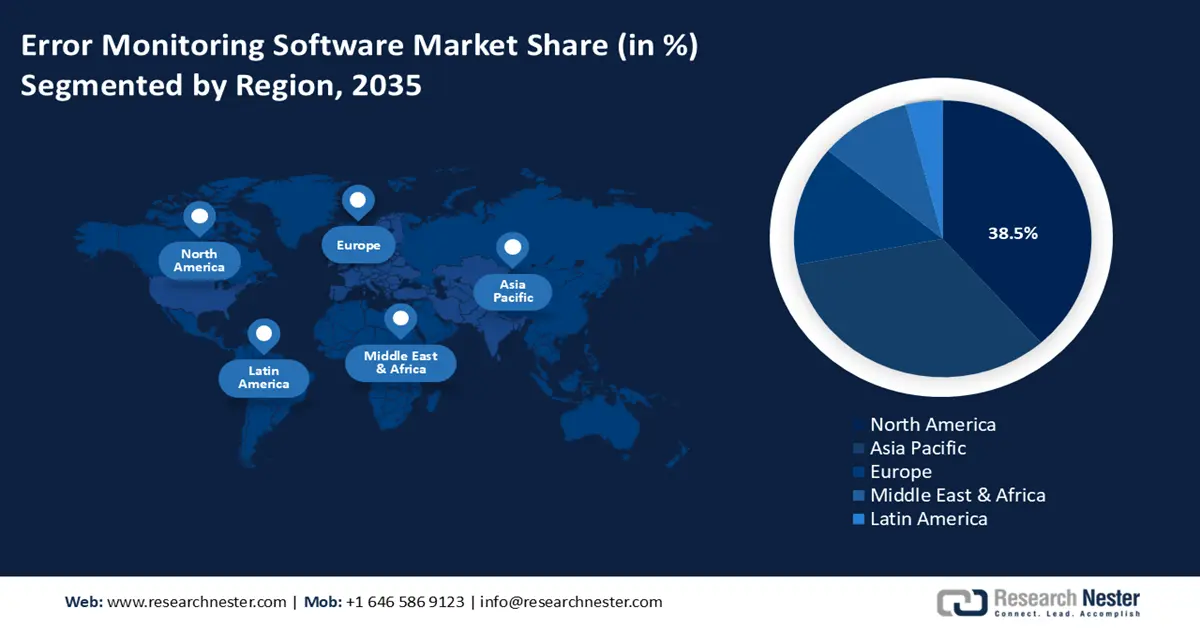

Error Monitoring Software Market - Regional Analysis

North America Market Insights

The North America error monitoring software market is poised to register a dominant revenue share of 38.5% by the end of 2035. A major factor that has contributed to the growth is the heightened investments in digital infrastructure, along with a growing push to adopt advanced cybersecurity policies. The tech ecosystem in the country is mature for the greater adoption of error monitoring software solutions. Additionally, the U.S. government's allocation of USD 65 billion via the Infrastructure Investment and Jobs Act is a highlight of the commitment to improving internet accessibility. From that investment, USD 42.45 billion was dedicated to the BEAD program. Additionally, in Canada, the Affordable Connectivity Program seeks to provide discounted internet services to households with low incomes. The convergence of supportive investments from government bodies has ensured that North America to remain lucrative by the end of 2035.

The U.S. error monitoring software market is expected to maintain a leading share in North America throughout the forecast period. The growth is supported by federal initiatives that seek to expand the country's digital infrastructure. In terms of supportive investments, the NTIA launched the Digital Equity Competitive Grant Program, which allocates more than USD 1.0 billion to support projects for digital inclusion. The robust technological ecosystem in the country is slated to ensure sustained opportunities for the adoption of error monitoring software throughout the forecast timeline.

The Canada error monitoring software market is estimated to be driven by the increasing digitalization across various enterprises. The cloud shift in the public sector is also a prime accelerator for the application of error monitoring software solutions. Furthermore, according to Statistics Canada, in 2023, around 7% of Canadian businesses with five or more employees utilized AI software or hardware, indicating a 3% increase from 2021. The information and cultural industries sector also had the highest AI adoption at 26%, with the largest increase of 13% since 2021. The country’s high internet penetration and digitalization of operations are thus set to accelerate the trade of error monitoring software solutions in the years ahead.

APAC Market Insights

The APAC error monitoring software market is projected to register a rapid CAGR of 10.5% during the forecast period due to the rapid digital shift across industries such as finance, e-commerce, and healthcare. As more businesses adopt cloud-based applications, the demand for real-time error monitoring and resolution tools has increased. Further, the integration of AI and machine learning boosts the predictive capabilities of these error tracking tools, allowing for faster and more optimized issue resolving power. A surging startup environment and a rising number of SMEs further increase the need for flexible, cost-effective monitoring pathways. Additionally, businesses are placing greater emphasis on user experience, making error detection critical to maintaining service quality. Government initiatives promoting digital infrastructure and data compliance also contribute to market expansion.

In China, the error monitoring software market is expected to account for a significant share during the forecast period. This growth is fueled by the country's strong push for digital transformation, bolstered by significant government investment and a rapidly growing tech sector. The government reported that the software and IT services industry earned about USD 1.73 trillion in 2023. This is a 13.4% increase compared to the previous year. Additionally, the government's emphasis on strengthening cybersecurity and ensuring system reliability reinforces the critical role of error monitoring tools in China's digital ecosystem.

The India error monitoring software market is estimated to increase at the fastest CAGR from 2026 to 2035. The rapid digital transformation and strong presence of BFSI, IT services, and e-commerce sectors are propelling the adoption of error monitoring software solutions. The government-backed digitalization programs are also key factors boosting the overall market growth. The India Brand Equity Foundation (IBEF) reported that the country’s information technology (IT) industry was calculated at USD 253.9 billion in FY24, expanding at a rate of 3.8% year-on-year. Thus, the booming developer ecosystem, coupled with widespread adoption of cloud infrastructure, is set to push the overall trade of error monitoring software solutions in the years ahead.

Europe Market Insights

The Europe error monitoring software market is estimated to account for the second-largest revenue share through 2035. The region’s heavy focus on data protection under the General Data Protection Regulation (GDPR) emphasizes a high need for error monitoring software solutions. The sectors such as financial services, healthcare, manufacturing, and e-commerce are prime end users of error monitoring software solutions. The public sector’s strong push toward cloud adoption is set to act as a major driver for the overall market growth.

Germany is expected to lead sales of error monitoring software solutions throughout the forecast period. The advanced manufacturing sector and strong financial services industry are the key promoters of error monitoring software technologies. The International Trade Administration (ITA) states that Germany has one of the biggest information and communication technology (ICT) markets globally and is Europe’s largest software market, with about 100,000 IT companies employing around 1.189 million people. In 2024, the German ICT market earned USD 240.9 billion, and this grew to USD 252 billion in 2025. This indicates that investing in Germany is poised to double the revenues of key players in the years ahead.

The U.K. error monitoring software market is projected to be driven by its strong financial services sector and dynamic technology ecosystem. The early shift toward cloud-native operations in both the public and private sectors is accelerating the demand for error monitoring software solutions. The TechUK report reveals that the country’s tech industry employs more than 1.7 million people and contributes over USD 187.5 billion to the economy each year. Thus, heavy reliance on digital platforms is estimated to accelerate the trade of error monitoring software technologies.