Estrogen Receptor Modulators Market Outlook:

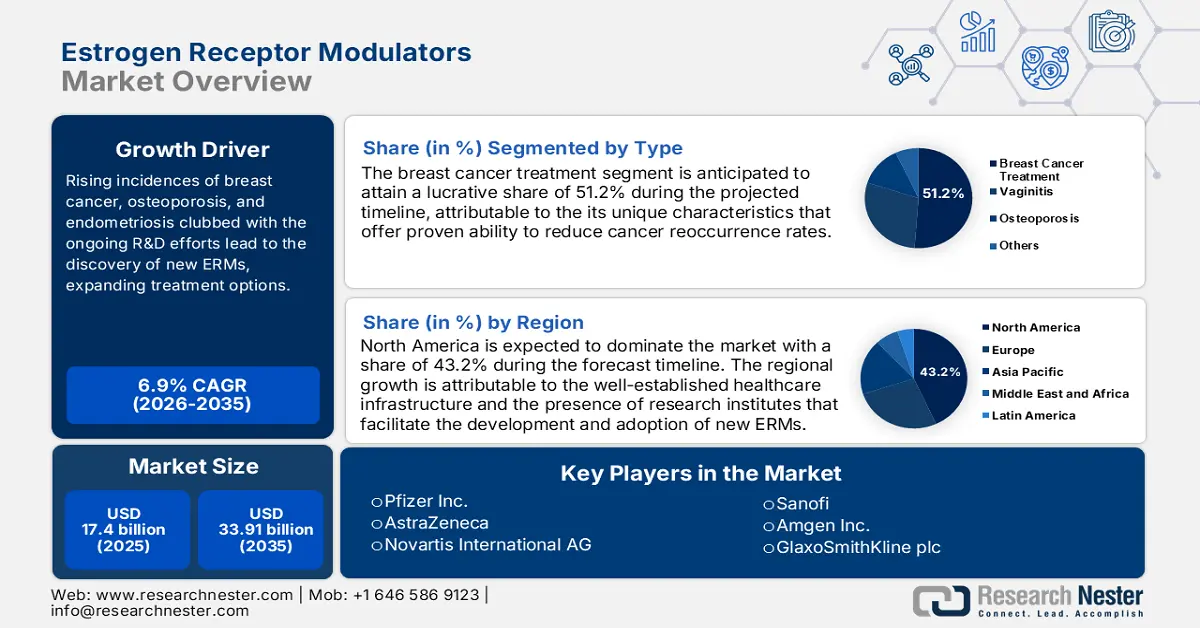

Estrogen Receptor Modulators Market size was over USD 17.4 billion in 2025 and is projected to reach USD 33.91 billion by 2035, witnessing around 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of estrogen receptor modulators is evaluated at USD 18.48 billion.

The growth of estrogen receptor modulators market is influenced by their therapeutic significance and versatility. The growing incidence of estrogen-dependent conditions, especially breast cancer, necessitates the development of targeted therapies that can effectively modulate estrogen activity. Moreover, such instances are most commonly found in women. For instance, according to reports published by WHO in the year 2022, 670,000 women lost their lives to breast cancer and 2.3 million women received a diagnosis. Furthermore, in December 2024, it was unveiled that approximately 310,720 women received a diagnosis of invasive breast cancer, with women under 50 years of age accounting for 16% of these cases.

In addition, massive strides in pharmacological research in the estrogen receptor modulators market have discovered new ERMs such as selective estrogen receptor modulators (SERMs), that show improved selectivity and efficacy than their conventional analogs. Furthermore, they have been crucial in this regard because they offer a dual mechanism where they can act as estrogen agonists in some tissues but antagonists in others, thus reducing the side effects related to hormone action. For instance, in December 2023, the new approaches to combat ESR1-mutant breast cancer, such as innovative selective estrogen receptor degraders (SERDs) and SERMs were reviewed at a State-of-the-Art Session at the 2023 San Antonio Breast Cancer Symposium. At present, elacestrant is the sole approved oral drug for ER+, HER2- metastatic ESR1-mutated breast cancer.

Key Estrogen Receptor Modulators Market Insights Summary:

Regional Highlights:

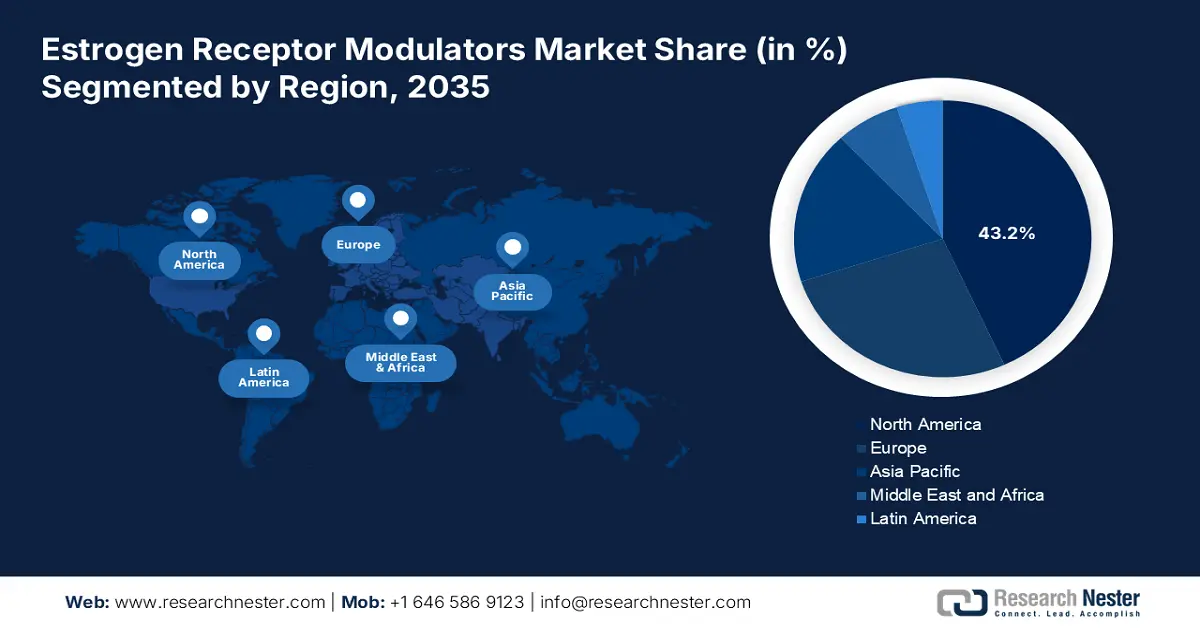

- By 2035, the North America estrogen receptor modulators market is set to command over 43.2% share, supported by strengthened regulatory recognition and accelerated approvals for novel ERM formulations.

- The market in Asia Pacific is projected to expand rapidly during 2026-2035, underpinned by synergistic clinical trials advancing combination therapies.

Segment Insights:

- The breast cancer treatment segment is expected to secure more than 51.2% share of the estrogen receptor modulators market by 2035, propelled by the rising burden of hormone receptor-positive breast cancer.

- The breast cancer segment is projected to lead by 2035, reinforced by the strong therapeutic performance of ERMs in managing hormone receptor-positive breast cancer.

Key Growth Trends:

- Advancement in drug development

- Combination therapy research

Major Challenges:

- Cost and accessibility

- Integration into treatment protocols

Key Players: Novartis International AG, AstraZeneca, Pfizer Inc., Amgen Inc., Eli Lilly and Company, Roche Holding AG, Sanofi, GlaxoSmithKline plc.

Global Estrogen Receptor Modulators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.4 billion

- 2026 Market Size: USD 18.48 billion

- Projected Market Size: USD 33.91 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 2 December, 2025

Estrogen Receptor Modulators Market - Growth Drivers and Challenges

Growth Drivers

-

Advancement in drug development: A prime growth driver within the estrogen receptor modulators market is the discovery of new chemical entities. It offers better selectivity and potency, derived based on advanced knowledge of the biology of the estrogen receptor. This has unveiled mechanisms of molecular events in the process of estrogen signaling. For instance, in January 2023, Elacestrant was approved by the FDA for postmenopausal women or adult men with ER-positivethose who have advanced or metastatic breast cancer that is ER-positive, HER2-negative. Thus, researchers could formulate targeted drugs with fewer adverse effects and higher therapeutic efficacy.

-

Combination therapy research: The significant growth driver in the estrogen receptor modulators market would be the research into combination therapy. It is mainly due to the possibility of enhancing treatment effectiveness and the breaking of mechanisms of resistance to monotherapy. For instance, in April 2023, KRAZATI as monotherapy was developed clinically as a first-line treatment for patients with non-small cell lung cancer who have a KRASG12C mutation in combination with a PD-1 inhibitor. This approach widens the scope of therapeutic ERMs and promotes clinical adoption for holistic treatment strategies.

Challenges

-

Cost and accessibility: The major concern in the estrogen receptor modulators market, is the high price of research, development, and manufacture of such sophisticated treatments. Also, complicated procedures in the synthesis of active modulators increase the prices and are highly unaffordable to many patients, especially in developing and middle-income countries where healthcare is not well developed. In such cases, the financial barrier limits access to essential treatments that result in differences in health outcomes because people without enough insurance cover or money might avoid essential drugs. Thus, it poses a challenge in the growth of market.

-

Integration into treatment protocols: Estrogen receptor modulators market has one of the most crucial challenges which is complex tailoring of protocols within treatments and more stringent clinical directions. As patient responses are unique, including genetic variation, comorbid conditions, and simultaneous use of drugs, this makes the provider's decision as to therapy problematic. In addition, existing protocols for treatment may not adequately address the specific mechanism of action of estrogen receptor modulators which, in turn contributes to inconsistencies with prescribing practices. This lack of standardized guidance leads to suboptimal therapeutic outcomes.

Estrogen Receptor Modulators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 17.4 billion |

|

Forecast Year Market Size (2035) |

USD 33.91 billion |

|

Regional Scope |

|

Estrogen Receptor Modulators Market Segmentation:

Type Segment Analysis

Breast cancer treatment segment is expected to account for more than 51.2% estrogen receptor modulators market share by the end of 2035. It is primarily due to the high prevalence of hormone receptor-positive breast cancer, which accounts for a significant proportion of all such cases. For instance, in February 2023, according to the WHO report, high-income nations have 5-year survival rates of over 90%, while South Africa and India have rates of 40% and 66%, respectively. Moreover, access to high-quality, resource-appropriate services must be systematically improved in order to close the disparities in breast cancer outcomes.

Established in 2021, the World Health Organization's Global Breast Cancer Initiative (GBCI) unites stakeholders from various sectors and around the world with the common objective of reducing breast cancer by 2.5% annually, which would save 2.5 million lives over a 20-year period. Because this focus on therapeutics remarkable benefits of modulation for the inhibition of tumor growth by estrogen receptor have been evident. In addition, as indicated for these agents across all clinical disciplines and improved outcome of the treatment in the clinics, the scope, thus, translates to an influential representation in the context of market share as well.

Application Segment Analysis

The breast cancer segment is anticipated to dominate the estrogen receptor modulators market by 2035. Since these agents have proven to show spectacular efficacy for treating hormone receptor-positive breast cancer. The focus on well-researched and developed treatments will play crucial role in improving patient survival and the quality of their life post such diagnosis, especially against this dominant cause of cancer. For instance, in October 2024, it was published in the National Institutes of Health that clinical trials of inavolisib, palbociclib, and fulvestrant together produced encouraging results. This established a new standard of care for patients with advanced breast cancer that is PIK3CA-mutant, hormone receptor-positive, and HER2-negative.

Moreover, estrogen receptor modulators selectively target estrogen effects on tumor growth and therefore provide a backbone for adjuvant and metastatic treatment settings. For instance, in June 2021, Sanofi is collaborating with the European Organization for Research and Treatment of Cancer, the Breast International Group, and Alliance Foundation Trials, that provide clinical research on breast cancer that is revolutionizing practice. Working together, the Phase 3 AMEERA-6 study assessed the safety and effectiveness of Sanofi's investigational amcenestrant in estrogen receptor-positive (ER+) patients. This study is anticipated to be the first pivotal trial of an oral selective estrogen receptor degrader (SERD) in the adjuvant setting.

Our in-depth analysis of the global estrogen receptor modulators market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Estrogen Receptor Modulators Market - Regional Analysis

North America Market Insights

North America estrogen receptor modulators market is projected to dominate revenue share of over 43.2% by 2035. Furthermore, the value of ERMs has gained increasing recognition through regulatory agencies with accelerated approval processes for innovative formulations addressing unmet medical needs. This has been a strong impetus for pharmaceutical companies to invest considerably in research and development efforts toward broadening the therapeutic potential of ERMs in the region.

The U.S. is experiencing an exceptional growth in the estrogen receptor modulators market attributable to the rising prevalence and awareness of early detection to ensure increased recovery rate. For instance, in August 2024, it was revealed by the National Breast Cancer Foundation that about 1 in 8 women, or 13% of all women in the U.S., will get breast cancer at some point in their lives. The 5-year relative survival rate is 99% if the disease is detected in its earliest locations. Moreover, over 4 million people in the US have survived breast cancer as of right now.

In Canada, the estrogen receptor modulators market is experiencing a significant growth owing to the supportive regulatory framework that foster a conducive ecosystem for growth. For instance, in July 2023, Atossa Therapeutics, Inc. announced that Health Canada has granted a no objection letter in response to the company's clinical trial application for its Phase 2 EVANGELINE study. In addition, Atossa's patented SERM, (Z)-endoxifen, and exemestane plus goserelin are being used as a neoadjuvant treatment for premenopausal women. In regard to grade 1 or 2 estrogen receptor positive (ER+) / human epidermal growth factor receptor 2 negative (HER2-) breast cancer.

Asia Pacific Market Insights

The estrogen receptor modulators market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline i.e. 2026-2035. Ongoing clinical trials of combinations of therapies which include ERMs, are exhibiting synergies that will hope to improve a treatment outcome among a range of patient populations in the region. As more awareness about personalized medicine approaches for the optimization of hormonal therapies the market for ERMs is very well poised to continue growth with both clinical efficacy and safety profiles.

In India the estrogen receptor modulators market is witnessing a substantial surge attributable to the heavy investments in R&D activities to shape the state-of-the-art healthcare facilities. For instance, in October 2024, the acquisition of USD 1 million in seed funding by cancer care start-up Oncare was the major step forward for India's healthcare industry. The company strategizes to collaborate with mid-sized hospitals, usually those with 50–100 beds in contrast to the unaffordable treatments offered in corporate hospitals and approach to cut the cost of cancer treatment by up to 40%.

In China the estrogen receptor modulators market is witnessing a strong influence due to the clinical trials and successions by companies to reshape the applications of treatment for effectiveness. For instance, in December 2024, Shanghai Henlius Biotech, Inc. reported that the first patient in China received a dose of HLX78 (oral lasofoxifene) in combination with abemaciclib (a CDK4/6 inhibitor) in the international multi-center Phase 3 clinical trial (ELAINE-3, NCT05696626) for patients with locally advanced or metastatic ER+/HER2- breast cancer.

Estrogen Receptor Modulators Market Players:

- Novartis International AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca

- Pfizer Inc.

- Amgen Inc.

- Eli Lilly and Company

- Roche Holding AG

- Sanofi

- GlaxoSmithKline plc

To create state-of-the-art diagnostic solutions, established players in the estrogen receptor modulators market, primarily concentrate on innovation and technological advancements. They also collaborate with up-and-coming players to take advantage of their technology. For instance, in January 2024, Insilico Medicine and Menarini Group, via its Stemline subsidiary, inked an exclusive licensing agreement. With the help of Insilico's AI, Stemline acquires the worldwide rights to create and market a novel small-molecule KAT6A inhibitor for hormone-sensitive and other cancers.

Here's the list of some key players:

Recent Developments

- In Febuary 2024, Arvinas, Inc. and Pfizer Inc. announced that the U.S. FDA granted fast track designation for the study of vepdegestrant (ARV-471) for monotherapy in adults with ER positive/human growth epidermal growth factor 2 negative (ER+/HER2-).

- In October 2022, AstraZeneca's capivasertib plus Faslodex (fulvestrant) showed a statistically significant and clinically meaningful improvement in progression-free survival (PFS) with hormone receptor (HR), according to positive high-level results from the CAPItello-291 Phase III trial.

- Report ID: 7004

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Estrogen Receptor Modulators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.