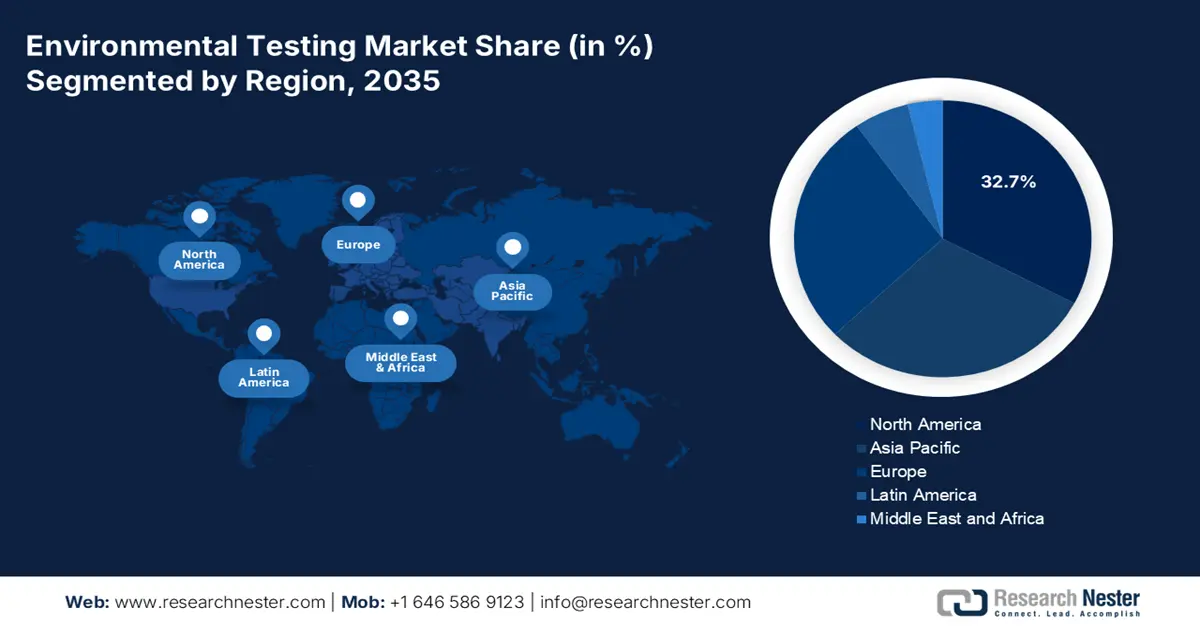

Environmental Testing Market - Regional Analysis

North America Market Insights

North America in the environmental testing market is anticipated to hold the largest share of 32.7% by the end of 2035. The market’s upliftment in the region is highly fueled by in-depth industrial ecosystems, strict regulatory frameworks, the presence of federal programs, along with standards that need routine monitoring across soil, air, and water. According to a data report published by the CISA Government in 2023, the chemical sector in the region, particularly in the U.S., has converted raw materials into over 70,000 diversified products, which are crucial to modernized life. In addition, these are readily distributed to over 750,000 end users throughout the nation. Besides, 700,000 chemical facilities in the U.S., usually ranging from chemical distributors to petrochemical manufacturers, to utilized, stored, manufactured, delivered, or transported chemicals, along with a global and complicated supply chain, thus suitable for the environmental testing market’s growth.

The U.S. Economy in the Chemical Sector in North America (2023)

|

Components |

Units |

|

Chemical Industry Valuation |

USD 486 billion |

|

Overall U.S. GDP |

25% |

|

Goods Manufactured |

96% |

|

Global Chemical Supply |

13% from the U.S. |

|

Direct Employment |

529,000 |

|

Job Opportunity |

6.8 jobs |

|

Jobs Created |

Over 4.1 million |

|

Chemical Exports |

USD 125.3 billion |

|

Chemicals and Related Products |

10% of every USD 1 of U.S. exports |

Source: CISA Government

The U.S. in the environmental testing market is growing significantly, owing to industrial scale driving the testing demand, regulatory drivers, the federal budget perspective, along with the sector’s importance and infrastructure. As per an article published by the Trade Government in 2025, the country effectively exported more than USD 494 billion worth of chemicals as of 2022. In addition, the country is considered a notable leader in chemical production, with more than 13% of the world’s chemicals emerging from the U.S. Moreover, this particular sector’s 14,000 establishments produce more than 70,000 products. Besides, in the middle of 2024, the country’s chemical manufacturing industry has directly employed more than 902,300 employees. Moreover, the overall FDI in the industry has been USD 766.7 billion as of 2023, thus denoting a positive impact on the market’s upliftment.

Canada in the environmental testing market is also growing due to the Environmental Protection Act, Environment and Climate Change Canada priorities, along with substance management, chemical safety standards, corporate sustainability, and the presence of government programs and expenditure. As stated in an article published by the Government of Canada in October 2025, a total of USD 29 billion has been successfully committed at the federal level for cleantech projects. In addition, more than 8,300 funding agreements have been readily signed with beneficiaries. Moreover, for funded cleantech projects, the medical deal value is USD 278,000, and meanwhile, the most common beneficiaries are non-profit organizations, having gained more than USD 21 billion in funding. Therefore, with such investments and deals, there is a huge growth opportunity for the environmental testing market in the country.

Cleantech Funding Committed in Canada (2016-2024)

|

Years |

Fund Amount (USD) |

|

2016 |

0.2 billion |

|

2017 |

1.4 billion |

|

2018 |

1.3 billion |

|

2019 |

1.8 billion |

|

2020 |

2.3 billion |

|

2021 |

4.1 billion |

|

2022 |

6.2 billion |

|

2023 |

7.7 billion |

|

2024 |

4.3 billion |

Source: Government of Canada

Europe Market Insights

Europe in the environmental testing market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by the existence of strict regulatory frameworks, decarbonization projects, circular economy strategies, and tightened contaminant thresholds for expanding testing across waste, air, soil, and water. According to an article published by the Europe Environment Agency in December 2024, 51% to 60% of rivers, along with 11% to 35% of lakes, and 47% to 100% of coastal and transitional waters have exceeded the yearly average environmental quality standards for perfluorooctane sulfonate (PFOS) in the overall region. Besides, the Forever Pollution project has readily estimated that there exist almost 23,000 per- and polyfluoroalkyl substances (PFAS), of which 2,300 are considered hotspots with increased pollution levels, thereby enhancing the market’s demand.

Germany in the environmental testing market is gaining increased exposure, owing to sustained growth in sustainable chemicals, strong standards implementation, and upscaling of its very own manufacturing and chemical base. As per an article published by the ITA in August 2025, the advanced manufacturing industry in the country amounts to USD 991,050 million in total exports, which is followed by USD 721,621 million in total imports. In addition, USD 36,753 million caters to imports from the U.S., USD 269,429 million in trade surplus, and 1.0 as the EUR-USD exchange rate. Moreover, organizations in the country are implementing futuristic plans to expand by 64% in Enterprise Resource Planning (ERP), 75% in Manufacturing Execution Systems (MES), 72% in cloud-based systems, and 70% in cybersecurity, thus creating an optimistic outlook for the market’s development.

France in the environmental testing market is also developing due to modernization in industrial testing infrastructure, sustainability initiatives, and escalated regulatory environments. Additionally, the presence of PFAS policies, stringent effluent and emissions controls, along with an increase in the adoption of online and rapid monitoring, are other drivers fueling the market’s growth in the country. As per an article published by NLM in December 2022, the country spends over USD 695 million on water pollution expenses, which has been allocated to diminish nitrate and pesticide emissions from agriculture. Besides, the human ecosystem and health impact, owing to the nitrogen pollution of seas and rivers, is almost USD 164 million in the overall region. Therefore, with all these expenses, there is a huge focus on treating water for human consumption, which in turn, is proliferating the market’s development.

APAC Market Insights

The Asia Pacific in the environmental testing market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is extremely propelled by the presence of stringent pollutant standards across air, soil, and water, increased urbanization, and industrial scale. According to an article published by the World Bank Organization in October 2025, industrial projects cater to 4.8% growth in regional projects. In this regard, Vietnam is gradually leading at a 6.6% growth, which is followed by 5.9% growth for Mongolia, and 5.3% growth for Philippines. Besides, Cambodia, Indonesia, and China are each expected to grow at 4.8%, and meanwhile, countries in Pacific Island are predicted to grow at 2.7%, along with Thailand at 2.0%. Therefore, with this continuous growth in industries, the market in the overall region is continuously expanding with huge growth opportunities.

The environmental testing market in China is gaining increased traction, owing to the presence of a massive chemical base, intensified environmental compliance, and continuous investment in advanced manufacturing and specialty chemicals. As per an article published by the ITIF Organization in April 2024, the country accounted for 44% of international chemical production, along with 46% of capital investment. However, the country is regarded as leading the world in terms of chemical industry sales, accounting for over 40% of the international market, with a major focus on basic chemicals. Besides, China accounts for almost 55% of the international capacity for acetic acid, nearly 50% of the global carbon black capacity, and about 45% of the worldwide capacity for titanium dioxide. Therefore, with these huge contributions in the world’s chemical sector, the market in the country is gaining increased importance.

The environmental testing market in India is also growing due to rapid industrial expansion, policy modernization, and capacity build-out across utilities, infrastructure, pharma, and chemicals. As stated in a data report published by the IBEF Organization in August 2025, manufacturing has emerged as the ultimate central pillar of the country’s economic growth, readily contributing to 16% to 17% of the GDP, and employing more than 27 million workers. The presence of government strategies, such as production-linked incentive (PLI) and Make in India schemes, has resulted in targeting manufacturing to cater to 25% of GDP in the future. Besides, there has been a surge in the industry’s momentum, when the HSBC India Manufacturing PMI successfully hit a 16-month high of 59.1, attributed to rapid increase in factory orders, thereby suitable for uplifting the market.