Erosion and Sediment Control Market Outlook:

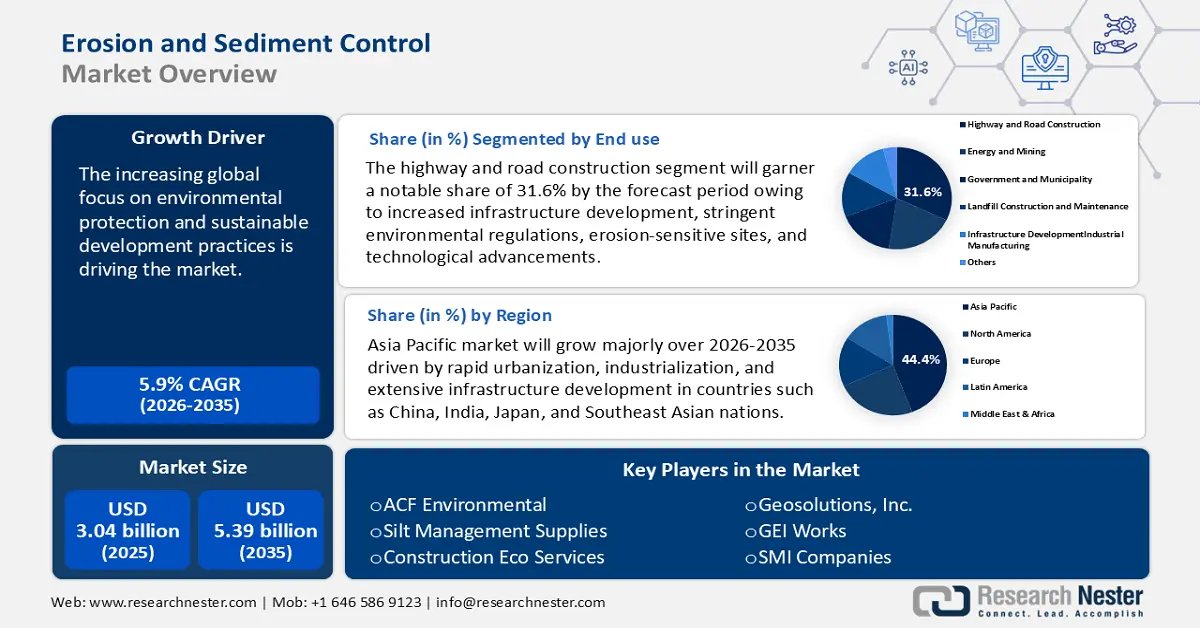

Erosion and Sediment Control Market size was over USD 3.04 billion in 2025 and is anticipated to cross USD 5.39 billion by 2035, growing at more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of erosion and sediment control is assessed at USD 3.2 billion.

The increasing global focus on environmental protection and sustainable development practices is driving the erosion and sediment control market. The need for efficient erosion control methods is growing as more people become aware of the detrimental effects that soil erosion causes to ecosystems, water quality, and agricultural output. According to the European Commission's Joint Research Center (JRC) study (2023), under three possible climate-economic scenarios, the worldwide soil erosion rate is expected to rise from 30% to 66% between 2015 and 2070. Soil erosion's current global impact on agricultural output is estimated to be at USD 8 billion.

Governments and environmental agencies worldwide are implementing stringent regulations to mitigate soil erosions and protect natural resources, driving the adoption of erosion control products across various sectors. This regulatory push is particularly evident in the construction industry, where erosion and sediment control plans are mandatory for many projects, creating a steady demand for erosion control products. Several environmental programs are conducted by the Government worldwide. For instance, the United Nations Environment Program has been a major catalyst in the creation of Multilateral Environmental Agreements (MEAs) and soft law regulations and is the only UN agency solely focused on international environmental issues. To advance the development of international environmental law and policy, UN Environment collaborates with several partners, including national governments, businesses, industry, the media, civil society, IGOs, and NGOs.

Key Erosion and Sediment Control Market Insights Summary:

Regional Highlights:

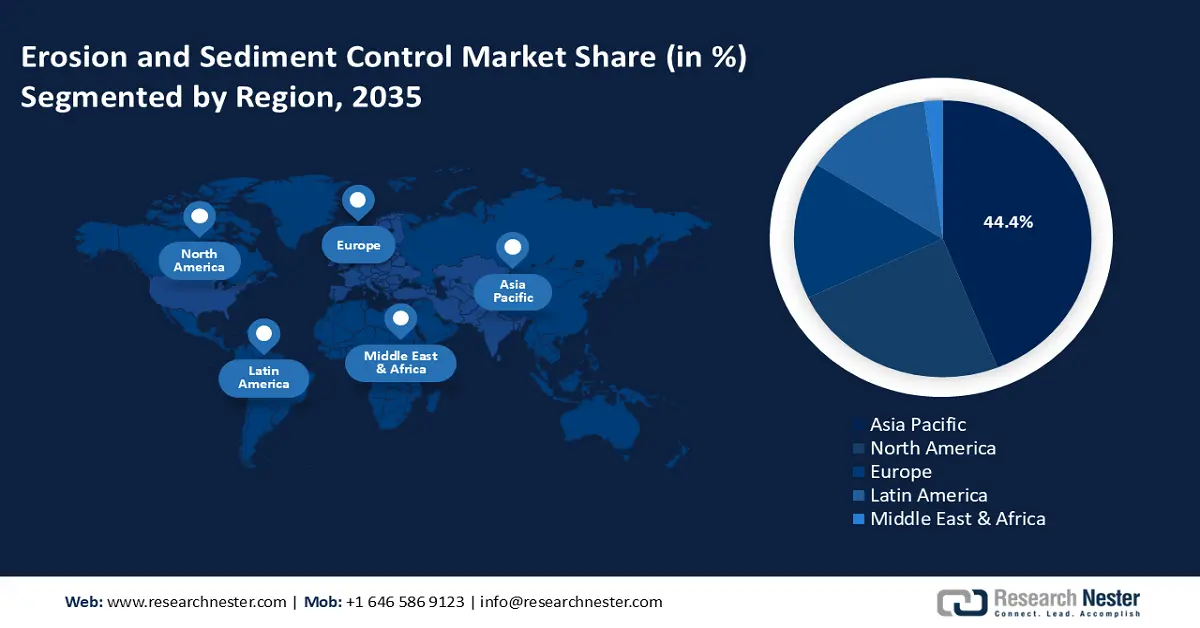

- Asia Pacific erosion and sediment control market will account for 44.40% share by 2035, attributed to rapid urbanization, industrialization, and extensive infrastructure development in key Asian economies.

Segment Insights:

- Highway and road construction segment in the erosion and sediment control market is expected to achieve 31.60% growth by the forecast year 2035, driven by infrastructure development, strict environmental regulations, and erosion-sensitive project sites.

Key Growth Trends:

- Agricultural expansion and soil conservation

- Water quality management

Major Challenges:

- Initial high costs and limited awareness

- Low-cost alternatives

Key Players: ACF Environmental, Silt Management Supplies, Construction Eco Services, Geosolutions, Inc., GEI Works, SMI Companies.

Global Erosion and Sediment Control Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.04 billion

- 2026 Market Size: USD 3.2 billion

- Projected Market Size: USD 5.39 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Erosion and Sediment Control Market Growth Drivers and Challenges:

Growth Drivers

-

Agricultural expansion and soil conservation: As global food demand rises due to population growth; agricultural expansion is inevitable. Clearing land for farming often leads to increased soil erosion, driving the need for erosion control measures. Large-scale land conversion in developing regions leads to higher risks of soil degradation, creating opportunities for erosion control solutions like sediment fences, mulches, and geotextiles. Farmers adopting practices such as strip cropping, no-till farming, and buffer zones use erosion control products to maintain productivity and minimize land degradation.

Soil conservation techniques are prioritized to combat the loss of fertile soil caused by erosion. This includes using biodegradable mats, vegetative stabilization, and sediment barriers. Many governments are introducing subsidies and incentives for soil conservation projects, boosting the adoption of erosion control solutions. The Farm Bill is a federal omnibus bill that oversees many of the United States' agricultural and food programs. The Farm Bill, which is passed every five years, influences what U.S. residents eat and how it is cultivated by providing crop insurance, assistance for important commodity crops, and improvements to food access through programs like the Supplemental Nutrition Assistance Program (SNAP). Conservation, climate, and farming organizations have joined forces to seek that the 2023 Farm Bill protect the USD 20 billion investment in sustainable agriculture made possible by the Inflation Reduction Act. -

Water quality management: Water quality management initiatives, driven by regulatory frameworks, ecological preservation needs, and the impact of urbanization and agriculture, are fueling the growth of the erosion and sediment control market. sediment runoff from construction sites, agricultural lands, and deforested areas leads to the contamination of water bodies, affecting aquatic ecosystems and water quality. Erosion control solutions like sediment barriers, geotextiles, and vegetative covers are essential to minimize sedimentation and maintain clean water supplies.

Erosion control measures, such as stormwater retention ponds, silt fences, and bioengineering solutions, are used to manage runoff sediment pollution in urban areas. Additionally, increased rainfall intensity and extreme weather events due to climate change accelerate erosion and sediment flow into water systems. As a result, advanced erosion control products are in demand to mitigate these impacts and ensure water quality. A wet pond (also referred to as stormwater pond, wet retention pond, or wet extended detention pond) requires adequate drainage to sustain its permanent pool. In humid locations, drainage zones are generally 10-20 acres and are suitable for areas with upstream slopes of up to 15%. Furthermore, wet ponds can effectively remove stormwater contaminants, particularly those linked with settleable solids.

Typical pollutant removal rates of wet ponds:

|

Pollutant |

Influent Concentration (Median) |

Effluent Concentration (Median) |

|

Total copper (µg/L) |

8.24 |

4.00 |

|

Total zinc (µg/L) |

22.60 |

12.00 |

|

Total suspended solids (mg/l) |

38.9 |

12.0 |

|

Total nitrogen (mg/L) |

1.50 |

1.31 |

|

Nitrate (mg/L) |

0.45 |

0.22 |

|

Total phosphorus (mg/L) |

0.18 |

0.10 |

|

E. coli (most probable number/100 mL) |

780 |

180 |

Challenges

-

Initial high costs and limited awareness: Erosion control products can be expensive to manufacture and install, making them less accessible for small-scale projects or in developing regions. Limited financial resources among small agricultural businesses and local governments can hinder the adoption of erosion control measures. Further, many stakeholders including farmers and small contractors, may lack awareness of the long-term benefits of erosion and sediment control solutions. A lack of technical knowledge and training in implementing erosion control systems can lead to improper use or underutilization of these products.

-

Low-cost alternatives: Traditional practices such as reforestation and natural vegetation growth can compete with commercial erosion products, especially in regions with low technological adoption. In some areas, cheaper alternatives like sandbags or basic ditches are preferred over advanced erosion control solutions.

Erosion and Sediment Control Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 3.04 billion |

|

Forecast Year Market Size (2035) |

USD 5.39 billion |

|

Regional Scope |

|

Erosion and Sediment Control Market Segmentation:

Product Type Segment Analysis

The mats, turfs, and blankets segment will capture a significant erosion and sediment control market share by 2035. These products are designed to prevent soil erosion, stabilize disturbed land, and support vegetation growth in areas prone to environmental degradation. Their growth is fueled by increased demand in construction, infrastructure development, and land reclamation projects. Mats, turfs, and blankets can be used on slopes, embankments, drainage channels, and disturbed soils. These are ideal for preventing erosion on steep terrains and stabilizing soil in areas undergoing re-vegetation.

Erosion control mats are made from biodegradable materials like coir, jute, or synthetic fibers to provide immediate protection and promote vegetation growth. Turf Reinforcement Mats (TRMs) are permanent solutions designed to strengthen natural vegetation in high-flow channels. Blankets are designed for temporary use, particularly in preventing soil erosion during vegetation establishment.

End use Segment Analysis

Highway and road construction segment is projected to hold erosion and sediment control market share of more than 31.6% by 2035. The market expansion is due to increased infrastructure development, stringent environmental regulations, erosion-sensitive sites, and technological advancements. Global investments in new highways and road expansions are rising due to the growing urbanization. Road infrastructure investments in the U.S. were USD 91.7 billion in 2021, according to the Organization for Economic Co-operation and Development (OECD). In developed nations like Japan, aging infrastructure is undergoing upgrades, necessitating erosion control measures during construction.

Regulatory frameworks mandate erosion and sediment control to mitigate the environmental impact of highway and road projects. Compliance with laws like Japan’s Soil Contamination Countermeasures Act and similar global standards promotes adopting erosion control solutions. Additionally, innovations in erosion control materials, such as high-performance geotextiles and permanent turf reinforcement mats, provide durable solutions for highway projects. Advanced sediment control techniques like hydroseeding, are gaining popularity for roadside vegetation establishment.

Our in-depth analysis of the erosion and sediment control market includes the following segments:

|

Product Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Erosion and Sediment Control Market Regional Analysis:

APAC Market Insights

Asia Pacific in erosion and sediment control market is anticipated to hold more than 44.4% revenue share by 2035. The market is driven by rapid urbanization, industrialization, and extensive infrastructure development in countries such as China, India, Japan, and Southeast Asian nations. Governments in the region are implementing stringent environmental regulations and sustainability policies to protect against the negative environmental impacts associated with these developments, enhancing the demand for erosion and sediment control products.

The Government of China has implemented stringent environmental policies to address soil erosion and water pollution. Compliance with these regulations has become a priority for construction and industrial sectors, thereby driving the demand for erosion control products and practices. Further, with a vast agricultural sector, China faces challenges related to soil erosion, which can impact crop productivity and water quality. The adoption of erosion control measures in farming practices is contributing to erosion and sediment control market growth. The State Council and the Central Committee of the Communist Party of China jointly issued the guideline, which outlines China's goals to improve soil and water conservation by 2026 and 2035. According to the guideline, China seeks to improve its institutional mechanism and system for soil and water conservation by 2025, increase management effectiveness, and successfully control soil erosion brought on by human activity in strategic areas. About 73% of the country's territory should be free of soil erosion. By 2035, a systematic, coordinated, and efficient water and soil conservation system will have been established, human-induced soil erosion will be completely managed, and soil erosion in critical locations will be thoroughly addressed.

Agriculture plays a crucial role in India’s economy, and soil conservation is vital for maintaining land productivity and water quality. Farmers are increasingly adopting erosion control measures to enhance agricultural output. The increasing frequency and severity of extreme weather events, such as heavy rainfall and floods, exacerbate soil erosion issues. This has led to a greater emphasis on implementing erosion and sediment control measures to mitigate the adverse effects of climate change.

North America Market Insights

The North America erosion and sediment control market is expected to hold a significant share in the forecast period. Governments in the region, especially in the U.S. and Canada, have implemented strict environmental policies such as the Clean Water Act (CWA) and the National Pollutant Discharge Elimination System (NPDES). These regulations mandate construction projects and industrial operations to adopt erosion and sediment control measures to minimize environmental impact.

In the U.S. the Bipartisan Infrastructure Law (2021) allocates USD 1.2 trillion to revitalize the infrastructure, including roads, bridges, and water systems, which often require erosion and sediment control measures. Construction projects in sectors such as highways, airports, and energy pipelines contribute to the growing demand for erosion control solutions. In Canada there is a growing emphasis on sustainable construction practices, leading to increased adoption of erosion control technologies. The focus on minimizing environmental impact during construction activities has heightened the need for advanced erosion and sediment control solutions.

Erosion and Sediment Control Market Players:

- Triton Environmental

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ACF Environmental

- Silt Management Supplies

- Construction Eco Services

- Geosolutions, Inc.

- GEI Works

- SMI Companies

- L & M Supply

- Aussie Erosion Pty Ltd

- Jen-Hill Construction Materials

Companies are introducing sustainable and biodegradable products to meet the increasing demand for eco-friendly solutions. Key players are expanding their presence in high-growth regions like Asia Pacific, where rapid urbanization and infrastructure development drive demand for erosion and sediment control solutions. Moreover, the key players are also actively participating in awareness campaigns and training programs to educate contractors and stakeholders about the importance of erosion control measures.

Recent Developments

- In April 2024, Triton Environmental, Inc. (Triton), a full-service environmental consulting firm, and its subsidiary, Triton Coastal Consultants, LLC, announced that they have joined True Environmental, Inc. (True), a platform dedicated to collaborating with founder and employee-owned environmental consulting and engineering firms to provide capital solutions that accelerate growth and facilitate seamless ownership transitions. The union contributes to True's aim of creating a best-in-class platform in the environmental consulting and engineering business.

- In July 2022, The Environmental Assessment Office (EAO) and Coastal GasLink Pipeline Ltd. (CGL) signed a compliance agreement requiring CGL to take more proactive steps to reduce erosion and sedimentation on all new construction along the CGL pipeline route.

- Report ID: 7064

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Erosion and Sediment Control Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.