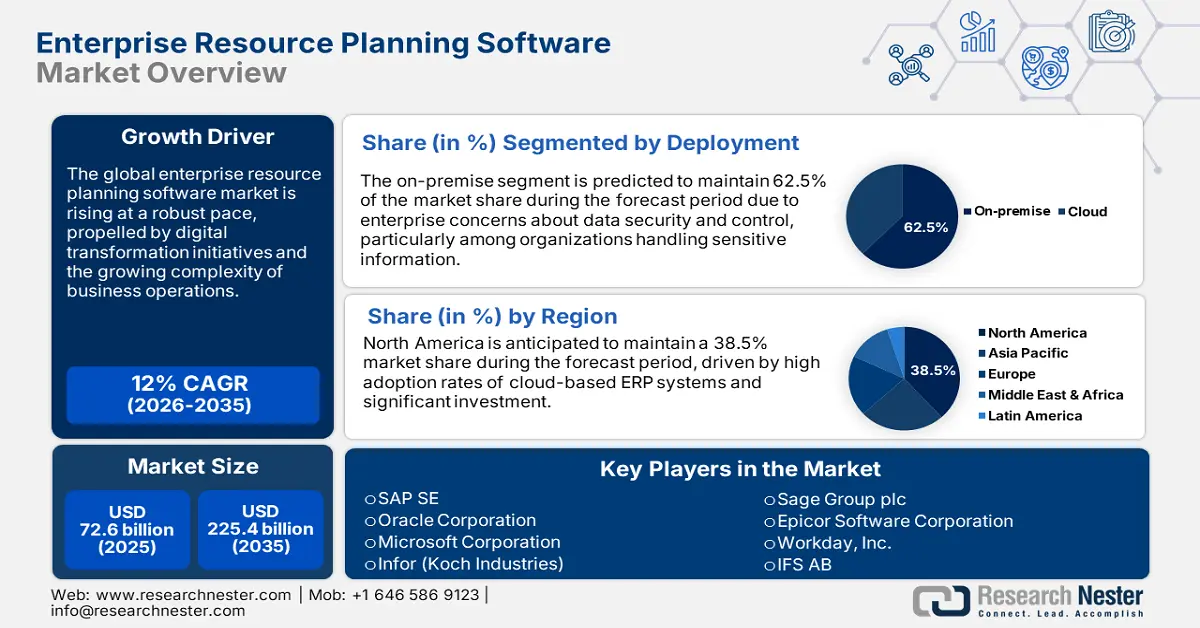

Enterprise Resource Planning Software Market Outlook:

Enterprise Resource Planning Software (ERP) Market size is valued at USD 72.6 billion in 2025 and is projected to reach a valuation of USD 225.4 billion by the end of 2035, rising at a CAGR of 12% during the forecast period, i.e., 2026-2035. In 2026, the industry size of enterprise resource planning software is assessed at USD 81.3 billion.

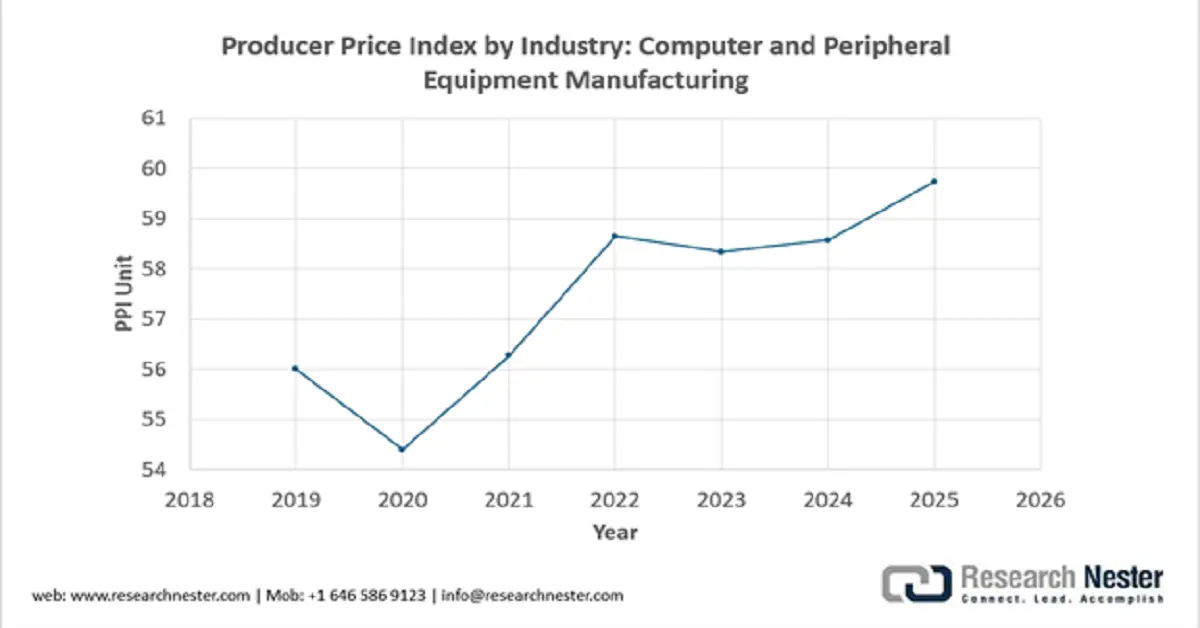

The global enterprise resource planning software (ERP) market is being disrupted by digitization projects, the adoption of cloud computing, and an increasing demand for end-to-end business process management across various industries. Industry participants focus on creating scalable solutions that integrate finance, supply chain, human resources, and customer relationship management on unified platforms with real-time data processing and automated workflows. The Producer Price Index (PPI) for Computer and Peripheral Equipment Manufacturing serves as a critical leading indicator for the ERP software market, reflecting underlying hardware cost trends that directly impact total system implementation expenses.

Source: U.S. BLS

This index's movement is particularly relevant for legacy providers like SAP, Oracle, and Microsoft, as stabilizing or declining hardware costs can accelerate adoption of their end-to-end platforms by reducing one of the key barriers to enterprise digital transformation. In January 2025, Deloitte announced that it had acquired virtually all the assets of SimplrOps, a niche enterprise software-as-a-service (SaaS) technology company that specializes in streamlining and automating operations and implementations for Workday, SAP, and Oracle. This acquisition demonstrates the strategic value of ERP automation competencies. Early technology innovators, including SAP SE, Oracle Corporation, and Microsoft Corporation, among others, established market innovation through the creation of end-to-end platforms, strategic partnerships, and the continuous refinement of cloud solutions.

Key players invest heavily in artificial intelligence tie-ins, industry-specific tailoring, and enhancing user experience as they expand their global market reach through acquisition strategies and local partnerships. In August 2025, SAP SE unveiled SAP Cloud ERP as the successor to legacy SAP ERP and SAP Business Suite as a cloud-first, AI-based platform integrating SAP Business Data Cloud, SAP Business AI, and SAP Build with a clean-core architecture. The platform features SAP's AI copilot, Joule, along with intelligent applications in finance, supply chain management, and human capital management, extending beyond standard ERP capabilities.