Enzymatic Cleaning Market ToC

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- SPSS Methodology

- Primary Research

- Data Triangulation

- Executive Summary

- Competitive Landscape

- Competitive Intelligence

- Strategic Imperative

- Outcome Actionable Insights

- Global Industry Overview (1/2)

- Regional Synopsis

- DROT

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- 3M Company

- Amity International

- BASF SE

- Byitrol

- Clorox Company

- Diversey, Inc.

- Ecolab, Inc.

- Enzyme Solutions, Inc.

- Getinge

- Metrex Research, LLC

- Novozymes A/S

- Spartan Chemical Company

- STERIS plc.

- Analysis Of Product Type

- Analysis Of Technical Issues Of Enzymatic Cleaning

- SWOT Analysis

- Regional Analysis On End-user (North America)

- Patent Analysis

- Recent Development Analysis

- Porter’s Five Forces Analysis

- Upcoming Technological Advancements

- Industry Risk Assessment

- Global Outlook and Projections (1/2)

- Global Overview

- Market Value (USD Million), Volume (Tons) Current and Future Projections, 2013-2037

- Increment &Opportunity Assessment, 2013-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2013-2037, By

- Product Type, Value (USD Million), Value (Tons)

- Protease Cleaners

- Amylase Cleaners

- Lipase Cleaners

- Cellulose Cleaners

- Others

- Process, Value (USD Million)

- Presoak

- Disinfection

- Manual Cleaning

- Automatic

- Device Type, Value (USD Million)

- Non-Critical

- Semi-Critical

- End User, Value (USD Million)

- Hospitals

- Clinics

- Diagnostic Centers

- Food and Beverages

- Hospitality

- Manufacturing

- Residential

- Others

- Product Type, Value (USD Million), Value (Tons)

- Regional Synopsis 9USD Million), 2013-2037, By

- North America, Value (USD Million), Volume (Tons)

- Europe, Value (USD Million), Volume (Tons)

- Asia Pacific, Value (USD Million), Volume (Tons)

- Latin America, Value (USD Million), Volume (Tons)

- Middle East and Africa, Value (USD Million), Volume (Tons)

- Global Overview

Cross Analysis of Product Type w.r.t End User, 2013-2037

- North America Market

- Overview

- Market Value (USD Million), Volume (Tons) Current and Future Projections, 2013-2037

- Increment &Opportunity Assessment, 2013-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2013-2037, By

- Product Type, Value (USD Million), Value (Tons)

- Protease Cleaners

- Amylase Cleaners

- Lipase Cleaners

- Cellulose Cleaners

- Others

- Process, Value (USD Million)

- Presoak

- Disinfection

- Manual Cleaning

- Automatic

- Device Type, Value (USD Million)

- Non-Critical

- Semi-Critical

- End user, Value (USD Million)

- Hospitals

- Clinics

- Diagnostic Centers

- Food and Beverages

- Hospitality

- Manufacturing

- Residential

- Others

- Product Type, Value (USD Million), Value (Tons)

- Country Level Analysis

- US, Value (USD Million), Volume (Tons)

- Canada, Value (USD Million), Volume (Tons)

- Overview

Cross Analysis of Product Type w.r.t End User, 2013-2037

- Europe Market

- Overview

- Market Value (USD Million), Volume (Tons) Current and Future Projections, 2013-2037

- Increment &Opportunity Assessment, 2013-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2013-2037, By

- Product Type, Value (USD Million), Value (Tons)

- Protease Cleaners

- Amylase Cleaners

- Lipase Cleaners

- Cellulose Cleaners

- Others

- Process, Value (USD Million)

- Presoak

- Disinfection

- Manual Cleaning

- Automatic

- Device Type, Value (USD Million)

- Non-Critical

- Semi-Critical

- End User, Value (USD Million)

- Hospitals

- Clinics

- Diagnostic Centers

- Food and Beverages

- Hospitality

- Manufacturing

- Residential

- Others

- Product Type, Value (USD Million), Value (Tons)

- Country Level Analysis

- UK, Value (USD Million), Volume (Tons)

- Germany, Value (USD Million), Volume (Tons)

- France, Value (USD Million), Volume (Tons)

- Italy, Value (USD Million), Volume (Tons)

- Spain, Value (USD Million), Volume (Tons)

- NORDIC, (USD Million), Volume (Tons)

- Rest of Europe, (USD Million), Volume (Tons)

- Overview

Cross Analysis of Product Type w.r.t End User, 2013-2037

- Asia Pacific Market

- Overview

- Market Value (USD Million), Volume (Tons) Current and Future Projections, 2013-2037

- Increment &Opportunity Assessment, 2013-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2013-2037, By

- Product Type, Value (USD Million), Value (Tons)

- Protease Cleaners

- Amylase Cleaners

- Lipase Cleaners

- Cellulose Cleaners

- Others

- Process, Value (USD Million)

- Presoak

- Disinfection

- Manual Cleaning

- Automatic

- Device Type, Value (USD Million)

- Non-Critical

- Semi-Critical

- End user, Value (USD Million)

- Hospitals

- Clinics

- Diagnostic Centers

- Food and Beverages

- Hospitality

- Manufacturing

- Residential

- Others

- Product Type, Value (USD Million), Value (Tons)

- Country Level Analysis

- China, Value (USD Million), Volume (Tons)

- Japan, Value (USD Million), Volume (Tons)

- India, Value (USD Million), Volume (Tons)

- Australia, Value (USD Million), Volume (Tons)

- South Korea, Value (USD Million), Volume (Tons)

- Vietnam, Value (USD Million), Volume (Tons)

- Thailand, Value (USD Million), Volume (Tons)

- Singapore, Value (USD Million), Volume (Tons)

- Malaysia, Value (USD Million), Volume (Tons)

- Rest of Asia Pacific, Value (USD Million), Volume (Tons)

- Overview

Cross Analysis of Product Type w.r.t End user, 2013-2037

- Latin America Market

- Overview

- Market Value (USD Million), Volume (Tons) Current and Future Projections, 2013-2037

- Increment &Opportunity Assessment, 2013-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2013-2037, By

- Product Type, Value (USD Million), Value (Tons)

- Protease Cleaners

- Amylase Cleaners

- Lipase Cleaners

- Cellulose Cleaners

- Others

- Process, Value (USD Million)

- Presoak

- Disinfection

- Manual Cleaning

- Automatic

- Device Type, Value (USD Million)

- Non-Critical

- Semi-Critical

- End User, Value (USD Million)

- Hospitals

- Clinics

- Diagnostic Centers

- Food and Beverages

- Hospitality

- Manufacturing

- Residential

- Others

- Product Type, Value (USD Million), Value (Tons)

- Country Level Analysis

- Brazil, Value (USD Million), Volume (Tons)

- Argentina, Value (USD Million), Volume (Tons)

- Mexico, Value (USD Million), Volume (Tons)

- Rest of Latin America, Value (USD Million), Volume (Tons)

- Overview

Cross Analysis of Product Type w.r.t End user, 2013-2037

- Middle East and Africa

- Overview

- Market Value (USD Million), Volume (Tons) Current and Future Projections, 2013-2037

- Increment &Opportunity Assessment, 2013-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2013-2037, By

- Product Type, Value (USD Million), Value (Tons)

- Protease Cleaners

- Amylase Cleaners

- Lipase Cleaners

- Cellulose Cleaners

- Others

- Process, Value (USD Million)

- Presoak

- Disinfection

- Manual Cleaning

- Automatic

- Device Type, Value (USD Million)

- Non-Critical

- Semi-Critical

- End User, Value (USD Million)

- Hospitals

- Clinics

- Diagnostic Centers

- Food and Beverages

- Hospitality

- Manufacturing

- Residential

- Others

- Product Type, Value (USD Million), Value (Tons)

- Country Level Analysis

- GCC, Value (USD Million), Volume (Tons)

- Israel, Value (USD Million), Volume (Tons)

- South Africa, Value (USD Million), Volume (Tons)

- Rest of Middle East and Africa, Value (USD Million), Volume (Tons)

- Overview

Cross Analysis of Product Type w.r.t End user, 2013-2037

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

- Legal Disclaimer

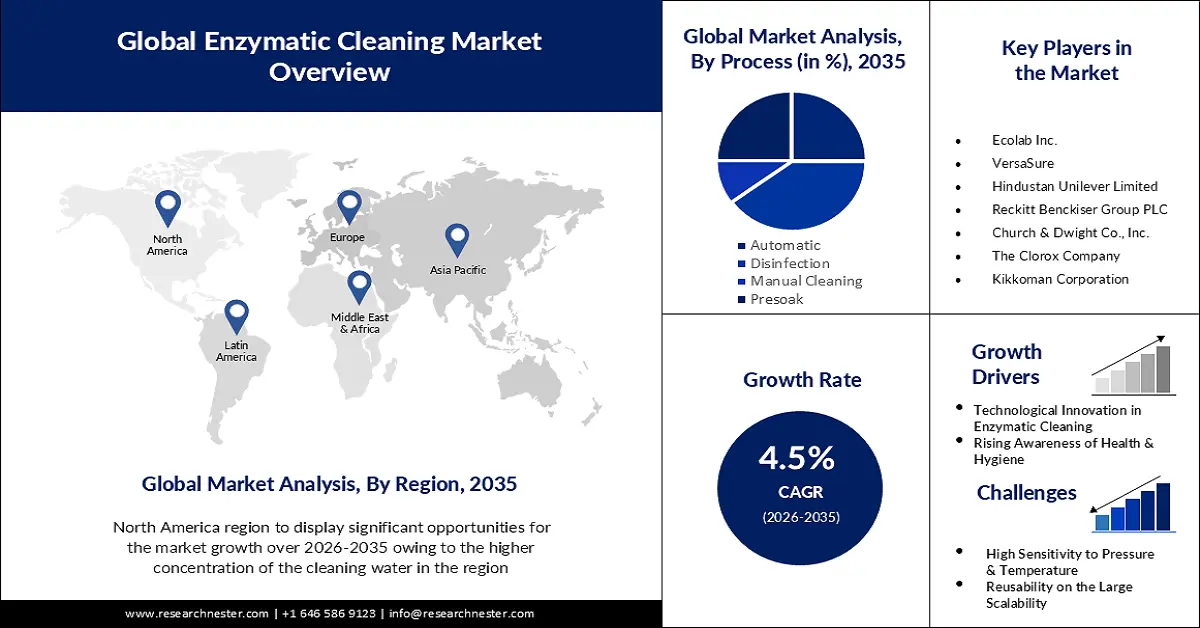

Enzymatic Cleaning Market Outlook:

Enzymatic Cleaning Market size was over USD 15.54 billion in 2025 and is anticipated to cross USD 24.13 billion by 2035, witnessing more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of enzymatic cleaning is assessed at USD 16.17 billion.

The enzymatic cleaning market is rapidly expanding due to the rising need for advanced enzymatic cleaning products in the healthcare sector and the inclination towards eco-friendly products. Enzymatic cleaners are widely used in hospitals, clinics, and other healthcare settings due to clean and decontaminate medical devices, surgical instruments, and the surroundings. These cleaners are less corrosive compared to chemical cleaners and can be thus used on a variety of surfaces and materials. Different types of enzymatic cleaners are available in the enzymatic cleaning market that are suitable for cleaning a broad range of medical equipment, surfaces, floors, and laundry.

The sales of enzymatic cleaners witnessed a sudden spike in 2020, amidst the COVID-19 pandemic. Many companies launched new products to cater to the growing need for safety and hygiene in healthcare institutions. In June 2020, Novozymes announced the launch of a new enzyme solution, Remify Everis 100 L for cleaning surgical devices and instruments. The primary aim of this product launch was to reduce the number of Healthcare Associated Infections (HAIs). Another incidence was when Kenya Medical Research Institute (KEMRI) launched 4 cleaning products in Kenya, including KEMiZyme, a surgical instrument cleaner to cater to rising COVID-19 cases in the country.

Key Enzymatic Cleaning Market Insights Summary:

Regional Highlights:

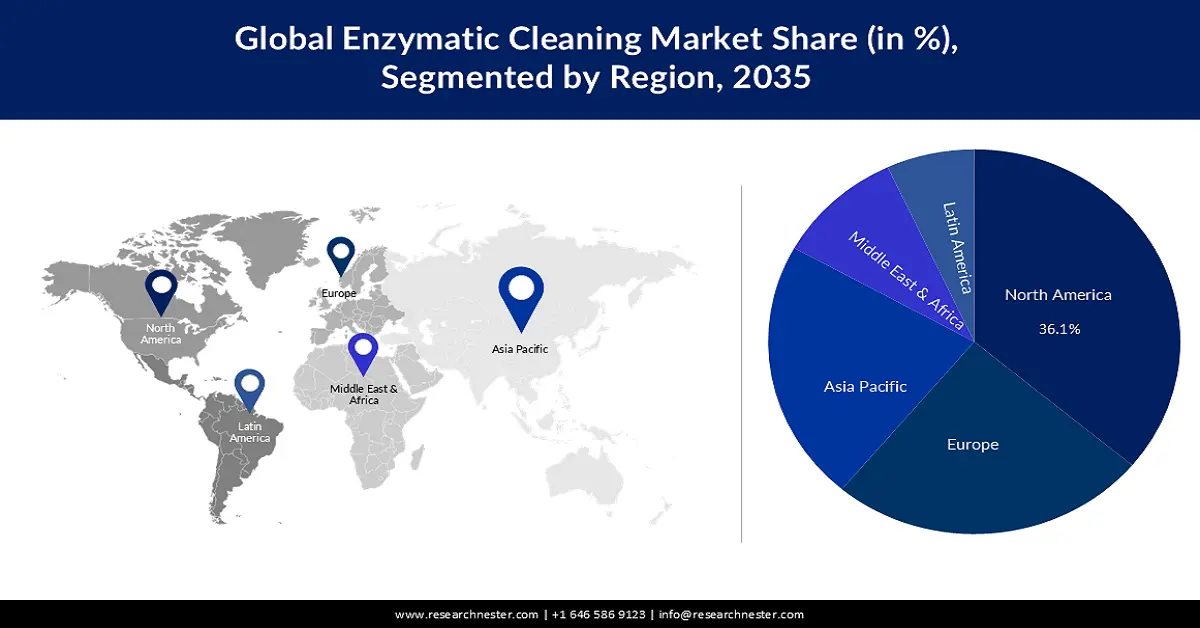

- North America’s enzymatic cleaning market attains a 36.1% share by 2035, driven by growing awareness of hygiene and the rising popularity of eco-friendly cleaning products.

- Asia Pacific’s market garners a significant revenue share by 2035, attributed to rising demand for eco-friendly cleaners due to urbanization and environmental concerns.

Segment Insights:

- The protease cleaners segment in the enzymatic cleaning market is forecasted to capture a 28.30% share by 2035, fueled by its specific ability to break down protein-based residues across industries.

- The hospital segment in the enzymatic cleaning market is projected to capture a substantial share by 2035, driven by rising patient admissions and the growing need for effective cleaning products.

Key Growth Trends:

- Rising awareness about the benefits of enzymatic cleaning products

- Increasing investments to launch new and effective formulations

Major Challenges:

- Concerns with stability and shelf life:

- Price sensitivity

Key Players: Ecolab Inc., Diversey, Inc., Enzyme Solutions, Inc., STERIS plc., Spartan Chemical Company, Cascades Inc..

Global Enzymatic Cleaning Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.54 billion

- 2026 Market Size: USD 16.17 billion

- Projected Market Size: USD 24.13 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 11 September, 2025

Enzymatic Cleaning Market Growth Drivers and Challenges:

Growth Drivers

-

Rising awareness about the benefits of enzymatic cleaning products- People are steadily realizing the benefits of enzymatic cleaners over conventional chemical cleaners. These enzymatic cleaners are usually environmentally friendly compared to chemical cleaners and are thus safe to use around pets and children. Moreover, as these cleaners break down organic matter through natural enzymatic processes, they pose less risk of chemical burns or respiratory irritation.

Several governments across the globe are initiating various schemes such as incentives, grants, subsidies, and tax redemptions for manufacturers to support the development and product of eco-friendly products.The government of India and organizations such as EPA (United States Environmental Protection Agency) and ETA (Enzyme Technical Association) have launched the Eco Mark Scheme and Ecolabels to identify eco-friendly products. - Increasing investments to launch new and effective formulations- Manufacturers are heavily investing in R&D activities to launch novel and effective formulations of enzymatic cleaning products to cater to growing product demand. They are focused on improving the performance of the products in terms of cleaning efficiency and enzyme stability.

Some of them are also focused on expanding their businesses in international enzymatic cleaning market. For instance, in 2020, Vikr Bioscience Pvt. Ltd, a “Make in India” manufacturer of specialized enzymatic cleaning products announced its plans to expand into the international market. The company has a wide product base of floor cleaners, dishwashing liquid, laundry liquid, toilet cleaners, and other products suitable for commercial, residential, and industrial surfaces.

Challenges

-

Price sensitivity: As enzymatic cleaning solutions are formulated with organic products; the prices can be higher than traditional chemical cleaners. This can be a barrier for consumers and small businesses with budget constraints. They may look out for cost-effective alternatives, hampering the adoption of some enzymatic cleaning products.

-

Concerns with stability and shelf life: Most enzymatic cleaners are sensitive to pH, temperature, and other environmental factors that can denature the cleaners, causing them to lose their functionality and stability. This is a crucial factor that may hamper the overall shelf life of enzymatic cleaning solutions.

Enzymatic Cleaning Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 15.54 billion |

|

Forecast Year Market Size (2035) |

USD 24.13 billion |

|

Regional Scope |

|

Enzymatic Cleaning Market Segmentation:

Product Type Segment Analysis

Protease cleaners segment is anticipated to dominate around 28.3% enzymatic cleaning market share by the end of 2035, owing to its specific ability to break down protein-based residues and stains across various industries for different applications. These cleaners are widely used for cleaning surfaces and surgical instruments in healthcare facilities, equipment cleaning and sanitization in food processing industries, and stain removal and fabric maintenance in laundry. Protease cleaners are also used in animal care facilities for cleaning animal shelters and farms along with equipment cleaning.

End Use Segment Analysis

By 2035, Hospital segment is poised to hold substantial enzymatic cleaning market share, owing to rising patient admissions and rising need for effective cleaning products for instruments, laundry, and surroundings. Enzymatic cleaners are used in the initial cleaning processes as hospitals are most prone to HIA. Various advanced cleaning medical grade solutions, specially designed for healthcare purposes are widely available in the enzymatic cleaning market. This is also due to stringent healthcare regulations for cleanliness and hygiene announced by several governments and organizations including, the International Sanitary Supply Association (ISSA), the U.S. Environmental Protection Agency among others.

In 2017, the Asia Pacific Society of Infection Control launched its revised guidelines for disinfection and sterilization of instruments in healthcare facilities. These guidelines emphasize the need for instrument sanitization and the hazardous effects of chemical cleaning solutions. Along with this, many key players are launching new products for instrument cleaning. In June 2019, DuPont Nutrition & Biosciences launched the OPTIMASE profile of biobased enzymes for instrument cleaning applications. The liquid protease helps in enhanced stability in liquid detergents, reducing the need for extra enzyme-stabilizing ingredients, and saving formulation space and costs.

Our in-depth analysis of the global enzymatic cleaning market includes the following segments:

|

Product Type |

|

|

Process |

|

|

Device Type |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enzymatic Cleaning Market Regional Analysis:

North America Market Insights

North America region is expected to account for more than 36.1% market share by 2035, driven by growing awareness of hygiene and the rising popularity of eco-friendly cleaning products. Consumers in this region are shifting towards eco-friendly alternatives to cater to rising environmental as well as health concerns associated with chemical cleaning products.

The U.S. enzymatic cleaning market is expected to register rapid revenue growth by the end of 2035 owing to presence of robust healthcare infrastructure and the rising number of surgical procedures. According to a recent survey, every year, more than 64 million surgeries take place in the U.S., ranging from nominal tooth extraction procedures to open heart surgeries. Thus, there has been a growing demand for cleaning products, including enzymatic cleaners in healthcare centers across the U.S. Moreover, U.S. manufacturers are focused on expanding the applications of enzymatic cleaners beyond healthcare, food and beverages, and industrial cleaning, which is further expected to fuel market growth.

Asia Pacific Market Insights

Asia Pacific region in enzymatic cleaning market is estimated to capture significant revenue share by the end of 2035 primarily due to the high usage of enzymatic cleaners in multi-type material cleaning across several verticals, including, hospitality, healthcare, and food processing. Rapid urbanization and growing awareness about environmental issues and the impact of chemical cleaners on human health has resulted in increasing demand for eco-friendly cleaning products for residential purposes. Moreover, some countries in this region have implemented stringent regulations on the use of chemical cleaners, thereby promoting the use of eco-friendly cleaners, including enzyme-based cleaners.

In India, the demand for enzymatic cleaners has significantly increased as people are steadily becoming aware of the benefits of these products. Well-known brands based in India such as Lysol, Harpic, Godrej, Nirlon, and Eureka Fobes are focused on launching eco-friendly cleaning products to cater to the growing demand for sustainable cleaning products.

Some emerging enzymatic cleaning market players are also making efforts to launch their products and establish their presence in the market. For instance, Satopradhan a specialized satvic store based in Amritsar, India offers a wide a wide range of organic, vegan, and eco-friendly products, including enzyme cleaners. One of its high-selling products is the Eco-friendly Floor Cleaner, enriched with good microbes that clean with floor without toxic fume emissions, thereby reducing the indoor levels of VOC pollutants.

Enzymatic Cleaning Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Novozymes A/S

- Ecolab Inc.

- Diversey, Inc.

- Enzyme Solutions, Inc.

- STERIS plc.

- Spartan Chemical Company

- Cascades Inc.

The enzymatic cleaning market is extremely fragmented, comprising key players operating at regional and global levels. The key players in the market are focused on adopting several strategies such as mergers and acquisitions, partnerships, license agreements, and product launches to enhance their product base and maintain their market position. These companies are focused on developing advanced products for several applications, including household, healthcare, food and beverages, and industrial areas to cater to rising need for eco-friendly and efficient cleaning solutions. Here are some of the leading companies operating in the global enzymatic cleaning market:

Recent Developments

- In October 2023, BASF announced the addition of the next-generation cleaning enzyme Lavergy M Ace 100L to its Lavergy portfolio. M Ace 100 L is the novel mannanase formation suitable to get rid of suborn stains in commercial and home laundry.

- In January 2023, Cascade, a well-known dishwasher detergent brand in the U.S announced the launch of Cascade Platinum Plus, a first-of-its-kind cleaning system with 50% more protein-fighting enzymes for breaking down protein-rich foods and strong grease cleaning powder to get rid of grease and dry dishes faster.

- Report ID: 5387

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Enzymatic Cleaning Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.