Esophageal Cancer Market Outlook:

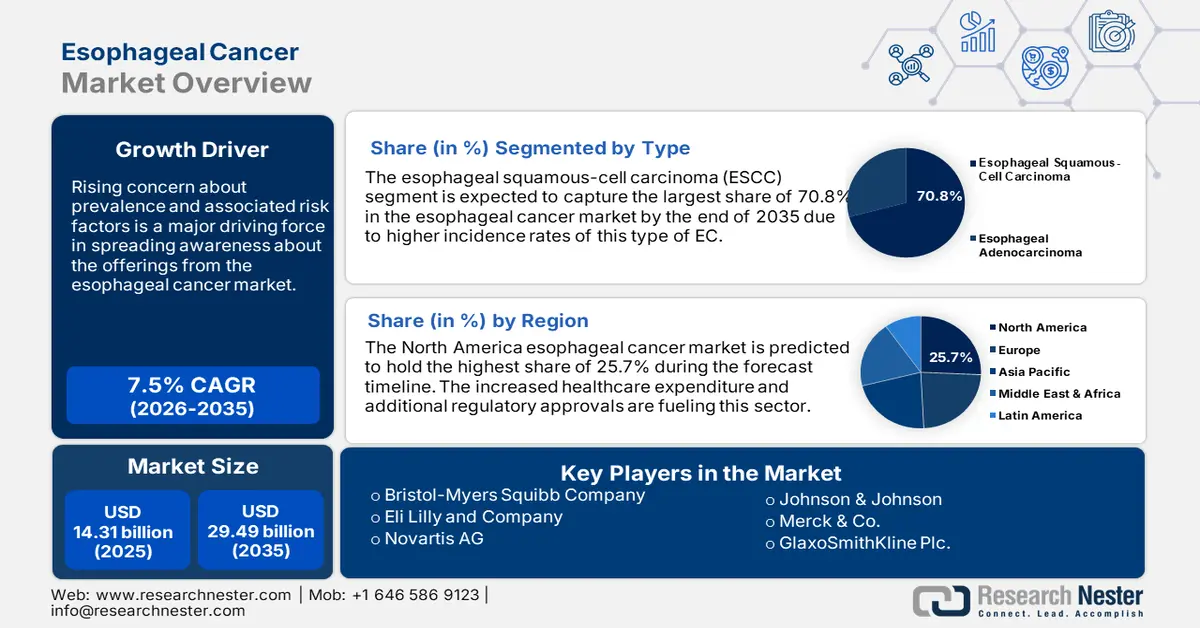

Esophageal Cancer Market size was valued at USD 14.31 billion in 2025 and is expected to reach USD 29.49 billion by 2035, registering around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of esophageal cancer is evaluated at USD 15.28 billion.

Rising concern about prevalence and associated risk factors is a major driving force in spreading awareness about the offerings from the esophageal cancer market. According to an NLM article, globally over 0.6 million and 0.5 million new and death cases were registered respectively in 2020, making it a common malignancy in the world. It further projected the numbers to be 739, 666 & 723, 466 by 2030 and 987,723 & 914,304 by 2040. The impacts of lifestyle changes such as smoking, alcohol consumption, and acid reflux have become significant contributors to the disease. In addition, the threats have been found to correlate with the growing population of obese and GERD patients. Thus, the need for faster and more effective solutions is increasing.

Particularly, immunotherapies, targeted therapies, and combined solutions have captured a big part of the consumer base in this sector. For instance, in October 2021, the report from a comprehensive cancer center, ROSWELL PARK revealed that immunotherapy medications such as nivolumab have the potential to beat the chemotherapy and radiation responses in EC patients. Thus, with the recent introduction of these therapeutics in the esophageal cancer market, investments in this category have risen.

Key Esophageal Cancer Market Insights Summary:

Regional Highlights:

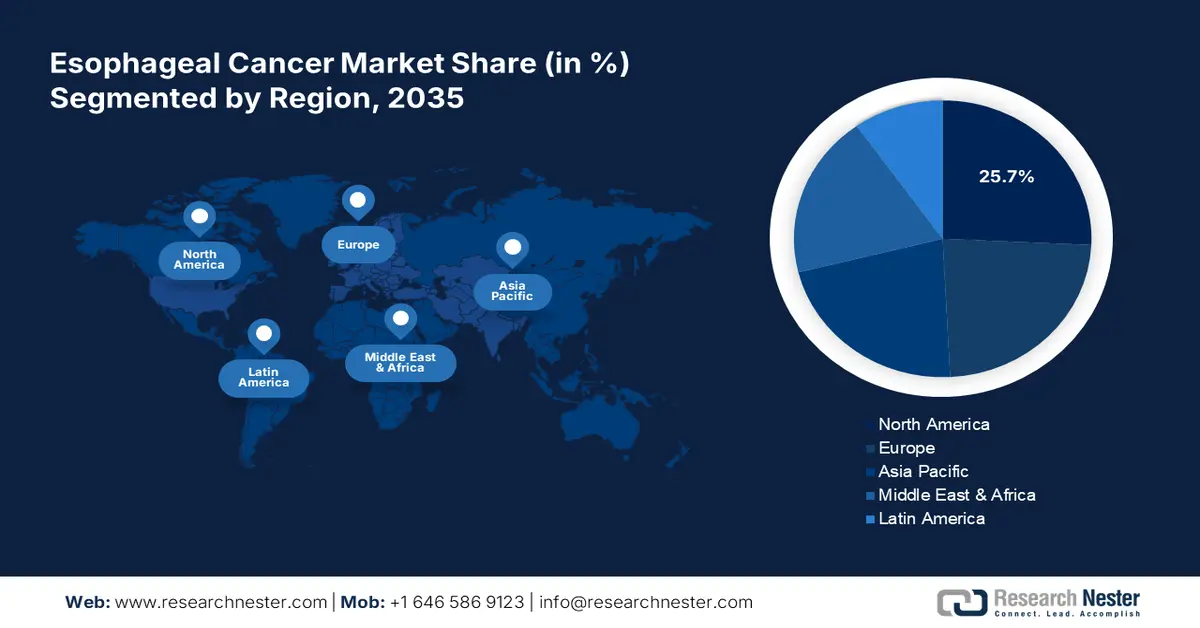

- North America leads the Esophageal Cancer Market with a 25.7% share, driven by increased healthcare expenditure and regulatory approvals improving cancer care access, supporting growth through 2026–2035.

- The Asia Pacific esophageal cancer market is forecasted for rapid growth through 2035, fueled by the high incidence and mortality of esophageal cancer in the region.

Segment Insights:

- The Esophageal Squamous-Cell Carcinoma segment is anticipated to capture over 70.8% market share by 2035, driven by its higher global incidence, especially in the EC belt regions.

- The Chemotherapy segment is expected to dominate the Esophageal Cancer Market by 2035, propelled by its essential role in treatment regimens and promising survival outcomes.

Key Growth Trends:

- Acceptance for treatments and prevention

- Supportive investments for R&D

Major Challenges:

- Limited options for heterogeneity

- Lack of accessible and affordable treatments

- Key Players: Eli Lilly and Company, Bristol-Myers Squibb Company, Novartis AG, Johnson & Johnson, Merck & Co..

Global Esophageal Cancer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.31 billion

- 2026 Market Size: USD 15.28 billion

- Projected Market Size: USD 29.49 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (25.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, UK

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Esophageal Cancer Market Growth Drivers and Challenges:

Growth Drivers

- Acceptance for treatments and prevention: Besides the intervention of innovative therapies and tailored medicines in the esophageal cancer market, the early emergence of diagnosis and prevention techniques also caught the attention. Many research and study papers have highlighted the efficacy of these aspects by establishing better patient outcomes and responsiveness during treatment. This is further promoting the adoption of related solutions, fostering a strong foundation for this sector.

- Supportive investments for R&D: Frequent research grants from healthcare authorities have been a crucial source of financial support in the esophageal cancer market. These dedicated investments directly fund future innovations, leading to diversification in this sector. This encourages both institutions and pharma companies to be engaged in new drug developments and treatment protocols. For instance, in September 2023, the Medical Research Council allocated USD 0.6 million to the Christie NHS Foundation Trust and the University of Manchester. This investment was made to accelerate the production of more innovative immunotherapies for treating patients with esophageal cancer (EC).

Challenges

- Limited options for heterogeneity: Being a heterogeneous disease, patients often develop a high risk of treatment resistance due to a variety of subtypes and genetic mutations. This may create a matter of questioning the effectiveness of the commercially available solutions in the esophageal cancer market. The dispute may further drag trust issues along with complexities and limitations in these treatment options. In addition, the need for specific and personalized approaches may raise the treatment cost, restricting optimum adoption.

- Lack of accessible and affordable treatments: There are no therapeutics, or non-drug treatments from the esophageal cancer market that can offer a one-size-fits-all option. Despite continuous developmental efforts, finding such a convenient and cost-effective solution is still a challenge in this sector. Additionally, delayed diagnosis and shortage of effective biomarkers are some of the concerning factors for patients, seeking affordable options. Moreover, the economic and time gap in cancer care delivery in budget-constrained regions may hinder globalization.

Esophageal Cancer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 14.31 billion |

|

Forecast Year Market Size (2035) |

USD 29.49 billion |

|

Regional Scope |

|

Esophageal Cancer Market Segmentation:

Type (Esophageal Squamous-Cell Carcinoma, Esophageal Adenocarcinoma)

The esophageal squamous-cell carcinoma (ESCC) segment is set to capture over 70.8% esophageal cancer market share by 2035. Higher incidences of this type of EC are the major contributors to the growth of this segment. According to an NLM study, published in October 2023, 90% of the total global EC cases are registered to be a result of ESCC. The report further stated that this kind of conditions is largely found around the EC belt (China, Iran, and Central Asia), captivating some of the largest marketplaces for EC service and solution providers. Thus, the tendency to prioritize this segment among healthcare investors is notably visible, inspiring pharma developers to focus on this specific category.

Treatment (Surgery, Chemotherapy, Radiotherapy)

Based on treatment, the chemotherapy segment is anticipated to dominate the esophageal cancer market during the forecast period, 2025-2035. Being an essential part of most of the therapeutic conjunctions and treatment processes, this segment has gained traction over the past years. The dependency of newly developed drugs in delivering optimum results for treating ECs is accumulating a major section of investments in this sector. For instance, in June 2022, Novartis published the results of a multi-regional RATIONALE 306 study on the benefits of combining chemotherapy with tislelizumab in metastatic ESCC treatment. The study showcased improved overall survival (OS) in adult patients, marking the significance of this combination as a first-line treatment.

Our in-depth analysis of the global esophageal cancer market includes the following segments:

|

Type |

|

|

Phase |

|

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Esophageal Cancer Market Regional Analysis:

North America Market Analysis

North America esophageal cancer market is set to capture over 25.7% revenue share by 2035. The increased healthcare expenditure and additional regulatory approvals have remarkably helped the region maximize access to adequate cancer care facilities. In addition, the high occurrence of ECs across this regional demography ensured an uninterrupted flow of innovations in this sector, backed by national health organizations and pharma leaders. According to the National Cancer Institute, around 22,370 citizens of America are poised to get diagnosed with esophageal cancer, whereas, the number of death cases is estimated to account for 16,130 in 2024. The report further evaluated the new cases to reach 17,690 in men and 4,680 in women in the same year.

The U.S. is augmenting the esophageal cancer market with a higher prevalence rate of esophageal adenocarcinoma compared to other landscapes. This has cultivated a good supply-demand chain in this sector, empowered by the presence of globally leading pharmaceutical companies. Thus, the country is considered to be at the top of the list of profitable marketplaces across the world. According to the National Library of Medicine, the accumulated expenditure value of immune checkpoint inhibitors (ICIs) in the U.S. reached USD 4.1 billion in 2021. On the other hand, the cost per prescription dropped by USD 20881.1 between 2011 and 2021. This shows the meticulous efforts of the country in making treatment more generally available for patients.

Canada is opening new opportunities for global leaders in the esophageal cancer market by deliberately pushing the government to take immediate action against the rising EC and mortality cases. The country’s governing authorities are well aware of the concerning statistics of probable new and death cases, which is forcing them to adopt effective strategies such as research funding and accelerated drug approvals. For instance, in January 2025, Health Canada accepted the application for commercialization of the FDA-approved VYLOY (zolbetuximab for injection) by Astellas Pharma. This ensured sufficient distribution of this VYLOY, which is highly effective for advanced gastric and gastroesophageal junction cancer when combined with chemotherapy.

APAC Market Statistics

Asia Pacific is projected to witness the fastest growth in the esophageal cancer market during the period, 2025-2035. The frequent incidences and higher mortality cases of ECs across the region are notable driving factors in this sector. The share of incidence and mortality of esophageal cancer in Asia was accounted to be the highest in the world by 2020, capturing 79.7% and 79.8% respectively, as per NLM data. Developing countries such as India, China, and Japan are utilizing their pharmaceutical excellence to cope with the rising threats to public health. Their governing bodies are also participating in these initiatives by offering ease of trading for both domestic and international leaders of this sector.

EC Incidence & Mortality Cases in APAC Countries (2020):

|

Country |

Incidence |

Mortality |

|

China |

324,422 |

301,135 |

|

India |

63,180 |

58,342 |

|

Bangladesh |

21,745 |

20,319 |

|

Japan |

26,262 |

12,270 |

|

Pakistan |

10,117 |

9,443 |

China, with its enhanced R&D capabilities, distributed along with pharma companies and several research institutions is commendably solidifying its grasp on the esophageal cancer market. The country’s notable progress in the biopharmaceutical industry has paid off in its continuous investments in clinical trials and drug developments. This brought new treatment solutions from their collection of innovative therapeutics with promising results. For instance, in May 2024, Mabwell gained an Orphan Drug Designation (ODD) from the FDA for its solely developed Nectin-4-targeting ADC. This novel therapy paved the way for the expansion of the company in the U.S. EC market.

The emphasizing pharma industry of India is presenting prosperous opportunities for the esophageal cancer market. With the rise in the conjugated value of imports and exports in the country, international forces are finding lucrative scopes of investment in this sector. According to IBEF data, the pharmaceutical industry of India is anticipated to be valued at USD 130.0 billion by 2030 due to the inflating demand for innovative therapies. In addition, the country’s bioeconomy is projected to hold USD 300.0 billion by the same timeframe, making it the 3rd largest shareholder of the Asia biotechnology industry. This signifies the potential of this country to make remarkable progress in this sector.

Key Esophageal Cancer Market Players:

- Amgen

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly and Company

- Hoffmann-La Roche

- Bristol-Myers Squibb Company

- Boehringer Ingelheim GmbH

- GlaxoSmithKline Plc.

- Novartis AG

- Johnson & Johnson

- Gilead Sciences

- Merck & Co.

- BeiGene, Ltd.

The rigorous activities of the leaders in developing the most effective solutions for better patient outcomes have brought healthy competition in the esophageal cancer market. They are individually involved in creating new options for patients to make the offerings more accessible for every regional or economic landscape. For instance, in September 2020, Daiichi Sankyo attained approval for its ENHERTU (trastuzumab deruxtecan) to be used in treating HER2-positive metastatic gastric cancer from the Ministry of Health, Labour and Welfare (MHLW) in Japan. The HER2-directed antibody-drug conjugate (ADC) is proven to be effective for gastroesophageal junction adenocarcinoma after chemotherapy. Such key players are:

Recent Developments

- In November 2024, BeiGene received approval from the European Commission for its TEVIMBRA, the first-line treatment of advanced esophageal squamous cell carcinoma (ESCC) and gastric adenocarcinoma. The approved combination of tislelizumab-jsgr and chemotherapy is highly effective in delivering improved outcomes.

- In May 2022, Bristol Myers Squibb gained allowance from the FDA to market its both first-line treatments, Opdivo (nivolumab) and Opdivo plus Yervoy (ipilimumab) for unresectable metastatic esophageal squamous cell carcinoma. The first regiment is to be used in combination with fluoropyrimidine- and platinum-containing chemotherapy.

- Report ID: 7048

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Esophageal Cancer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.