Esophageal Dysphagia Market Outlook:

Esophageal Dysphagia Market size was valued at USD 2.15 Billion in 2025 and is expected to reach USD 3.78 Billion by 2035, expanding at around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of esophageal dysphagia is evaluated at USD 2.26 Billion.

The aging of populations worldwide has influenced growth in the esophageal dysphagia market. For instance, in October 2024, according to the WHO statistics, the percentage of people over 60 will almost double, from 12% to 22%, between 2015 and 2050. In addition, according to the UN data published in January 2023, it is predicted that the global population of people 65 and older will grow more than double, from 761 million in 2021 to 1.6 billion in 2050. This is because advancing age is associated with changes within the esophageal motility and muscle strength.

Moreover, an increase in chronic conditions such as GERD, obesity, and diabetes contribute to the presence of esophageal dysfunction. For instance, according to data presented by the International Diabetes Federation Atlas (2021), 10.5% of adults aged 20 to 79 have diabetes. Furthermore, it estimates that 643 million by 20230, and 1 in 8 adults, or 783 million people, will have diabetes by 2045, a 46% increase. Moreover, increased awareness of early detection and management contributes to growing attention and diagnosis rates.

In addition, the use of drugs that have caused anomalies in esophageal motility by their relation to acid reflux and neurological disorders increases the burden on dysphagia. For instance, according to the World Drug Report 2023, in 2021, 1 in 17 individuals worldwide between the ages of 15 and 64 reported using drugs. Between 2011 and 2021, the estimated number of users increased from 240 million to 296 million, or 5.8% of the world's population aged 15 to 64. Furthermore, a change to a sedentary lifestyle and a side effect of various medications are other significant factors driving the market's expansion.

Key Esophageal Dysphagia Market Insights Summary:

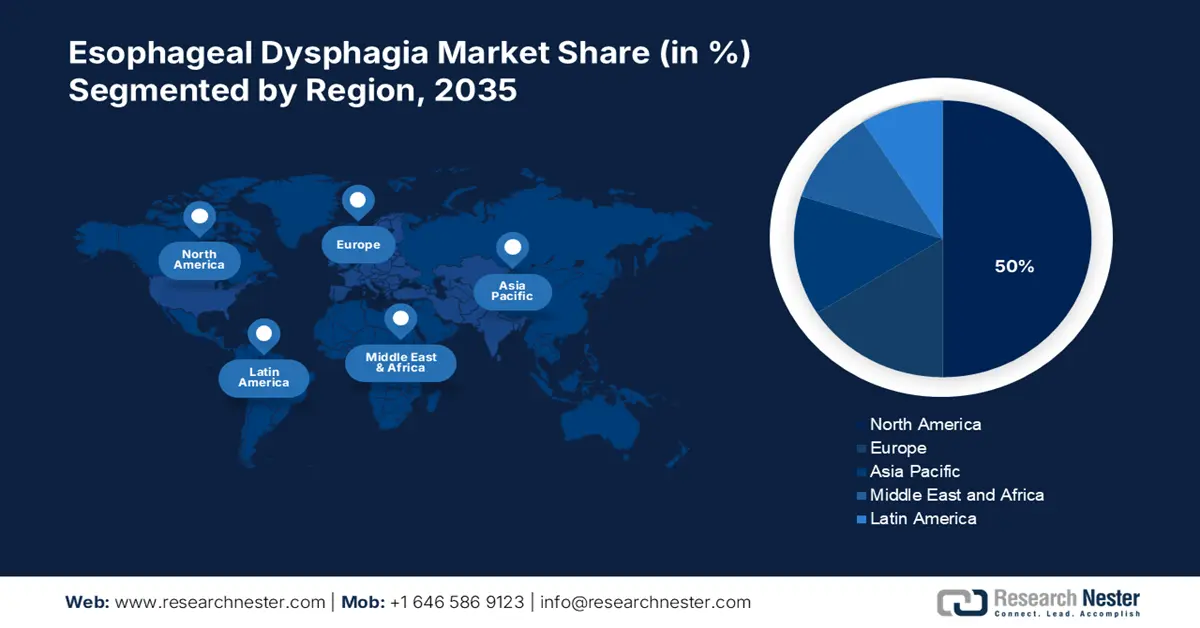

Regional Highlights:

- North America leads the esophageal dysphagia market with a 50% share, propelled by advanced diagnostic capabilities and rising prevalence of esophageal dysphagia, supporting strong growth prospects through 2035.

- Asia Pacific's Esophageal Dysphagia Market is expected to see significant growth by 2035, driven by rising preference for minimally invasive procedures and gastrointestinal disease prevalence.

Segment Insights:

- The Feeding Tube segment is projected to dominate the market by 2035, fueled by the increasing prevalence of esophageal dysphagia and evolving feeding tube technologies.

- The Endoscopy segment of the Esophageal Dysphagia Market is expected to achieve over 45.6% share by 2035, fueled by the accuracy of high-definition imaging and therapeutic capabilities enhancing diagnosis and treatment.

Key Growth Trends:

- Revolutionizing the diagnostics procedures

- Breakthroughs in therapeutic devices

Major Challenges:

- Diverse etiology

- Complexity of treatment

- Key Players: Merck Sharp & Dohme Corp., Biostagel, Torax Medical, Inc., NinePoint Medical Inc., Elekta AB, Eisai Co Ltd., and more.

Global Esophageal Dysphagia Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.15 Billion

- 2026 Market Size: USD 2.26 Billion

- Projected Market Size: USD 3.78 Billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Esophageal Dysphagia Market Growth Drivers and Challenges:

Growth Drivers

-

Revolutionizing the diagnostics procedures: The growing demand in the esophageal dysphagia market is significantly driven by better resolution manometry, endoscopy, and fluoroscopy, as it improves the ability to detect dysfunction in the esophagus. These advances in technology make for improved diagnosis of the cause of dysphagia with more directed treatments arising from this more accurate diagnosis. For instance, in December 2024, PENTAX Medical launched the automated, brushless, channel pre-cleaning solution AquaTYPHOON, for endoscopes. It helps standardize the pre-cleaning procedure and prevent human error while reducing water consumption by over 70% and waste by 99%.

-

Breakthroughs in therapeutic devices: The innovation in therapeutic devices has significantly fueled esophageal dysphagia market growth. This includes smart stimulation devices and minimally invasive surgical tools that have greatly improved the management of dysphagia with enhanced patient outcomes and shorter recovery time. The market is expanding with these advanced devices being adopted at a rapid pace. For instance, in October 2023, joimax made its debut internationally at the SMISS Annual Forum in Las Vegas and the EUROSPINE 2023 Annual Meeting in Frankfurt. It introduced a new iLESSYS Biportal Interlaminar Endoscopic Surgical System for the treatment of spinal disorders.

Challenges

-

Diverse etiology: The esophageal dysphagia market inherently challenges commercial developments. It causes neurological disease through mechanical obstructions, GERD, or dysfunction of muscle. It largely necessitates singular diagnostic approaches thus individual treatments that make earlier identification along with subsequent effective management troublesome. This diversity of the underlying factors also requires care in a multidisciplinary approach by gastroenterologists, speech therapists, and surgeons, which creates coordination challenges and hinders streamlined patient outcomes.

-

Complexity of treatment: In the esophageal dysphagia market one of the massive challenges is based on a multi-disciplinary approach. Patients need various interventions from gastroenterologists, speech therapists, and even surgeons, depending on the cause. This wide variability makes it very complex to standardize care, thus leading to a fragmented plan of treatment. In addition, more and more spread of health care services and problems arising in the provision of patient services have also urged the need for efficient and fluent treatment procedures.

Esophageal Dysphagia Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 2.15 Billion |

|

Forecast Year Market Size (2035) |

USD 3.78 Billion |

|

Regional Scope |

|

Esophageal Dysphagia Market Segmentation:

Diagnosis (Dynamic Swallowing Study, X-Ray, Endoscopy, Manometry, Imaging Scans, MRI Scan, CT scan)

Endoscopy segment is anticipated to hold over 45.6% esophageal dysphagia market share by the end of 2035, due to its pivotal role in the diagnosis and evaluation of swallowing disorders with accuracy. Technological advancements in endoscopy, such as high-definition imaging and therapeutic intervention capabilities, have dramatically improved the accuracy of diagnosis and treatment. For instance, in October 2024, Olympus Europa SE & Co. KG announced that its group company, Odin Medical Ltd. has been approved as a CE-marked medical device in Europe under the Medical Device Regulation (MDR) for its cutting-edge cloud-AI (artificial intelligence) endoscopy devices, CADDIE, CADU, and SMARTIBD.

Product (Feeding Tube, Nasogastric Tube, Percutaneous Endoscopic Gastrostomy, Nutritional Solutions, Thickeners, Beverages, Purees, Drugs, Proton Pump Inhibitors, Others)

The feeding tube segment is anticipated to dominate the esophageal dysphagia market by 2035. This growth is due to the management of patients who suffer from an extreme difficulty of swallowing. PEG tubes are among the most commonly used tubes for patients who cannot safely ingest food or liquids for long or severe periods. With the growing prevalence of esophageal dysphagia, especially in the aged and comorbid patients, the use of feeding tubes has soared. For instance, in May 2024, the risk of complications from the PEG insertion procedure is extremely low, with a morbidity rate of 3–5·9%. The evolution of more sophisticated and patient-friendly feeding tube technologies has only further enhanced the stronghold of this segment in the market.

Our in-depth analysis of the global market includes the following segments:

|

Diagnosis |

|

|

Treatment |

|

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Esophageal Dysphagia Market Regional Analysis:

North America Market Statistics

North America esophageal dysphagia market is projected to capture revenue share of around 50% by the end of 2035. Advanced diagnostic capacity in the region further leads to earlier detection and increased awareness among the medical fraternity. This improves patient outcomes and enhances general awareness about esophageal dysphagia as a clinical entity. Thus, the rising prevalence of esophageal dysphagia drives the requirement for targeted medical interventions.

The U.S. esophageal dysphagia market is unfolding a plethora of growth opportunities owing to the robust regulatory framework that leverages smooth development and easy innovations for better patient outcomes. For instance, in January 2024, AnX Robotica, a US-based manufacturer, was given de novo approval by the US Food and Drug Administration (FDA) for its NaviCam ProScan endoscopy tool that uses artificial intelligence (AI). Thus, it facilitates the growth of more efficient and smarter healthcare solutions.

The esophageal dysphagia market in Canada is expected to grow significantly due to the well-established governance system and regulatory structure. It allows acceptance from society and smoother functioning of providing sound healthcare facilities. For instance, in December 2021, Medtronic Canada ULC was licensed with the Hugo robotic-assisted surgery (RAS) system by Health Canada. These procedures are used in laparoscopic surgical procedures for urology and gynecology, which account for roughly half of all robotic procedures carried out.

Asia Pacific Market Analysis

The esophageal dysphagia market in the Asia Pacific is anticipated to grow significantly during the forecast timeline i.e. 2025-2035. Instead of choosing open surgeries, which require lengthy incisions through the muscles, that take a long time to heal, people are becoming more interested in minimally invasive procedures. In addition, one of the main factors propelling the growth of the gastroenterology is rising prevalence of gastrointestinal disorders in the young, adult, and elderly populations in the region.

India in the esophageal dysphagia market is expanding its reach and capacity to advance medical facilities and improve healthcare infrastructure equipped with modern diagnostics tools. For instance, in July 2024, FUJIFILM, the healthcare provider with headquarters in Japan is increasing its presence in the Indian market. It has launched a new endoscopic center in Mumbai with a focus on gastroscopes, bronchoscopes, and high-end processors equipped with the latest technologies.

The endoscope's increasing technological sophistication is anticipated to fuel the esophageal dysphagia market expansion in China. For instance, enlightenVue, Inc. declared in December 2021 that China had awarded the business a patent that covered the fundamental technology of its SurgiVue single-use micro-endoscope platform. Through two working channels with a working diameter of two millimeters, the patented technology allows the endoscope to be used for both diagnostic and therapeutic purposes in a single procedure.

Key Esophageal Dysphagia Market Players:

- Cipla Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck Sharp & Dohme Corp.

- Biostagel

- Torax Medical, Inc.

- NinePoint Medical Inc.

- Elekta AB

- Eisai Co Ltd

- AstraZeneca Plc

- Kent Precision Foods Group, Inc.

- Nestlé Health Science France

- Nutricia Ltd

- R. Bard, Inc.

- Cook Medical Incorporated

The competitive landscape of the esophageal dysphagia market is showing remarkable growth with established players of medical device manufacturers, pharmaceuticals, and certain healthcare service providers. They focus on innovating and bringing new solutions to the field. For instance, in March 2023, NVIDIA revealed that Medtronic's GI GeniusTM intelligent endoscopy module will incorporate NVIDIA healthcare and edge AI technologies. It is the first FDA-approved AI-assisted colonoscopy tool to assist doctors in identifying polyps that may develop into colorectal cancer.

Here's the list of some key players:

Recent Developments

- In January 2024, EndoSound Inc., is committed to improving patient care, 510(k) clearance for its EndoSound Vision SystemTM (EVSTM). This significant accomplishment comes after the FDA designated the company as a breakthrough device in July 2021.

- In November 2022, Integrated Endoscopy launched the first-of-its-kind 4K endoscope for arthroscopic surgery, the second-generation NUVIS Single-Use Arthroscope. This is a significant accomplishment for the business in terms of compatibility and image quality.

- Report ID: 7040

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Esophageal Dysphagia Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.