Epoxy Type Stabilizer Market Outlook:

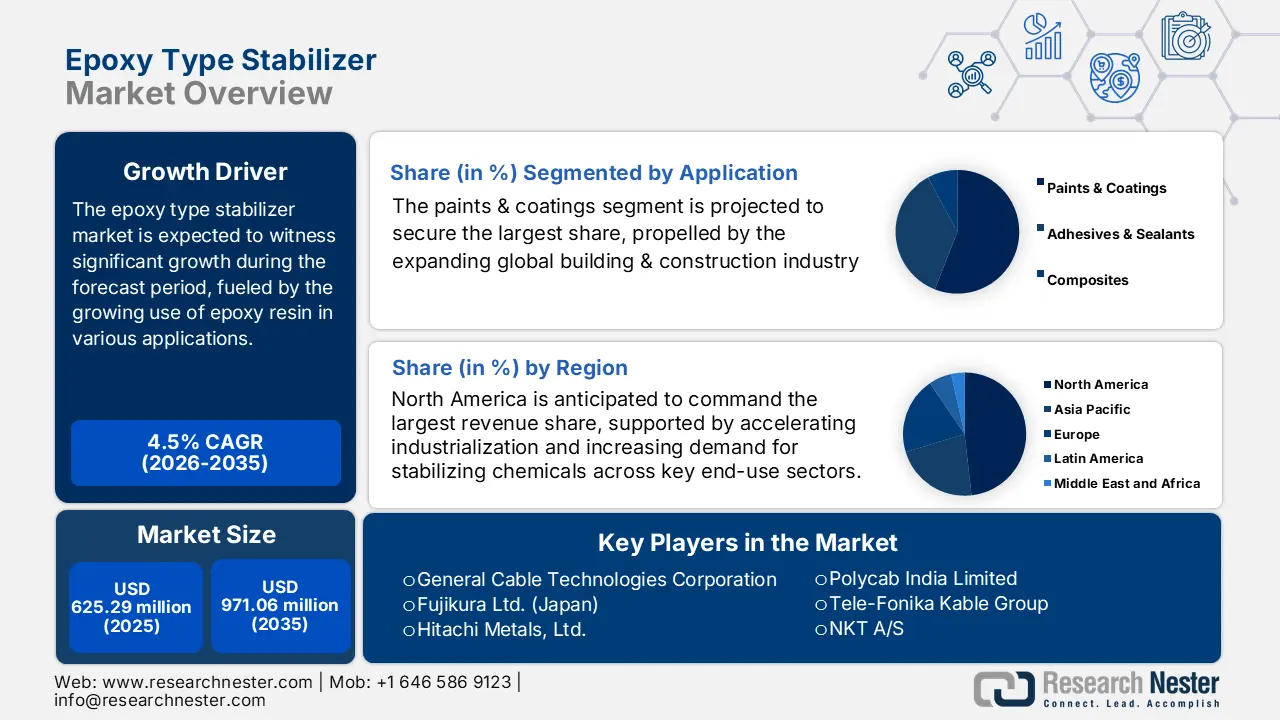

Epoxy Type Stabilizer Market size was valued at USD 625.29 million in 2025 and is likely to cross USD 971.06 million by 2035, expanding at more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of epoxy type stabilizer is assessed at USD 650.61 million.

The growth of the market can be attributed to its use in a wide range of coating and adhesive applications owing to its versatility, including wood, concrete, PVC, metals, and glass. Along with these, their ability to improve material strength, thermal stability, and corrosion resistance is also expected to drive market growth in the coming years. Urbanization increases per capita income while attracting more people to cities. As a result of this combined effect, industrial demand for building & construction, food & beverages, automobiles, and others gradually increases. Therefore, industrialization and urbanization around the world and the emphasis of market players on expanding their product portfolios are projected to offer ample growth opportunities to the market in the near future. According to the United Nations Organization, as of May 2018, about 55% of the global population lives in urban areas, and is anticipated to increase to about 68% by 2050.

Stabilizers are important in improving the appearance and physical properties of polymer materials. However, with the growing demand for better stabilizers from a variety of industries, consumers’ attention has shifted to epoxy type stabilizers. Epoxy type stabilizers are advanced stabilizers with exceptional adhesiveness given the presence of an epoxy group. Epoxy is a polymer, which is a class of chemical compounds composed of large molecules with repeating subunits. Stabilizing resins, such as epoxy resins (molecular formula: C21H25ClO5) are composed of epoxy groups of molecules that harden (or cure) through chemical reactions caused by combining them with other substances or heating them to a high temperature. According to the data published in the ITC Trade Map, the global value of the export of epoxy resin was USD 88,93,926 Thousand in 2021, up from USD 59,27,070 Thousand in 2020.

Key Epoxy Type Stabilizer Market Insights Summary:

Regional Insights:

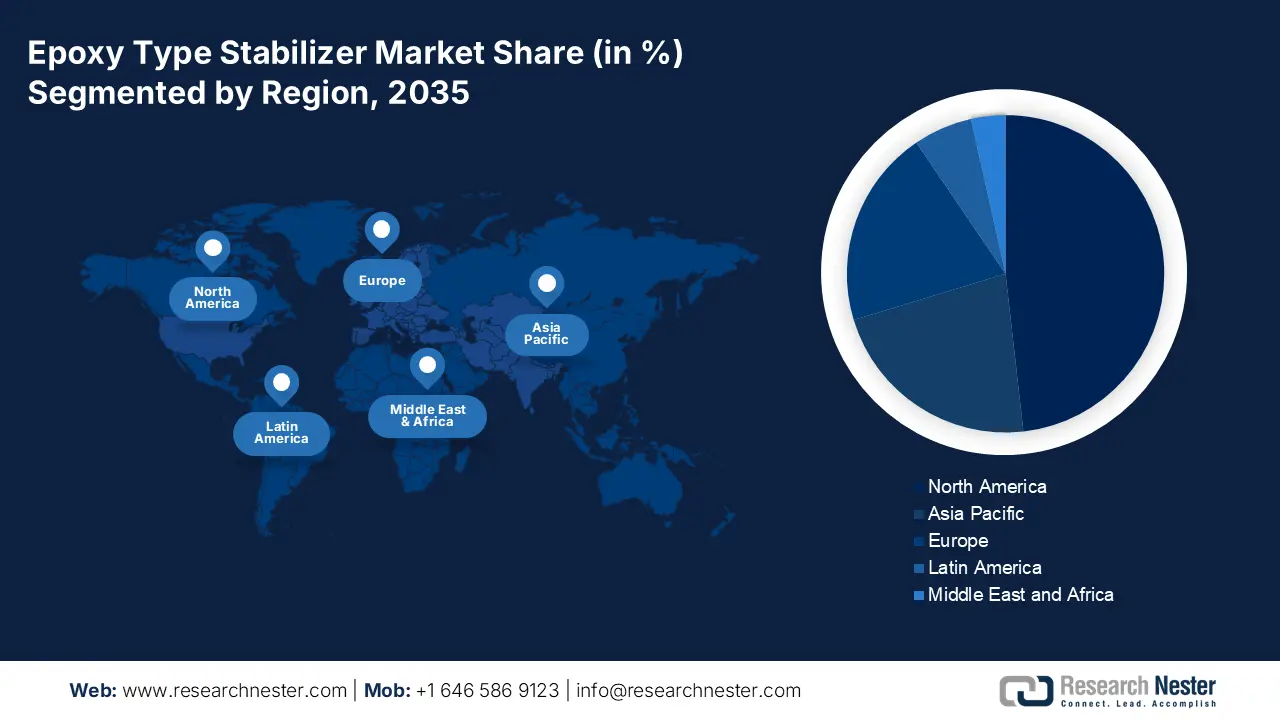

- North America is projected to hold the largest revenue share in the epoxy type stabilizer market, driven by accelerating industrialization and rising demand for stabilizing chemicals across automotive, construction, and consumer goods sectors.

- Asia Pacific is expected to record the highest CAGR, supported by expanding packaging demand fueled by e-commerce growth and increasing product trade across the region.

Segment Insights:

- Paints & coatings segment in the epoxy type stabilizer market is anticipated to secure the largest revenue share, propelled by robust growth in global construction activities and widening architectural and industrial coating applications.

- Building & Construction end-user segment is set to capture a significant share, strengthened by increasing construction output and greater adoption of epoxy-based materials for durable, chemical-resistant, and high-performance structural coatings.

Key Growth Trends:

- Growing Use of Epoxy Resin in Various Applications

- Rising Need for the Prevention of UV Light Induced Distortion

Major Challenges:

- Access to Numerous Low Cost Alternatives

- High Price of Epoxy Type Stabilizers

Key Players: BASF SE, Evonik Industries AG, Clariant AG, Solvay S.A., ADEKA Corporation, Songwon Industrial Co., Ltd., Akzo Nobel N.V., Kyowa Chemical Industry Co., Ltd., Huntsman International LLC, Albemarle Corporation.

Global Epoxy Type Stabilizer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 625.29 million

- 2026 Market Size: USD 650.61 million

- Projected Market Size: USD 971.06 million by 2035

- Growth Forecasts: 4.5%

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, India, Germany

- Emerging Countries: Vietnam, Indonesia, Brazil, Mexico, Malaysia

Last updated on : 21 November, 2025

Epoxy Type Stabilizer Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Use of Epoxy Resin in Various Applications - The increasing usage of epoxy resin in various applications, such as adhesives, coatings, construction, and others, is expected to drive market growth. With the increasing application in the construction sector, over USD 145 billion resin was generated in the year 2020 in the United States.

-

Rising Need for the Prevention of UV Light-Induced Distortion - Epoxy type stabilizers extend the life of substrates by preventing decay corrosion and UV light-induced distortion. For instance, UV degradation can affect many natural and synthetic polymers, including rubber, plastics, and more.

- Rising Use of Adhesives in the Automotive & Transportation Industry - The growing demand for automotive parts, as well as the use of adhesives in the automotive industry, backed by the rising production and sales of vehicles, are expected to drive the market growth. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global sales of all vehicles were around 83 million in 2021.

- Growing Application of Adhesives for Making Furniture - The rising use of adhesives for making furniture, backed by the increasing exports of furniture globally, is expected to boost the market growth owing to the multi-purpose properties of these adhesives such as water-proof properties, strong bonds, and others. Epoxy resin can be used as an adhesive to stabilize wood in a way that is adequate for many applications. Further, as per the ITC Trade Map data, the worldwide export value of wooden furniture for offices without seats was USD 4,137,415 thousand in 2021.

Challenges

-

Access to Numerous Low-Cost Alternatives - Other cheap and less expensive alternatives for epoxy include polyesters and vinyl esters. Both these chemical compounds are cheaper than epoxy and are used for the construction and repair of fiberglass boats. The increasingly cheaper options to replace epoxy is estimated to hinder the market growth during the forecast period.

-

High Price of Epoxy Type Stabilizers

- Harmful Health Effects of These Chemicals

Epoxy Type Stabilizer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 625.29 million |

|

Forecast Year Market Size (2035) |

USD 971.06 million |

|

Regional Scope |

|

Epoxy Type Stabilizer Market Segmentation:

Paints & coatings Segment Analysis

The global epoxy type stabilizer market is segmented and analyzed for demand and supply by application into adhesives & sealants, paints & coatings, and composites. Out of these, the paints & coatings segment is anticipated to garner the largest revenue by the end of 2035, backed by the growing building & construction industry worldwide. For instance, as per the data published by the United States Census Bureau (USCB), privately-owned housing units numbered 1,695,000 in May 2022, up from 1,691,000 units in May 2021 with a 0.2% increase globally. Furthermore, there were 592,000 structures with 5 or more units as of May 2022 globally. On the other hand, paints and coatings are majorly used in architectural and industrial end-use applications, which is also expected to boost the growth of the segment in the coming years.

Building & ConstructionSegment Analysis

The global epoxy type stabilizer market is also segmented and analyzed for demand and supply by end-user into electrical & electronics, marine, renewable energy & power generation, packaging, food & beverages, building & construction, automotive & transportation, and others. Amongst these segments, the building & construction segment is expected to garner a significant share. The increasing construction and building sector are estimated to drive market growth in the coming years as per the market analysis. The value of the construction sector in the U.S. in the year 2021 was estimated to be over USD 1 trillion. Epoxy resin is used in the construction and building industry as an adhesive or coating material. The epoxy resin provides strength owing to its polymeric structure, withstand high temperatures, compatibility, and fast curing time. Water-based epoxy paint is used in the construction sector to provide a fast-protective coating to tiles, or floors. Combining epoxy with quartz and tiles provides a high performance and stable flooring. It is also applied on walls and roofs to get a high glossy look with durability. As epoxy coating gives resistance against chemical, heat, and mechanical damage with highly electric resistance it is used in the construction industry.

Our in-depth analysis of the global epoxy type stabilizer market includes the following segments:

|

By Product Type |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Epoxy Type Stabilizer Market - Regional Analysis

North America Market Insights

North America industry is expected to account for largest revenue share by 2035. The growth of the market can be attributed to the rapid growth in industrialization and the rising demand for stabilizing chemicals in end-use industries including automotive & transportation, building & construction, consumer goods, and others. Urbanization is associated with a higher standard of living and therefore, people in countries such as the United States and Canada are becoming increasingly interested in improving the appearance of their homes as a result of their changing lifestyles and rising economic expansion. According to the World Bank, the United States' annual GDP growth rate was expected to be 5.7 percent in 2021, up from 2.3 percent in 2019. To improve the aesthetics and prevent the degradation of wood, concrete, composite, and plastic products—epoxy resins, coatings, paints, and stabilizers are used. This, in turn, is driving the epoxy type stabilizer market growth in the region.

Asia Pacific Market Insights

On the other hand, the market in the Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth of the market in the region can be attributed to the growing demand for packaging materials in end-user industries where these stabilizers are used massively, and the growing packaging industry in the region, backed by rising trade of products and increasing e-commerce services. For instance, according to the statistics by the Indian Brand Equity Foundation (IBEF), the packaging industry in India was expected to reach USD 204.81 billion by 2050 from USD 50.5 billion in 2019.

Epoxy Type Stabilizer Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Clariant AG

- Solvay S.A.

- ADEKA Corporation

- Songwon Industrial Co., Ltd.

- Akzo Nobel N.V.

- Kyowa Chemical Industry Co., Ltd.

- Huntsman International LLC

- Albemarle Corporation

Recent Developments

-

Tinuvin, a light stabilizer product by BASF SE, has been taken up by a Japanese company, Suiko Co., Ltd. The product has been utilized to make rotationally-molded low-density polyethylene (LDPE) slides for playgrounds that provide UV stabilization and ensure that the slides will remain bright and colorful for years to come.

-

Evonik Industries AG introduced SURFYNOL104 Z, a low VOC version of SURFYNOL 104. Some of the key benefits associated with this new additive include low water sensitivity, better foam control, and pigment and substrate wetting.

- Report ID: 4162

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Epoxy Type Stabilizer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.