons per year by the start of 2024.

The automotive industry of the country has responded to the rising production of ethanol by driving the production of flex-fuel vehicles capable of operating on high ethanol blends. Additionally, ongoing research efforts aim to enhance ethanol production efficiency and vehicle compatibility to ensure sustained growth of the sector.

The Canada ethanol vehicle industry is poised to expand during the forecast period. The push to reduce carbon emissions in the country is a major driver of the sector and government mandates supporting innovations in the clean fuel industry are poised to assist the sector’s growth. For instance, in June 2022, the Government of Canada announced support for the final Clean Fuel Regulations to support innovations in the fuel industry. The government support for investors and stakeholders to bring low-carbon fuels to the ethanol vehicle market in Canada is poised to drive demand for hybrid plug-in vehicles that support ethanol blended fuels. Additionally, Canada has a well-established agricultural industry, particularly wheat and corn, ensuring a steady domestic supply of primary feedstocks for ethanol production.

Europe Market Insights

The Europe ethanol vehicle market is poised to grow rapidly during the forecast period. The market’s growth in Europe is attributed to mandates supporting ethanol blends in fuel driving the adoption of vehicle engines that can support biofuels. For instance, the Red II mandate by the European Union that by 2030, at least 32% of Europe’s energy should be from renewable resources, and at least 14% of all energy in road and rail transport fuels to be produced from renewable energy sources by 2030. Additionally, countries in Europe have implemented national policies to promote the use of biofuels driving the sector’s expansion.

Companies are investing to improve the ethanol supply chain in Europe which is poised to drive the growth of the ethanol vehicle sector. For instance, in December 2024, ArcelorMittal and LanzaTech announced the ethanol production milestone and the shipment of the first barge from the flagship Steelanol facility in Belgium.

The Germany ethanol vehicle sector is poised to exhibit growth during the forecast period. The Energiewende policy of Germany remains a major driver for the ethanol vehicle market as the country has emphasized a transition to renewable energy sources across all sectors, including the transportation sector of Germany. Furthermore, the cost-effectiveness of ethanol-blended gasoline such as E10 has led to increased usage in the country creating opportunities for manufacturers to launch ethanol fuel-supporting vehicles. Furthermore, the deal between the EU and the government of Germany bodes positively for automakers in the country as the continued usage of ICE vehicles is expected to continue after 2035 provided, they are integrated with CO2-neutral fuels.

The Belgium ethanol vehicle sector is poised to expand during the forecast period owing to rising demand for biofuel integration in the transportation sector. For instance, in 2021, E10 accounted for 79% of gasoline consumption in the country, highlighting a heightened consumer acceptance of ethanol blended fuels. Furthermore, the country’s commitment to biofuels consumption in the transport sector drives the ethanol vehicle market growth coupled with increasing ethanol production. For instance, in March 2023, ArcelorMittal announced the first industrial production of ethanol at its Steelanol plant in the country.

Ethanol Vehicle Market Players:

- TOYOTA MOTOR CORPORATION

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EID Parry

- Raizen

- Valero Energy

- Mitsubishi Motors Corporation

- Volkswagen AG

- General Motors

- Ford Motor Company

- Daimler AG

- Nissan Motor Corporation

- AG Volvo

- John Deere

The ethanol vehicle market is poised to expand during the forecast period. Leading companies in the sector are leveraging strategic initiatives to expand revenue share and strengthen market presence. Partnerships with automakers to promote and develop flex-fuel vehicles leveraging higher ethanol blends to penetrate various markets is projected to assist in market expansion. Furthermore, investments in marketing campaigns to emphasize the environmental benefits of ethanol and appealing to policymakers for favorable regulations is poised to assist the ethanol vehicle market growth. In September 2024, Gevo Inc., announced a definitive agreement to acquire the ethanol production plant and carbon capture and sequestration assets of Red Trail Energy, LLC for USD 210 million in a bid to expand its ethanol portfolio.

Here are some key players in the ethanol vehicle market:

Recent Developments

- In September 2024, General Motors announced the decision to produce hybrid flex vehicles that can run on 100% ethanol or gasoline alongside their batteries in Brazil. GM stated that two hybrid-flex models will be made at its factories in Sao Paolo, Brazil.

- In May 2024, Volvo Trucks announced that they are expanding model offers adapted for biodiesel B100. A full range of new Volvo truck models can now be powered by 100% biodiesel, offering another renewable fuel choice for customers looking to reduce CO2 emissions from transport.

- Report ID: 6898

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ethanol Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.